One Day Insurance

In today's fast-paced world, our needs and priorities often change rapidly. Whether it's a sudden trip, a short-term project, or a unique situation that requires coverage, traditional insurance policies may not always fit the bill. This is where One Day Insurance steps in as a flexible and innovative solution, offering tailored protection for specific periods.

Imagine being able to insure your vehicle for just one day while borrowing a friend's car, or securing your home for a day when you're hosting a large event. One Day Insurance provides an efficient and cost-effective approach to managing your risks, especially for those unexpected situations that don't align with standard insurance terms.

Understanding One Day Insurance

One Day Insurance, as the name suggests, is a type of insurance coverage that is valid for a single day or a specified short period. It is designed to provide protection for unique, temporary, or unexpected events, activities, or possessions. This innovative insurance model offers a flexible and cost-efficient solution for individuals and businesses facing specific, short-term risks.

The concept of One Day Insurance has gained traction across various sectors, including auto, property, liability, and even health insurance. It provides an effective way to bridge the gap in traditional insurance policies, which often require long-term commitments. By offering coverage for a day or a few days, this type of insurance allows individuals and businesses to manage their risks more dynamically and cost-effectively.

Key Benefits of One Day Insurance

- Flexibility: One Day Insurance allows individuals and businesses to secure coverage for specific, short-term needs. Whether it’s a one-off event, a temporary project, or a unique situation, this type of insurance provides the flexibility to insure only when and what is necessary.

- Cost-Effectiveness: Traditional insurance policies often require long-term commitments, which can result in unnecessary expenses for short-term risks. With One Day Insurance, users pay only for the coverage they need, making it a cost-effective option for occasional or temporary risks.

- Quick and Easy Process: Obtaining One Day Insurance is typically a straightforward and fast process. Many providers offer online platforms where users can quickly and easily secure coverage for their specific needs, often within minutes.

- Tailored Coverage: One Day Insurance policies can be customized to fit the unique needs of the user. Whether it’s liability coverage for a specific event, property insurance for a short-term rental, or auto insurance for a borrowed vehicle, these policies can be tailored to provide the exact coverage required.

Real-World Applications of One Day Insurance

One Day Insurance has a wide range of applications, catering to various industries and personal situations. Here are some practical examples of how this innovative insurance model can be utilized:

Event Organizers and Planners

Event organizers often face unique risks associated with their events. From public liability concerns to potential property damage, these risks can be significant. One Day Insurance provides a tailored solution, allowing organizers to secure coverage specifically for the duration of their event. This ensures that any potential liabilities or damages are covered without the need for a long-term insurance commitment.

| Event Type | One Day Insurance Coverage |

|---|---|

| Music Festival | Public liability, medical expenses, property damage |

| Sports Tournament | Accidental injury, equipment damage, spectator liability |

| Community Fair | Food contamination, stallholder liability, personal accident |

Vehicle Owners and Borrowers

Whether you’re lending your vehicle to a friend or borrowing one for a specific trip, One Day Insurance offers a convenient and affordable solution. This type of insurance ensures that both the vehicle owner and borrower are covered for the duration of the loan, providing peace of mind for all parties involved.

| Vehicle Usage | One Day Insurance Coverage |

|---|---|

| Friend's Car Loan | Comprehensive coverage, including liability and physical damage |

| Rental Car | Collision damage waiver, liability protection, personal accident |

| Road Trip | Extended mileage coverage, roadside assistance, rental car reimbursement |

Property Owners and Tenants

For property owners, especially those who rent out their spaces on a short-term basis, One Day Insurance can be a valuable tool. It provides coverage for specific periods, such as during a tenant’s stay, ensuring that both the owner and tenant are protected against potential liabilities and damages.

| Property Type | One Day Insurance Coverage |

|---|---|

| Airbnb Rental | Property damage, liability for guests, personal belongings protection |

| Short-Term Lease | Structural damage, tenant liability, rental income protection |

| Special Events | Damage to the property, liability for attendees, event cancellation |

How Does One Day Insurance Work?

The process of obtaining One Day Insurance is typically straightforward and efficient. Here’s a step-by-step guide to understanding how it works:

Step 1: Identify Your Insurance Needs

The first step is to identify the specific insurance coverage you require for your short-term needs. This could be for a one-off event, a temporary project, or a unique situation that requires insurance protection.

Step 2: Research Insurance Providers

Once you have identified your insurance needs, research the market to find insurance providers that offer One Day Insurance policies. Look for reputable providers that specialize in short-term coverage and have a good track record of claims handling.

Step 3: Compare Policies and Premiums

Different insurance providers may offer varying policies and premiums for One Day Insurance. Take the time to compare these options, considering factors such as coverage limits, exclusions, and the overall cost. Ensure that the policy you choose provides adequate coverage for your specific needs.

Step 4: Obtain a Quote and Purchase Coverage

Many insurance providers offer online platforms where you can obtain a quote for One Day Insurance in real-time. Simply provide the necessary details, such as the type of coverage required, the duration, and any specific risks involved. Once you have reviewed the quote and are satisfied with the coverage and premium, you can proceed to purchase the policy.

Step 5: Utilize Your Coverage

With your One Day Insurance policy in place, you can now utilize the coverage for the specified period. Ensure that you understand the terms and conditions of the policy, including any exclusions or limitations. Should any insured event occur during the coverage period, you can file a claim with your insurance provider, following their claims process.

Step 6: Renew or Extend Coverage (if needed)

One Day Insurance policies are designed for short-term coverage. However, if your needs extend beyond the initial coverage period, you may have the option to renew or extend the policy. This can be particularly useful for ongoing projects or events that require insurance protection over multiple days or weeks.

Considerations and Best Practices

While One Day Insurance offers a flexible and cost-effective solution, there are some considerations to keep in mind:

- Policy Limits and Exclusions: As with any insurance policy, it's crucial to understand the limits and exclusions of your One Day Insurance coverage. Ensure that the policy provides adequate coverage for your specific risks and that you are aware of any situations that may not be covered.

- Claims Process: Familiarize yourself with the claims process outlined by your insurance provider. Understand the documentation required, the timelines for submitting claims, and any specific procedures for different types of claims.

- Renewal Options: If you anticipate needing insurance coverage for multiple days or weeks, consider the renewal options offered by your insurance provider. Some providers may offer discounts for extended coverage periods or allow you to tailor the policy to your changing needs.

- Comparison Shopping: One Day Insurance is a relatively new concept, and different providers may offer varying policies and premiums. Take the time to compare multiple providers to find the best fit for your needs and budget.

The Future of Insurance

One Day Insurance represents a shift towards more flexible and tailored insurance solutions. As our lives become increasingly dynamic and our needs evolve rapidly, this type of insurance offers a practical and efficient way to manage risks. It empowers individuals and businesses to take control of their insurance coverage, ensuring they are protected only when and where it matters most.

With its flexibility and cost-effectiveness, One Day Insurance is well-positioned to become a mainstream insurance option. As more providers enter the market and competition increases, we can expect to see even more innovative and affordable short-term insurance solutions. This will not only benefit those with unique, temporary risks but also contribute to a more efficient and responsive insurance industry as a whole.

Can I purchase One Day Insurance for my car if I only need it for a few hours?

+

Yes, many One Day Insurance providers offer flexible coverage options, allowing you to insure your car for a few hours or a specific time period. This can be especially useful if you’re borrowing a friend’s car for a short trip or need coverage for a limited time.

Are there any limitations or exclusions with One Day Insurance policies?

+

Like any insurance policy, One Day Insurance policies may have limitations and exclusions. It’s important to carefully review the terms and conditions of your policy to understand what is and isn’t covered. Some common exclusions may include pre-existing conditions, certain types of damages, or events occurring outside the specified coverage period.

Can I purchase One Day Insurance for my home if I’m hosting a large party or event?

+

Absolutely! One Day Insurance can be a great option for homeowners who are hosting large gatherings or events. It provides coverage for potential liabilities and damages that may occur during the event, ensuring you and your guests are protected.

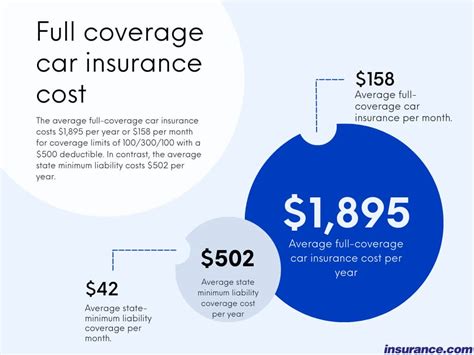

Is One Day Insurance more expensive than traditional insurance policies?

+

One Day Insurance can be a cost-effective solution for short-term risks. While the premium for a single day of coverage may seem higher on a per-day basis compared to a long-term policy, you’re only paying for the coverage you need, which can make it more affordable in the long run. Additionally, some providers offer discounts for extended coverage periods or loyalty programs.

How do I file a claim with my One Day Insurance provider?

+

The claims process for One Day Insurance policies is typically similar to traditional insurance policies. You’ll need to contact your insurance provider and provide the necessary details and documentation related to the insured event. Be sure to familiarize yourself with the claims process outlined in your policy to ensure a smooth claims experience.