Best Health Insurance In Arizona

When it comes to finding the best health insurance in Arizona, it's important to consider various factors such as coverage options, cost, network of healthcare providers, and additional benefits. Arizona, known for its diverse landscape and vibrant communities, offers a range of health insurance plans to cater to the unique needs of its residents. This comprehensive guide will delve into the world of health insurance in the Grand Canyon State, providing an expert analysis to help you make an informed decision.

Understanding Health Insurance in Arizona

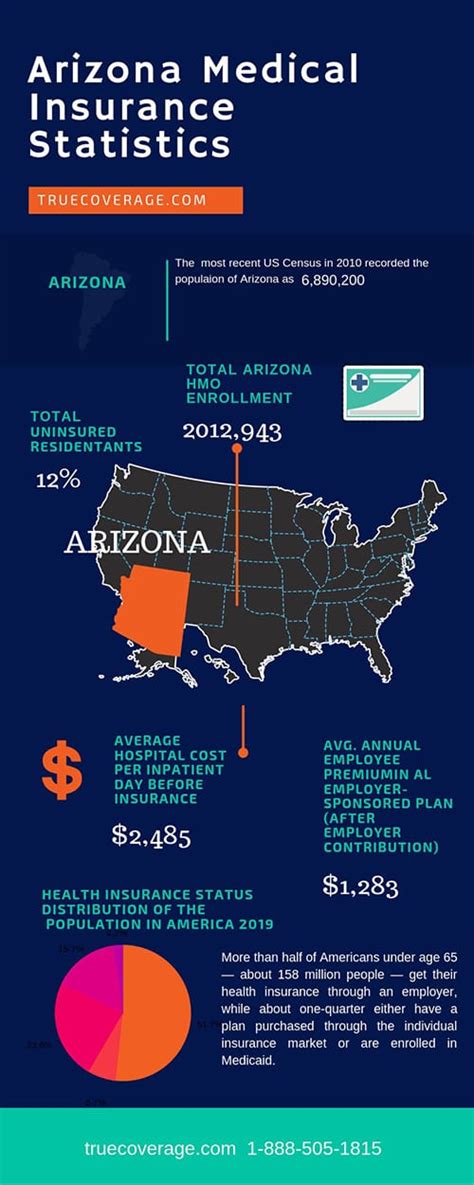

Health insurance in Arizona operates within the framework of the Affordable Care Act (ACA), also known as Obamacare, which aims to make healthcare more accessible and affordable. The state has taken steps to expand healthcare coverage, ensuring that residents have access to a wide range of options. Whether you’re an individual, a family, or a small business owner, understanding the landscape of health insurance in Arizona is crucial.

Arizona's health insurance market offers a variety of plans, including those available through the Health Insurance Marketplace (also known as the ACA Marketplace) and those offered by private insurers. The marketplace provides a platform for individuals and families to compare and enroll in plans that suit their needs and budgets. Additionally, Arizona residents can explore group health insurance plans through their employers or consider Medicare and Medicaid options if eligible.

Key Considerations for Choosing Health Insurance

Selecting the best health insurance plan involves careful evaluation of several factors. Here are some key considerations to guide your decision-making process:

Coverage and Benefits

Examine the scope of coverage provided by different plans. Look for plans that offer comprehensive benefits, including preventive care, prescription drug coverage, mental health services, and specialized treatments. Consider your specific healthcare needs and choose a plan that aligns with them. For instance, if you have a pre-existing condition, ensure that the plan covers it adequately.

Network of Providers

A strong network of healthcare providers is essential for convenient and cost-effective care. Research the plans’ provider networks to ensure that your preferred doctors, specialists, and hospitals are included. Consider the proximity of these providers to your home or workplace, especially if you require regular medical attention.

Cost and Financial Considerations

Health insurance plans vary in terms of premiums, deductibles, copayments, and out-of-pocket maximums. Assess your financial situation and determine how much you can comfortably afford for monthly premiums and other associated costs. Additionally, consider the plan’s cost-sharing arrangements and whether it offers financial assistance or tax credits to make it more affordable.

Additional Benefits and Services

Beyond the basic coverage, some health insurance plans offer additional benefits and services. These can include wellness programs, fitness incentives, telehealth services, and access to discounted rates for certain healthcare procedures. Evaluate these extras to determine if they enhance the overall value of the plan.

Top Health Insurance Providers in Arizona

Arizona is home to several reputable health insurance providers, each offering a range of plans to cater to different needs. Here’s an overview of some of the leading providers in the state:

Blue Cross Blue Shield of Arizona

Blue Cross Blue Shield of Arizona (BCBSAZ) is a trusted name in the health insurance industry, offering a wide range of plans. Their network includes top-rated hospitals and healthcare providers across the state. BCBSAZ provides both individual and family plans, as well as employer-sponsored group plans. Known for their comprehensive coverage and member benefits, they offer plans that cater to various budgets and healthcare needs.

Cigna Health Insurance

Cigna is a national health insurance provider with a strong presence in Arizona. They offer a variety of plans, including individual, family, and employer-sponsored options. Cigna’s plans are known for their competitive pricing and flexible coverage options. Their network includes a wide range of healthcare providers, ensuring accessibility and convenience for policyholders.

UnitedHealthcare

UnitedHealthcare is a leading health insurance provider in Arizona, offering a comprehensive range of plans. They provide individual, family, and employer-sponsored plans, with a focus on affordability and comprehensive coverage. UnitedHealthcare’s network includes top-quality healthcare providers, ensuring policyholders have access to the care they need. Additionally, they offer wellness programs and incentives to promote healthy lifestyles.

Aetna Health Insurance

Aetna is a well-established health insurance provider in Arizona, offering a diverse range of plans. Their plans are designed to meet the unique needs of individuals, families, and employers. Aetna’s network includes a vast array of healthcare providers, ensuring policyholders have a wide range of choices. They also offer additional benefits such as telemedicine services and wellness programs to enhance the overall healthcare experience.

Health Net of Arizona

Health Net is a reputable health insurance provider in Arizona, offering both individual and group plans. Their plans are known for their competitive pricing and comprehensive coverage. Health Net’s network includes a diverse range of healthcare providers, ensuring policyholders have access to quality care. Additionally, they provide member support services and wellness initiatives to promote overall well-being.

Comparative Analysis: Top Plans in Arizona

To help you make an informed decision, let’s delve into a comparative analysis of some of the top health insurance plans available in Arizona. This analysis will provide insights into coverage, cost, and additional benefits, allowing you to choose the plan that best suits your needs.

| Plan Name | Coverage Highlights | Cost Structure | Additional Benefits |

|---|---|---|---|

| BCBSAZ Preferred Plan | Comprehensive coverage including preventive care, prescription drugs, and specialty services. Access to top-rated hospitals. | Competitive premiums with varying deductible options. Offers financial assistance for eligible individuals. | Wellness programs, fitness incentives, and access to online health tools. |

| Cigna Open Access Plan | Flexible coverage with a wide range of benefits. Includes mental health services and wellness programs. | Affordable premiums with varying copayment structures. Offers discounts for healthy lifestyle choices. | Telehealth services, access to discounted fitness memberships, and online health resources. |

| UnitedHealthcare Choice Plan | Comprehensive coverage with a focus on preventive care. Includes vision and dental benefits. | Competitive premiums with cost-sharing options. Offers tax credits for eligible individuals. | Wellness programs, fitness incentives, and access to health coaching services. |

| Aetna Signature Plan | Comprehensive coverage with a focus on specialty services. Includes telemedicine and mental health support. | Affordable premiums with flexible cost-sharing arrangements. Offers financial incentives for healthy behaviors. | Wellness programs, fitness trackers, and access to online health communities. |

| Health Net Gold Plan | Comprehensive coverage with a wide range of benefits. Includes access to a large network of providers. | Competitive premiums with varying deductible options. Offers financial assistance for eligible individuals. | Wellness initiatives, access to discounted fitness programs, and member support services. |

Tips for Choosing the Right Plan

Selecting the best health insurance plan in Arizona requires careful consideration of your specific needs and priorities. Here are some tips to guide you through the process:

- Assess Your Healthcare Needs: Evaluate your current and potential future healthcare requirements. Consider any pre-existing conditions, regular medical treatments, or specialized care you may need.

- Compare Plans Side-by-Side: Use online tools and resources to compare plans based on coverage, cost, and additional benefits. Look for plans that align with your priorities and budget.

- Research Provider Networks: Ensure that your preferred healthcare providers are included in the plan's network. This is crucial for convenience and cost-effectiveness.

- Understand Cost-Sharing Arrangements: Familiarize yourself with the plan's cost-sharing structure, including deductibles, copayments, and out-of-pocket maximums. Choose a plan that aligns with your financial situation.

- Explore Additional Benefits: Consider the value-added benefits offered by different plans. Wellness programs, fitness incentives, and telehealth services can enhance your overall healthcare experience.

- Check for Financial Assistance: Many plans offer financial assistance or tax credits to make health insurance more affordable. Check if you're eligible for such programs.

- Read Reviews and Testimonials: Research online reviews and testimonials from policyholders to gain insights into the plan's performance and customer satisfaction.

- Seek Professional Advice: If you're unsure about your options, consider consulting with an insurance broker or financial advisor who can provide expert guidance based on your specific circumstances.

Conclusion: Your Path to Quality Healthcare

Finding the best health insurance in Arizona is a crucial step towards ensuring access to quality healthcare for you and your loved ones. By considering factors such as coverage, cost, provider networks, and additional benefits, you can make an informed decision that aligns with your needs and budget. Remember, health insurance is a vital investment in your well-being, and with the right plan, you can navigate the healthcare system with confidence and peace of mind.

How do I know if I’m eligible for financial assistance or tax credits for health insurance in Arizona?

+Eligibility for financial assistance or tax credits depends on various factors, including your income level and family size. You can use the Health Insurance Marketplace’s eligibility calculator to determine if you qualify. Additionally, certain plans may offer financial incentives based on healthy lifestyle choices or other criteria.

Can I keep my current doctor if I switch health insurance plans in Arizona?

+It depends on whether your current doctor is included in the new plan’s provider network. Before switching plans, research the network to ensure your preferred healthcare providers are covered. Some plans offer out-of-network options, but they may come with higher costs.

What happens if I have a pre-existing condition? Will I be covered by health insurance in Arizona?

+Under the Affordable Care Act, health insurance plans in Arizona cannot deny coverage or charge higher premiums based on pre-existing conditions. This means that you have the right to obtain coverage, regardless of your health status. However, it’s important to carefully review the plan’s coverage details to ensure your specific condition is adequately addressed.

Are there any discounts or incentives for healthy behaviors offered by health insurance providers in Arizona?

+Yes, many health insurance providers in Arizona offer discounts or incentives for healthy behaviors. These can include rewards for maintaining a healthy weight, quitting smoking, or participating in wellness programs. Some plans may also provide discounted rates for certain healthcare procedures or services. Check with your insurance provider or explore their website for details on these incentives.