Full Term Life Insurance

Full term life insurance is a fundamental component of financial planning, offering a safety net for individuals and their loved ones. In today's dynamic world, understanding the intricacies of this insurance type is crucial. This article aims to delve deep into full term life insurance, exploring its mechanics, benefits, and implications.

Understanding Full Term Life Insurance

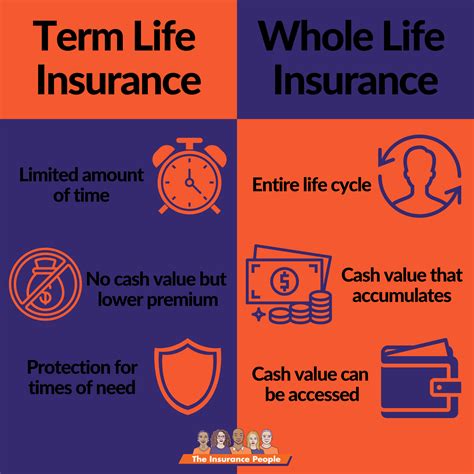

Full term life insurance, often simply referred to as “term life insurance,” is a type of coverage that provides financial protection for a specified period, known as the “term.” This period can range from 10 to 30 years, during which the policyholder’s beneficiaries receive a lump-sum payment (the death benefit) upon the policyholder’s demise. The key characteristic of full term life insurance is its temporary nature, as opposed to permanent life insurance policies that offer coverage for the entirety of one’s life.

Key Features and Benefits

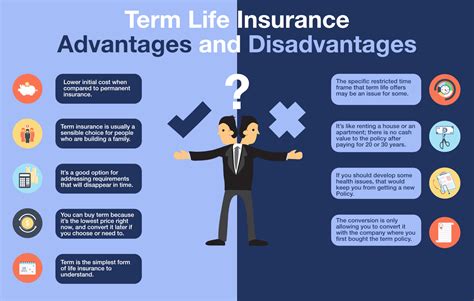

- Affordability: One of the most appealing aspects of full term life insurance is its cost-effectiveness. Policies are designed to be more affordable compared to permanent life insurance, making it accessible to a broader range of individuals.

- Customizable Terms: Policyholders can choose the length of their coverage term, aligning it with their specific needs and financial goals. For instance, a parent might opt for a 20-year term to cover their children’s education and ensure financial security until they become independent.

- Guaranteed Death Benefit: In the event of the policyholder’s death during the term, the beneficiaries receive the full death benefit, which can provide much-needed financial stability and peace of mind.

- Flexibility: Full term life insurance policies can be renewed or converted into permanent life insurance, allowing policyholders to adapt their coverage as their circumstances and needs change.

How Full Term Life Insurance Works

When an individual purchases a full term life insurance policy, they agree to pay a premium at regular intervals (monthly, quarterly, or annually) for a specified period. The premium amount is determined by various factors, including the policyholder’s age, health status, and the chosen term length. Throughout the term, the policyholder is protected, and their beneficiaries are assured of the death benefit if the need arises.

Upon the policyholder's death, the beneficiaries can file a claim with the insurance company. The claim process typically involves submitting proof of the policyholder's death, such as a death certificate, and any other required documentation. Once the claim is approved, the beneficiaries receive the death benefit, which can be used to cover a variety of expenses, including funeral costs, outstanding debts, or ongoing living expenses.

| Policy Feature | Description |

|---|---|

| Term Length | Typically ranges from 10 to 30 years, allowing customization based on individual needs. |

| Premium Payment | Paid at regular intervals, with rates often locked in for the entire term, providing budget predictability. |

| Death Benefit | The amount paid to beneficiaries upon the policyholder's death during the term, providing financial security. |

| Renewal and Conversion | Policies can be renewed or converted to permanent life insurance, offering flexibility in coverage. |

Choosing the Right Full Term Life Insurance

Selecting the appropriate full term life insurance policy involves a thoughtful evaluation of your personal and financial circumstances. Here are some key considerations:

Assessing Your Needs

Begin by identifying your reasons for seeking life insurance. Are you looking to cover outstanding debts, ensure your family’s financial stability, or provide for specific financial goals like college education for your children? Understanding your primary objectives will guide your policy selection.

Determining Coverage Amount

The coverage amount, or the death benefit, should be sufficient to meet your identified needs. It should cover your outstanding debts, provide for your family’s living expenses, and address any other financial goals you’ve set. Financial advisors often recommend calculating this amount based on your annual income and multiplying it by the number of years you wish to provide coverage.

Selecting the Term Length

The term length should align with your financial goals and life stage. For instance, if you’re a young professional with a growing family, you might opt for a longer term to cover your children’s education and ensure financial stability until they’re self-sufficient. On the other hand, an older individual might choose a shorter term to cover specific financial obligations or provide a safety net for their spouse.

Considering Premium Costs

Premiums for full term life insurance can vary significantly based on factors like age, health status, and the chosen term length. While affordability is a key consideration, it’s essential to strike a balance between cost and adequate coverage. Regularly reviewing and adjusting your policy as your circumstances change can help ensure you’re getting the best value for your needs.

Real-World Applications and Case Studies

Full term life insurance has proven to be a valuable tool for individuals and families across various life stages and financial situations. Let’s explore a few real-world scenarios where full term life insurance played a pivotal role.

Providing Financial Security for Young Families

Consider the case of John and Emily, a young couple with two children. John, the primary income earner, purchases a 20-year full term life insurance policy with a substantial death benefit. Should an unforeseen event lead to John’s demise, the policy ensures Emily and their children are financially secure, covering living expenses, educational costs, and any outstanding debts.

Supporting Retirement Goals

Sarah, a 55-year-old professional, opts for a 10-year full term life insurance policy to provide a financial buffer during her retirement planning. The policy’s death benefit is designed to cover her mortgage balance and any other financial obligations, ensuring her retirement goals remain on track even in the event of her untimely passing.

Protecting Business Interests

Full term life insurance is also utilized in business settings. For instance, a partnership might purchase full term life insurance policies for each partner, ensuring that in the event of a partner’s death, the business can continue smoothly. The death benefit can be used to buy out the deceased partner’s share, providing financial stability and continuity for the remaining partners and the business.

Expert Insights and Future Implications

Full term life insurance remains a crucial component of financial planning, offering flexibility, affordability, and peace of mind. As individuals and families navigate evolving financial landscapes, the role of full term life insurance is expected to remain central. Here are some expert insights and future considerations:

The Rise of Digital Insurance

The insurance industry is witnessing a digital transformation, with online platforms and apps making it easier than ever to compare policies, obtain quotes, and manage coverage. This trend is expected to continue, offering consumers greater convenience and transparency in their insurance choices.

Personalized Coverage

Advancements in technology and data analytics are enabling insurers to offer more personalized coverage options. This could mean more tailored policies based on individual health and lifestyle factors, potentially leading to more accurate pricing and improved consumer experiences.

Long-Term Financial Planning

Full term life insurance is increasingly being viewed as a key component of long-term financial planning. As individuals seek to protect their financial futures and those of their loved ones, the importance of this type of insurance is likely to grow. Financial advisors and insurance professionals will play a critical role in guiding individuals through this complex landscape.

What happens if I outlive my full term life insurance policy?

+If you outlive your full term life insurance policy, you no longer have coverage, and your beneficiaries won't receive the death benefit. However, many insurers offer the option to renew the policy for another term or convert it to a permanent life insurance policy.

Can I increase the coverage amount during the term of my full term life insurance policy?

+Increasing the coverage amount during the term of a full term life insurance policy is typically not possible without undergoing a new underwriting process. However, some insurers offer the option to purchase additional coverage at specific intervals during the term, often with a new medical exam.

Are there any tax implications with full term life insurance?

+Full term life insurance death benefits are generally tax-free in many countries, including the United States. However, it's important to consult with a tax professional to understand the specific tax implications in your jurisdiction.

In conclusion, full term life insurance serves as a vital financial safety net, offering protection and peace of mind for policyholders and their beneficiaries. With its affordability, flexibility, and customizable terms, it remains an essential tool in financial planning. As the insurance landscape evolves, staying informed and consulting with experts can help individuals make the best choices for their unique circumstances.