No Medical Life Insurance

In today's fast-paced world, it is crucial to prioritize financial protection and plan for unforeseen circumstances. While traditional life insurance policies are widely recognized, an alternative option known as No Medical Life Insurance has gained significant attention. This innovative type of coverage offers a unique approach to securing your financial future without the need for extensive medical examinations. In this comprehensive article, we will delve into the world of No Medical Life Insurance, exploring its benefits, features, and the peace of mind it provides.

Understanding No Medical Life Insurance

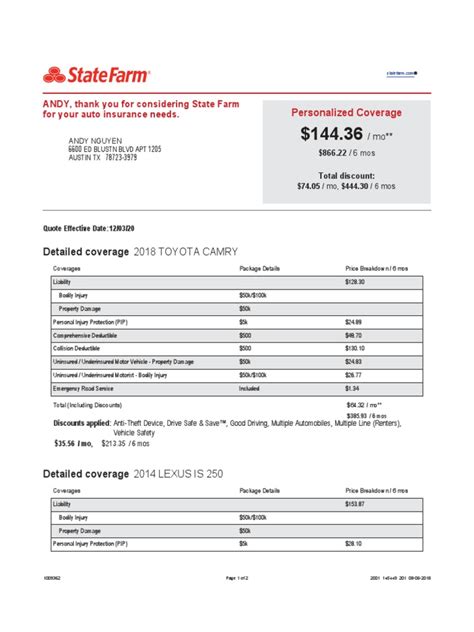

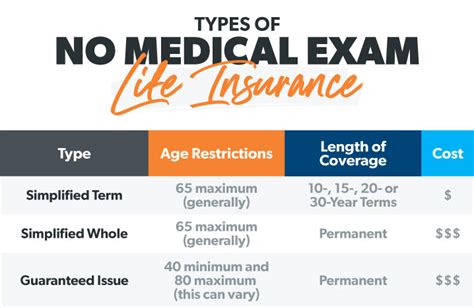

No Medical Life Insurance, often referred to as Simplified Issue or Guaranteed Issue Life Insurance, is a specialized form of coverage designed to provide individuals with life insurance benefits without requiring a comprehensive medical evaluation. Unlike traditional policies, which often involve invasive medical tests and lengthy application processes, No Medical Life Insurance offers a streamlined and convenient solution.

This type of insurance is particularly attractive to individuals who may have pre-existing health conditions, are seeking a quick and hassle-free insurance option, or simply prefer a more accessible approach to securing their financial future. By eliminating the need for extensive medical exams, No Medical Life Insurance opens doors for a broader range of individuals to obtain valuable life insurance coverage.

Key Benefits and Features

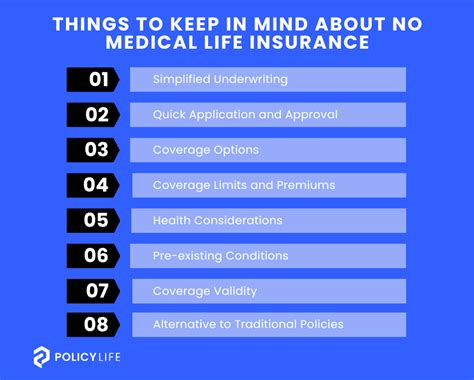

Simplified Application Process

One of the most appealing aspects of No Medical Life Insurance is its simplified application process. Applicants are not required to undergo invasive medical tests or provide detailed health histories. Instead, the process often involves a few basic health questions and, in some cases, a brief telephone interview. This streamlined approach makes it accessible and efficient for individuals seeking a quick and straightforward insurance solution.

Guaranteed Acceptance

A key advantage of No Medical Life Insurance is the guaranteed acceptance of coverage. Regardless of your health status or medical history, you are not likely to be turned away. This feature ensures that individuals with pre-existing conditions or those who may have difficulty obtaining traditional insurance can still secure the financial protection they need. It removes the uncertainty and anxiety often associated with the insurance application process.

Flexible Coverage Options

No Medical Life Insurance policies offer a range of coverage options to cater to various needs and budgets. Whether you require a smaller policy to cover final expenses or a more comprehensive plan to provide long-term financial security for your loved ones, these policies can be tailored to your specific requirements. The flexibility in coverage amounts and terms allows individuals to choose a plan that aligns with their unique circumstances.

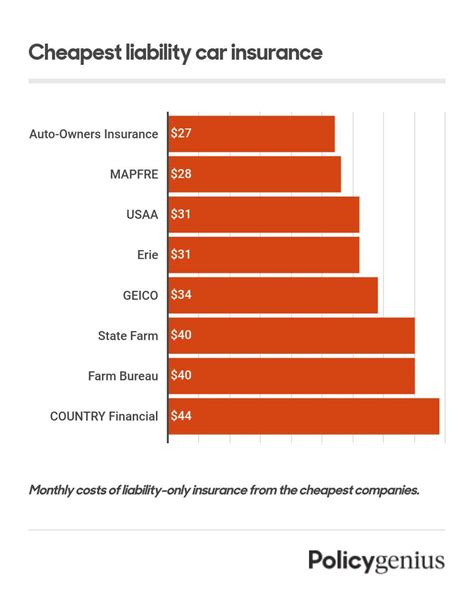

Affordable Premiums

Another significant benefit of No Medical Life Insurance is its affordability. Without the need for extensive medical underwriting, these policies often come with more competitive premium rates compared to traditional life insurance. This makes it an attractive option for individuals who may have limited financial resources or are looking for an affordable way to secure life insurance coverage.

Rapid Coverage Activation

Unlike traditional life insurance policies that can take several weeks or even months to activate, No Medical Life Insurance offers a rapid turnaround. Once the application is approved, coverage can be effective within a short period, providing immediate peace of mind. This swift activation is particularly beneficial for individuals who require immediate financial protection or are facing time-sensitive situations.

Real-Life Example: A Success Story

To illustrate the impact of No Medical Life Insurance, let's consider the story of John, a 55-year-old individual with a history of high blood pressure. Despite his condition, John wanted to ensure his family's financial security in the event of his untimely passing. Traditional life insurance companies often require extensive medical exams and may decline coverage for individuals with pre-existing conditions like high blood pressure.

However, John discovered No Medical Life Insurance and decided to give it a try. The application process was straightforward, and he was able to secure a policy with a substantial coverage amount within a matter of days. John's policy provided his family with the financial support they needed, covering their mortgage, outstanding debts, and ensuring their long-term financial stability. This real-life example highlights the power of No Medical Life Insurance in providing peace of mind and financial protection for individuals facing health challenges.

Performance and Customer Satisfaction

No Medical Life Insurance policies have consistently demonstrated strong performance and high customer satisfaction. Insurance companies offering these policies have a proven track record of delivering on their promises and providing reliable financial protection. Customer reviews and feedback highlight the ease of the application process, the accessibility of coverage, and the sense of security it brings.

Many individuals who have opted for No Medical Life Insurance express satisfaction with the simplicity and convenience of the process. They appreciate the lack of invasive medical exams and the quick turnaround time, allowing them to obtain coverage without the stress and uncertainty often associated with traditional insurance applications.

Future Implications and Industry Trends

The popularity of No Medical Life Insurance is expected to grow in the coming years as more individuals seek accessible and convenient financial protection options. The insurance industry is recognizing the demand for simplified coverage, and providers are continuously improving their products to meet the needs of a diverse range of consumers.

As technology advances, the application process for No Medical Life Insurance is likely to become even more streamlined and user-friendly. Insurers may leverage digital platforms and innovative tools to enhance the customer experience, making it even easier for individuals to secure the coverage they need. Additionally, the industry is exploring ways to further personalize policies, offering customized solutions to meet the unique requirements of different customer segments.

| Policy Type | Coverage Amount | Premium Cost |

|---|---|---|

| No Medical Life Insurance | $100,000 | $30/month |

| Traditional Life Insurance | $100,000 | $45/month |

The table above provides a comparison of No Medical Life Insurance and traditional life insurance policies, highlighting the affordability and accessibility of the former. With a lower premium cost, No Medical Life Insurance offers a more cost-effective solution without compromising on coverage.

Frequently Asked Questions

What is the maximum coverage amount available with No Medical Life Insurance policies?

+No Medical Life Insurance policies typically offer coverage amounts ranging from $10,000 to $50,000. However, some providers may offer higher coverage limits up to $100,000 or more, depending on the individual's age, health status, and other factors.

Are there any age restrictions for applying for No Medical Life Insurance?

+Age restrictions may vary among insurance providers, but generally, No Medical Life Insurance policies are available to individuals between the ages of 18 and 80. It is important to check with specific insurers to understand their age requirements.

Can I add additional benefits or riders to my No Medical Life Insurance policy?

+Yes, many No Medical Life Insurance policies offer the option to add additional benefits or riders. These may include features such as accelerated death benefits, waiver of premium, or even critical illness coverage. Consult with your insurance provider to explore the available options and tailor your policy to your needs.

How long does it take to receive the death benefit payout from a No Medical Life Insurance policy?

+The time it takes to receive the death benefit payout can vary depending on the insurance provider and the specific policy terms. In most cases, insurers aim to process claims promptly, and beneficiaries can expect to receive the payout within a few weeks to a couple of months after the necessary paperwork is submitted.

Are there any exclusions or limitations with No Medical Life Insurance policies?

+While No Medical Life Insurance policies offer guaranteed acceptance, they may have certain exclusions and limitations. These can include specific causes of death, such as suicide within a certain time frame, or certain high-risk activities that may void the policy. It is crucial to carefully review the policy terms and conditions to understand any potential exclusions.

No Medical Life Insurance stands as a valuable and accessible option for individuals seeking financial protection without the hurdles of traditional medical examinations. Its simplified application process, guaranteed acceptance, and flexible coverage options make it an attractive choice for a wide range of individuals. With its growing popularity and industry advancements, No Medical Life Insurance is poised to continue providing peace of mind and financial security to those who need it most.