Njm Insurance

NJM Insurance Group, commonly known as NJM, is a leading property and casualty insurance company based in the heart of the Northeast. With a rich history spanning over a century, NJM has built a strong reputation for its commitment to customer satisfaction and its unique approach to insurance. In this article, we delve into the world of NJM Insurance, exploring its origins, key offerings, and the factors that set it apart in the competitive insurance landscape.

A Legacy of Innovation and Customer Focus

NJM Insurance Group was founded in 1913, originally as the New Jersey Manufacturers Casualty Insurance Company. From its inception, the company focused on providing insurance solutions tailored to the needs of businesses and individuals in the manufacturing industry. Over the years, NJM expanded its reach and now offers a comprehensive range of insurance products to customers across multiple states.

What sets NJM apart is its unwavering dedication to its customers. The company operates with a strong sense of community and strives to deliver exceptional service. NJM's customer-centric approach is evident in its personalized insurance plans, efficient claims processes, and its commitment to providing education and resources to help policyholders understand their coverage.

Comprehensive Insurance Offerings

NJM Insurance Group offers a diverse array of insurance products to meet the needs of its diverse customer base. Here’s an overview of their key offerings:

Auto Insurance

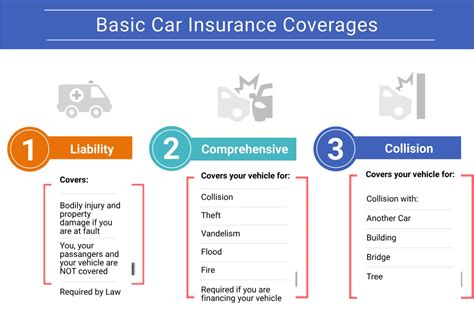

NJM’s auto insurance policies provide comprehensive coverage for vehicles, including liability, collision, and comprehensive protection. The company offers competitive rates and customizable plans to suit various driving needs. Additionally, NJM provides road assistance services and accident forgiveness options to enhance customer peace of mind.

Homeowners Insurance

For homeowners, NJM offers a range of policies designed to protect properties and personal belongings. These policies cover various risks, including fire, theft, and natural disasters. NJM’s homeowners insurance plans also include liability coverage and additional living expenses in case of temporary displacement due to insured events.

Business Insurance

NJM’s business insurance solutions are tailored to meet the unique needs of small to medium-sized enterprises. The company offers commercial property, general liability, and professional liability insurance, among other coverage options. NJM’s business insurance plans provide protection against a wide range of risks, ensuring business owners can focus on their operations with confidence.

Workers’ Compensation

NJM’s workers’ compensation insurance is a vital offering for businesses, ensuring the well-being of employees in the event of work-related injuries or illnesses. The company’s policies provide medical benefits, wage replacement, and rehabilitation services, helping employers fulfill their legal obligations and support their workforce.

Technology and Innovation

NJM Insurance Group embraces technology to enhance its operations and improve the customer experience. The company has invested in digital platforms and mobile apps, allowing policyholders to manage their insurance needs conveniently. NJM’s online services enable customers to access policy information, make payments, and file claims with ease.

Additionally, NJM utilizes advanced data analytics and risk assessment tools to provide accurate and personalized insurance solutions. This technological prowess enables the company to offer competitive rates and tailored coverage, ensuring customers receive the best value for their insurance needs.

Awards and Recognition

NJM Insurance Group’s dedication to customer satisfaction and innovation has not gone unnoticed. The company has received numerous accolades and awards, including:

- J.D. Power recognition for its outstanding customer service in the auto insurance sector.

- A A+ (Superior) rating from AM Best, reflecting NJM's financial strength and stability.

- Multiple awards for its workplace culture, including being named one of the "Best Places to Work" by various publications.

Community Engagement and Giving Back

NJM Insurance Group believes in giving back to the communities it serves. The company actively engages in philanthropic initiatives and supports various causes. NJM’s corporate social responsibility programs focus on education, environmental sustainability, and community development. Through its charitable efforts, NJM aims to make a positive impact and contribute to the well-being of the communities it calls home.

Conclusion

NJM Insurance Group has established itself as a trusted and innovative force in the insurance industry. With a rich history, a customer-centric approach, and a commitment to technological advancement, NJM continues to thrive and provide exceptional insurance solutions. Whether it’s auto, homeowners, business, or workers’ compensation insurance, NJM’s personalized approach and focus on customer satisfaction make it a top choice for individuals and businesses seeking comprehensive coverage.

How can I get a quote for NJM insurance policies?

+You can request a quote for NJM insurance policies by visiting their official website or contacting their customer service team. NJM offers online quote tools and personalized assistance to help you find the right coverage for your needs.

What makes NJM’s auto insurance stand out from competitors?

+NJM’s auto insurance is known for its competitive rates, personalized coverage options, and excellent customer service. They offer accident forgiveness, road assistance, and a streamlined claims process, ensuring a positive experience for policyholders.

Does NJM provide insurance coverage outside of the Northeast region?

+Yes, while NJM’s presence is strongest in the Northeast, they have expanded their reach to offer insurance solutions in multiple states. Check NJM’s website or contact their team to determine the states where their policies are available.

What are the key benefits of NJM’s homeowners insurance policies?

+NJM’s homeowners insurance policies provide comprehensive coverage for properties and belongings. They offer flexible plans, additional living expenses coverage, and efficient claims handling, ensuring peace of mind for homeowners.