Nationwide Auto Insurance Companies

The auto insurance landscape is vast and diverse, with numerous companies offering a wide range of policies to cater to the varying needs of drivers across the United States. Choosing the right auto insurance provider is a crucial decision that can impact your financial security and peace of mind. In this comprehensive guide, we delve into the world of nationwide auto insurance companies, exploring their offerings, reputation, and unique features to help you make an informed choice.

Understanding the Auto Insurance Market

The auto insurance market in the US is highly competitive, with both large, well-established companies and smaller, regional insurers vying for customers. While some insurers focus on providing comprehensive coverage options, others specialize in offering affordable policies for specific driver profiles. Understanding the unique characteristics of each insurer is key to finding the best fit for your needs.

Nationwide Auto Insurance Giants: A Comprehensive Overview

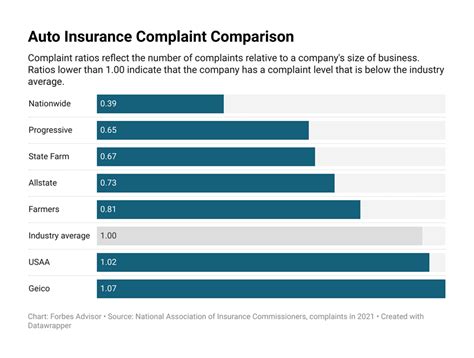

Let’s delve into some of the leading nationwide auto insurance companies, examining their offerings, customer satisfaction, and financial stability.

State Farm: The Trusted Choice

State Farm is a household name in the insurance industry, known for its extensive network of agents and customer-centric approach. With a focus on personalized service, State Farm offers a range of auto insurance policies, including standard coverage, SR-22 insurance, and specialized options for high-risk drivers. The company’s strong financial standing and commitment to customer satisfaction make it a top choice for many drivers.

State Farm's unique offerings include:

- Drive Safe & Save: A usage-based insurance program that rewards safe driving habits with discounts.

- Steer Clear: A program designed for young drivers, offering educational resources and potential discounts.

- Roadside Assistance: 24/7 emergency roadside services are included with most policies.

Geico: Where Savings Are Found

Geico, an acronym for Government Employees Insurance Company, has become a go-to choice for many drivers seeking affordable auto insurance. The company's focus on digital convenience and competitive pricing has attracted a large customer base. Geico offers a range of coverage options, including standard policies, SR-22 filings, and specialized plans for high-risk drivers.

Geico's standout features include:

- Military Discounts: Geico offers exclusive discounts for active-duty military personnel and their families.

- Easy Online Management: Customers can manage their policies, make payments, and file claims entirely online.

- Accident Forgiveness: Some policies include accident forgiveness, preventing premium increases after the first at-fault accident.

Progressive: Innovative Insurance Solutions

Progressive has established itself as an innovative force in the auto insurance industry, constantly introducing new products and services. The company offers a wide range of coverage options, from standard policies to specialized plans for high-risk drivers. Progressive's focus on customer education and digital convenience has made it a popular choice for many.

Progressive's unique offerings include:

- Name Your Price: A tool that allows customers to set their desired price range for coverage and find a policy that fits.

- Snapshot: A usage-based insurance program that analyzes driving habits to offer personalized rates.

- 24/7 Claims Service: Customers can file claims and receive support anytime through various channels.

Allstate: You're in Good Hands

Allstate is a well-known insurer with a strong presence across the US. The company offers a comprehensive range of auto insurance policies, including standard coverage, SR-22 insurance, and specialized plans for high-risk drivers. Allstate's commitment to customer service and education has earned it a solid reputation in the industry.

Allstate's notable features include:

- Drivewise: A usage-based insurance program that rewards safe driving with potential discounts.

- Accident Forgiveness: Some policies include accident forgiveness, preventing premium increases after a certain number of accidents.

- Claim Satisfaction Guarantee: Allstate promises to resolve claims quickly and fairly, offering a satisfaction guarantee.

USAA: Exclusive Military Benefits

USAA is a unique insurer, offering auto insurance exclusively to military members, veterans, and their families. With a strong focus on customer service and military-specific benefits, USAA has earned a reputation for excellence in the industry. The company provides a range of auto insurance policies, including standard coverage and specialized options for high-risk drivers.

USAA's standout features include:

- Military Discounts: USAA offers significant discounts to active-duty military personnel and their families.

- 24/7 Claims Support: Customers can file claims and receive assistance anytime, ensuring quick resolution.

- Accident Forgiveness: Some policies include accident forgiveness, protecting customers from premium increases after accidents.

Specialized Auto Insurance Providers

In addition to the major nationwide insurers, there are specialized providers catering to specific driver profiles. These insurers often offer competitive rates and tailored coverage for drivers with unique needs.

The General: Insurance for High-Risk Drivers

The General is a subsidiary of American Family Insurance, specializing in providing auto insurance to high-risk drivers. The company offers a range of coverage options, including SR-22 insurance and policies for drivers with less-than-perfect records. The General’s focus on affordability and customer service has made it a popular choice for drivers facing challenges in obtaining insurance.

Metromile: Pay-Per-Mile Insurance

Metromile is a pioneer in the pay-per-mile insurance space, offering policies that charge based on the number of miles driven. This unique approach is ideal for low-mileage drivers, providing significant savings. Metromile’s innovative technology and focus on sustainability have attracted a dedicated customer base.

Choosing the Right Auto Insurance Provider

Selecting the best auto insurance company involves considering a range of factors, including coverage options, pricing, customer service, and financial stability. Here are some key considerations to guide your decision-making process:

- Coverage Options: Ensure the insurer offers the type of coverage you need, whether it's standard policies, SR-22 insurance, or specialized plans for high-risk drivers.

- Pricing: Compare quotes from multiple insurers to find the most competitive rates for your specific needs.

- Customer Service: Look for insurers with a strong reputation for excellent customer service, prompt claims processing, and easy-to-use digital platforms.

- Financial Stability: Choose insurers with a solid financial standing to ensure they can provide long-term coverage and support.

- Additional Benefits: Explore unique offerings like usage-based insurance programs, accident forgiveness, and military discounts to find added value.

By carefully evaluating these factors and researching the specific needs of your driving profile, you can make an informed decision and choose the auto insurance company that best suits your requirements.

The Future of Auto Insurance

The auto insurance industry is undergoing significant changes, driven by advancements in technology and shifting consumer preferences. As autonomous vehicles and shared mobility services gain traction, the traditional auto insurance model is likely to evolve. Insurers are already exploring new coverage options and risk assessment methods to stay relevant in this evolving landscape.

One notable trend is the rise of usage-based insurance, which rewards safe driving habits and offers personalized rates. This approach is gaining popularity, especially among younger drivers who value data-driven pricing and digital convenience. Additionally, insurers are investing in telematics and connected car technologies to gather real-time driving data, further refining their risk assessment processes.

Another key area of focus is sustainability. With growing environmental concerns, insurers are exploring ways to reduce their carbon footprint and support eco-friendly initiatives. Some insurers are offering discounts for hybrid and electric vehicles, while others are partnering with sustainability organizations to promote eco-conscious driving practices.

The future of auto insurance also involves a shift towards personalized coverage. Insurers are leveraging data analytics and machine learning to tailor policies to individual driver profiles. This approach considers not only driving behavior but also lifestyle factors, such as occupation and commuting patterns, to offer customized coverage options.

Furthermore, the rise of digital technologies is transforming the way insurers interact with customers. Online quote comparisons, digital claims processing, and self-service platforms are becoming the norm, offering convenience and efficiency. Insurers are also investing in chatbots and artificial intelligence to enhance customer service and provide instant support.

In conclusion, the auto insurance landscape is dynamic and evolving, driven by technological advancements and changing consumer needs. As the industry adapts to these changes, drivers can expect more personalized coverage options, innovative risk assessment methods, and a greater focus on sustainability. By staying informed and engaging with the latest trends, drivers can make well-informed choices and navigate the evolving auto insurance market with confidence.

What factors should I consider when choosing an auto insurance company?

+

When selecting an auto insurance provider, consider factors such as coverage options, pricing, customer service reputation, financial stability, and additional benefits like usage-based insurance programs or accident forgiveness.

Are there any specialized auto insurance providers for high-risk drivers?

+

Yes, there are specialized providers like The General and Metromile that cater to high-risk drivers and offer competitive rates and tailored coverage.

What is usage-based insurance, and how does it work?

+

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is a pricing model that uses data from a device installed in your car to track your driving habits. Insurers analyze this data to offer personalized rates based on your actual driving behavior.

How does the future of auto insurance look with the rise of autonomous vehicles and shared mobility services?

+

The future of auto insurance is expected to evolve with the rise of autonomous vehicles and shared mobility services. Insurers are exploring new coverage options, risk assessment methods, and pricing models to adapt to these changing transportation trends.