Most Affordable Insurance In Florida

Florida, known for its vibrant culture, diverse population, and unique attractions, also presents a complex landscape when it comes to insurance. With a range of options available, finding the most affordable insurance in the Sunshine State can be a challenging task. In this comprehensive guide, we delve into the world of insurance, offering insights, tips, and strategies to help Floridians secure the best coverage at the most competitive rates.

Understanding the Insurance Landscape in Florida

Florida’s insurance market is diverse, catering to the varied needs of its residents. From car insurance to health coverage, homeowners’ policies, and more, the options can be overwhelming. It’s crucial to navigate this market with a strategic approach to ensure you’re getting the best value for your money.

The Importance of Shopping Around

One of the key strategies in finding affordable insurance is comparison shopping. Different providers offer varying rates and coverage options, and by exploring multiple options, you can identify the most cost-effective plan for your needs. Online comparison tools and insurance brokers can be valuable resources in this process, providing a comprehensive overview of the market.

Government-Offered Programs

Florida, like many states, offers government-backed insurance programs to provide coverage to those who might not otherwise be able to afford it. These programs often have eligibility criteria based on income and other factors, but they can be a lifeline for those in need. Understanding these programs and their requirements is essential for those seeking the most affordable options.

| Program Name | Eligibility Criteria |

|---|---|

| Florida Healthy Kids | Children under 18 whose family income is too high for Medicaid but cannot afford private insurance |

| Medicaid | Low-income individuals and families, pregnant women, elderly, and people with disabilities |

| Florida's Medicare Savings Programs | Seniors and people with disabilities with limited income and resources |

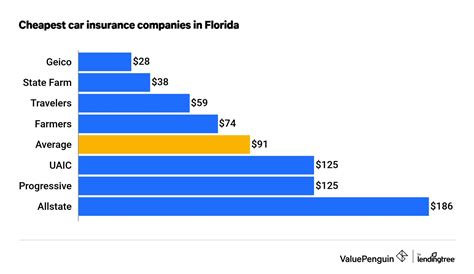

Car Insurance: A Comprehensive Guide

For many Floridians, car insurance is a significant expense. The state’s unique no-fault system and diverse population make car insurance rates a complex matter. Here’s a detailed look at how to navigate this landscape and find the most affordable coverage.

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, which means that regardless of who caused an accident, each driver’s insurance company pays for their own medical bills and lost wages. This system aims to expedite the claims process and reduce litigation. However, it also means that drivers must carry Personal Injury Protection (PIP) coverage, which can increase insurance costs.

Factors Affecting Car Insurance Rates

Several factors influence car insurance rates in Florida, including the driver’s age, gender, driving record, and the type of vehicle insured. Additionally, the insurer, the coverage limits chosen, and any additional features or discounts can significantly impact the final cost.

Tips to Lower Your Car Insurance Costs

If you’re looking to reduce your car insurance expenses, here are some strategies to consider:

- Increase your deductible: Opting for a higher deductible can lead to lower premiums, but ensure you can afford the increased out-of-pocket expense in the event of a claim.

- Bundle policies: Many insurers offer discounts when you bundle multiple policies, such as car and home insurance.

- Maintain a clean driving record: A clean driving history can lead to significant savings on your insurance premiums.

- Explore discounts: Many insurers offer discounts for various reasons, such as good student discounts, safe driver discounts, or loyalty discounts. Ensure you’re taking advantage of all applicable discounts.

Health Insurance: Navigating the Options

Health insurance is a critical aspect of financial planning, and finding affordable coverage is essential. In Florida, the health insurance market offers a range of options, from private plans to government-backed programs. Here’s a guide to help you navigate this landscape.

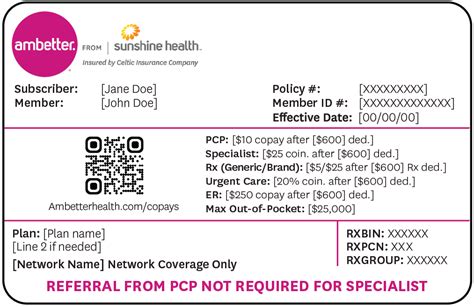

Private Health Insurance Plans

Private health insurance plans in Florida are offered by a variety of providers, each with its own network of doctors and hospitals. These plans often provide more flexibility in choosing healthcare providers but can come with higher premiums. It’s crucial to carefully review the coverage details and network restrictions to ensure the plan meets your needs.

Government-Backed Health Insurance Programs

Florida residents may also be eligible for government-backed health insurance programs, such as Medicaid and the Children’s Health Insurance Program (CHIP). These programs offer comprehensive coverage at little to no cost, but they have strict eligibility criteria based on income and other factors. Understanding these programs and their enrollment processes is essential for those seeking affordable health coverage.

The Affordable Care Act (ACA) and Florida

The ACA, also known as Obamacare, has significantly impacted the health insurance landscape in Florida. It has expanded Medicaid coverage and introduced the Health Insurance Marketplace, where Floridians can shop for and enroll in private health insurance plans. The Marketplace offers income-based subsidies to help make insurance more affordable, making it a valuable resource for those seeking coverage.

Homeowners’ Insurance: Protecting Your Biggest Investment

For homeowners in Florida, finding affordable insurance is crucial to protect their biggest investment. The state’s unique climate and susceptibility to natural disasters make homeowners’ insurance a complex matter. Here’s a guide to help you navigate this landscape.

Understanding Florida’s Homeowners’ Insurance Market

Florida’s homeowners’ insurance market is highly competitive, with a range of providers offering various coverage options. However, the state’s vulnerability to hurricanes and other natural disasters can drive up insurance costs. It’s crucial to carefully review the coverage limits and exclusions to ensure you’re adequately protected.

Tips to Lower Your Homeowners’ Insurance Costs

If you’re looking to reduce your homeowners’ insurance expenses, here are some strategies to consider:

- Increase your deductible: Similar to car insurance, opting for a higher deductible can lead to lower premiums. However, ensure you can afford the increased out-of-pocket expense in the event of a claim.

- Bundle policies: Many insurers offer discounts when you bundle multiple policies, such as homeowners’ and car insurance.

- Maintain a good credit score: Your credit score can impact your insurance premiums. A higher credit score can lead to lower rates, so maintaining a good credit history is crucial.

- Review your coverage annually: Insurance needs can change over time. Regularly reviewing your coverage ensures you’re not overinsured or underinsured, helping you optimize your premiums.

The Future of Affordable Insurance in Florida

The insurance landscape in Florida is continually evolving, influenced by technological advancements, regulatory changes, and market dynamics. As the state works to improve access to affordable insurance, several key trends and developments are worth noting.

Technological Innovations

The rise of digital technologies has significantly impacted the insurance industry, with insurers now offering online platforms and mobile apps for policy management and claims processing. These innovations have not only improved customer experience but have also led to more efficient processes, potentially driving down costs.

Regulatory Changes

Regulatory changes, such as those related to the ACA and state-specific initiatives, can significantly impact insurance affordability. In Florida, ongoing discussions around healthcare reform and insurance regulation can influence the cost and availability of coverage. Staying informed about these changes is essential for making informed decisions.

Market Competition

Florida’s competitive insurance market is a double-edged sword. While it offers a wide range of options, it can also lead to confusion and the potential for consumers to overpay. However, this competition also drives insurers to offer innovative products and competitive pricing, ultimately benefiting consumers. Staying informed about the latest offerings and comparing multiple options can help ensure you’re getting the best value.

What is the average cost of car insurance in Florida?

+The average cost of car insurance in Florida can vary widely depending on various factors. According to recent data, the average annual premium for minimum liability coverage in Florida is around 1,500, while full coverage can cost upwards of 2,000. However, these figures can vary significantly based on the driver’s age, driving record, and the type of vehicle insured.

How can I find affordable health insurance in Florida?

+Finding affordable health insurance in Florida can be achieved through a combination of strategies. Exploring government-backed programs like Medicaid and the Health Insurance Marketplace can provide cost-effective coverage. Additionally, comparing private health insurance plans and taking advantage of income-based subsidies can help lower costs. It’s also essential to review your coverage needs annually to ensure you’re not overpaying.

What factors influence homeowners’ insurance rates in Florida?

+Several factors influence homeowners’ insurance rates in Florida, including the location and construction of the home, the deductible chosen, and the coverage limits. The home’s proximity to the coast and its susceptibility to natural disasters like hurricanes can significantly impact rates. Additionally, the insurer, the policy’s endorsements and add-ons, and the homeowner’s credit score can all influence the final cost.