Mortgage Insurance Quote

Securing a home is a significant milestone for many individuals and families, and understanding the financial aspects, especially the costs associated with mortgage insurance, is crucial. Mortgage insurance plays a vital role in the home-buying process, offering protection to both the borrower and the lender. In this comprehensive guide, we will delve into the world of mortgage insurance quotes, exploring the factors that influence these quotes, the benefits they provide, and how to navigate the process effectively.

Understanding Mortgage Insurance Quotes

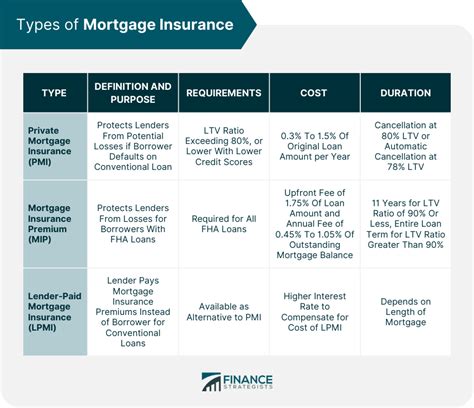

Mortgage insurance, often referred to as MI, is a safeguard designed to protect lenders in case borrowers default on their mortgage loans. It provides a financial safety net, allowing lenders to offer more flexible loan terms and lower down payment requirements to borrowers. Obtaining a mortgage insurance quote is a crucial step in the home-buying journey, as it helps borrowers understand the overall cost of their mortgage and make informed decisions.

The quote for mortgage insurance is typically expressed as a percentage of the loan amount, and this percentage can vary based on several key factors. It's important to note that mortgage insurance quotes are not a one-size-fits-all proposition; they are tailored to the borrower's specific circumstances and the type of loan they are seeking.

Factors Influencing Mortgage Insurance Quotes

Several factors come into play when determining the quote for mortgage insurance. Here’s a breakdown of the key elements that influence these quotes:

- Loan-to-Value Ratio (LTV): This is the ratio of the loan amount to the property's value. Lenders typically require mortgage insurance if the LTV is above a certain threshold, often around 80%. The higher the LTV, the higher the perceived risk, which can result in a higher insurance premium.

- Credit Score: Your credit score is a significant indicator of your financial health and responsibility. Lenders use credit scores to assess the risk associated with lending money. Borrowers with higher credit scores may qualify for lower mortgage insurance premiums, as they are considered less risky borrowers.

- Down Payment: The amount of money you put down as a down payment can impact your mortgage insurance quote. Generally, a larger down payment reduces the LTV and may result in a lower insurance premium. Some lenders even offer reduced or eliminated mortgage insurance for borrowers with a substantial down payment.

- Loan Type: The type of loan you choose can affect your insurance quote. Conventional loans often require mortgage insurance if the down payment is less than 20%, while government-backed loans like FHA loans have their own insurance requirements and premiums.

- Occupancy Status: Whether you plan to occupy the property as your primary residence, a second home, or an investment property can influence your insurance quote. Primary residences often have lower insurance requirements compared to investment properties.

- Loan Term: The length of your loan term can also impact your insurance quote. Longer loan terms may result in higher insurance premiums due to the increased risk associated with extended repayment periods.

It's important to note that these factors can interact with each other, and a comprehensive evaluation of your financial situation and loan preferences is necessary to obtain an accurate mortgage insurance quote.

Benefits of Mortgage Insurance

Mortgage insurance offers several advantages to both borrowers and lenders. For borrowers, it opens up opportunities to purchase a home with a lower down payment, making homeownership more accessible. It also provides a safety net, ensuring that borrowers can still secure financing even if their credit score or financial situation isn’t perfect.

For lenders, mortgage insurance reduces the risk associated with lending money to borrowers with lower credit scores or higher LTV ratios. This risk mitigation allows lenders to offer more flexible loan options and expand their customer base.

Obtaining a Mortgage Insurance Quote

Now that we understand the factors influencing mortgage insurance quotes and the benefits they provide, let’s explore the process of obtaining an accurate quote.

Gathering the Necessary Information

To obtain an accurate mortgage insurance quote, you’ll need to gather the following information:

- Your credit score and credit report.

- The estimated value of the property you wish to purchase.

- The amount of your down payment.

- The type of loan you're interested in (conventional, FHA, etc.).

- Your preferred loan term.

- Details about your income, employment status, and any other relevant financial information.

Having this information readily available will streamline the quote process and ensure you receive an accurate estimate.

Working with a Mortgage Professional

To obtain a mortgage insurance quote, you can work with a mortgage professional, such as a loan officer or a mortgage broker. These experts have access to various lenders and can provide you with quotes from multiple sources. They can also guide you through the process, offering insights and advice tailored to your specific circumstances.

When working with a mortgage professional, be prepared to discuss your financial goals, preferences, and any concerns you may have. They can help you understand the trade-offs between different loan options and insurance requirements, ensuring you make informed decisions.

Online Quote Tools

In addition to working with a mortgage professional, you can also explore online quote tools and mortgage calculators. These tools allow you to input your financial information and loan preferences to generate an estimated insurance premium. While these tools can provide a quick estimate, it’s important to remember that they may not account for all the unique factors that influence your specific situation.

Understanding the Quote

When you receive a mortgage insurance quote, it’s essential to understand its components. The quote will typically include the following:

- Premium Amount: This is the actual cost of the mortgage insurance, often expressed as a percentage of the loan amount or as a monthly premium.

- Coverage Duration: Mortgage insurance premiums are typically paid monthly until a certain point in the loan term, such as when the loan-to-value ratio reaches a specified threshold.

- Cancellation Options: Some mortgage insurance policies allow for cancellation once the loan reaches a certain point, reducing the overall cost of insurance. Understanding the cancellation options is crucial for long-term planning.

Discuss the quote with your mortgage professional to ensure you understand the terms and conditions associated with the insurance coverage.

Navigating the Mortgage Insurance Landscape

Obtaining a mortgage insurance quote is just the first step in the home-buying process. As you move forward, there are several considerations and strategies to keep in mind to ensure a smooth and successful experience.

Improving Your Credit Score

A higher credit score can lead to a lower mortgage insurance premium. If you have time before applying for a mortgage, consider taking steps to improve your credit score. This may involve paying down existing debts, ensuring timely payments, and reducing your overall credit utilization.

Exploring Loan Options

Different loan types have varying insurance requirements and premiums. Explore the options available to you, such as conventional loans, FHA loans, or VA loans. Each option has its own set of advantages and considerations, and understanding these differences can help you choose the loan that best aligns with your financial goals and circumstances.

Understanding Insurance Cancellation

Mortgage insurance is not a permanent expense. In many cases, borrowers can cancel their insurance coverage once their loan-to-value ratio reaches a certain point, typically around 78%. Understanding the cancellation process and the requirements for cancellation is crucial to minimize long-term insurance costs.

Considerations for Refinancing

If you already have a mortgage and are considering refinancing, mortgage insurance may come into play again. Refinancing can provide an opportunity to reduce your interest rate, change your loan term, or even eliminate mortgage insurance if your home’s value has increased. Understanding the refinancing process and its potential impact on insurance requirements is essential.

Case Study: A Real-World Example

To illustrate the practical application of mortgage insurance quotes, let’s consider a real-world scenario:

John is a first-time homebuyer with a credit score of 720. He wants to purchase a home valued at $300,000 and plans to make a down payment of $60,000. He is interested in a 30-year fixed-rate conventional loan. After gathering the necessary information and working with a mortgage broker, John receives the following mortgage insurance quote:

| Loan Amount | $240,000 |

|---|---|

| Loan-to-Value Ratio | 80% |

| Mortgage Insurance Premium | 0.5% of the loan amount annually, or $1,200 per year |

| Coverage Duration | Up to 7 years or until the loan-to-value ratio reaches 78% |

| Cancellation Options | Insurance can be canceled once the loan balance is 78% of the original property value |

In this case, John's mortgage insurance quote is based on his financial situation and loan preferences. The quote provides a clear understanding of the insurance premium and its duration, allowing John to plan his finances accordingly.

Conclusion: Empowering Homebuyers

Mortgage insurance quotes are a vital component of the home-buying process, providing borrowers with the information they need to make informed decisions. By understanding the factors that influence these quotes and the benefits of mortgage insurance, homebuyers can navigate the financial landscape with confidence. Whether you’re a first-time buyer or an experienced homeowner, having a clear understanding of mortgage insurance quotes empowers you to take control of your financial future and achieve your homeownership goals.

Frequently Asked Questions

How does mortgage insurance benefit borrowers?

+

Mortgage insurance benefits borrowers by allowing them to purchase a home with a lower down payment, making homeownership more accessible. It also provides a safety net, ensuring borrowers can still secure financing even with less-than-perfect credit.

Can I avoid mortgage insurance completely?

+

Yes, there are ways to avoid mortgage insurance. One common method is making a down payment of at least 20% of the home’s purchase price. Additionally, some loan programs, such as VA loans for veterans, do not require mortgage insurance.

How long do I need to pay mortgage insurance?

+

The duration of mortgage insurance payments depends on the type of loan and the loan-to-value ratio. For conventional loans, mortgage insurance is typically required until the loan-to-value ratio reaches 78%, at which point it can be canceled. For FHA loans, mortgage insurance is required for the life of the loan unless the borrower refinances.