Cheap Auto Insurance Near Me

Are you on the hunt for affordable auto insurance that won't break the bank? Finding the right coverage at a reasonable price can be a daunting task, but with a bit of research and knowledge, you can secure the protection you need without sacrificing your budget. In this comprehensive guide, we will explore the world of cheap auto insurance, delve into factors that influence pricing, uncover money-saving tips, and provide you with a step-by-step process to secure the best deals in your area.

Understanding Cheap Auto Insurance

Cheap auto insurance refers to coverage options that offer the necessary protection for your vehicle at a price that aligns with your financial capabilities. It is a balance between affordability and adequate coverage to safeguard you from potential financial burdens arising from accidents or other vehicle-related incidents.

Factors Influencing Auto Insurance Costs

The cost of auto insurance is influenced by a multitude of factors, each playing a role in determining the final premium. Here are some key considerations:

- Location: Where you reside significantly impacts insurance rates. Urban areas tend to have higher premiums due to increased traffic and potential for accidents.

- Age and Gender: Insurance providers often consider these factors, as statistical trends suggest certain age groups and genders are more prone to accidents.

- Driving Record : A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents or traffic violations may result in higher rates.

- Vehicle Type and Usage: The make, model, and age of your vehicle, as well as its primary purpose (commute, leisure, business), influence insurance costs.

- Coverage Options: The level of coverage you choose, such as liability-only or comprehensive coverage, directly affects the premium.

- Deductibles: Opting for higher deductibles can lower your premium, but it means you’ll pay more out of pocket if you file a claim.

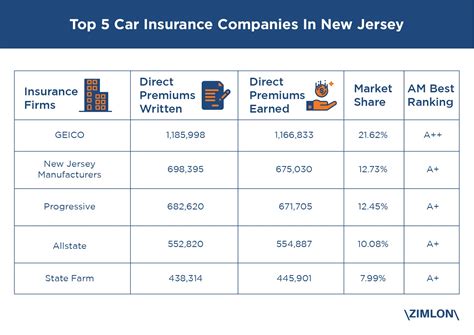

- Insurance Provider: Different companies offer varying rates and discounts, so comparing providers is crucial.

Tips for Finding Cheap Auto Insurance

Securing cheap auto insurance requires a strategic approach. Here are some tips to help you navigate the process effectively:

1. Compare Multiple Quotes

Obtain quotes from various insurance providers to identify the most competitive rates. Online comparison tools can streamline this process, allowing you to gather multiple quotes in one go.

2. Understand Your Coverage Needs

Assess your specific coverage requirements. Consider factors like the value of your vehicle, the cost of repairs, and your financial ability to cover potential out-of-pocket expenses. This assessment will guide you in choosing the right level of coverage.

3. Review Your Deductibles

Evaluate the impact of different deductible amounts on your premium. While higher deductibles can lead to lower premiums, ensure you can afford the out-of-pocket expenses in case of a claim.

4. Explore Discounts

Insurance providers offer a range of discounts, including those for safe driving, bundling multiple policies, and loyalty. Inquire about available discounts and ensure you’re taking advantage of all applicable ones.

5. Maintain a Clean Driving Record

A clean driving record is crucial for keeping insurance costs down. Avoid traffic violations and accidents to ensure your premiums remain competitive.

6. Consider Usage-Based Insurance

Some providers offer usage-based insurance, where your premium is determined by your actual driving behavior. This can be beneficial for low-mileage drivers or those with a proven record of safe driving.

7. Bundle Policies

If you have multiple insurance needs, such as home and auto, consider bundling them with the same provider. Bundling often results in significant discounts and simplifies your insurance management.

Step-by-Step Guide to Finding Cheap Auto Insurance

1. Research and Compare Providers

Start by researching reputable insurance providers in your area. Online reviews and ratings can provide valuable insights into customer experiences and satisfaction levels.

Use comparison websites or tools to obtain multiple quotes from different providers. Ensure you’re comparing policies with similar coverage levels to make an accurate assessment.

2. Evaluate Your Coverage Needs

Assess your vehicle’s value, your financial situation, and the level of coverage you require. Consider the potential risks and costs associated with different scenarios, such as accidents or theft.

3. Request Quotes

Contact the shortlisted insurance providers and request quotes based on your coverage needs. Provide accurate information about your driving history, vehicle details, and any applicable discounts.

4. Analyze Quotes and Choose the Best Option

Carefully review the quotes, comparing premiums, coverage levels, and any additional benefits or exclusions. Consider the financial stability and reputation of the providers to ensure long-term reliability.

5. Negotiate and Finalize Your Policy

If you find a quote that aligns with your budget and coverage requirements, negotiate any additional discounts or coverage adjustments. Finalize the policy by providing necessary documentation and making the initial payment.

Future Implications and Considerations

The auto insurance landscape is constantly evolving, influenced by technological advancements, changing regulations, and shifting market dynamics. Here are some future considerations to keep in mind:

- Telematics and Usage-Based Insurance: With the rise of telematics technology, usage-based insurance is becoming more prevalent. This allows providers to track driving behavior in real-time, offering discounts to safe drivers.

- Digitalization and Convenience: The insurance industry is embracing digitalization, offering online platforms for policy management, claims processing, and even virtual inspections. This enhances convenience and efficiency.

- Emerging Technologies: Innovations like autonomous vehicles and advanced driver-assistance systems may impact insurance premiums in the future. As these technologies become more widespread, insurance providers will need to adapt their policies.

- Regulatory Changes: Keep an eye on any upcoming regulatory changes that may affect auto insurance. These changes can impact coverage requirements, pricing structures, and available discounts.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually, or whenever your personal circumstances change significantly. This ensures your coverage remains up-to-date and aligned with your needs.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time. However, be mindful of any cancellation fees or penalties associated with terminating your existing policy early.

What factors can lead to an increase in my auto insurance premium?

+Various factors can contribute to an increase in your premium, including accidents, traffic violations, changes in your driving record, or even moving to a new location with higher insurance rates.