Money Market Account Is It Fdic Insured

Money market accounts are a popular savings option among investors, offering a blend of features from both traditional savings accounts and mutual funds. These accounts provide an opportunity to earn higher interest rates compared to standard savings accounts while still ensuring easy access to funds. But one crucial aspect that prospective investors often inquire about is the safety of their funds. So, is a money market account FDIC-insured? Let's delve into this question and explore the features, benefits, and security measures associated with money market accounts.

Understanding Money Market Accounts

A money market account, often abbreviated as MMA, is a type of savings account offered by banks and credit unions. It’s designed to provide higher interest rates than traditional savings accounts, making it an attractive option for individuals seeking a safe place to grow their savings. MMAs typically offer features such as check-writing privileges and ATM access, making them convenient for everyday use.

The primary purpose of a money market account is to offer a balance between liquidity and interest earnings. While the interest rates are not as high as those offered by money market funds or certificates of deposit (CDs), MMAs provide more flexibility and accessibility to funds. This makes them a popular choice for individuals who want a safe place to keep their emergency funds or short-term savings.

FDIC Insurance and Money Market Accounts

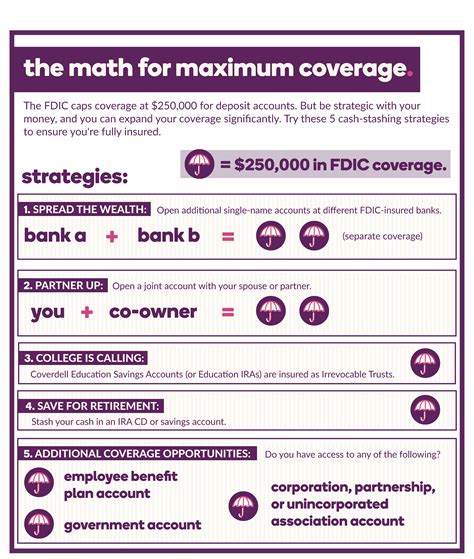

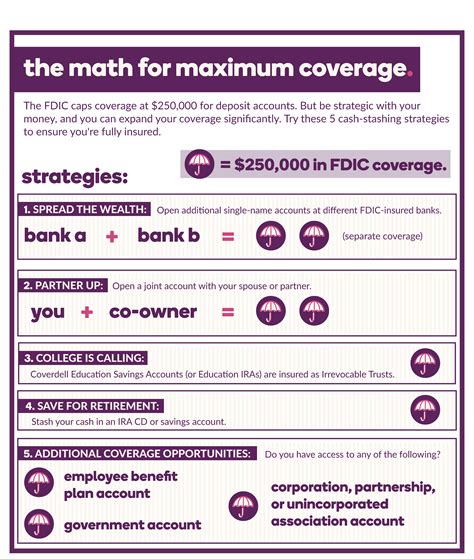

The Federal Deposit Insurance Corporation (FDIC) is a U.S. government corporation that provides deposit insurance to banks and credit unions. This insurance protects the funds of customers in the event of a bank failure, ensuring that depositors do not lose their money. FDIC insurance covers various types of deposit accounts, including checking accounts, savings accounts, and money market deposit accounts (MMDAs). However, it’s essential to understand that not all money market accounts are FDIC-insured.

To be eligible for FDIC insurance, a money market account must meet specific criteria. Firstly, it must be offered by an FDIC-insured bank or credit union. Secondly, the account must be a true money market deposit account, which is a type of savings account that typically requires a higher minimum balance and may have certain transaction limitations. These accounts are distinct from money market funds, which are mutual funds that invest in short-term debt securities and are not FDIC-insured.

FDIC insurance provides significant peace of mind for account holders. In the event of a bank failure, FDIC insurance guarantees that each depositor's funds, including those in money market deposit accounts, are protected up to the insurance limit. As of 2024, the standard insurance amount is $250,000 per depositor, per insured bank. This means that even if a bank fails, depositors with accounts below this limit will have their funds fully reimbursed by the FDIC.

Features and Benefits of Money Market Accounts

Money market accounts offer several features and benefits that make them an attractive savings option:

Higher Interest Rates

One of the primary advantages of MMAs is their ability to offer higher interest rates than traditional savings accounts. While the rates may not be as competitive as those offered by money market funds or CDs, they still provide a better return on investment compared to standard savings accounts. This makes MMAs an ideal choice for individuals looking to grow their savings over time.

Liquidity and Accessibility

MMAs strike a balance between liquidity and interest earnings. Unlike CDs, which have fixed terms and penalties for early withdrawal, MMAs allow account holders to access their funds easily. They typically come with check-writing privileges and ATM access, making it convenient to manage and withdraw funds as needed.

Transaction Flexibility

While MMAs may have certain transaction limitations, they generally offer more flexibility than other savings accounts. Account holders can make a limited number of transfers and withdrawals each month, providing a level of convenience for managing finances.

Safety and Security

As mentioned earlier, money market deposit accounts offered by FDIC-insured banks or credit unions are covered by FDIC insurance. This means that the funds in these accounts are protected up to the insurance limit, ensuring that account holders do not lose their savings in the event of a bank failure.

Comparing Money Market Accounts and Money Market Funds

It’s essential to differentiate between money market accounts and money market funds, as they are often confused due to their similar names. Money market funds, unlike money market accounts, are mutual funds that invest in short-term debt securities. They are not FDIC-insured and carry a certain level of risk, albeit typically lower than other types of funds.

| Feature | Money Market Account | Money Market Fund |

|---|---|---|

| FDIC Insurance | Yes (for MMDAs) | No |

| Investment Type | Savings Account | Mutual Fund |

| Interest Rates | Competitive, but lower than money market funds | Generally higher than MMAs |

| Risk Level | Low | Low to Moderate |

| Liquidity | High | High |

| Minimum Balance | Varies, typically higher than savings accounts | Varies, often lower than MMAs |

Choosing the Right Money Market Account

When selecting a money market account, it’s crucial to consider several factors to ensure it aligns with your financial goals and needs. Here are some key considerations:

Interest Rates

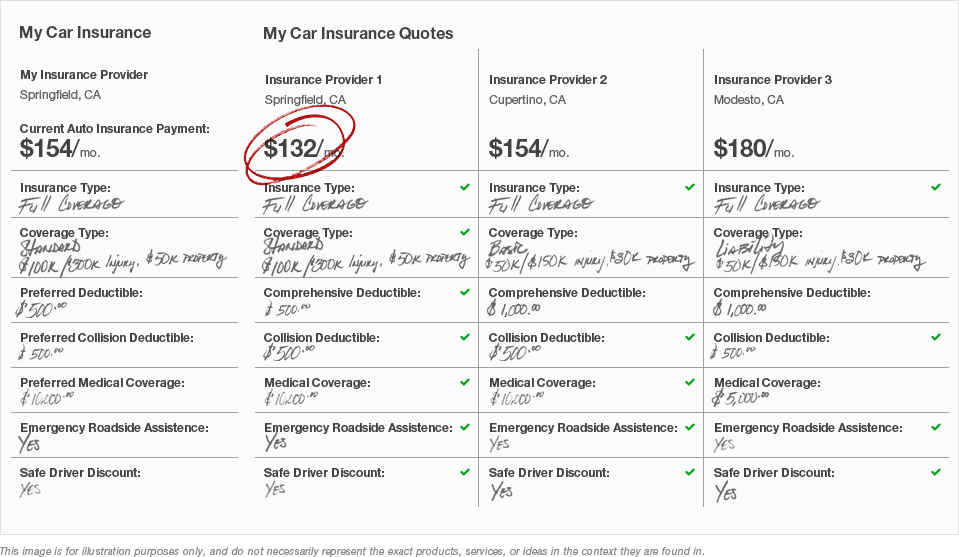

Compare the interest rates offered by different banks and credit unions. While higher interest rates are desirable, it’s essential to balance them with other features and requirements of the account.

Minimum Balance Requirements

MMAs often require a higher minimum balance than traditional savings accounts. Ensure that you can maintain the required balance to avoid any fees or penalties.

Transaction Limitations

Review the transaction limitations and restrictions associated with the account. Understand the number of transfers and withdrawals you can make each month and ensure they align with your financial management needs.

Fees and Charges

Be aware of any fees or charges associated with the account, such as maintenance fees, ATM fees, or fees for exceeding transaction limits. Choose an account with fee structures that are transparent and reasonable.

FDIC Insurance

Always confirm that the money market account you choose is FDIC-insured if you want the security of knowing your funds are protected. Ensure that the bank or credit union offering the account is FDIC-insured and that the account is a true money market deposit account.

The Future of Money Market Accounts

Money market accounts have evolved over the years to meet the changing needs of investors. With the rise of online banking and digital financial services, MMAs have become more accessible and user-friendly. Many banks and credit unions now offer online account opening, mobile banking, and digital transaction capabilities, making it easier than ever to manage and monitor your savings.

Furthermore, the FDIC has continuously adapted its policies and insurance limits to ensure the protection of depositors' funds. The increase in the standard insurance amount to $250,000 per depositor, per insured bank, provides even more security for account holders. This ensures that even in the unlikely event of a bank failure, depositors' savings are safeguarded.

Looking ahead, money market accounts are likely to continue offering a balance of safety, liquidity, and interest earnings. As financial institutions innovate and adapt to digital trends, we can expect further enhancements in the convenience and accessibility of MMAs. This includes potential improvements in mobile banking features, more competitive interest rates, and possibly even expanded transaction capabilities while maintaining the security and protection that MMAs are known for.

Can I open a money market account online?

+Yes, many banks and credit unions now offer the ability to open money market accounts online. This process typically involves filling out an application form, providing necessary identification documents, and making an initial deposit. Online account opening is a convenient way to start saving without having to visit a physical bank branch.

Are there any limitations on accessing funds in a money market account?

+Money market accounts generally have certain transaction limitations. While they offer more flexibility than traditional savings accounts, there may be restrictions on the number of transfers and withdrawals you can make each month. It’s important to review the specific terms and conditions of the account to understand these limitations.

Can I have multiple money market accounts with the same bank?

+Yes, it is possible to have multiple money market accounts with the same bank or credit union. This can be beneficial for separating your savings for different purposes or keeping track of specific goals. However, it’s important to be aware of any fees or charges associated with maintaining multiple accounts.