Minimum Auto Insurance Coverage

Understanding the minimum auto insurance coverage requirements is crucial for every driver. While it's essential to have adequate insurance to protect yourself financially in case of accidents, it's also important to be aware of the legal requirements in your jurisdiction. This comprehensive guide will delve into the specifics of minimum auto insurance coverage, offering insights and expert advice to ensure you're well-informed and prepared.

The Basics of Minimum Auto Insurance Coverage

Minimum auto insurance coverage refers to the least amount of insurance coverage that a driver is legally required to carry in a given state or region. These requirements are designed to ensure that all drivers have some level of financial protection in the event of an accident. While the specific coverage amounts and types can vary significantly from one place to another, there are some common elements that make up the minimum insurance package.

Liability Coverage

Liability insurance is a fundamental component of minimum auto insurance coverage. It’s designed to protect you financially if you’re found at fault in an accident. This coverage typically has two parts: bodily injury liability and property damage liability.

- Bodily Injury Liability: This coverage pays for the medical expenses and lost wages of those injured in an accident that you caused. The minimum limit for bodily injury liability varies by state, but it’s typically expressed in the format of two numbers, such as 25/50/10. These numbers represent thousands of dollars: the first number is the maximum payout per person injured, the second is the maximum per accident, and the third is the property damage liability limit.

- Property Damage Liability: This coverage pays for damage you cause to someone else’s property, such as their vehicle, fence, or building. The minimum limit for property damage liability also varies by state.

Additional Coverage Options

While liability coverage is the backbone of minimum auto insurance, some states also require drivers to carry additional types of insurance. These may include:

- Personal Injury Protection (PIP): PIP covers medical expenses for you and your passengers, regardless of fault. It may also cover lost wages and other related expenses.

- Medical Payments Coverage: Similar to PIP, this coverage pays for medical expenses for you and your passengers, but it typically has a lower limit and doesn’t cover lost wages.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

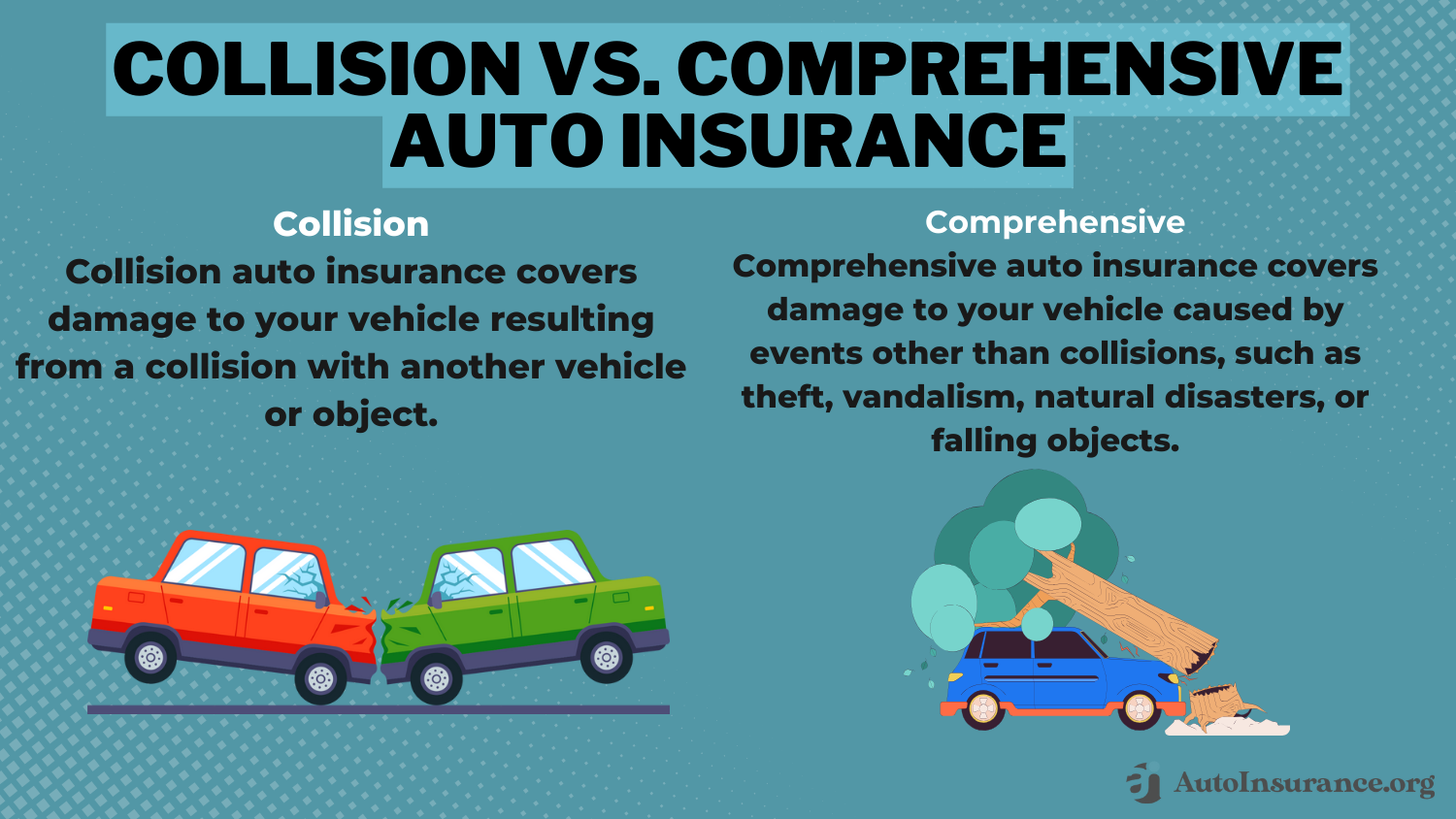

- Collision and Comprehensive Coverage: While not always required, these coverages are essential for protecting your own vehicle. Collision coverage pays for damage to your vehicle in an accident, while comprehensive coverage covers damage from non-collision incidents like theft, vandalism, or natural disasters.

State-by-State Variations

The specific minimum auto insurance coverage requirements can vary significantly from one state to another. Some states have very basic requirements, while others have more comprehensive coverage mandates. Here’s a look at the minimum coverage requirements in a few select states:

California

California requires drivers to carry at least 15,000 of bodily injury liability per person, 30,000 of bodily injury liability per accident, and $5,000 of property damage liability. Additionally, California requires drivers to carry either proof of financial responsibility or an SR-22 certificate, which demonstrates that a driver has met the state’s minimum insurance requirements.

New York

In New York, drivers must carry at least 25,000 of bodily injury liability per person, 50,000 of bodily injury liability per accident, and $10,000 of property damage liability. New York also requires drivers to carry supplementary uninsured/underinsured motorists (SUM) coverage, which provides protection if the at-fault driver has no or insufficient insurance coverage.

Texas

Texas has one of the lowest minimum insurance requirements in the nation. Drivers are only required to carry 30,000 of bodily injury liability per person, 60,000 of bodily injury liability per accident, and $25,000 of property damage liability. However, Texas is a tort state, which means that drivers can be sued for damages beyond their insurance limits if found at fault in an accident.

Florida

Florida’s minimum auto insurance requirements are unique. Drivers must carry at least 10,000 of personal injury protection (PIP) coverage and 10,000 of property damage liability. Florida is also a no-fault state, which means that drivers must turn to their own insurance for compensation, regardless of who was at fault in an accident.

| State | Bodily Injury Liability (Per Person) | Bodily Injury Liability (Per Accident) | Property Damage Liability |

|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 |

| New York | $25,000 | $50,000 | $10,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| Florida | $10,000 (PIP) | N/A | $10,000 |

The Importance of Adequate Coverage

While meeting the minimum auto insurance requirements is essential to stay legal, it’s often advisable to carry higher limits. The minimum coverage amounts are typically designed to cover minor accidents, but they may not be sufficient for more severe incidents. Here’s why you should consider increasing your coverage limits:

Severe Accidents

In a serious accident, medical bills and property damage costs can quickly exceed the minimum coverage limits. If you’re found at fault and your insurance doesn’t cover the full extent of the damages, you may be held personally liable for the remaining amount. This could lead to financial hardship or even bankruptcy.

Legal Requirements

Some states have specific legal requirements for certain types of drivers or vehicles. For example, if you lease a car or finance a vehicle through a bank, the lender may require you to carry full coverage insurance, which includes collision and comprehensive coverage in addition to liability.

Protection for Your Assets

Carrying higher insurance limits can protect your personal assets. If you’re sued for an amount exceeding your insurance coverage, your personal assets, such as your home or savings, could be at risk. Increasing your coverage limits can provide a safety net for your financial well-being.

Factors Affecting Insurance Rates

Insurance rates can vary significantly based on a multitude of factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. Generally, sports cars and luxury vehicles are more expensive to insure due to their higher repair costs. Additionally, if you use your vehicle for business purposes, your rates may be higher.

Driving History

Your driving history is a significant factor in determining your insurance rates. If you have a clean driving record with no accidents or traffic violations, you’re likely to receive lower rates. On the other hand, if you have a history of accidents or violations, your rates will likely be higher.

Age and Gender

Insurance rates can also be influenced by your age and gender. Younger drivers, particularly those under 25, are often considered higher risk and may face higher premiums. Similarly, males under the age of 25 often pay higher rates than females in the same age group.

Location

The area where you live and drive can impact your insurance rates. Urban areas with higher populations and more traffic tend to have higher rates due to increased accident risks. Similarly, areas with a higher crime rate may have higher insurance costs to cover the risk of theft or vandalism.

Tips for Saving on Auto Insurance

While it’s important to have adequate auto insurance coverage, you don’t want to pay more than necessary. Here are some tips to help you save on your auto insurance premiums:

Shop Around

Insurance rates can vary significantly between providers. It’s worth your time to shop around and compare quotes from multiple insurers. You can use online tools or work with an insurance broker to find the best rates for your specific situation.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. If you’re in the market for new insurance, consider bundling your policies to potentially save money.

Maintain a Good Driving Record

A clean driving record can lead to lower insurance rates. Avoid traffic violations and accidents to keep your record clean. If you have a history of accidents or violations, taking a defensive driving course may help reduce your insurance rates.

Consider Higher Deductibles

Increasing your deductible, the amount you pay out of pocket before your insurance kicks in, can lower your premiums. However, it’s important to choose a deductible that you can afford to pay in the event of an accident.

Review Your Coverage Annually

Insurance rates and your personal circumstances can change over time. It’s a good idea to review your coverage and rates annually to ensure you’re still getting the best deal. Your insurance needs may change as your life circumstances change, so it’s important to stay up-to-date.

The Future of Auto Insurance

The auto insurance industry is evolving rapidly, driven by advancements in technology and changing consumer behaviors. Here are some trends and developments to watch in the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics devices and usage-based insurance programs are becoming increasingly popular. These programs use data from your driving behavior, such as speed, acceleration, and mileage, to determine your insurance rates. This can lead to more personalized and potentially lower rates for safe drivers.

Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is expected to have a significant impact on the auto insurance industry. Electric vehicles may be cheaper to insure due to their lower risk of certain types of accidents, while autonomous vehicles could lead to a dramatic reduction in accidents, potentially lowering insurance rates for all drivers.

Data-Driven Insurance

Insurance companies are increasingly using advanced analytics and data-driven models to assess risk and set premiums. This can lead to more accurate and fair pricing, as well as new products and services tailored to specific customer segments.

Digital Transformation

The digital transformation of the insurance industry is ongoing, with more insurers offering online and mobile services. This shift to digital can improve the customer experience, streamline processes, and reduce costs for both insurers and customers.

Collaborative and Shared Mobility

The rise of ride-sharing and car-sharing services is changing the way people use vehicles. Insurers are adapting to these new mobility models, offering specialized insurance products for ride-sharing drivers and exploring new business models for the shared economy.

What happens if I don’t have enough insurance coverage in an accident?

+If you’re involved in an accident and your insurance coverage doesn’t fully cover the damages, you may be held personally liable for the remaining amount. This could lead to financial hardship or even bankruptcy, so it’s important to have adequate coverage.

Can I lower my insurance rates by increasing my deductibles?

+Yes, increasing your deductible can often lead to lower insurance premiums. However, it’s important to choose a deductible that you can afford to pay in the event of an accident.

Are there any discounts available for auto insurance?

+Yes, many insurance companies offer discounts for various reasons. Common discounts include safe driver discounts, multi-policy discounts (for bundling auto and home insurance), and good student discounts. It’s worth asking your insurer about any discounts you may be eligible for.