Marketplace Insurance Open Enrollment

Welcome to the comprehensive guide on Marketplace Insurance Open Enrollment, an annual event that plays a crucial role in ensuring access to affordable healthcare coverage for millions of Americans. This article aims to provide an in-depth understanding of the process, its importance, and the key considerations for individuals and families navigating the marketplace during this critical period.

Understanding Marketplace Insurance Open Enrollment

Marketplace Insurance Open Enrollment is a designated period each year when individuals and families have the opportunity to enroll in health insurance plans through the Health Insurance Marketplace, often referred to as the Health Insurance Exchange. This marketplace, established under the Affordable Care Act (ACA), offers a range of insurance options from various providers, allowing consumers to compare and choose the plan that best suits their needs and budget.

The open enrollment period typically runs from November 1st to December 15th, providing a window of just over a month for individuals to review their options, make changes to their existing coverage, or enroll in a new plan. It's a critical time for those who require health insurance but may not be eligible for coverage outside of this annual event.

The Importance of Open Enrollment

Open enrollment is essential for several reasons. Firstly, it ensures that individuals and families have access to healthcare coverage, which is a fundamental aspect of overall well-being. By providing a platform for comparison and enrollment, the marketplace promotes competition among insurance providers, leading to more affordable and comprehensive plans.

Secondly, open enrollment allows individuals to assess their healthcare needs and choose a plan that aligns with their current circumstances. Life changes such as marriage, the birth of a child, or a new job can significantly impact the type of coverage required. The open enrollment period offers a chance to make these necessary adjustments.

Lastly, for those who qualify for subsidies or tax credits, open enrollment is the time to review and update their income information to ensure they receive the maximum financial assistance available. These subsidies can make a significant difference in the affordability of healthcare, especially for low- and middle-income households.

Key Considerations During Open Enrollment

Navigating the Health Insurance Marketplace during open enrollment can be a complex process, but with the right approach and understanding, it can be streamlined and effective.

Assessing Your Needs

Before diving into plan comparisons, it’s essential to assess your healthcare needs. Consider factors such as your current health status, any ongoing medical conditions, and the healthcare services you anticipate requiring in the coming year. This assessment will guide you in choosing a plan with the appropriate coverage and benefits.

For example, if you have a chronic condition that requires regular medication, you'll want to prioritize plans with good prescription drug coverage and potentially look for those with lower out-of-pocket costs for pharmaceuticals. On the other hand, if you're generally healthy but anticipate undergoing a major medical procedure in the near future, a plan with a higher premium but lower out-of-pocket maximum might be a better fit.

Understanding Plan Types and Coverage

The Health Insurance Marketplace offers a variety of plan types, each with its own set of benefits and cost structures. The primary plan types include:

- Bronze Plans: These plans have the lowest premiums but higher out-of-pocket costs. They're ideal for individuals who are generally healthy and don't anticipate significant healthcare expenses.

- Silver Plans: Silver plans strike a balance between premiums and out-of-pocket costs. They're a popular choice as they often qualify for cost-sharing reductions, making healthcare more affordable for those who meet certain income criteria.

- Gold Plans: Gold plans offer more comprehensive coverage with higher premiums and lower out-of-pocket costs. They're suitable for individuals with higher healthcare needs or those who prefer a plan with more extensive benefits.

- Catastrophic Plans: Designed for individuals under 30 or those with a hardship exemption, catastrophic plans have low premiums but high deductibles. They provide basic coverage for emergencies and preventive care.

Each plan also comes with a network of healthcare providers, so it's crucial to review the network to ensure your preferred doctors and hospitals are included.

Comparing Plans and Premiums

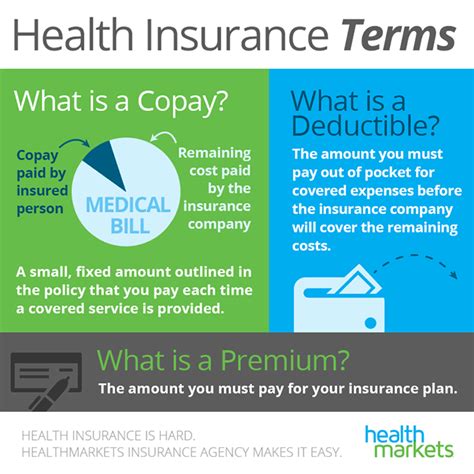

When comparing plans, pay close attention to the premiums (the monthly cost of the plan) and the out-of-pocket costs (deductibles, copayments, and coinsurance). While a lower premium might be appealing, it’s essential to consider the overall cost of the plan, including potential out-of-pocket expenses.

For instance, a plan with a lower premium but a high deductible might seem affordable at first glance, but if you require extensive medical care, the out-of-pocket costs could quickly add up. On the other hand, a plan with a slightly higher premium but lower out-of-pocket maximums could provide more financial security.

Utilizing Tax Credits and Subsidies

One of the significant advantages of the Health Insurance Marketplace is the availability of tax credits and subsidies to make healthcare more affordable. These financial aids are based on your household income and family size.

If you qualify for these subsidies, it's crucial to update your income information during open enrollment to ensure you receive the maximum benefit. The marketplace will calculate your premium tax credits and cost-sharing reductions, which can significantly reduce your monthly premiums and out-of-pocket costs.

Enrolling and Managing Your Coverage

Once you’ve chosen your plan, the enrollment process is relatively straightforward. You can enroll online, by phone, or in person with the assistance of a marketplace navigator or certified application counselor.

It's important to note that enrollment is not instantaneous. Your coverage typically begins on January 1st of the following year, so plan accordingly if you have immediate healthcare needs.

Throughout the year, it's essential to manage your coverage effectively. Keep track of your plan's benefits and coverage limits, and be aware of any changes that may occur during the year, such as network updates or plan adjustments.

Marketplace Insurance Open Enrollment: A Comprehensive Overview

Marketplace Insurance Open Enrollment is a critical period for millions of Americans to secure their healthcare coverage for the upcoming year. By understanding the process, assessing your needs, and comparing plans, you can make an informed decision that best suits your healthcare requirements and budget.

Remember, healthcare is a fundamental right, and with the right approach and resources, navigating the Health Insurance Marketplace can be a manageable and rewarding experience. Stay informed, ask questions, and take control of your healthcare future during this annual open enrollment period.

FAQ

What happens if I miss the open enrollment period?

+If you miss the open enrollment period, you may still be able to enroll in a health insurance plan if you qualify for a Special Enrollment Period (SEP). A SEP is typically granted if you experience certain life events, such as losing your job-based coverage, getting married, or having a baby. These events create a 60-day window to enroll outside of the open enrollment period. However, it’s important to note that qualifying for a SEP is not guaranteed, and the availability of plans may be limited.

Can I switch plans during open enrollment?

+Yes, open enrollment is the time to make changes to your existing coverage. If you already have a plan through the Health Insurance Marketplace, you can switch to a different plan that better suits your needs or budget. It’s a good opportunity to review your options and ensure you’re getting the most value from your healthcare coverage.

How do I know if I qualify for tax credits or subsidies?

+Tax credits and subsidies are available to individuals and families who meet certain income criteria. The specific income thresholds vary based on your family size and the state you reside in. You can use the Health Insurance Marketplace’s eligibility calculator to determine if you qualify. It’s a straightforward process that considers your household income and family size to estimate the amount of financial assistance you may receive.