Look Up Insurance License

Navigating the complex world of insurance is an essential part of financial planning and protection. One critical aspect of this process is understanding the role of insurance licenses and how to look them up. This comprehensive guide will delve into the significance of insurance licenses, the steps involved in looking them up, and the various methods and resources available to do so.

Understanding Insurance Licenses

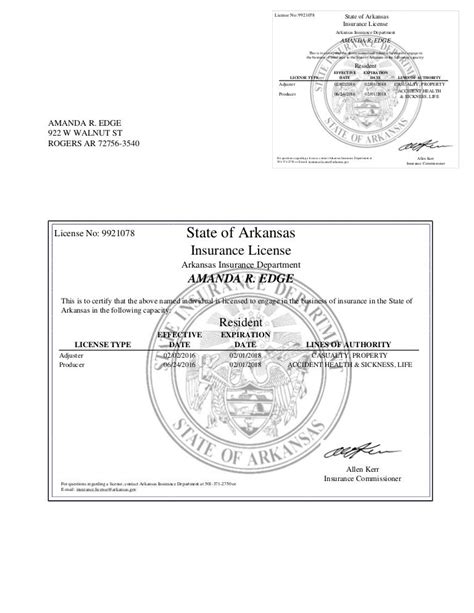

Insurance licenses are legal authorizations granted by state regulatory bodies to individuals or entities allowing them to sell, solicit, or negotiate insurance products within a specific jurisdiction. These licenses ensure that insurance professionals meet certain standards of knowledge and ethics, protecting consumers from potential fraud or misrepresentation.

There are several types of insurance licenses, each pertaining to different insurance sectors. The most common types include:

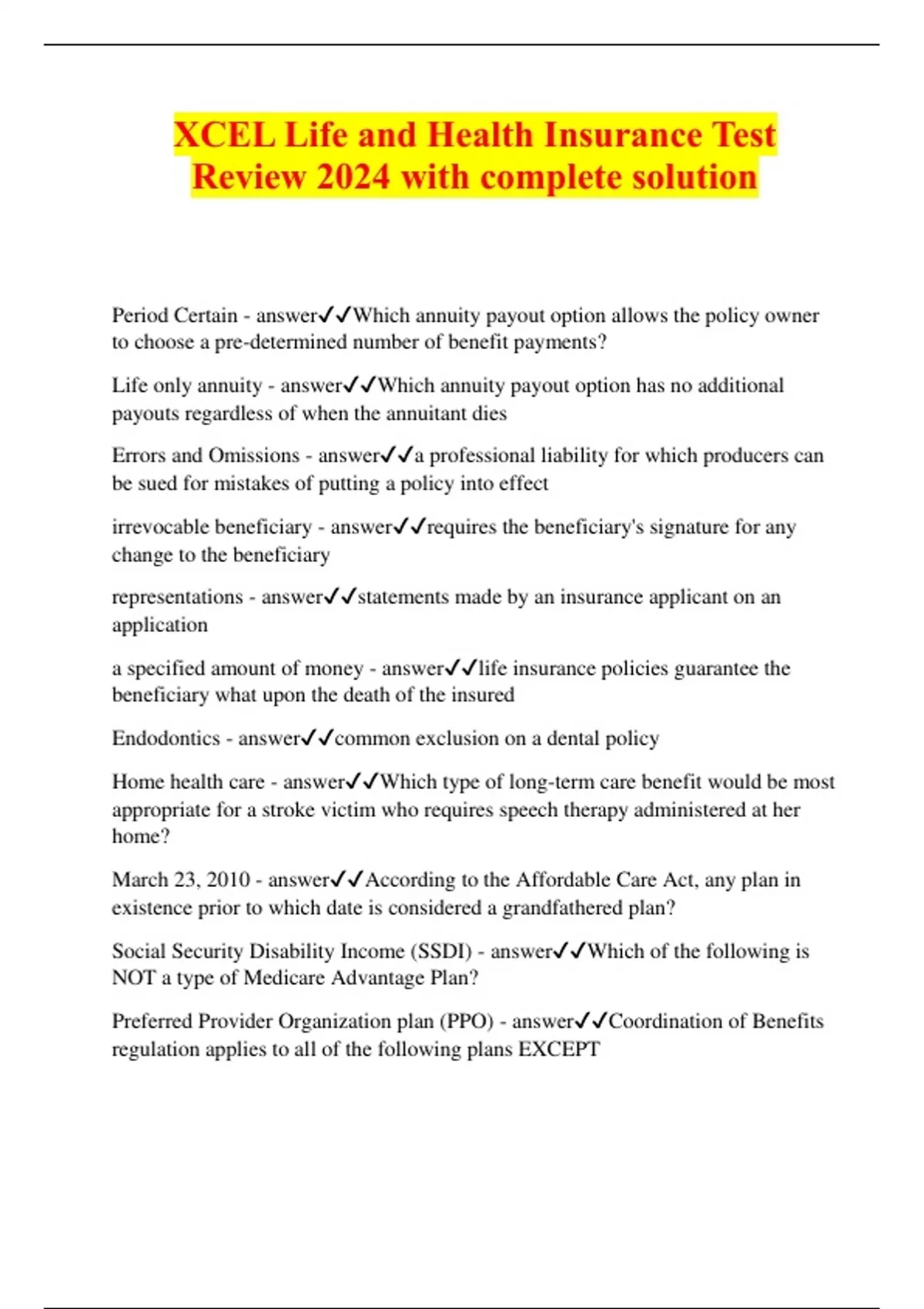

- Life and Health Insurance Licenses: These licenses permit the sale of life insurance, health insurance, and related products like annuities and long-term care insurance.

- Property and Casualty Insurance Licenses: Holders of these licenses are authorized to sell property, casualty, and liability insurance, covering risks like auto, home, and business insurance.

- Variable Insurance Licenses: Variable insurance licenses allow the sale of variable products, such as variable life insurance and variable annuities, which offer investment components.

- Adjustor Licenses: Adjustors, or claims adjusters, require licenses to investigate and settle insurance claims. These licenses are often specific to the type of insurance claims handled, such as property or auto claims.

Insurance licenses are crucial as they:

- Ensure consumer protection by requiring professionals to adhere to ethical standards and industry regulations.

- Provide a means to verify the credentials and qualifications of insurance professionals.

- Allow consumers to make informed decisions about their insurance choices.

- Help maintain the integrity and stability of the insurance industry.

Why Look Up an Insurance License

Looking up an insurance license serves several important purposes:

- Consumer Protection: By verifying an insurance professional's license, consumers can ensure they are dealing with a legitimate and qualified individual. This step helps prevent fraud and ensures the agent has the necessary knowledge to provide appropriate advice.

- License Verification: License lookup allows consumers to confirm that an insurance agent is licensed to sell the specific type of insurance product they are interested in. This verification ensures the agent is legally authorized to provide the services required.

- Complaint History: Many insurance license lookup platforms provide information on any complaints or disciplinary actions taken against an insurance professional. This data can help consumers make informed decisions and avoid potential issues.

- Education and Experience: License lookup often includes details about an agent's educational background and professional experience. This information can give consumers insights into the agent's qualifications and expertise.

Methods to Look Up an Insurance License

There are several methods and resources available to look up insurance licenses. The most common include:

State Insurance Department Websites

Most state insurance departments provide online platforms for license lookup. These websites typically allow users to search by the agent’s name, license number, or other identifying information. For instance, the California Department of Insurance offers a License Search feature, where you can input an agent’s name or license number to verify their credentials.

National Association of Insurance Commissioners (NAIC)

The NAIC, a standard-setting and regulatory support organization, provides a License Lookup tool that allows users to search for insurance professionals across multiple states. This tool is particularly useful for individuals dealing with agents licensed in multiple jurisdictions.

Insurance Company Websites

Many insurance companies provide information about their agents’ licenses and qualifications on their websites. This information is often available in the “About Us” or “Our Team” sections. For example, State Farm has a Find an Agent feature, where you can search for agents by name or location and view their licensing information.

Third-Party Websites

Several third-party websites offer insurance license lookup services. These platforms aggregate data from various sources, including state insurance departments and the NAIC, to provide comprehensive license information. Examples include AgentCheck and AgentPages, which offer detailed profiles of insurance professionals, including their license status, disciplinary actions, and more.

State Insurance Journals or Newspapers

State insurance journals or newspapers often publish lists of licensed insurance professionals and their qualifications. These resources can provide additional insights into an agent’s background and experience.

Steps to Look Up an Insurance License

Here is a step-by-step guide on how to look up an insurance license:

- Identify the Insurance Professional: Gather the agent's name, license number (if known), and the state(s) they are licensed in. This information is often available on the insurance professional's business card or website.

- Choose a Lookup Method: Select the most appropriate method for your needs. If the agent is licensed in your state, using your state's insurance department website is a good starting point. For agents licensed in multiple states, the NAIC's License Lookup tool might be more convenient.

- Search for the License: Visit the chosen platform and enter the agent's details. Most platforms will provide filters or search bars to input the necessary information.

- Review the Results: Once you've found the agent's license, carefully review the information provided. This should include the agent's name, license type(s), license status, and any relevant disciplinary actions or complaints.

- Cross-Reference the Information: If possible, cross-reference the information with other sources. This can help ensure the accuracy of the data and provide additional insights. For example, you can compare the license details with the agent's business website or other public records.

Tips for a Successful Insurance License Lookup

To ensure a smooth and accurate insurance license lookup process, consider the following tips:

- Accurate Information: Ensure you have the correct name and license number (if available) of the insurance professional you are looking up. Incorrect or incomplete information can lead to inaccurate results.

- Multiple Sources: Cross-referencing information from multiple sources can help verify the accuracy of the data. This practice also provides a more comprehensive understanding of the insurance professional's credentials.

- Stay Updated: License information can change over time. Regularly check the license status to ensure you are dealing with an active and up-to-date license.

- Understand License Types: Familiarize yourself with the different types of insurance licenses and their specific requirements. This knowledge can help you interpret the license information accurately.

- Seek Professional Guidance: If you have difficulty understanding the license information or need further clarification, consider reaching out to a licensed insurance professional or an insurance expert for guidance.

Future of Insurance License Lookup

The future of insurance license lookup is likely to be shaped by advancements in technology and data accessibility. Here are some potential developments:

- Digital Transformation: As more states and insurance companies digitize their records, license lookup processes are expected to become more streamlined and efficient. This transformation could lead to real-time license verification and easier access to comprehensive license information.

- AI and Machine Learning: Artificial intelligence and machine learning technologies could enhance the accuracy and speed of license lookup processes. These technologies can analyze large datasets and provide more sophisticated insights into an agent's qualifications and performance.

- Blockchain Integration: Blockchain technology, known for its security and transparency, could be leveraged to create a secure and immutable record of insurance licenses. This integration could enhance data integrity and make license lookup processes more trustworthy.

- Enhanced Consumer Education: With the increasing complexity of insurance products and the importance of consumer protection, there is a growing need for consumer education. Future license lookup platforms might include more user-friendly interfaces and educational resources to help consumers understand insurance licensing and its significance.

Frequently Asked Questions

What happens if an insurance agent’s license is suspended or revoked?

+If an insurance agent’s license is suspended or revoked, it means they are no longer legally authorized to sell insurance products. This action is typically taken due to serious violations of insurance laws or unethical behavior. In such cases, the agent cannot provide insurance services until their license is reinstated, which involves a rigorous review process by the state insurance department.

Can an insurance professional have multiple licenses?

+Yes, insurance professionals often hold multiple licenses to sell different types of insurance products. For instance, an agent might have a life and health insurance license as well as a property and casualty insurance license. Multiple licenses allow agents to offer a broader range of insurance services to their clients.

How often do insurance licenses need to be renewed?

+Insurance licenses typically need to be renewed every one to three years, depending on the state and license type. Renewal requirements often include completing a certain number of continuing education hours to ensure that insurance professionals stay up-to-date with industry developments and regulations.

Are insurance license lookup platforms always accurate and up-to-date?

+While insurance license lookup platforms strive for accuracy, the information they provide is only as reliable as the data they receive from state insurance departments and other sources. It’s important to note that license status and disciplinary actions can change quickly. Therefore, it’s advisable to cross-reference information from multiple sources and regularly check for updates.

What should I do if I find inaccurate information about an insurance professional’s license status?

+If you come across inaccurate information about an insurance professional’s license status, it’s essential to bring it to the attention of the relevant authorities. Contact the state insurance department where the agent is licensed and provide them with the details of the inaccurate information. They can investigate the matter and take appropriate action to correct the records.