Home Insurance Comparison

Home insurance is a vital aspect of protecting one's largest investment: their home. With a wide array of insurance providers offering various policies, it can be a daunting task to navigate the market and choose the best coverage for your specific needs. This comprehensive guide aims to simplify the process by comparing key aspects of home insurance, empowering homeowners to make informed decisions.

Understanding the Basics of Home Insurance

Home insurance, also known as homeowners insurance, is a financial safeguard that provides coverage for damages or losses related to your home, its contents, and any potential liability claims. It is designed to offer peace of mind and financial protection against unexpected events, such as natural disasters, theft, or accidents.

A typical home insurance policy consists of several components, including:

- Dwelling Coverage: This covers the physical structure of your home, including the roof, walls, and permanent fixtures.

- Personal Property Coverage: Provides protection for your personal belongings, such as furniture, electronics, and clothing.

- Liability Coverage: Safeguards you against legal claims and medical expenses if someone is injured on your property.

- Additional Living Expenses: Covers temporary living costs if your home becomes uninhabitable due to a covered event.

- Optional Coverages: These can include protection for specific items like jewelry, art, or collectibles, as well as additional coverage for natural disasters like floods or earthquakes.

The cost of home insurance varies based on several factors, such as the location, size, and age of your home, as well as the level of coverage you choose. It's essential to understand these factors to ensure you're getting the right coverage at a competitive price.

Comparing Home Insurance Policies: A Comprehensive Overview

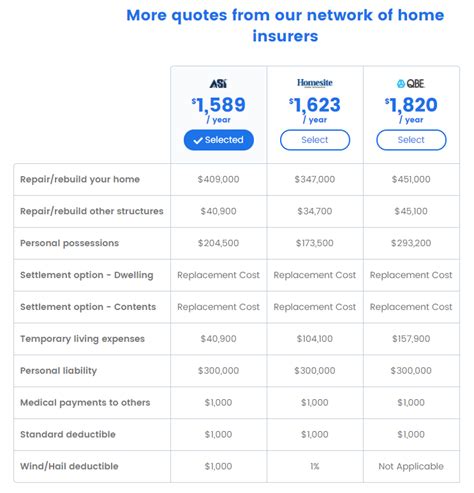

When comparing home insurance policies, several key aspects should be considered to ensure you’re getting the best value and coverage.

Coverage Options

Different insurance providers offer varying levels of coverage. It’s crucial to assess your specific needs and understand the differences between policy types. For instance, some policies may provide replacement cost coverage, ensuring you receive the full cost to rebuild your home, while others might offer actual cash value coverage, which takes depreciation into account.

Additionally, consider the limits and deductibles of each policy. Higher limits can provide more extensive coverage, but they often come with higher premiums. Likewise, a lower deductible can reduce your out-of-pocket expenses in the event of a claim, but it may also increase your overall insurance cost.

| Insurance Provider | Coverage Type | Limits | Deductibles |

|---|---|---|---|

| Provider A | Replacement Cost | $500,000 | $1,000 |

| Provider B | Actual Cash Value | $350,000 | $500 |

| Provider C | Replacement Cost | Unlimited | $2,500 |

Policy Features and Benefits

Beyond the basic coverage, home insurance policies can offer a range of additional features and benefits. These can include:

- Water Backup Coverage: Protects against damage caused by sewer or drain backups.

- Identity Theft Protection: Provides resources and support if you become a victim of identity theft.

- Green Home Endorsement: Offers additional coverage for eco-friendly rebuilding after a covered loss.

- Equipment Breakdown Coverage: Covers the cost of repairing or replacing broken home systems and appliances.

These features can enhance your policy and provide added peace of mind. However, it's important to remember that they often come at an additional cost, so weigh the benefits against your budget and needs.

Pricing and Discounts

The price of home insurance can vary significantly between providers, even for similar coverage. It’s crucial to compare premiums to ensure you’re getting a competitive rate. Additionally, many insurance companies offer discounts that can further reduce your costs. Common discounts include:

- Multi-Policy Discount: Saves you money when you bundle your home and auto insurance with the same provider.

- Safety Features Discount: Rewards you for having security systems, fire alarms, or other safety enhancements in your home.

- Loyalty Discount: Recognizes your long-term relationship with the insurer by offering a reduced rate over time.

- Homeowner Association Discount: Provides a discount if you’re a member of a homeowner association that meets certain safety and maintenance standards.

When comparing prices, consider not only the initial quote but also the potential for future savings through these discounts.

Claims Handling and Customer Service

In the event of a claim, you’ll want to ensure your insurance provider offers a smooth and efficient claims process. Research the company’s reputation for prompt and fair claim settlements, and consider factors like:

- Claims Response Time: How quickly does the insurer respond to and process claims?

- Customer Service Accessibility: Are their customer service representatives easily reachable and helpful?

- Online Resources: Does the insurer offer digital tools and resources to streamline the claims process and provide policyholders with self-service options?

Reading customer reviews and checking ratings from independent agencies can provide valuable insights into an insurer's claims handling and customer service quality.

Policy Add-ons and Endorsements

Some insurance providers offer additional coverage options, known as add-ons or endorsements, that can be added to your policy to enhance your protection. These can include:

- Earthquake Coverage: Provides coverage for damage caused by earthquakes, which is often excluded from standard policies.

- Flood Insurance: Protects against flood damage, a common exclusion in many home insurance policies.

- Personal Umbrella Insurance: Offers additional liability coverage beyond the limits of your home insurance policy.

- Scheduled Personal Property: Allows you to schedule specific high-value items for coverage, ensuring they’re adequately protected.

These add-ons can provide essential coverage for specific risks, but they may also increase your premium. Carefully consider your needs and the potential costs before adding them to your policy.

Making an Informed Decision: Choosing the Right Home Insurance

With a comprehensive understanding of the key aspects of home insurance, you’re now equipped to make an informed decision. Here are some final considerations to guide your choice:

Assess Your Risks

Evaluate the unique risks and vulnerabilities of your home and neighborhood. For instance, if you live in an area prone to natural disasters like hurricanes or wildfires, ensure your policy provides adequate coverage for these events. Consider any specific risks, such as theft or vandalism, and choose a policy that addresses these concerns.

Compare Multiple Quotes

Obtain quotes from several insurance providers to compare coverage, pricing, and discounts. Online tools and insurance brokers can be valuable resources for this process. Ensure you’re comparing similar policies and consider any endorsements or add-ons that may be necessary for your situation.

Understand Exclusions and Limitations

Every home insurance policy has exclusions and limitations. Understand what’s not covered by your policy and consider whether you need additional coverage for these exclusions. Common exclusions include flood damage, earthquake damage, and damage caused by pests or vermin.

Choose a Reputable Insurer

Select an insurance provider with a strong financial standing and a good reputation for customer service and claims handling. Check financial ratings from agencies like AM Best or Standard & Poor’s to ensure the insurer is financially stable. Reading reviews and seeking recommendations from trusted sources can also provide valuable insights.

Consider Long-term Value

While initial pricing is important, also consider the long-term value of the policy. Look for an insurer that offers competitive rates, provides excellent service, and has a track record of fair claims handling. Regularly review your policy and consider updating it as your needs and circumstances change.

Seek Professional Advice

If you’re unsure about the best home insurance policy for your needs, consider consulting an insurance broker or financial advisor. They can provide expert guidance and help you tailor your coverage to your specific circumstances.

Conclusion: Navigating the Home Insurance Market

Navigating the home insurance market can be complex, but with a thorough understanding of the key factors and a systematic approach to comparison, you can find the best coverage for your home. Remember, your home is one of your most valuable assets, and ensuring its protection is essential. By comparing policies, understanding your risks, and seeking expert advice, you can make an informed decision that provides the peace of mind and financial security you deserve.

What factors determine the cost of home insurance?

+The cost of home insurance is influenced by several factors, including the location, size, and age of your home, as well as the level of coverage you choose. Other factors that can impact the cost include the crime rate in your area, the presence of natural disaster risks, and any discounts you may qualify for.

How often should I review my home insurance policy?

+It’s recommended to review your home insurance policy annually, or whenever you experience significant life changes, such as renovations, purchasing high-value items, or moving to a new location. Regular reviews ensure your coverage remains adequate and up-to-date with your needs.

Can I customize my home insurance policy to fit my specific needs?

+Yes, most home insurance policies can be customized to fit your specific needs. This can include adding endorsements or riders for high-value items, adjusting coverage limits, or including optional coverages for specific risks. Consulting with your insurance provider can help you tailor your policy to your requirements.

What should I do if I need to file a claim with my home insurance provider?

+If you need to file a claim, it’s important to act promptly. Contact your insurance provider as soon as possible and provide them with all the necessary details about the incident. They will guide you through the claims process, which typically involves submitting documentation and evidence to support your claim.

Are there any common misconceptions about home insurance that I should be aware of?

+One common misconception is that home insurance covers all types of water damage. However, most policies exclude damage caused by floods or groundwater. Additionally, many policies do not cover damage caused by pests or vermin. It’s important to carefully review your policy to understand what’s covered and what’s not.