Local Health Insurance Agents

In the vast landscape of health insurance, the role of local health insurance agents stands as a crucial bridge between consumers and the complex world of healthcare coverage. These professionals, often overlooked, play a pivotal part in guiding individuals and families through the intricate process of selecting the right health insurance plan.

The Role of Local Health Insurance Agents

Local health insurance agents are licensed professionals who specialize in understanding the intricacies of health insurance plans. They serve as trusted advisors, offering personalized guidance to help individuals navigate the complex web of healthcare coverage options. With their in-depth knowledge of the local market, these agents are equipped to recommend plans that align with their clients’ unique needs and budgets.

One of the primary benefits of engaging with a local health insurance agent is the personalized service they provide. Unlike online comparison tools or generic brochures, these agents take the time to understand their clients' specific healthcare requirements, financial constraints, and even personal preferences. This personalized approach ensures that the recommended plans are tailored to the individual, maximizing the value and coverage they receive.

Expertise in Local Markets

Local health insurance agents are deeply rooted in their communities, which gives them a unique advantage. They have an intimate understanding of the local healthcare providers, hospitals, and clinics, as well as the specific coverage needs of residents in their area. This local expertise allows them to recommend plans that not only offer comprehensive coverage but also ensure access to preferred healthcare providers and facilities.

For instance, an agent serving a rural community might suggest plans that cover specialized medical services that may not be readily available locally, ensuring that residents have access to the necessary care. Conversely, an agent in an urban area might focus on plans that offer discounts or incentives for using specific hospitals or healthcare networks within the city.

| Community Type | Agent's Focus |

|---|---|

| Rural | Specialized Medical Services |

| Urban | Healthcare Network Incentives |

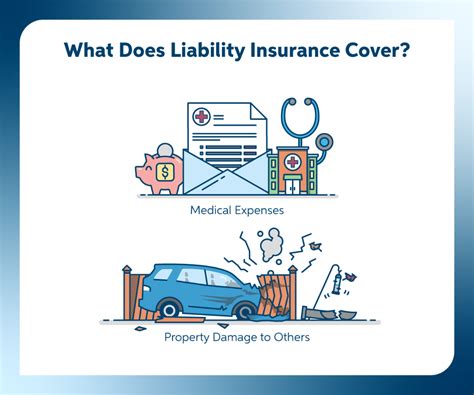

Navigating Complex Plans and Terms

Health insurance plans can be notoriously complex, with intricate terms and conditions that often leave consumers bewildered. Local health insurance agents act as interpreters, breaking down these complexities into simple, understandable language. They explain the differences between various plan types, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs), ensuring their clients understand the trade-offs between cost and coverage.

Furthermore, agents can provide insights into the fine print, highlighting potential pitfalls or benefits that might not be immediately obvious. This includes details like prescription drug coverage, out-of-pocket maximums, and the process for seeking referrals or prior authorizations, ensuring their clients are fully informed before making a decision.

The Benefits of Choosing a Local Agent

Opting for a local health insurance agent brings a host of advantages that extend beyond just the selection of a suitable plan. These agents offer ongoing support and guidance, ensuring their clients’ coverage remains aligned with their changing needs and circumstances.

Personalized Service and Attention

In a world increasingly dominated by digital transactions and automated processes, the personalized service offered by local agents stands out. They take the time to understand their clients’ unique situations, whether it’s a recent change in health status, a new job, or a growing family. This personalized attention ensures that the recommended plans are not only suitable for the present but also adaptable to future needs.

For example, a local agent might recommend a plan with a lower premium and higher deductible for a young, healthy individual, knowing that this person may not require extensive medical care in the immediate future. However, if this individual's health status changes or they start a family, the agent can quickly adjust their recommendation, ensuring continuous, appropriate coverage.

Ongoing Support and Guidance

The relationship with a local health insurance agent doesn’t end once a plan is selected. These professionals provide ongoing support, helping their clients navigate the complexities of their chosen plan. They offer guidance on understanding benefits, maximizing coverage, and addressing any concerns or issues that may arise during the plan’s tenure.

In the event of a claim, local agents can be invaluable. They can assist in the claim process, ensuring that all necessary paperwork is completed accurately and that the claim is submitted efficiently. This level of support can be particularly beneficial for those who may be unfamiliar with the claim process or those who require specialized care and need to understand the approval process for certain treatments.

Advocacy and Problem Resolution

Local health insurance agents can also act as advocates for their clients. In situations where there may be a dispute or misunderstanding with an insurance provider, these agents can step in and mediate, ensuring their clients’ rights and coverage are respected. They can also provide clarity and support in cases of non-payment or delayed payment, ensuring their clients receive the benefits they are entitled to.

Furthermore, agents can assist in appealing insurance decisions. If a claim is denied or a treatment is not covered, the agent can work with the client to gather the necessary information and present a strong case for reconsideration. This advocacy role can be instrumental in ensuring clients receive the healthcare services they need and deserve.

Future Trends and the Evolving Role of Local Agents

As the healthcare landscape continues to evolve, the role of local health insurance agents is also transforming. With the rise of digital health tools and online resources, these agents are adapting their services to meet the changing needs and expectations of consumers.

Digital Integration and Online Tools

Local agents are increasingly integrating digital tools into their practice, offering online portals and mobile apps that provide real-time updates and information to their clients. These platforms can include features like plan comparisons, benefit summaries, and even tools for tracking and managing healthcare expenses.

By embracing digital technologies, local agents can enhance their service offerings, providing their clients with convenient access to information and resources. This integration of digital tools also allows agents to stay connected with their clients, offering timely updates and guidance even outside of traditional office hours.

Specialized Services and Niche Markets

The healthcare industry is diverse, and with the rise of specialized healthcare needs, local agents are increasingly focusing on niche markets. This includes catering to specific demographics, such as seniors or young professionals, as well as those with unique healthcare requirements, like those with chronic conditions or those requiring specialized treatments.

By specializing in these niche markets, local agents can offer deeper expertise and more tailored recommendations. This specialized approach ensures that clients receive coverage that not only meets their basic needs but also addresses their unique healthcare challenges.

Community Engagement and Education

Local health insurance agents are also playing a crucial role in community education and engagement. They are often involved in local health fairs, community events, and educational workshops, providing information and guidance to residents on healthcare coverage and related topics. This community outreach not only helps raise awareness about healthcare options but also builds trust and confidence in the local agent community.

By actively engaging with their community, local agents can identify and address specific healthcare concerns and trends, ensuring that their services remain relevant and beneficial to the residents they serve.

Conclusion: The Value of Local Health Insurance Agents

Local health insurance agents are invaluable resources in the complex world of healthcare coverage. Their expertise, personalized service, and ongoing support make them an essential part of the healthcare landscape. As consumers navigate the ever-changing healthcare market, the guidance and advocacy provided by these local professionals can make all the difference in ensuring access to quality, affordable healthcare.

Whether it's helping individuals understand their coverage options, advocating for their rights, or simply providing peace of mind, local health insurance agents are a vital link between consumers and the healthcare system. Their role is not just about selling insurance plans; it's about empowering individuals to make informed decisions about their healthcare and ensuring they receive the care they need and deserve.

How do I find a reputable local health insurance agent?

+Finding a reputable local health insurance agent involves some research. Start by asking for recommendations from friends, family, or colleagues who have had positive experiences with their agents. You can also check online reviews and ratings, but be cautious as some may be biased. Look for agents who are licensed and have a good standing with state regulatory bodies. Finally, interview a few agents to assess their knowledge, communication skills, and ability to tailor recommendations to your specific needs.

What questions should I ask a local health insurance agent?

+When meeting with a local health insurance agent, it’s important to ask questions to understand their expertise and how they can assist you. Some key questions include: What types of plans do you specialize in? How do you stay updated with the latest healthcare regulations and plan changes? Can you provide references or testimonials from previous clients? What is your process for helping me find the right plan? By asking these questions, you can gauge the agent’s knowledge, experience, and ability to meet your specific needs.

Can a local health insurance agent help me if I have a pre-existing condition?

+Absolutely! One of the strengths of local health insurance agents is their ability to navigate the complexities of health insurance, including pre-existing conditions. They can guide you through the process of finding a plan that offers the coverage you need while taking into account your specific health circumstances. Their expertise can be invaluable in ensuring you receive the necessary care and are not penalized for your pre-existing condition.