Life Insurance Meaning

Life insurance is a financial safety net designed to provide peace of mind and protect your loved ones in the event of your untimely demise. It's an essential tool that ensures your family's financial stability and security, even in the face of an uncertain future. Understanding the meaning and purpose of life insurance is crucial, as it empowers you to make informed decisions about your financial planning and provides a solid foundation for your family's well-being.

The Significance of Life Insurance

Life insurance serves as a safeguard against the financial challenges that can arise after a person’s death. It provides a lump sum payment, known as a death benefit, to the designated beneficiaries, who can then use this financial support to cover various expenses and maintain their standard of living.

The primary objective of life insurance is to offer financial protection to your dependents, ensuring they can continue their lives without facing immediate financial burdens. This can include covering funeral expenses, paying off debts, funding children's education, or providing income for daily expenses. Life insurance acts as a safety net, offering a sense of security and stability during a time of emotional upheaval.

Key Components of Life Insurance

Policyholder and Beneficiaries

The policyholder is the person who purchases the life insurance policy and makes regular premium payments to maintain coverage. They decide who the beneficiaries will be, which can include spouses, children, parents, or any other dependent individuals.

Beneficiaries are the individuals who receive the death benefit upon the policyholder's passing. They are designated by the policyholder and can be changed or updated throughout the policy's lifespan. It's important to review and update beneficiary information regularly to ensure it aligns with your current circumstances and wishes.

Premiums and Coverage Amount

Premiums are the regular payments made by the policyholder to keep the life insurance policy active. The cost of premiums can vary based on several factors, including the policyholder’s age, health status, lifestyle, and the chosen coverage amount.

The coverage amount, or death benefit, is the sum of money that the beneficiaries will receive upon the policyholder's death. This amount is determined during the policy purchase and can be adjusted as needed. It's crucial to choose a coverage amount that adequately reflects your financial goals and the needs of your dependents.

Policy Types and Terms

Life insurance policies come in various types, each designed to meet different needs and financial situations. The two main categories are term life insurance and permanent life insurance.

Term Life Insurance offers coverage for a specific period, typically ranging from 10 to 30 years. It provides a death benefit only if the policyholder dies during the term of the policy. Term life insurance is generally more affordable and suitable for individuals seeking temporary coverage, such as during their working years when financial obligations are high.

Permanent Life Insurance, on the other hand, provides lifelong coverage, ensuring that the death benefit is paid whenever the policyholder passes away. This type of insurance often includes a cash value component that grows over time and can be accessed by the policyholder while they are alive. Permanent life insurance policies, such as whole life, universal life, and variable life, offer more comprehensive coverage but tend to have higher premiums.

How Life Insurance Works

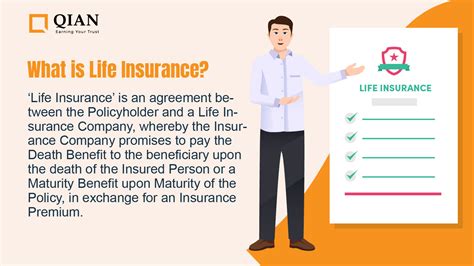

When you purchase a life insurance policy, you enter into a contract with the insurance company. This contract outlines the terms and conditions of the policy, including the coverage amount, premium payments, and any additional riders or benefits you may have chosen.

During the application process, the insurance company assesses your health, lifestyle, and other factors to determine your risk level. This assessment may involve medical examinations, health questionnaires, and reviews of your medical history. Based on this evaluation, the insurance company assigns you a risk category, which influences the premium you pay.

Once the policy is in force, you are responsible for making timely premium payments to maintain coverage. The insurance company, in turn, assumes the risk of paying out the death benefit if you pass away during the policy term. If you die while the policy is active, the insurance company verifies the claim and pays the death benefit to your designated beneficiaries.

Claims Process

When a life insurance policyholder passes away, the beneficiaries must initiate the claims process to receive the death benefit. This typically involves submitting the necessary documentation, such as a death certificate and any other required forms, to the insurance company.

The insurance company reviews the claim and verifies the policyholder's death and beneficiary information. Once the claim is approved, the beneficiaries receive the death benefit, which can be paid as a lump sum or in installments, depending on the policy terms.

The Importance of Regular Reviews

Life insurance policies should be reviewed periodically to ensure they continue to meet your needs and financial goals. Life circumstances can change, and it’s essential to adjust your coverage accordingly. For instance, major life events such as marriage, the birth of a child, purchasing a home, or retiring may require modifications to your life insurance policy.

Regular reviews allow you to assess whether your coverage amount is adequate, whether you need to add or remove beneficiaries, or if you should consider switching policy types. It's also an opportunity to evaluate the financial health of your insurance company and ensure they remain a reliable partner for your long-term financial security.

The Future of Life Insurance

The life insurance industry is evolving, and technological advancements are shaping the way policies are purchased and managed. Online platforms and mobile apps are making it easier for individuals to compare policies, apply for coverage, and manage their policies remotely.

Additionally, the industry is seeing a shift towards more personalized and flexible policies. Insurers are offering a wider range of coverage options, allowing policyholders to customize their policies to fit their unique needs. This includes the ability to add riders for specific coverage, such as accelerated death benefits for critical illnesses or long-term care needs.

| Life Insurance Statistics | Data |

|---|---|

| Global Life Insurance Market Size | $3.8 trillion (estimated) |

| Percentage of Americans with Life Insurance | 59% |

| Average Life Insurance Coverage in the US | $242,000 |

What happens if I miss a premium payment on my life insurance policy?

+

Missing a premium payment can have serious consequences for your life insurance coverage. Depending on the terms of your policy, you may have a grace period of 30 days or more to make the payment. If you fail to make the payment within this grace period, your policy may lapse, and you’ll lose coverage. It’s important to stay up to date with your premium payments to maintain your policy’s validity.

Can I change the beneficiaries on my life insurance policy?

+

Yes, you can typically change the beneficiaries on your life insurance policy at any time. This is especially important if your circumstances change, such as a divorce, remarriage, or the birth of a child. By updating your beneficiary information, you can ensure that your death benefit goes to the individuals you intend to support.

Are there any tax implications with life insurance payouts?

+

In most cases, life insurance death benefits are not subject to federal income tax in the United States. However, it’s important to consult with a tax professional to understand the specific tax laws in your jurisdiction and how they may apply to your particular situation.