Life Insurance Cash Value

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their families. One unique aspect of certain life insurance policies is the concept of cash value, which offers policyholders the potential for long-term financial growth and flexibility. This article delves into the world of life insurance cash value, exploring its definition, how it works, and the benefits it can offer policyholders.

Understanding Life Insurance Cash Value

In the realm of life insurance, cash value refers to the portion of a policy that accumulates over time and functions as a savings component. It is not a standard feature of all life insurance policies; rather, it is an additional benefit typically found in permanent life insurance policies, such as whole life, universal life, and variable life insurance.

Unlike term life insurance, which provides coverage for a specified period, permanent life insurance offers coverage for the policyholder's entire life, assuming premiums are paid as agreed. The cash value aspect of these policies acts as a financial asset, growing through investment of the premium payments and potentially earning interest or dividends.

How Cash Value Accumulates

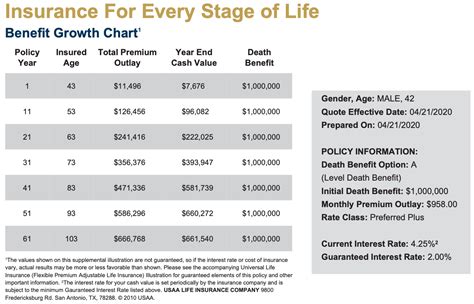

The accumulation of cash value within a life insurance policy is a gradual process. Each premium payment made by the policyholder contributes to this savings component. Over time, the cash value grows, and it can be used for various financial purposes while the policy remains active.

The growth of cash value depends on several factors, including the type of permanent life insurance policy, the investment strategy employed by the insurance company, and the overall performance of the investments. Some policies offer guaranteed cash value growth, while others provide the potential for higher returns but with greater investment risk.

Benefits of Life Insurance Cash Value

The cash value component of permanent life insurance policies offers several advantages to policyholders, providing them with financial flexibility and potential long-term growth.

- Savings and Investment: Cash value acts as a savings account, allowing policyholders to build financial reserves over time. This accumulated wealth can be used for various purposes, such as funding retirement, covering unexpected expenses, or providing a financial cushion during challenging times.

- Loan and Withdrawal Options: Policyholders can borrow against the cash value of their life insurance policy or withdraw a portion of it. This can be particularly beneficial for covering short-term financial needs without liquidating other investments or incurring additional debt.

- Policy Continuation: In certain situations, such as financial hardship or temporary inability to pay premiums, policyholders can use the cash value to continue their coverage. This ensures that the life insurance policy remains active, providing peace of mind and maintaining the death benefit for beneficiaries.

- Tax Advantages: Cash value growth within a life insurance policy often enjoys tax advantages. Earnings on the cash value are typically tax-deferred, and withdrawals or loans taken against the cash value are generally tax-free as long as the policy remains in force. This tax treatment can significantly enhance the financial benefits of cash value accumulation.

However, it's important to note that borrowing against or withdrawing from the cash value may reduce the death benefit of the policy and have tax implications if the policy is surrendered or lapses. Consulting with a financial advisor is crucial to fully understand the potential impact of these actions.

Comparing Cash Value Life Insurance Policies

When considering life insurance policies with cash value, it’s essential to understand the differences between the various types of permanent life insurance:

| Policy Type | Features |

|---|---|

| Whole Life Insurance | Provides guaranteed cash value growth, a fixed premium, and a level death benefit throughout the policyholder's life. Offers stability and long-term financial planning. |

| Universal Life Insurance | Offers flexible premiums and the potential for higher cash value growth. Policyholders can adjust premiums and death benefits, making it suitable for those seeking customization and flexibility. |

| Variable Life Insurance | Allows policyholders to invest their premiums in separate accounts, offering the potential for higher returns but also carrying greater investment risk. The cash value and death benefit fluctuate based on investment performance. |

The choice between these policies depends on individual financial goals, risk tolerance, and the desired level of flexibility. Consulting with a qualified financial advisor can help individuals make informed decisions based on their unique circumstances.

Maximizing the Benefits of Cash Value

To fully leverage the advantages of life insurance cash value, policyholders should consider the following strategies:

- Regular Premium Payments: Consistent premium payments are crucial for building cash value. Missing payments or paying less than the agreed premium can reduce the growth of cash value and impact the overall financial benefits of the policy.

- Understanding Policy Features: Policyholders should thoroughly understand the terms and conditions of their life insurance policy, including the specific features and benefits of the cash value component. This knowledge empowers them to make informed decisions regarding their financial planning.

- Reviewing Performance and Adjusting Strategies: Regularly reviewing the performance of the cash value and making necessary adjustments can optimize its growth. Policyholders can work with their insurance company or financial advisor to ensure their investments align with their financial goals and risk tolerance.

- Exploring Tax-Efficient Strategies: Given the tax advantages of cash value growth, policyholders can benefit from exploring tax-efficient strategies. This may involve utilizing the cash value for specific financial goals, such as funding retirement accounts or covering tax-deductible expenses.

The Future of Life Insurance Cash Value

As the financial landscape evolves, life insurance policies with cash value continue to play a crucial role in long-term financial planning. The flexibility and potential for growth offered by these policies make them an attractive option for individuals seeking comprehensive financial protection and savings opportunities.

With advancements in investment strategies and technology, insurance companies are continually improving the cash value component of permanent life insurance policies. This includes offering more diverse investment options, enhanced transparency, and easier access to policy information and management.

Furthermore, the integration of technology in the insurance industry has made it more convenient for policyholders to monitor and manage their cash value. Online platforms and mobile applications now provide real-time access to policy details, allowing policyholders to make informed decisions about their financial strategies.

In conclusion, life insurance cash value is a valuable feature of permanent life insurance policies, offering policyholders a range of financial benefits and opportunities. By understanding how cash value works and exploring the various policy options, individuals can make informed decisions to secure their financial future and protect their loved ones.

Can I access the cash value of my life insurance policy at any time?

+Yes, policyholders can typically access the cash value of their life insurance policy through loans or withdrawals. However, it’s important to consider the potential impact on the death benefit and the tax implications of these actions.

Are there any risks associated with life insurance cash value policies?

+While life insurance cash value policies offer many benefits, they also carry some risks. These include the potential for lower returns on investment, especially in variable life insurance policies, and the possibility of policy lapse if premiums are not paid.

How does cash value growth compare to other investment options?

+The growth of cash value in life insurance policies can vary depending on the type of policy and investment strategy. While it may not offer the same potential for high returns as some riskier investments, it provides a stable and guaranteed savings component with tax advantages.