Liberty Mutual Auto Insurance

The Evolution of Liberty Mutual: A Comprehensive Guide to its Auto Insurance Services

In the ever-evolving landscape of the insurance industry, few names carry as much weight and historical significance as Liberty Mutual. With a rich heritage spanning over a century, this renowned insurer has continuously adapted to meet the changing needs of its customers. This article delves deep into the world of Liberty Mutual Auto Insurance, exploring its evolution, unique offerings, and the impact it has had on the industry. By examining its history, services, and market presence, we aim to provide an insightful guide for anyone seeking comprehensive auto insurance coverage.

A Historical Perspective: Liberty Mutual’s Legacy

The story of Liberty Mutual began in 1912, when a group of Boston-based businessmen, led by entrepreneur Benjamin F. Gardner, recognized the need for affordable insurance coverage for working-class individuals. Their vision was to create an insurance company that prioritized customer needs and offered accessible, reliable protection. This marked the birth of the Massachusetts Employees Insurance Association (MEIA), which later became Liberty Mutual Insurance.

Over the decades, Liberty Mutual has witnessed and influenced significant changes in the insurance sector. It has consistently embraced technological advancements, from the early days of paper-based records to the digital revolution that transformed the industry. This forward-thinking approach has positioned Liberty Mutual as a leader in innovation, allowing it to offer cutting-edge services and customer experiences.

Auto Insurance Services: A Comprehensive Overview

Liberty Mutual’s auto insurance offerings reflect its commitment to providing tailored coverage options that cater to a diverse range of drivers. The company understands that each driver has unique needs, and it strives to offer flexible and customizable policies to meet those needs.

Comprehensive Coverage

Liberty Mutual’s comprehensive auto insurance plan is designed to offer extensive protection. It includes liability coverage for bodily injury and property damage, as well as protection for the policyholder’s vehicle against theft, vandalism, and damage caused by natural disasters or accidents. Additionally, this plan often includes medical payments coverage, which can help cover the cost of medical expenses for the policyholder and their passengers after an accident.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage claims made against the policyholder. |

| Comprehensive Coverage | Protects against non-collision incidents such as theft, vandalism, and natural disasters. |

| Collision Coverage | Covers damage to the insured vehicle in the event of an accident, regardless of fault. |

| Medical Payments Coverage | Assists with medical expenses for the policyholder and passengers after an accident. |

Collision Coverage

For drivers who want additional protection, Liberty Mutual offers collision coverage. This type of insurance covers the cost of repairing or replacing the insured vehicle after an accident, regardless of who is at fault. It provides peace of mind, knowing that the policyholder’s vehicle is protected against the financial burden of repairs.

Customizable Add-Ons

Liberty Mutual understands that every driver’s situation is unique. That’s why it offers a range of customizable add-ons to enhance basic coverage. These include roadside assistance, rental car reimbursement, gap insurance, and coverage for custom parts and equipment. By tailoring their policies, drivers can create a personalized insurance plan that aligns with their specific needs and preferences.

Discounts and Savings

Liberty Mutual is known for its commitment to providing value to its customers. The company offers a variety of discounts to help policyholders save on their auto insurance premiums. These include discounts for safe driving, multi-policy bundles, and loyalty rewards. Additionally, Liberty Mutual often provides special discounts for certain professions, military personnel, and students, making its insurance offerings even more affordable and accessible.

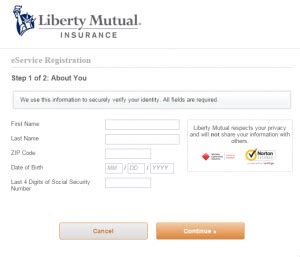

Innovative Features and Digital Services

Liberty Mutual’s dedication to innovation is evident in its suite of digital services and features. The company has developed cutting-edge tools and platforms to enhance the customer experience and make managing insurance policies more convenient and efficient.

Digital Claims Processing

In the event of an accident, Liberty Mutual’s digital claims processing system streamlines the process. Policyholders can file claims online or through the Liberty Mutual mobile app, providing a convenient and efficient way to initiate the claims process. The app allows users to upload photos, videos, and other relevant documentation, making it easier to gather the necessary information for a claim.

Telematics-Based Insurance

Liberty Mutual has embraced telematics, a technology that uses data from vehicles to assess driving behavior. Its RightTrack® program offers policyholders the opportunity to install a small device in their vehicle that tracks driving habits. Based on this data, drivers can receive personalized feedback on their driving and potentially earn discounts on their insurance premiums. This innovative approach encourages safer driving habits and rewards responsible drivers.

Digital Payment Options

Liberty Mutual understands the importance of flexibility when it comes to payment options. The company offers a variety of digital payment methods, including online payments through its website and mobile app, as well as automatic payments and direct billing. This ensures that policyholders can choose the payment method that best suits their preferences and financial situation.

Market Presence and Customer Satisfaction

Liberty Mutual’s impact on the insurance industry is significant, and its market presence is a testament to its success. The company operates in all 50 states and has a substantial market share, particularly in the Northeast and Midwest regions of the United States. Its extensive network of agents and customer service representatives ensures that policyholders have easy access to support and guidance.

Customer satisfaction is a top priority for Liberty Mutual, and the company consistently receives high marks for its services. It has earned recognition from reputable organizations such as J.D. Power and the National Association of Insurance Commissioners (NAIC) for its excellent customer service and claims handling. Additionally, Liberty Mutual has been praised for its transparent and fair claims process, ensuring that policyholders receive the coverage they deserve.

Customer Feedback and Reviews

Positive customer feedback highlights Liberty Mutual’s commitment to excellence. Many policyholders appreciate the company’s focus on customer satisfaction, citing its friendly and knowledgeable staff, as well as its efficient claims processing. Liberty Mutual’s dedication to providing personalized service and tailored coverage options has earned it a reputation as a trusted and reliable insurer.

The Future of Liberty Mutual Auto Insurance

As the insurance industry continues to evolve, Liberty Mutual remains at the forefront of innovation. The company is investing in emerging technologies, such as artificial intelligence and machine learning, to further enhance its services and improve the customer experience. By leveraging these advancements, Liberty Mutual aims to offer even more efficient and personalized insurance solutions.

Furthermore, Liberty Mutual is expanding its focus on sustainability and environmental initiatives. The company recognizes the impact of climate change on the insurance industry and is committed to reducing its environmental footprint. This includes exploring renewable energy options, promoting eco-friendly driving practices, and supporting sustainable business practices throughout its operations.

What are the key benefits of choosing Liberty Mutual Auto Insurance?

+Liberty Mutual offers a range of benefits, including customizable coverage options, innovative digital services, and a commitment to customer satisfaction. Policyholders can tailor their insurance plans to meet their specific needs, take advantage of digital tools for efficient claims processing and payment, and benefit from the company’s focus on providing excellent customer service.

How does Liberty Mutual’s telematics program work, and what are the potential benefits for policyholders?

+The RightTrack® program uses telematics technology to assess driving behavior. Policyholders can install a device in their vehicle that tracks their driving habits, and based on this data, they may receive personalized feedback and potential discounts on their insurance premiums. This program encourages safer driving and rewards responsible drivers.

What sets Liberty Mutual apart from other auto insurance providers in the market?

+Liberty Mutual’s focus on innovation, customer satisfaction, and sustainability sets it apart. The company’s commitment to providing tailored coverage options, efficient digital services, and fair claims handling, coupled with its dedication to reducing its environmental impact, makes it a standout choice for many drivers.