State Department Of Insurance

The State Department of Insurance is a vital entity within the regulatory framework of the insurance industry, tasked with overseeing and ensuring compliance with insurance laws and regulations. This department plays a crucial role in protecting the interests of policyholders and maintaining the stability of the insurance market. With a focus on consumer protection, market conduct, and industry oversight, the State Department of Insurance serves as a watchdog, ensuring fair practices and transparency within the insurance sector.

Regulatory Functions and Consumer Protection

The primary responsibility of the State Department of Insurance is to regulate the insurance industry within its jurisdiction. This involves a range of functions aimed at safeguarding consumers and maintaining the integrity of the insurance market. Some key regulatory functions include:

- License and Registration: The department is responsible for licensing insurance companies, agents, and brokers. This process ensures that only qualified and trustworthy entities are allowed to operate within the state, protecting consumers from fraudulent or incompetent practices.

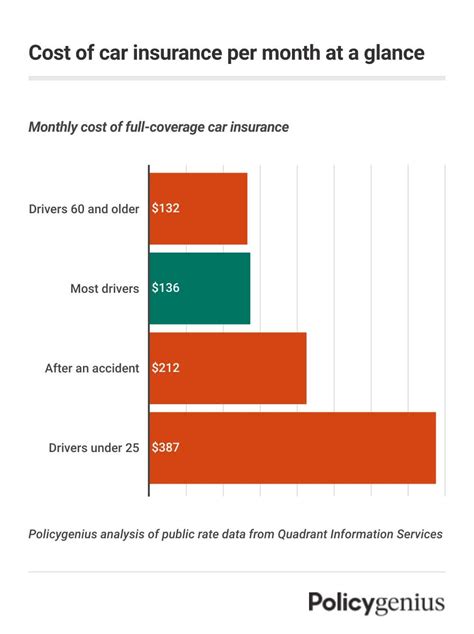

- Rate Review and Approval: Insurance rates are subject to review and approval by the department to ensure they are fair, reasonable, and non-discriminatory. This process prevents insurance companies from overcharging or undercutting each other, promoting a competitive yet fair market.

- Market Conduct Examinations: Regular examinations of insurance companies’ practices are conducted to assess compliance with laws and regulations. These examinations help identify and rectify any unfair or deceptive practices, ensuring a level playing field for all market participants.

- Consumer Education and Outreach: The department provides educational resources and outreach programs to inform consumers about their rights and responsibilities, helping them make informed decisions about insurance products and services.

- Complaint Handling and Resolution: A dedicated consumer affairs division handles complaints from policyholders, investigates alleged violations, and mediates disputes to resolve consumer issues and ensure fair treatment.

Insurance Fraud Detection and Prevention

One of the critical roles of the State Department of Insurance is to combat insurance fraud. This includes both identifying and prosecuting insurance fraud perpetrators and implementing preventive measures to deter such activities. The department works closely with law enforcement agencies and utilizes advanced analytics and data mining techniques to detect suspicious patterns and identify potential fraudsters.

For instance, the department may analyze claims data to identify excessive or unusual claim patterns, which could indicate fraudulent activities. By detecting and prosecuting fraud, the department helps maintain the financial integrity of the insurance industry and ensures that honest policyholders are not unduly burdened by fraudulent claims.

Market Stability and Financial Solvency Oversight

The State Department of Insurance is also responsible for overseeing the financial solvency of insurance companies operating within its jurisdiction. This includes regular financial examinations to assess the companies’ ability to meet their financial obligations, such as paying valid claims. By ensuring the financial stability of insurance companies, the department helps protect policyholders’ interests and maintains market confidence.

Additionally, the department plays a crucial role in monitoring and managing insurance company insolvencies. In the event of an insurer’s insolvency, the department works to ensure policyholder claims are paid and that the liquidation process is fair and transparent. This function is critical in protecting consumers’ financial interests and maintaining the overall stability of the insurance market.

Regulatory Technology and Data Analytics

In today’s digital age, the State Department of Insurance leverages advanced technology and data analytics to enhance its regulatory capabilities. By utilizing cutting-edge tools and techniques, the department can improve its efficiency, effectiveness, and responsiveness in regulating the insurance industry.

- Data-Driven Decision Making: The department employs advanced analytics to analyze large volumes of data, including insurance company financial statements, claims data, and consumer complaints. This enables data-driven decision-making, helping the department identify trends, detect anomalies, and make informed policy decisions.

- Artificial Intelligence and Machine Learning: AI and machine learning technologies are used to automate certain regulatory processes, such as fraud detection and market conduct examinations. These technologies can process vast amounts of data quickly and accurately, helping the department identify potential issues and take proactive measures.

- Blockchain Technology: The department explores the use of blockchain to enhance data security, transparency, and efficiency. Blockchain can improve the integrity and traceability of insurance-related data, making it harder for fraudulent activities to go undetected.

- RegTech Solutions: Regulatory technology (RegTech) solutions are increasingly adopted to streamline regulatory processes, such as license application and renewal, rate filing, and reporting. These solutions reduce manual errors, improve compliance, and enhance the overall efficiency of the regulatory framework.

Industry Collaboration and Innovation

The State Department of Insurance actively collaborates with industry stakeholders, including insurance companies, agents, brokers, and consumer groups, to promote innovation and improve regulatory practices. Through open dialogue and feedback, the department can better understand industry challenges and implement regulatory solutions that are both effective and practical.

Additionally, the department encourages and supports industry innovation, such as the development and adoption of new insurance products and technologies. By fostering a conducive regulatory environment, the department helps the insurance industry stay competitive and adapt to changing market dynamics.

Future Implications and Regulatory Challenges

As the insurance industry continues to evolve, the State Department of Insurance faces new challenges and opportunities. The rise of digital technologies and the increasing complexity of insurance products present both risks and opportunities for the regulatory framework.

One of the key challenges is keeping pace with technological advancements and ensuring that the regulatory framework remains relevant and effective in a rapidly changing market. This includes adapting to new distribution channels, such as online platforms and mobile applications, and addressing the regulatory implications of emerging technologies like artificial intelligence and blockchain.

Furthermore, the department must continue to enhance its data analytics capabilities to effectively monitor and regulate the insurance market. This involves investing in advanced technologies, training staff in data analytics, and collaborating with industry experts to stay ahead of emerging risks and opportunities.

How does the State Department of Insurance protect consumer interests?

+The State Department of Insurance protects consumer interests through various means, including licensing and regulating insurance companies and agents, reviewing and approving insurance rates, conducting market conduct examinations, providing consumer education and outreach programs, and handling consumer complaints.

What role does the department play in combating insurance fraud?

+The department plays a crucial role in detecting and prosecuting insurance fraud. It utilizes advanced analytics and data mining techniques to identify suspicious patterns and potential fraudsters. By taking proactive measures, the department helps maintain the financial integrity of the insurance industry and protects honest policyholders.

How does the department ensure the financial solvency of insurance companies?

+The department oversees the financial solvency of insurance companies through regular financial examinations. It assesses the companies’ ability to meet their financial obligations, such as paying valid claims. By ensuring financial stability, the department protects policyholders’ interests and maintains market confidence.