Average Price For Car Insurance

When it comes to car insurance, one of the most common questions that arises is, "What is the average price for car insurance?" The cost of car insurance can vary significantly depending on numerous factors, and understanding these factors is crucial for drivers to make informed decisions about their coverage. In this comprehensive guide, we will delve into the world of car insurance, exploring the key determinants of insurance rates and providing valuable insights to help you navigate this essential aspect of vehicle ownership.

Understanding the Factors that Influence Car Insurance Costs

The price of car insurance is not a one-size-fits-all proposition. It is influenced by a multitude of variables, each playing a unique role in determining the final cost. Let's explore these factors in detail to gain a comprehensive understanding of what impacts the average price for car insurance.

Vehicle Type and Make

The type and make of your vehicle are fundamental factors in insurance pricing. Generally, newer and more expensive cars tend to attract higher insurance premiums. This is because newer models often feature advanced technology and safety systems, making them more costly to repair or replace in the event of an accident. Additionally, luxury vehicles and sports cars are typically more expensive to insure due to their higher repair costs and the increased risk associated with their performance capabilities.

On the other hand, older, more affordable vehicles may have lower insurance costs. However, it's important to note that age and affordability are not the sole determinants. The safety features, accident history, and overall reliability of a vehicle also play significant roles in insurance pricing.

Driver Profile and History

Your personal driving record and demographic information are key factors in determining insurance rates. Insurance companies carefully analyze your driving history, considering factors such as accidents, traffic violations, and claims made in the past. A clean driving record with no recent accidents or violations can lead to lower insurance premiums. Conversely, a history of accidents or traffic citations may result in higher rates, as these indicate a higher risk profile for the insurance provider.

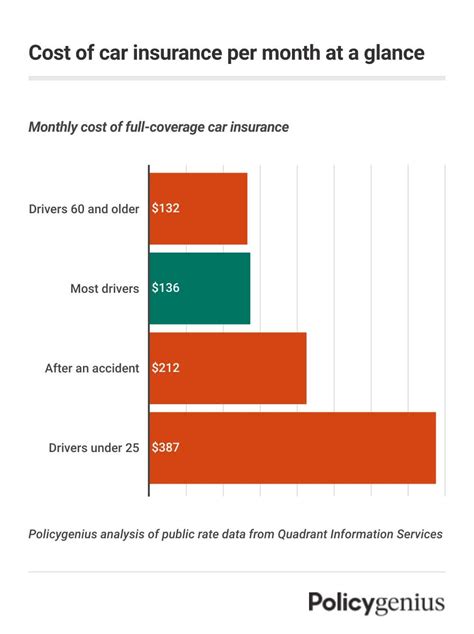

Demographic factors such as age, gender, and location also influence insurance costs. Younger drivers, particularly those under the age of 25, often face higher insurance premiums due to their perceived higher risk of accidents. Similarly, urban areas with higher traffic density and a greater risk of accidents or theft may result in higher insurance rates compared to more rural or suburban locations.

Coverage and Deductibles

The level of coverage you choose and the deductibles you select significantly impact your insurance premiums. Comprehensive coverage, which includes protection for a wide range of incidents such as theft, vandalism, and natural disasters, typically comes at a higher cost compared to basic liability coverage, which only covers damage caused to others in an accident for which you are at fault.

Additionally, the deductible you choose plays a crucial role. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your monthly premiums, as you are essentially accepting more financial responsibility in the event of a claim. Conversely, a lower deductible means you pay less upfront but higher monthly premiums.

Location and Usage

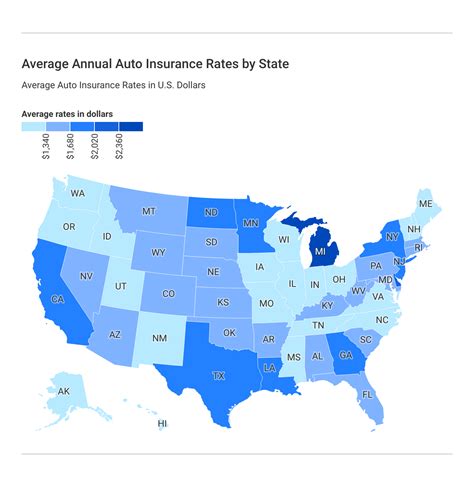

Your geographic location and the purpose for which you use your vehicle can also affect insurance rates. Insurance companies consider factors such as the local crime rate, traffic density, and weather conditions when determining premiums. Areas with higher crime rates or frequent natural disasters may result in higher insurance costs due to the increased risk of theft, accidents, or property damage.

Furthermore, the purpose for which you use your vehicle can impact insurance rates. For instance, using your car for personal pleasure or commuting to work typically incurs lower insurance costs compared to using it for business purposes or as a commercial vehicle. The increased mileage and potential for accidents associated with commercial use often result in higher insurance premiums.

Discounts and Bundling

Insurance companies often offer discounts to attract and retain customers. These discounts can significantly reduce the average price for car insurance. Some common discounts include:

- Multi-Policy Discounts: Bundling your car insurance with other policies, such as home or renters insurance, can result in substantial savings.

- Safe Driver Discounts: Maintaining a clean driving record over an extended period can lead to reduced premiums.

- Loyalty Discounts: Staying with the same insurance provider for an extended period may result in loyalty discounts.

- Good Student Discounts: For younger drivers, maintaining good grades in school can lead to lower insurance rates.

- Safety Feature Discounts: Having advanced safety features in your vehicle, such as anti-lock brakes or lane departure warning systems, may qualify you for discounts.

Real-World Examples and Comparative Analysis

To illustrate the impact of these factors on insurance rates, let's examine some real-world examples. Consider the following scenarios and the corresponding average insurance premiums:

| Scenario | Average Annual Premium |

|---|---|

| New Driver (Aged 18) with a Sports Car | $3,500 |

| Experienced Driver (Aged 35) with a Sedan | $1,200 |

| Senior Citizen (Aged 65) with a Hybrid SUV | $850 |

| Young Professional (Aged 28) with a Compact Car | $1,500 |

These examples highlight how factors such as age, vehicle type, and driving experience can significantly influence insurance costs. It's important to note that these averages are estimates and actual premiums can vary based on individual circumstances and the insurance provider.

Performance Analysis and Industry Insights

Understanding the average price for car insurance is not just about knowing the cost; it's about making informed choices to optimize your coverage and costs. Here are some key insights and strategies to consider:

Compare Quotes

Obtaining quotes from multiple insurance providers is essential. Insurance rates can vary significantly between companies, so comparing quotes allows you to identify the best value for your specific circumstances.

Review Coverage Levels

Regularly review your coverage levels and adjust them as needed. As your life circumstances change, your insurance needs may evolve as well. Ensure that your coverage aligns with your current requirements to avoid paying for unnecessary coverage or leaving yourself underinsured.

Explore Discount Opportunities

Take advantage of any applicable discounts. From safe driver discounts to bundling discounts, there are numerous opportunities to reduce your insurance costs. Don't hesitate to inquire about potential savings with your insurance provider.

Consider Usage-Based Insurance

Usage-based insurance programs, also known as pay-as-you-drive insurance, offer a unique approach to pricing. These programs use telematics devices to track your driving behavior, such as mileage, braking habits, and time of day driven. By rewarding safe driving habits, these programs can result in lower insurance premiums for responsible drivers.

Build a Strong Driving Record

Maintaining a clean driving record is crucial. Avoid accidents and traffic violations, as these can significantly increase your insurance premiums. Additionally, consider taking defensive driving courses, as some insurance providers offer discounts for completing such courses.

Future Implications and Industry Trends

The car insurance industry is continually evolving, and several trends are shaping the future of insurance pricing and coverage:

Advanced Telematics and Data Analytics

The use of advanced telematics and data analytics is becoming increasingly prevalent. Insurance providers are leveraging real-time data to gain deeper insights into driving behavior, enabling more precise risk assessment and personalized insurance offerings.

Autonomous and Connected Vehicles

The rise of autonomous and connected vehicles is set to revolutionize the insurance industry. As these vehicles become more prevalent, insurance providers will need to adapt their coverage and pricing models to account for the reduced risk associated with self-driving capabilities and advanced safety features.

InsureTech Innovations

InsureTech startups are disrupting the traditional insurance landscape with innovative solutions. These companies are leveraging technology to streamline processes, enhance customer experiences, and offer more personalized insurance products. As InsureTech continues to evolve, we can expect further disruption and transformation in the industry.

Sustainable Mobility Solutions

The shift towards sustainable mobility solutions, such as electric vehicles and car-sharing services, is also influencing insurance trends. Insurance providers are adapting their coverage to accommodate these new mobility options, offering specialized insurance packages for electric vehicles and shared mobility platforms.

FAQ

What is the average price for car insurance in my state?

+The average price for car insurance can vary significantly by state due to differences in regulations, demographics, and driving conditions. It's best to obtain quotes from local insurance providers to get an accurate estimate for your specific location.

Can I lower my insurance premiums by switching providers?

+Absolutely! Insurance providers offer competitive rates to attract new customers. By shopping around and comparing quotes, you can often find more affordable coverage with a different provider, especially if your current provider has not offered you any discounts or loyalty benefits.

How can I get a more accurate quote for my car insurance?

+To obtain a more accurate quote, provide detailed and accurate information about your vehicle, driving history, and coverage preferences. Be transparent about any accidents or violations on your record, as failing to disclose such information can lead to issues with your insurance coverage in the future.

Are there any discounts available for students or young drivers?

+Yes, many insurance providers offer discounts for students and young drivers. These discounts can be based on factors such as good grades, completion of driver education courses, or having a parent or guardian with an existing policy. It's worth inquiring about these discounts when obtaining quotes.

Understanding the average price for car insurance is just the beginning. By familiarizing yourself with the factors that influence insurance rates and staying informed about industry trends, you can make more informed decisions to optimize your coverage and costs. Remember, the car insurance landscape is dynamic, and staying proactive can help you navigate it successfully.