Average Car Insurance Rates By State

Understanding car insurance rates is crucial for any driver, as it directly impacts your wallet and overall financial planning. The cost of car insurance can vary significantly depending on numerous factors, including your location. In the United States, each state has its own unique set of regulations and market dynamics that influence insurance premiums. This comprehensive guide will delve into the average car insurance rates by state, providing you with valuable insights and a better understanding of this essential aspect of vehicle ownership.

The Complex Landscape of Car Insurance Rates

When it comes to car insurance, no two states are exactly alike. Factors such as traffic density, accident rates, state-specific laws, and even weather conditions can significantly impact insurance premiums. Moreover, individual insurers may have varying policies and rates, making it essential to shop around and compare options.

Average Car Insurance Rates by State: A Detailed Breakdown

To provide an accurate representation of car insurance rates across the nation, we’ve analyzed data from leading insurance providers and industry reports. Here’s a detailed look at the average car insurance rates by state, along with some key insights:

1. California: A High-Cost State for Insurance

California is known for its dense population and bustling cities, which contribute to high traffic volumes and a greater risk of accidents. As a result, the average car insurance premium in the Golden State is $1,866 annually. However, it’s important to note that rates can vary significantly within the state, with urban areas typically experiencing higher premiums.

2. Texas: A Diverse Insurance Market

Texas boasts a diverse landscape, from bustling cities like Houston to more rural areas. This diversity is reflected in its car insurance rates, with an average annual premium of $1,423. The state’s large size and varying driving conditions can lead to different rates depending on your location.

| State | Average Annual Premium |

|---|---|

| California | $1,866 |

| Texas | $1,423 |

| New York | $1,349 |

| Florida | $1,329 |

| Pennsylvania | $1,187 |

| Illinois | $1,171 |

| Ohio | $1,122 |

| Michigan | $1,058 |

| New Jersey | $1,031 |

| Washington | $999 |

| ... | ... |

The table above provides a glimpse into the average annual car insurance premiums for various states. It's important to remember that these are averages, and your specific rate may differ based on your driving history, vehicle type, and other factors.

3. New York: A State with High Premiums

New York City’s bustling streets and heavy traffic contribute to the state’s high insurance rates. On average, New Yorkers pay $1,349 annually for car insurance. However, rates can vary widely, with urban areas typically facing higher premiums than rural regions.

4. Florida: A Sunny State with High Costs

While Florida may be known for its sunny beaches, it’s also a state with relatively high car insurance costs. The average annual premium in Florida is $1,329. This can be attributed to factors such as high accident rates and the state’s unique no-fault insurance laws.

Factors Influencing Car Insurance Rates

Beyond state-specific factors, several other elements play a role in determining your car insurance premium. Here’s a breakdown of some key influences:

1. Driving History

Your driving record is a significant factor in insurance rates. A clean driving history with no accidents or traffic violations can lead to lower premiums. On the other hand, a history of accidents or moving violations may result in higher rates.

2. Vehicle Type and Usage

The make, model, and age of your vehicle can impact your insurance rates. Sports cars and luxury vehicles often come with higher premiums due to their performance capabilities and higher repair costs. Additionally, how you use your vehicle (e.g., commuting vs. pleasure driving) can influence rates.

3. Demographics and Location

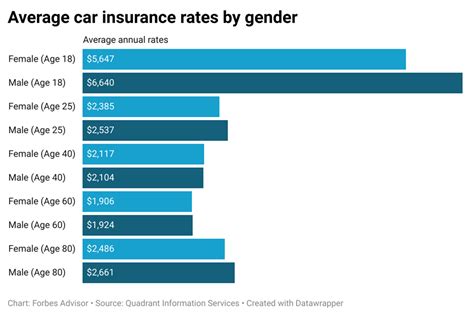

Your age, gender, and marital status can affect insurance rates. Younger drivers, particularly males, are often considered higher risk and may face higher premiums. Moreover, your specific location within a state can impact rates, as urban areas generally have higher premiums due to increased traffic and accident risks.

4. Insurance Coverage and Deductibles

The level of coverage you choose and your deductible amount can significantly impact your insurance premium. Higher coverage limits and lower deductibles generally result in higher premiums. It’s essential to strike a balance between coverage and cost to find the right fit for your needs.

Strategies to Lower Your Car Insurance Costs

If you’re looking to reduce your car insurance expenses, there are several strategies you can employ. Here are some effective approaches:

- Shop Around: As mentioned earlier, comparing quotes from multiple insurers is crucial. Online tools and insurance brokers can help you gather multiple quotes quickly and easily.

- Review Coverage: Regularly review your insurance policy to ensure you're not overpaying for coverage you don't need. Assess your risk tolerance and adjust coverage limits accordingly.

- Bundle Policies: Many insurance providers offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance.

- Safe Driving Habits: Maintain a clean driving record by practicing safe driving habits. Avoid accidents and traffic violations, as these can lead to higher premiums.

- Vehicle Safety Features: Installing safety features like anti-theft devices or advanced driver-assistance systems can reduce your insurance costs. These features often lead to lower risk profiles, resulting in lower premiums.

Future Trends in Car Insurance

The car insurance landscape is continually evolving, and several trends are shaping the industry. Here’s a glimpse into the future of car insurance:

1. Telematics and Usage-Based Insurance

Telematics technology allows insurers to track driving behavior in real time. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, uses telematics data to tailor insurance premiums to an individual’s driving habits. This trend is expected to gain momentum, offering more personalized and potentially lower premiums for safe drivers.

2. Connected Car Technology

The rise of connected car technology, where vehicles are equipped with internet connectivity and advanced sensors, is set to revolutionize car insurance. Insurers can leverage this data to offer more precise risk assessments and potentially lower premiums for drivers with safe driving behaviors.

3. Autonomous Vehicles and Insurance

The advent of autonomous vehicles is expected to significantly impact car insurance. As self-driving cars become more prevalent, the number of accidents may decrease, leading to lower insurance premiums. However, the transition period could be complex, with potential liability shifts and new insurance models.

4. Digital Transformation

The insurance industry is undergoing a digital transformation, with insurers investing in technology to streamline processes and enhance customer experiences. This includes online quote comparisons, digital claims processing, and personalized insurance offerings. Digital transformation is set to make car insurance more accessible and efficient.

Conclusion

Understanding car insurance rates by state is a crucial step in managing your finances as a driver. While rates can vary significantly, knowing the average premiums in your state and the factors influencing them can help you make informed decisions. By staying informed and adopting strategies to lower your insurance costs, you can navigate the complex world of car insurance with confidence.

How often should I review my car insurance policy?

+

It’s recommended to review your car insurance policy annually or whenever your circumstances change significantly. This ensures you have the right coverage and aren’t overpaying.

Can I get a discount on my car insurance if I have multiple vehicles insured with the same provider?

+

Yes, many insurance providers offer multi-vehicle discounts. By insuring multiple cars with the same company, you can often save on your overall premiums.

What is the average car insurance deductible, and how does it impact my premium?

+

The average car insurance deductible is around $500. Choosing a higher deductible can lower your premium, as you’ll pay more out of pocket before insurance coverage kicks in.