How To Purchase Trip Insurance

Travel insurance is an essential consideration for any trip, offering peace of mind and financial protection in case of unforeseen circumstances. This comprehensive guide will walk you through the process of purchasing trip insurance, covering everything from understanding your coverage options to making an informed decision.

Assessing Your Insurance Needs

Before purchasing trip insurance, it's crucial to assess your specific needs and the potential risks associated with your journey. Consider the following factors to tailor your insurance coverage accordingly:

Destination and Activities

Research the destination you're traveling to and the activities you plan to engage in. Some countries or regions may have higher health and safety risks, while certain adventure activities might require specialized insurance. For instance, if you're planning a skiing trip, you'll want insurance that covers sports-related injuries.

Travel Companions

If you're traveling with family or friends, their health and age can impact the type of insurance you choose. For example, if you're traveling with an elderly relative, you might need to prioritize insurance with extensive medical coverage.

Duration of Your Trip

The length of your trip is another crucial factor. Longer trips may require more comprehensive insurance, especially if you're planning to extend your stay unexpectedly. Consider the potential risks and challenges that might arise over an extended period.

Existing Health Conditions

Pre-existing medical conditions can significantly impact your insurance needs. Ensure that your travel insurance policy covers any ongoing health issues you have. Some policies may exclude coverage for pre-existing conditions, so it's essential to read the fine print and understand your options.

Travel Document and Baggage Protection

Losing travel documents or luggage can be a significant inconvenience and expense. Look for insurance policies that offer protection for these eventualities, including assistance with replacing documents and compensation for lost or damaged baggage.

| Consideration | Importance |

|---|---|

| Destination and Activities | High |

| Travel Companions | Medium |

| Trip Duration | Medium to High |

| Pre-existing Health Conditions | High |

| Travel Document and Baggage Protection | Medium |

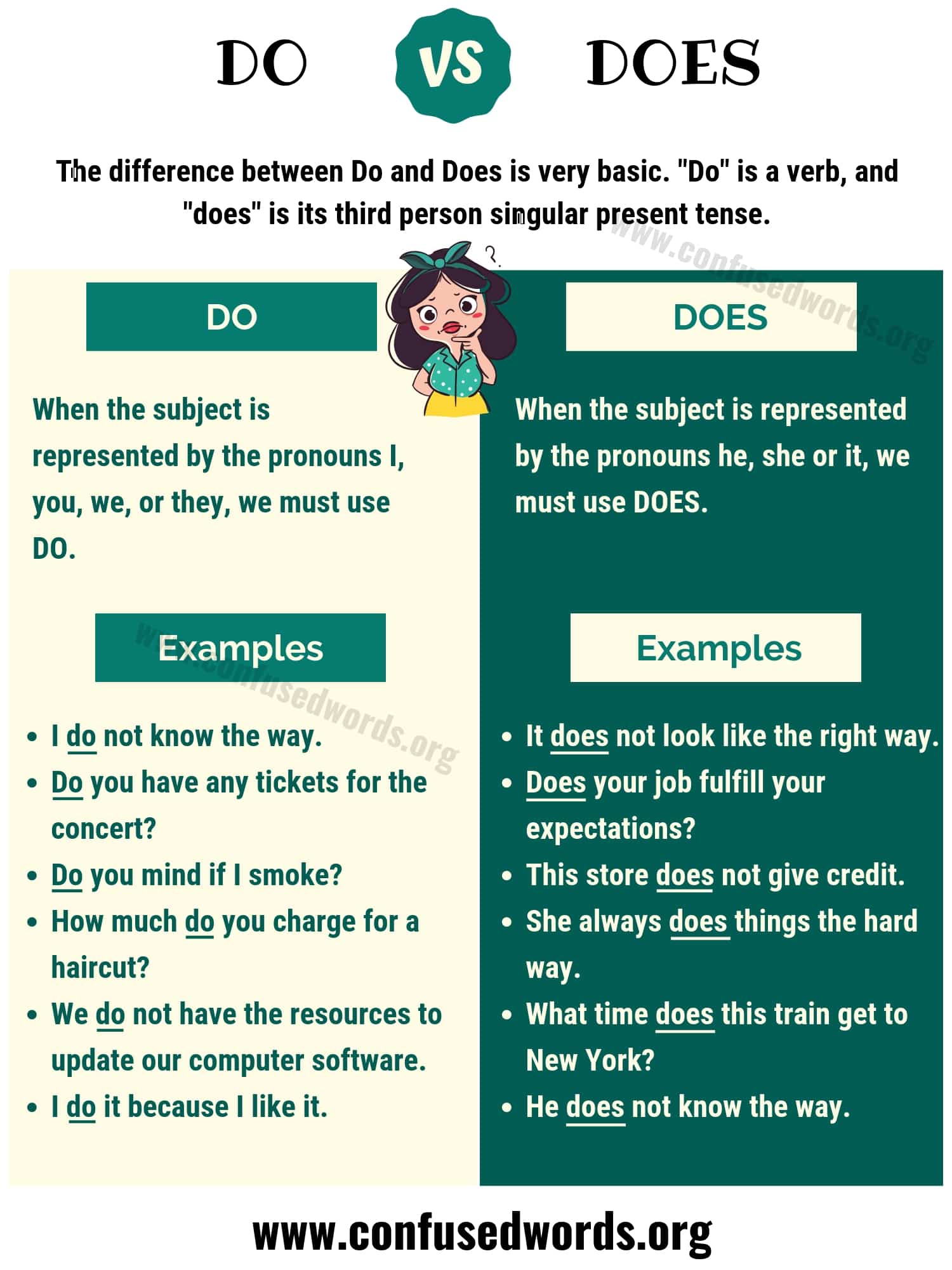

Types of Trip Insurance

Trip insurance comes in various forms, each catering to different needs. Understanding the different types available will help you make an informed decision:

Comprehensive Travel Insurance

This is the most extensive form of trip insurance, covering a wide range of potential issues. It typically includes medical and dental emergencies, trip cancellation or interruption, baggage loss or delay, and personal liability. Comprehensive insurance is ideal for travelers who want maximum protection.

Medical-Only Travel Insurance

As the name suggests, this type of insurance primarily focuses on covering medical emergencies during your trip. It's suitable for travelers who already have coverage for trip cancellation and baggage issues but want to ensure they're protected against unexpected health problems.

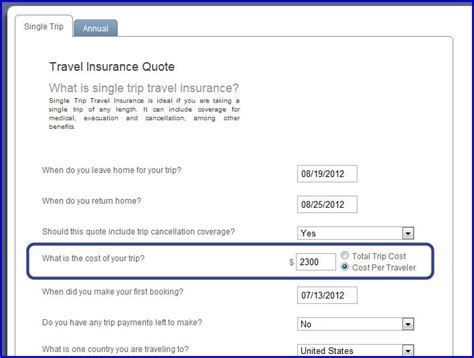

Single-Trip Insurance

As the name suggests, this policy covers a single trip, typically for a set duration. It's ideal for one-off vacations or business trips. Single-trip insurance can be customized to your specific needs, making it a flexible option.

Annual Multi-Trip Insurance

If you travel frequently, annual multi-trip insurance might be the most cost-effective option. It covers an unlimited number of trips within a year, up to a specified duration per trip. This type of insurance is especially useful for business travelers or those who take multiple vacations annually.

Cruise Insurance

For travelers embarking on a cruise, specialized cruise insurance offers coverage tailored to the unique risks of this type of travel. It often includes medical coverage, trip cancellation, and protection against missed ports or cabin confinement.

Comparing Insurance Providers

Once you've assessed your needs and understood the different types of trip insurance, it's time to compare providers. Look for reputable insurance companies with a solid track record of customer satisfaction and timely claim processing.

Key Considerations When Comparing Providers

- Financial Stability: Ensure the provider is financially stable and has the resources to pay out claims promptly.

- Coverage Options: Compare the scope of coverage offered by different providers to find the one that best matches your needs.

- Claim Process: Understand the claim process, including any requirements or exclusions. Look for providers with a straightforward and efficient claims process.

- Customer Service: Good customer service is essential, especially if you need assistance while traveling. Check online reviews and ratings to gauge customer satisfaction.

- Price: While price is an important factor, it shouldn't be the only consideration. Ensure you're getting adequate coverage for your money.

Purchasing Your Trip Insurance

With your research complete, you're ready to purchase your trip insurance. Here's a step-by-step guide to ensure a smooth process:

Step 1: Choose Your Provider

Based on your research, select the insurance provider that best meets your needs. Consider factors like coverage, price, and customer service when making your decision.

Step 2: Review the Policy

Before purchasing, carefully review the policy documents. Pay attention to the coverage limits, exclusions, and any specific terms and conditions. Ensure the policy aligns with your travel plans and needs.

Step 3: Purchase Online or Offline

Most insurance providers offer the option to purchase your policy online or through a travel agent. Online purchases often provide immediate coverage, while offline purchases may require a slight delay for processing.

Step 4: Receive Your Policy Documents

Once you've purchased your insurance, you'll receive your policy documents. Ensure you understand the terms and keep these documents in a safe place, easily accessible during your trip.

Using Your Trip Insurance

Now that you've purchased your trip insurance, it's important to understand how to use it effectively:

In Case of Emergency

If you find yourself in an emergency situation while traveling, contact your insurance provider immediately. They will guide you through the necessary steps and provide assistance. Keep emergency contact details easily accessible during your trip.

Filing a Claim

If you need to make a claim, follow the instructions provided by your insurance company. Typically, you'll need to provide documentation and evidence to support your claim. Ensure you understand the claim process and any deadlines for submitting your claim.

FAQs

Can I purchase trip insurance after my departure date?

+While some providers may offer limited coverage after departure, it's generally recommended to purchase insurance before your trip begins. This ensures you're covered from the moment you leave home.

What if I change my travel plans after purchasing insurance?

+If you need to change your travel plans, contact your insurance provider to understand how your coverage might be affected. Some policies may allow for adjustments, while others might have strict terms regarding changes.

How soon after purchasing insurance can I file a claim?

+Most insurance providers require a waiting period before you can file a claim. This period varies between providers and policies, so it's essential to review your policy documents.

By following this comprehensive guide, you’ll be well-equipped to navigate the world of trip insurance and make informed decisions to protect your travel experiences.