Find Me Cheap Auto Insurance

Finding affordable auto insurance is a top priority for many drivers, as it is an essential aspect of vehicle ownership. With the rising costs of insurance premiums, it's no wonder that individuals are actively seeking ways to reduce their expenses without compromising on coverage. This article aims to provide a comprehensive guide to help you find the most cost-effective auto insurance options available, ensuring you get the best value for your money.

Understanding Auto Insurance and Its Factors

Auto insurance is a contractual agreement between you and an insurance provider, where they agree to cover certain financial losses and liabilities arising from incidents involving your vehicle. The cost of this coverage, known as the premium, is influenced by a multitude of factors, each of which can significantly impact the overall price.

Key Factors Affecting Auto Insurance Rates

- Driver’s Age and Gender: Young drivers, especially males, often face higher premiums due to their statistically higher risk of accidents. As you age, your rates may decrease, with mature drivers enjoying more affordable options.

- Driving Record: A clean driving history is a significant factor in determining insurance rates. A single traffic violation or accident can lead to an increase in premiums, while a long history of safe driving can result in significant discounts.

- Vehicle Type and Usage: The make, model, and age of your vehicle play a role in insurance costs. Sports cars and luxury vehicles, for instance, are typically more expensive to insure. Additionally, the purpose of your vehicle’s use (commuting, business, pleasure) can also affect your rates.

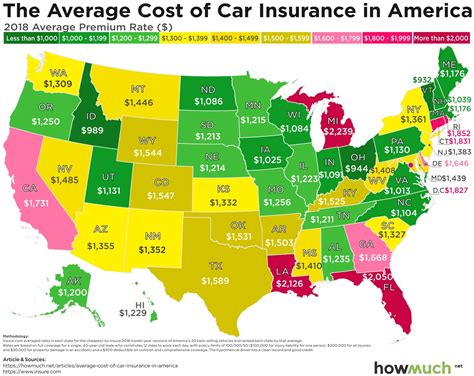

- Location: Insurance rates can vary significantly based on where you live. Urban areas often have higher premiums due to increased traffic and the potential for accidents and theft. Rural areas, on the other hand, may offer more affordable options.

- Coverage Type and Limits: The type of coverage you choose (liability, comprehensive, collision, etc.) and the limits of that coverage also affect your premium. Higher coverage limits generally mean higher costs.

- Insurance Company and Policy: Different insurance companies offer various policies with unique features and price points. Shopping around and comparing quotes is essential to finding the best deal.

Tips to Find Cheap Auto Insurance

Locating affordable auto insurance requires a combination of research, understanding of the market, and some clever strategies. Here are some expert tips to help you secure the best rates:

Shop Around and Compare Quotes

One of the simplest yet most effective ways to find cheap auto insurance is to compare quotes from multiple providers. Each insurance company uses its own formula to calculate rates, so the premiums can vary significantly between them. Online comparison tools can be especially useful for this task, as they allow you to quickly and easily obtain quotes from several insurers.

Consider Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. This is known as a “multi-policy discount” and can result in significant savings. If you’re in the market for other types of insurance, it’s worth exploring these bundling options to maximize your savings.

Explore Discounts

Insurance providers offer a variety of discounts that can reduce your premium. These may include safe driver discounts, good student discounts, discounts for low mileage, and more. Ask your insurance agent about the discounts available and ensure you’re taking advantage of all the ones that apply to you.

Adjust Your Coverage

While it’s essential to have adequate coverage, you may be able to save money by adjusting your policy. For instance, if you have an older vehicle, you might consider dropping collision or comprehensive coverage, as the cost of these coverages may outweigh the value of your car.

Maintain a Good Driving Record

A clean driving record is one of the best ways to keep your insurance premiums low. Avoid traffic violations and accidents, as these can lead to increased rates. Additionally, some insurance companies offer discounts for completing defensive driving courses, so consider enrolling in one if it’s available to you.

Consider Higher Deductibles

Opting for a higher deductible can reduce your insurance premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. While this means you’ll pay more if you need to make a claim, it can result in substantial savings on your monthly premiums.

Research Provider Reputation and Financial Stability

When choosing an insurance provider, it’s crucial to consider their reputation and financial stability. You want to ensure the company is reputable and has a track record of paying claims promptly. Check customer reviews and ratings, and consider the company’s financial health to avoid potential issues down the line.

Understanding Insurance Coverage and Claims

Understanding the coverage your auto insurance policy provides is essential to ensuring you have the protection you need. Different types of coverage offer different benefits, and knowing when and how to make a claim can impact your future premiums.

Types of Auto Insurance Coverage

- Liability Coverage: This is the most basic type of auto insurance and is typically required by law. It covers damages and injuries you cause to others in an accident. It does not cover your own vehicle or injuries.

- Collision Coverage: This coverage pays for damages to your vehicle if you’re in an accident, regardless of fault. It typically comes with a deductible, which you must pay before the insurance coverage kicks in.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, natural disasters, and animal collisions. It also includes coverage for damage caused by falling objects, such as tree branches.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re in an accident with a driver who either has no insurance or doesn’t have enough insurance to cover the damages.

- Personal Injury Protection (PIP): PIP covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. It’s a no-fault coverage, meaning it provides benefits regardless of liability.

- Medical Payments Coverage: Similar to PIP, medical payments coverage helps cover medical expenses for you and your passengers after an accident. However, it typically has a lower limit than PIP and may not cover as many expenses.

Making an Auto Insurance Claim

When you’re involved in an accident or experience a covered loss, you’ll need to make an insurance claim. Here’s a step-by-step guide to the claims process:

- Contact Your Insurance Company: As soon as possible after the incident, contact your insurance provider to report the claim. Most insurers have a 24/7 claims hotline for such situations.

- Provide Details: Be prepared to provide specific details about the incident, including the date, time, location, and any other involved parties (e.g., other drivers, witnesses). You'll also need to describe the damage and any injuries sustained.

- File a Police Report: In certain situations, such as hit-and-runs or accidents with significant property damage or injuries, you may be required to file a police report. Your insurance company may also request a copy of this report.

- Document the Scene: Take photographs of the accident scene, including any damage to vehicles, property, or the surrounding area. These can be valuable evidence for your claim.

- Cooperate with the Insurance Adjuster: An insurance adjuster will be assigned to your case to investigate and evaluate the claim. Cooperate fully with them, providing any additional information or documentation they request.

- Receive an Offer: Once the adjuster has completed their investigation, they will make an offer for the settlement of your claim. Review this offer carefully to ensure it covers all the costs associated with the incident.

- Accept or Dispute the Offer: If you agree with the offer, you can accept it, and the insurance company will process the payment. If you disagree, you can negotiate with the adjuster or, if necessary, seek legal advice.

Common Auto Insurance Scams and How to Avoid Them

Unfortunately, the auto insurance industry is not immune to scams and fraud. Being aware of these schemes and knowing how to avoid them can save you a lot of trouble and potential financial loss.

Common Auto Insurance Scams

- Phony Accidents: This scam involves criminals staging an accident with your vehicle and then claiming extensive damages and injuries. They may try to convince you to admit fault or even threaten you with legal action if you don’t cooperate.

- Puffin’ Scam: In this scam, a driver will pretend to be injured in an accident and then claim ongoing medical issues, such as back pain, which they attribute to the collision. They may even hire an actor to pretend to be a doctor or therapist to corroborate their story.

- Repair Shop Scams: Some repair shops will work with unscrupulous insurance adjusters to inflate the cost of repairs, then split the profits. As a result, you may end up paying more for your insurance, and the quality of the repairs may be compromised.

- Fake Insurance Agents: Be cautious of individuals claiming to be insurance agents who offer you incredibly low rates. They may take your money and disappear, leaving you without coverage.

Tips to Avoid Auto Insurance Scams

- Stay Vigilant: Always be cautious when dealing with unknown individuals or businesses, especially when they approach you unsolicited.

- Verify Credentials: Before engaging with any insurance agent or repair shop, verify their credentials and check for customer reviews and ratings.

- Don’t Admit Fault: Avoid admitting fault in an accident, even if you believe you may be partially responsible. Let the insurance companies and law enforcement determine liability.

- Document Everything: Take detailed notes of all interactions related to your insurance, including conversations, emails, and text messages. Keep records of all documents and photographs related to the incident.

- Work with Reputable Companies: Choose well-known and reputable insurance providers and repair shops. Ask for referrals from trusted sources, such as friends or family.

- Report Suspicious Activity: If you suspect you’re being scammed or have been a victim of insurance fraud, report it to your state’s insurance department and the National Insurance Crime Bureau (NICB)

Future Trends in Auto Insurance

The auto insurance industry is constantly evolving, with new technologies and innovations shaping the way insurance is priced and delivered. Understanding these trends can help you stay ahead of the curve and potentially save money in the long run.

Emerging Trends in Auto Insurance

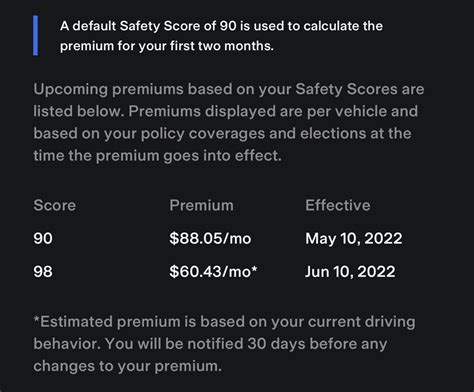

- Telematics and Usage-Based Insurance: Telematics devices installed in vehicles can track driving behavior, such as speed, braking, and mileage. This data is used to offer personalized insurance rates based on actual driving habits. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, can result in significant savings for safe drivers.

- Artificial Intelligence and Machine Learning: AI and machine learning are being used to analyze vast amounts of data, including driving behavior, weather conditions, and traffic patterns, to predict and prevent accidents. This technology can help insurance companies offer more accurate and personalized coverage, potentially leading to lower premiums for safer drivers.

- Connected Car Technology: As more vehicles become connected to the internet, insurance companies can leverage this data to offer new types of coverage. For instance, they can provide real-time alerts for potential hazards or offer discounts for using certain safety features.

- Blockchain Technology: Blockchain, the technology behind cryptocurrencies like Bitcoin, is being explored for its potential to enhance security and transparency in the insurance industry. It can be used to create an immutable record of insurance policies, claims, and payments, reducing the risk of fraud and speeding up the claims process.

- Self-Driving Cars: The advent of self-driving cars is expected to significantly reduce the number of accidents, leading to lower insurance premiums over time. However, the transition period may see an increase in premiums as insurers adjust to the new technology and its potential risks.

Conclusion

Finding cheap auto insurance requires a combination of knowledge, strategy, and a bit of shopping around. By understanding the factors that influence insurance rates, exploring discounts, and utilizing the latest technologies, you can secure the best value for your money. Remember, while saving money is important, it’s equally crucial to ensure you have adequate coverage to protect yourself and your vehicle in the event of an accident or other covered loss.

How often should I shop around for auto insurance quotes?

+It’s recommended to review your insurance coverage and shop around for quotes at least once a year. This allows you to stay informed about the market and ensure you’re still getting the best rates available.

Can I switch insurance providers mid-policy term?

+Yes, you can typically switch insurance providers at any time. However, be aware that you may incur a fee for canceling your existing policy early, and you may need to pay a deposit for your new policy.

What is the difference between liability and full coverage auto insurance?

+Liability insurance covers damages and injuries you cause to others in an accident. Full coverage, on the other hand, includes liability coverage as well as collision and comprehensive coverage, which protect your vehicle against a wide range of damages and incidents.