Insurance With State Farm

In the vast landscape of insurance providers, State Farm stands as a prominent player, offering a comprehensive range of insurance services. With a rich history spanning decades, State Farm has become a trusted name in the industry, catering to the diverse needs of individuals, families, and businesses across the United States. This article delves into the world of State Farm insurance, exploring its offerings, expertise, and the unique value it brings to its policyholders.

State Farm: A Legacy of Insurance Excellence

State Farm’s journey began in 1922 when its founder, George J. Mecherle, recognized the need for affordable auto insurance for farmers and rural residents. From these humble beginnings, State Farm has grown into one of the largest insurance providers in the United States, offering a wide array of insurance products and financial services.

Today, State Farm's presence is felt in every state, with a network of over 19,000 agents and countless satisfied customers. Its commitment to providing personalized service and tailored insurance solutions has earned it a reputation for excellence and customer satisfaction.

The State Farm Insurance Portfolio: A Comprehensive Overview

State Farm’s insurance portfolio is extensive, covering virtually every aspect of modern life. Here’s a glimpse into the key areas where State Farm shines:

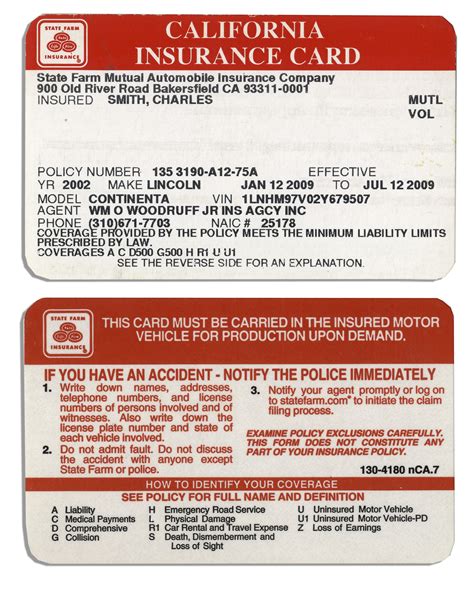

Auto Insurance: Safeguarding Your Vehicle

State Farm’s auto insurance policies are designed to offer comprehensive protection for car owners. With customizable coverage options, policyholders can choose the level of protection that suits their needs, whether it’s liability coverage, collision coverage, comprehensive coverage, or additional add-ons like rental car reimbursement and roadside assistance.

State Farm's auto insurance policies also come with valuable perks, such as accident forgiveness, which helps maintain your premium rates after a minor accident. Their claims process is streamlined and efficient, ensuring prompt and fair settlements.

| Policy Type | Coverage Highlights |

|---|---|

| Liability Coverage | Covers damages to others' property and injuries caused by the policyholder. |

| Collision Coverage | Pays for repairs or replacement of the insured vehicle after an accident. |

| Comprehensive Coverage | Protects against non-collision incidents like theft, vandalism, and natural disasters. |

Home Insurance: Protecting Your Sanctuary

State Farm’s home insurance policies provide peace of mind to homeowners and renters alike. Their comprehensive coverage includes protection against a wide range of perils, including fire, theft, vandalism, and natural disasters. Policyholders can customize their coverage to include additional features like personal property coverage, liability protection, and even coverage for unique items like jewelry or artwork.

State Farm's home insurance policies also offer valuable add-ons, such as identity restoration coverage, which provides assistance in the event of identity theft. Their claims process is renowned for its efficiency, with dedicated claims specialists ensuring a smooth and stress-free experience.

| Policy Type | Coverage Highlights |

|---|---|

| Dwelling Coverage | Covers the physical structure of the home. |

| Personal Property Coverage | Protects the contents of the home, including furniture, electronics, and clothing. |

| Liability Coverage | Provides protection against lawsuits arising from accidents on the insured property. |

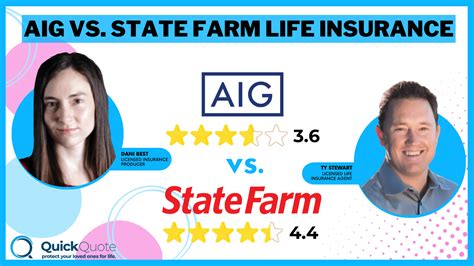

Life Insurance: Securing Your Legacy

State Farm offers a range of life insurance policies to help individuals and families protect their loved ones’ financial well-being. Their term life insurance policies provide coverage for a specified period, offering an affordable option for those seeking temporary protection. On the other hand, their permanent life insurance policies, such as whole life and universal life, offer lifelong coverage and additional benefits like cash value accumulation.

State Farm's life insurance policies are designed to meet diverse needs, whether it's covering funeral expenses, providing income replacement, or funding a child's education. Their experienced agents guide policyholders through the process, ensuring they choose the right coverage and understand the benefits.

| Policy Type | Coverage Highlights |

|---|---|

| Term Life Insurance | Offers coverage for a specified term, typically 10-30 years. |

| Whole Life Insurance | Provides lifelong coverage with cash value accumulation. |

| Universal Life Insurance | Offers flexible premiums and coverage amounts, with potential cash value growth. |

Health Insurance: Prioritizing Well-Being

State Farm understands the importance of health insurance in today’s world. Their health insurance plans are designed to offer comprehensive medical coverage, ensuring policyholders have access to quality healthcare when they need it most. From preventive care to specialized treatments, State Farm’s health insurance policies cover a wide range of medical expenses.

State Farm's health insurance plans often include additional benefits like prescription drug coverage, vision and dental care, and even wellness programs to encourage a healthy lifestyle. Their network of healthcare providers is extensive, ensuring policyholders have convenient access to quality care.

| Policy Type | Coverage Highlights |

|---|---|

| Health Maintenance Organization (HMO) | Covers a network of healthcare providers, typically requiring referrals for specialist care. |

| Preferred Provider Organization (PPO) | Offers more flexibility in choosing healthcare providers, with lower out-of-pocket costs within the network. |

| High Deductible Health Plan (HDHP) | Features higher deductibles and lower premiums, often paired with a Health Savings Account (HSA) for tax-advantaged savings. |

Business Insurance: Shielding Your Enterprise

State Farm recognizes the unique risks faced by businesses, and their business insurance policies are tailored to meet these challenges. From small startups to established corporations, State Farm offers a range of coverage options to protect businesses against property damage, liability claims, and interruptions in operations.

Their business insurance policies can be customized to include coverage for specific industries, such as retail, manufacturing, or professional services. State Farm's business insurance experts work closely with business owners to assess their risks and design a comprehensive insurance strategy.

| Policy Type | Coverage Highlights |

|---|---|

| General Liability Insurance | Protects against claims arising from property damage or bodily injury caused by the business. |

| Property Insurance | Covers physical damage to the business's property, including buildings and equipment. |

| Business Interruption Insurance | Provides coverage for lost income and additional expenses during periods when the business is unable to operate due to a covered event. |

The State Farm Advantage: Going Beyond Insurance

State Farm’s commitment to its policyholders extends beyond providing insurance coverage. Here’s a look at some of the unique advantages that set State Farm apart:

Personalized Service and Local Presence

State Farm’s network of local agents is a cornerstone of its success. These agents are deeply rooted in their communities, providing personalized service and expert advice. Policyholders can rely on their State Farm agent to guide them through the insurance process, answer questions, and address concerns.

The local presence of State Farm agents ensures that policyholders have a dedicated point of contact who understands their unique needs and can provide tailored solutions. This level of personalized service is a hallmark of State Farm's commitment to its customers.

Innovative Technology and Digital Solutions

State Farm embraces technology to enhance the insurance experience for its policyholders. Their digital platforms and mobile apps offer convenient access to policy information, claims management, and other self-service options. Policyholders can manage their policies, make payments, and even file claims from the comfort of their homes.

State Farm's innovative use of technology extends to its claims process, with tools like the Drive Safe app, which tracks driving behavior to offer discounts on auto insurance premiums. These digital solutions streamline the insurance journey, making it more efficient and customer-friendly.

Community Engagement and Philanthropy

State Farm is deeply committed to the communities it serves. Through various initiatives and partnerships, State Farm actively contributes to community development and charitable causes. Their philanthropic efforts focus on education, youth empowerment, disaster relief, and support for military families.

State Farm's community engagement extends beyond financial contributions. They encourage and support their employees and agents to volunteer and give back to their communities, fostering a culture of social responsibility.

Conclusion: Trusting State Farm for Your Insurance Needs

State Farm’s legacy of insurance excellence is built on a foundation of personalized service, comprehensive coverage, and a deep commitment to its policyholders. With a diverse range of insurance products and a network of dedicated agents, State Farm offers peace of mind and financial protection to individuals, families, and businesses across the United States.

Whether it's auto, home, life, health, or business insurance, State Farm's expertise and customer-centric approach make it a trusted partner in safeguarding what matters most. By choosing State Farm, policyholders gain not just insurance coverage but also the assurance of a company that understands their unique needs and is dedicated to their well-being.

How do I find a State Farm agent in my area?

+To locate a State Farm agent near you, you can use their online agent locator tool. Simply visit the State Farm website, navigate to the “Find an Agent” section, and enter your zip code or city and state. The tool will provide a list of nearby agents, along with their contact information and office locations. You can also call State Farm’s customer service number, and a representative can assist you in finding an agent in your area.

What are the benefits of having a local State Farm agent?

+Having a local State Farm agent offers several advantages. They provide personalized service, tailored to your specific needs and circumstances. They can meet with you in person to discuss your insurance requirements, answer questions, and offer expert advice. Local agents are familiar with the unique risks and regulations in your area, ensuring you receive the most appropriate coverage. Additionally, they are readily accessible, providing quick responses to inquiries and assisting with claims in a timely manner.

Can I manage my State Farm policies online?

+Absolutely! State Farm offers a user-friendly online platform and mobile app that allow policyholders to manage their insurance policies conveniently. You can access your policy information, make payments, view billing history, update personal details, and even file claims directly from your computer or mobile device. The online platform provides a secure and efficient way to manage your insurance needs, giving you control over your policies anytime, anywhere.