Liability Insurance For Company

In the complex world of business, safeguarding your enterprise against unforeseen events is paramount. Among the various types of insurance, liability insurance stands out as a critical component for any organization, regardless of size or industry. This article aims to delve deep into the intricacies of liability insurance, exploring its significance, coverage options, and the vital role it plays in protecting businesses from financial ruin. As we navigate through real-world examples and industry insights, you'll gain a comprehensive understanding of why liability insurance is not just an option but an essential safeguard for any company.

Understanding Liability Insurance: A Crucial Shield for Businesses

Liability insurance is a specialized form of coverage designed to protect businesses from financial losses arising from claims of negligence or other wrongful acts. These claims can range from personal injuries to property damage, and even advertising or intellectual property disputes. The primary objective of liability insurance is to provide a financial safety net, ensuring that businesses can withstand the potentially devastating financial consequences of such claims.

Imagine a scenario where a customer slips and falls on a wet floor in your retail store. The customer sustains injuries and decides to sue your company for negligence. Without adequate liability insurance, the financial burden of medical expenses, legal fees, and potential compensation could be overwhelming, potentially threatening the very existence of your business. This is where liability insurance steps in as a vital safeguard, covering these expenses and providing a crucial layer of protection.

The Scope of Liability Insurance: Tailoring Coverage to Business Needs

Liability insurance is not a one-size-fits-all solution. It offers a range of coverage options, allowing businesses to tailor their policies to meet specific needs. Here’s an overview of some key types of liability insurance and their applications:

General Liability Insurance

General liability insurance is the cornerstone of most business insurance portfolios. It provides broad coverage for various types of claims, including bodily injury, property damage, and personal and advertising injury. For instance, if a delivery driver for your catering business accidentally spills hot coffee on a client’s new laptop, general liability insurance would step in to cover the cost of the damaged laptop and any legal fees associated with the claim.

Product Liability Insurance

Product liability insurance is essential for businesses that manufacture, distribute, or sell goods. It protects against claims arising from defective products, such as injuries caused by faulty equipment or contaminated food products. In a real-world example, a toy manufacturer could face significant financial liability if a defective toy causes injury to a child. Product liability insurance would provide coverage for medical expenses, legal fees, and potential compensation.

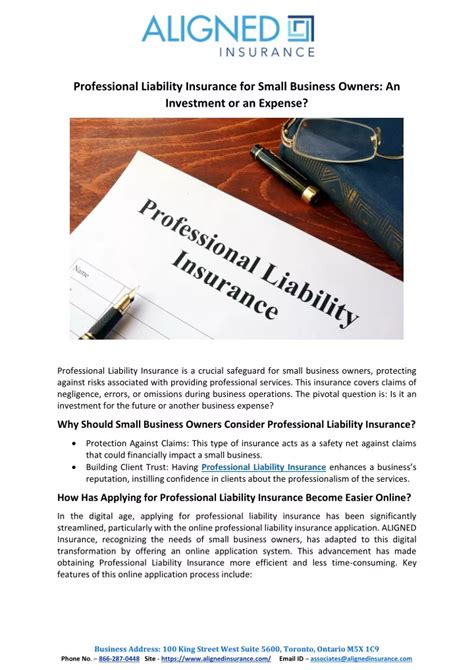

Professional Liability Insurance (Errors & Omissions Insurance)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is tailored for businesses that provide professional services. It covers claims arising from negligence, errors, or omissions in the provision of these services. For example, a software development company could face a lawsuit if a bug in their software causes financial losses for a client. Professional liability insurance would step in to cover the costs associated with such a claim.

Cyber Liability Insurance

In today’s digital age, cyber liability insurance has become increasingly important. It provides coverage for losses arising from cyber incidents, such as data breaches, hacking, or phishing attacks. With the rise in cybercrime, businesses of all sizes are vulnerable to these threats. Cyber liability insurance can cover the costs of investigating and resolving such incidents, as well as providing liability coverage for any resulting claims.

Real-World Examples: The Impact of Liability Insurance

Let’s explore some real-world scenarios where liability insurance has made a significant difference in protecting businesses:

Case Study: Restaurant Fire Incident

A popular restaurant in downtown New York City suffered a devastating fire, causing extensive damage to the building and injuring several patrons. The fire was determined to be the result of a faulty electrical wiring installation. Without liability insurance, the restaurant owner would have been personally liable for the property damage and medical expenses of the injured patrons. However, with comprehensive liability coverage in place, the insurance provider stepped in to cover these expenses, allowing the restaurant to recover and reopen.

Case Study: Construction Site Accident

A construction company was working on a high-rise building project when a worker fell from a scaffold, resulting in severe injuries. The worker sued the construction company for negligence. The company’s liability insurance policy covered the medical expenses, lost wages, and legal fees associated with the claim. This not only protected the company’s financial stability but also demonstrated their commitment to worker safety.

Case Study: Data Breach Incident

A small online retailer suffered a data breach, compromising the personal information of thousands of customers. The company was sued by affected individuals for negligence in protecting their data. Fortunately, the retailer had invested in cyber liability insurance, which covered the costs of investigating the breach, providing credit monitoring services to affected customers, and defending against the lawsuits.

The Process of Acquiring Liability Insurance: A Step-by-Step Guide

Obtaining the right liability insurance coverage for your business involves a series of careful steps. Here’s a guide to help you navigate this process:

- Assess Your Risks: Start by identifying the specific risks your business faces. Consider factors such as the nature of your operations, the products or services you offer, and the industries you work in. This assessment will help you determine the type and level of liability insurance coverage you need.

- Research Insurance Providers: Explore the market for reputable insurance companies that offer liability insurance tailored to your industry. Look for providers with a strong track record in claims handling and customer satisfaction.

- Compare Policies: Request quotes and carefully review the terms and conditions of different policies. Pay attention to coverage limits, deductibles, and any exclusions or limitations. Ensure that the policy aligns with your business's specific needs and provides adequate protection.

- Review Policy Details: Before finalizing your choice, thoroughly review the policy document. Understand the coverage provided, including any endorsements or amendments. Ensure that you have a clear understanding of what is and isn't covered.

- Purchase the Policy: Once you've selected the right policy, complete the necessary paperwork and make the required payments to secure your liability insurance coverage.

- Maintain and Review Regularly: Liability insurance is not a set-it-and-forget-it solution. Regularly review your policy to ensure it remains aligned with your business's evolving needs. As your business grows or changes, you may need to adjust your coverage accordingly.

The Future of Liability Insurance: Evolving Trends and Innovations

The world of liability insurance is continuously evolving to keep pace with changing business landscapes and emerging risks. Here are some trends and innovations shaping the future of liability insurance:

Digitalization and Automation

The insurance industry is embracing digitalization and automation to streamline processes and enhance efficiency. From online policy management to automated claims processing, these advancements are making liability insurance more accessible and user-friendly for businesses.

Data-Driven Risk Assessment

With the proliferation of data and advanced analytics, insurance providers are leveraging data-driven risk assessment models. These models help identify potential risks and tailor coverage more precisely to individual businesses, ensuring that policies are both comprehensive and cost-effective.

Insurtech Innovations

Insurtech startups are disrupting the traditional insurance landscape with innovative solutions. From parametric insurance, which provides rapid payouts based on predefined triggers, to blockchain-based insurance platforms, these innovations are enhancing efficiency, transparency, and accessibility in the liability insurance market.

Focus on Preventative Measures

Insurance providers are increasingly recognizing the value of preventative measures in reducing liability risks. They are offering risk management services and resources to help businesses implement best practices and reduce the likelihood of incidents that could lead to claims.

Conclusion: Liability Insurance as a Strategic Business Investment

In a world where risks are ever-present, liability insurance stands as a strategic investment for businesses. It provides a crucial safety net, ensuring that companies can weather the storms of unforeseen claims and incidents. By understanding the various types of liability insurance, tailoring coverage to specific needs, and staying abreast of evolving trends, businesses can protect their financial stability and focus on growth and success.

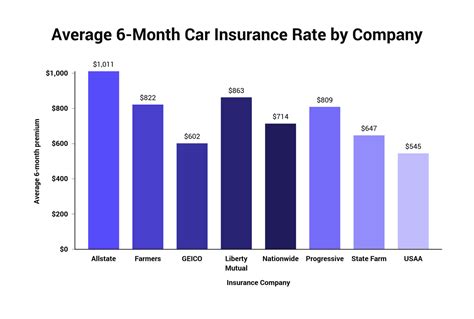

What is the average cost of liability insurance for a small business?

+The cost of liability insurance for small businesses can vary widely depending on factors such as industry, location, and the specific coverage needed. On average, small businesses can expect to pay anywhere from 300 to 1,000 per year for general liability insurance. However, the cost can be higher or lower based on the unique risks and circumstances of each business.

Can liability insurance cover legal fees associated with a lawsuit?

+Yes, liability insurance often includes coverage for legal defense costs and related expenses. This can be a crucial aspect of the policy, as legal fees can quickly escalate and become a significant financial burden for businesses.

Are there any industries that require specific types of liability insurance?

+Absolutely. Certain industries, such as healthcare, construction, and professional services, often have unique liability risks. As a result, they may require specialized liability insurance policies tailored to their specific needs. For example, medical malpractice insurance is a common requirement for healthcare providers.