Low Auto Insurance Rate

Obtaining a low auto insurance rate is a goal for many vehicle owners. With the right approach and understanding of the factors that influence insurance premiums, you can significantly reduce the cost of your coverage. In this comprehensive guide, we will delve into the strategies and insights that will help you navigate the auto insurance landscape and secure the most favorable rates.

Understanding Auto Insurance Rates

Auto insurance rates are determined by a multitude of factors, each carrying a different weight in the overall assessment of risk. Insurance companies use these factors to calculate the probability of an individual being involved in an accident or filing a claim. By understanding these variables, you can make informed decisions to lower your insurance costs.

Factors Influencing Auto Insurance Rates

The insurance landscape is complex, and rates are influenced by a combination of personal, vehicular, and environmental factors. Let’s break down some of the key considerations:

- Driver Profile: Your age, gender, driving record, and years of experience all play a role. Younger drivers, especially males, often face higher premiums due to statistical trends showing increased risk. A clean driving record with no accidents or violations can significantly lower your rates.

- Vehicle Characteristics: The make, model, and year of your vehicle impact insurance costs. Safer, more fuel-efficient vehicles generally result in lower premiums. Additionally, the purpose of the vehicle (personal or business use) and its storage location (garage or driveway) can affect rates.

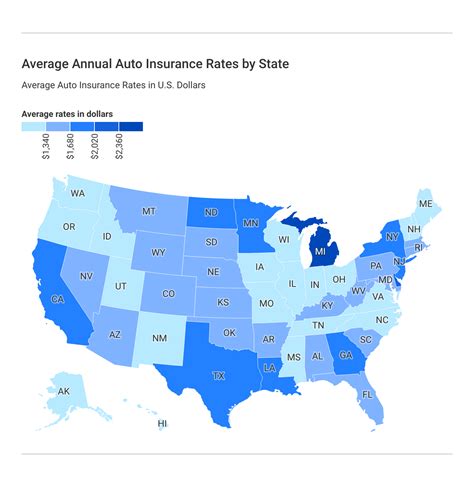

- Location and Usage: Where you live and how you use your vehicle matters. Urban areas often have higher rates due to increased traffic and accident risks. Commuting long distances or using your vehicle for business purposes can also impact your premium.

- Coverage and Deductibles: The level of coverage you choose and the associated deductibles are crucial. Higher coverage limits and lower deductibles generally result in higher premiums, but they provide more financial protection in the event of an accident.

- Insurance History: Your history with insurance companies, including any gaps in coverage, can affect your rates. Maintaining continuous coverage demonstrates stability and may lead to better rates.

Strategies for Lowering Auto Insurance Rates

Now that we’ve explored the factors influencing auto insurance rates, let’s dive into the strategies you can employ to secure the most competitive premiums.

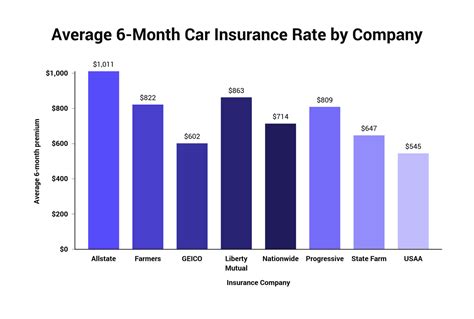

Shop Around and Compare

One of the most effective ways to lower your auto insurance rate is to compare quotes from multiple providers. Insurance companies use different rating systems, so the premium you receive from one may be significantly different from another. Use online comparison tools or contact insurance agents directly to gather quotes. Ensure you’re comparing apples to apples by requesting quotes for the same coverage levels.

Bundle Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who consolidate their coverage. By bundling, you not only save on premiums but also streamline your insurance management.

Improve Your Driving Record

Your driving record is a significant factor in determining your insurance rates. A clean driving record with no accidents or traffic violations is ideal. If you have a less-than-perfect record, consider taking defensive driving courses or driver improvement programs. These courses can help you become a safer driver and may even lead to reduced premiums.

Choose a Safer Vehicle

When selecting a vehicle, consider models that are known for their safety features and low accident rates. Insurance companies often offer discounts for vehicles equipped with advanced safety technologies, such as anti-lock brakes, electronic stability control, and collision avoidance systems. Additionally, vehicles with lower theft rates may also result in reduced premiums.

Increase Your Deductible

While it may seem counterintuitive, increasing your deductible can lower your insurance premiums. By agreeing to pay a higher amount out of pocket in the event of an accident, you reduce the financial risk for the insurance company. This reduction in risk can lead to lower premiums. However, ensure you can afford the increased deductible in the event of a claim.

Take Advantage of Discounts

Insurance companies offer a variety of discounts to policyholders. Common discounts include safe driver discounts, good student discounts, senior citizen discounts, and loyalty discounts. Some companies also offer discounts for certain occupations or professional affiliations. Be sure to inquire about all applicable discounts when obtaining quotes.

Maintain Continuous Coverage

Gap periods in your insurance coverage can negatively impact your rates. Insurance companies view continuous coverage as a sign of stability and responsibility. If you switch insurance providers, ensure there is no lapse in coverage. Maintaining a consistent insurance history can lead to more favorable rates.

Review Your Coverage Regularly

Your insurance needs may change over time. Review your coverage annually or whenever you experience significant life events, such as getting married, having children, or purchasing a new vehicle. Regularly assessing your coverage ensures you’re not overpaying for unnecessary features or underinsured for your current needs.

Utilize Technology for Discounts

Many insurance companies now offer usage-based insurance programs, also known as telematics. These programs use a device or smartphone app to monitor your driving habits, such as acceleration, braking, and mileage. Safe driving behaviors can lead to substantial discounts. However, be aware that these programs may also track and report negative driving behaviors, potentially resulting in increased premiums.

| Insurance Company | Discounts Offered |

|---|---|

| Company A | Safe Driver, Good Student, Senior Citizen, Loyalty |

| Company B | Safe Driver, New Car, Multi-Policy, Occupation |

| Company C | Safe Driver, Telematics, Pay-in-Full, Professional Affiliation |

Future Implications and Industry Trends

The auto insurance industry is continually evolving, influenced by technological advancements, changing regulations, and shifting consumer preferences. Here’s a glimpse into the future of auto insurance and its potential impact on rates.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles is expected to revolutionize the auto insurance industry. With self-driving cars, the traditional factors influencing insurance rates, such as driver experience and record, may become less relevant. Insurance companies may shift their focus to vehicle-specific risks, such as software glitches or hardware failures. This shift could lead to new pricing models and potentially lower rates for autonomous vehicle owners.

Telematics and Usage-Based Insurance

Usage-based insurance, or telematics, is gaining traction as a fairer way to assess insurance premiums. This technology provides real-time data on driving behaviors, allowing insurance companies to offer more accurate and personalized rates. While this may result in higher premiums for risky drivers, it can also lead to significant savings for safe drivers. The widespread adoption of telematics could reshape the insurance landscape and encourage safer driving practices.

Blockchain and Smart Contracts

Blockchain technology is poised to disrupt the insurance industry by introducing smart contracts and decentralized systems. Smart contracts can automate various insurance processes, including claims handling and policy management. This automation could lead to reduced administrative costs for insurance companies, potentially resulting in lower premiums for policyholders. Additionally, blockchain’s transparency and immutability can enhance trust and efficiency in the insurance ecosystem.

Regulatory Changes and Industry Competition

Regulatory changes and increased competition among insurance providers can also influence future insurance rates. Governments and industry bodies may implement measures to promote fair pricing and competition, potentially leading to more affordable insurance options. However, it’s important to note that regulatory interventions can also introduce complexities and additional costs, which may be passed on to consumers.

Consumer Empowerment and Education

With the proliferation of online resources and comparison tools, consumers are becoming more educated and empowered in their insurance choices. This shift towards informed decision-making can drive competition among insurance providers, leading to more transparent pricing and better value for consumers. Additionally, consumer advocacy groups and regulatory bodies can play a crucial role in ensuring fair practices and protecting consumer rights.

What is the average auto insurance rate in the United States?

+The average auto insurance rate in the U.S. varies by state and can range from 500 to 1,500 annually. However, this is just an estimate, and your actual rate will depend on numerous factors specific to your situation.

How often should I review my auto insurance policy?

+It’s recommended to review your auto insurance policy annually or whenever you experience significant life changes, such as buying a new car, getting married, or moving to a different location. Regular reviews ensure your coverage remains adequate and that you’re not overpaying for unnecessary features.

Can I negotiate my auto insurance rates?

+While auto insurance rates are largely determined by standardized algorithms, you can still negotiate with your insurance provider. Discuss your specific circumstances, such as a clean driving record or loyalty to the company, and inquire about any applicable discounts. Building a relationship with your insurance agent can also lead to more favorable rates over time.