Personal Health Insurance Coverage

In today's fast-paced and often unpredictable world, ensuring personal health and financial well-being has become a top priority for individuals and families. Personal health insurance coverage stands as a crucial safeguard, offering peace of mind and comprehensive protection against the unforeseen expenses and challenges that life can present. This article delves into the multifaceted realm of personal health insurance, exploring its significance, intricacies, and the transformative impact it can have on individuals' lives.

Understanding Personal Health Insurance: A Comprehensive Overview

Personal health insurance, also known as private health insurance or medical insurance, is a contract between an individual and an insurance provider. This contract outlines the terms and conditions under which the insurer agrees to provide financial coverage for various medical expenses and services. It acts as a vital safety net, ensuring that individuals can access necessary healthcare services without incurring overwhelming financial burdens.

The concept of personal health insurance has evolved significantly over the years, adapting to the changing healthcare landscape and the diverse needs of individuals. Modern personal health insurance plans offer a wide range of coverage options, catering to different lifestyles, ages, and health conditions. From routine check-ups and preventive care to specialized treatments and hospital stays, these plans aim to provide holistic protection.

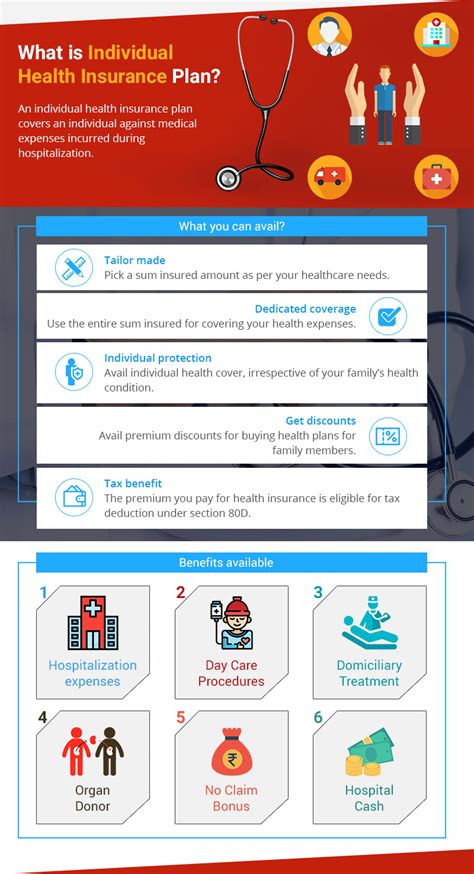

Key Features of Personal Health Insurance Plans

Personal health insurance plans typically include a range of essential benefits, such as:

- Hospitalization Coverage: Financial protection for expenses incurred during hospital stays, including room and board, surgical procedures, and medical treatments.

- Doctor Visits and Outpatient Services: Coverage for consultations with specialists, diagnostic tests, and outpatient procedures.

- Prescription Medications: Assistance with the cost of prescribed medications, ensuring individuals have access to necessary treatments.

- Preventive Care: Encouraging proactive health management through coverage for vaccinations, health screenings, and wellness programs.

- Maternity and Newborn Care: Support for expectant mothers and newborns, covering prenatal care, delivery expenses, and postnatal check-ups.

- Mental Health Services: Coverage for mental health conditions, including therapy sessions and counseling.

- Dental and Vision Care: Additional coverage options for dental procedures, eye examinations, and optical aids.

These features demonstrate the comprehensive nature of personal health insurance, providing individuals with the reassurance that their health and well-being are protected from various angles.

The Impact of Personal Health Insurance: Real-Life Stories and Benefits

The significance of personal health insurance becomes truly evident when we examine its impact on individuals’ lives. Real-life stories highlight the transformative power of this coverage, illustrating how it can alleviate financial strain and provide access to crucial healthcare services.

Story 1: Overcoming a Major Health Challenge

Meet Sarah, a young professional who was diagnosed with a serious medical condition. Without personal health insurance, the financial burden of her treatment would have been overwhelming. However, her comprehensive insurance plan covered the cost of specialized procedures, medications, and ongoing care, allowing her to focus on her recovery without worrying about mounting bills.

Story 2: Peace of Mind for a Growing Family

John and Emily, a young couple expecting their first child, chose to invest in personal health insurance. Their plan provided extensive maternity coverage, ensuring that they could afford the best prenatal care and delivery services. The peace of mind they gained allowed them to fully enjoy the journey of welcoming their newborn into the world.

Story 3: Managing Chronic Conditions

For individuals like Michael, who live with chronic health conditions, personal health insurance is a lifeline. His insurance plan covers the cost of regular medications, specialist consultations, and ongoing management of his condition. This financial support ensures that he can maintain his quality of life and continue working towards better health.

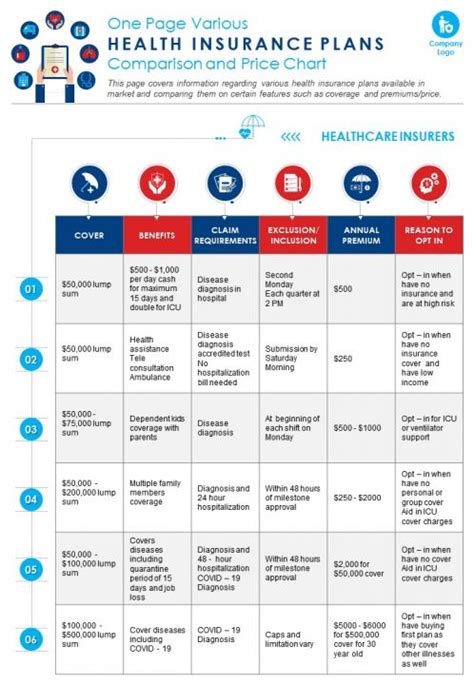

Choosing the Right Personal Health Insurance Plan

Selecting the most suitable personal health insurance plan requires careful consideration of various factors. Here are some key aspects to keep in mind during the decision-making process:

Assessing Your Needs

Begin by evaluating your current health status, medical history, and future healthcare needs. Consider any pre-existing conditions, medications you rely on, and the type of medical services you may require in the future. This assessment will help you choose a plan that aligns with your specific requirements.

Understanding Coverage Options

Research and compare different insurance providers and their offered plans. Look into the scope of coverage, including the types of medical services and treatments included. Pay attention to any exclusions or limitations, as these can significantly impact your experience with the plan.

Considering Cost and Deductibles

The cost of personal health insurance is a crucial factor. Evaluate the premiums, deductibles, and co-payments associated with different plans. Assess your financial situation and determine which plan offers the best balance between coverage and affordability.

Network of Healthcare Providers

Inquire about the network of healthcare providers associated with each insurance plan. Ensure that your preferred doctors, hospitals, and specialists are included in the network to avoid unexpected out-of-network charges.

Flexibility and Customization

Look for plans that offer flexibility and the ability to customize coverage. Some insurers provide add-on options or riders that allow you to enhance your coverage based on your specific needs, such as dental or vision care.

Comparing Provider Reputation and Customer Service

Research the reputation and reliability of the insurance providers you are considering. Read reviews and seek recommendations from trusted sources. Efficient customer service and prompt claim processing are essential for a positive insurance experience.

Maximizing Your Personal Health Insurance Benefits

Once you’ve selected your personal health insurance plan, it’s important to make the most of the benefits it offers. Here are some strategies to optimize your coverage:

Stay Informed

Familiarize yourself with the details of your insurance plan, including the covered services, exclusions, and any pre-authorization requirements. Regularly review the plan’s summary of benefits to ensure you understand your rights and responsibilities.

Utilize Preventive Care

Take advantage of the preventive care services covered by your plan. These services, such as annual check-ups, vaccinations, and health screenings, can help detect potential health issues early on and prevent more serious conditions from developing.

Choose In-Network Providers

When seeking medical care, prioritize in-network providers to avoid unexpected out-of-pocket expenses. Most insurance plans offer a directory of preferred providers, making it easier to find suitable healthcare professionals within your network.

Manage Your Medications

If you rely on prescription medications, work with your healthcare provider to ensure you are taking the most cost-effective and appropriate medications. Some insurance plans offer prescription drug programs that can help reduce the cost of essential medications.

Stay Organized with Claims and Billing

Keep accurate records of your medical claims and bills. Regularly review your insurance statements to ensure that your claims are processed correctly and that you are not being charged for services that should be covered by your plan.

Seek Support for Complex Conditions

If you are managing a complex or chronic health condition, consider utilizing the support services offered by your insurance provider. Many plans provide access to case managers or health advocates who can assist with coordinating care and navigating the healthcare system.

Future Trends and Innovations in Personal Health Insurance

The landscape of personal health insurance is continually evolving, driven by advancements in technology, changes in healthcare delivery, and shifting consumer expectations. Here are some key trends and innovations that are shaping the future of this industry:

Digital Health and Telemedicine

The integration of digital health technologies and telemedicine services is revolutionizing the way healthcare is delivered and accessed. Insurance providers are increasingly offering coverage for virtual consultations, remote monitoring, and digital health apps, providing greater convenience and accessibility for policyholders.

Value-Based Care Models

The shift towards value-based care models is influencing the design of personal health insurance plans. These models focus on outcomes and patient satisfaction, incentivizing insurers to offer coverage for preventive care, wellness programs, and integrated care models that aim to improve overall health and reduce the need for costly interventions.

Personalized Medicine and Genomics

Advancements in personalized medicine and genomics are enabling more tailored approaches to healthcare. Insurance providers are exploring ways to incorporate genetic testing and precision medicine into their coverage, offering customized treatment plans based on an individual’s unique genetic profile.

Consumer-Centric Insurance

There is a growing emphasis on consumer-centric insurance, with insurers striving to offer more personalized and flexible plans. This includes the development of customizable coverage options, transparent pricing, and improved customer engagement through digital platforms and mobile apps.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are being leveraged to enhance the efficiency and accuracy of insurance processes. Insurers are utilizing AI-powered tools for risk assessment, claim processing, and fraud detection, while also exploring the potential of predictive analytics to anticipate and manage healthcare needs more effectively.

Conclusion: Navigating the Complex World of Personal Health Insurance

Personal health insurance coverage is an essential component of financial planning and overall well-being. By understanding the intricacies of these plans, assessing your needs, and selecting the right coverage, you can navigate the complex healthcare landscape with confidence. With the right insurance in place, individuals can focus on their health, knowing that they have the support they need to access quality care and manage their financial responsibilities.

How do I choose the best personal health insurance plan for my needs?

+When selecting a personal health insurance plan, consider your current health status, medical history, and future healthcare needs. Evaluate the coverage options, including the types of medical services and treatments covered. Assess the cost, deductibles, and any exclusions. Research the network of healthcare providers and the reputation of the insurance provider. Seek plans that offer flexibility and customization to align with your specific requirements.

What are some common exclusions or limitations in personal health insurance plans?

+Common exclusions or limitations in personal health insurance plans may include pre-existing conditions, certain types of cosmetic procedures, alternative or complementary therapies, and specific diagnostic tests or treatments. It’s essential to carefully review the policy document to understand any exclusions or limitations that may apply to your specific plan.

How can I make the most of my personal health insurance benefits?

+To maximize your personal health insurance benefits, stay informed about your plan’s coverage and exclusions. Utilize preventive care services and choose in-network providers to avoid unexpected costs. Manage your medications and stay organized with claims and billing. If you have complex health needs, consider utilizing support services offered by your insurance provider to navigate the healthcare system more effectively.