Insurance Rates For Usps

When it comes to the United States Postal Service (USPS), the topic of insurance rates is of significant interest, especially for those regularly utilizing their services. USPS insurance offers an affordable and reliable way to protect valuable items during shipping, providing peace of mind to both senders and recipients. This article delves into the intricate details of USPS insurance rates, exploring the factors that influence them and offering valuable insights into this essential aspect of postal services.

Understanding USPS Insurance Rates

The USPS insurance program is designed to safeguard against potential losses or damages incurred during mail transit. This service is particularly crucial for businesses and individuals sending high-value items, as it provides financial protection and ensures the recipient receives their package intact. The insurance rates are structured to cover various mail classes and services, catering to diverse shipping needs.

One of the key features of USPS insurance is its flexibility. Customers can choose the level of coverage that best suits their needs, with options ranging from basic insurance to more comprehensive protection. This customization allows for precise cost management, ensuring that customers only pay for the coverage they require.

Factors Influencing USPS Insurance Rates

Several factors contribute to the determination of USPS insurance rates. These include:

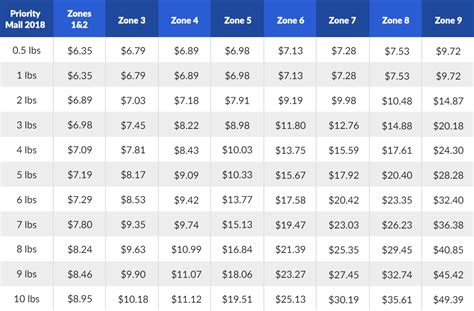

- Mail Class: Different mail classes, such as First-Class Mail, Priority Mail, and Priority Mail Express, have distinct insurance rates. For instance, First-Class Mail, being the most basic service, has a lower insurance rate compared to the expedited Priority Mail Express.

- Value of the Item: The insurance rate increases with the declared value of the item being shipped. This is a straightforward approach to ensure that the coverage matches the potential loss in case of damage or theft.

- Size and Weight: Larger and heavier packages often require more coverage, leading to higher insurance rates. This factor is particularly relevant for bulky items or those that require specialized handling.

- Additional Services: USPS offers various optional services, such as Signature Confirmation or Delivery Confirmation, which can influence the insurance rate. These services provide an added layer of security and tracking, which may impact the overall cost.

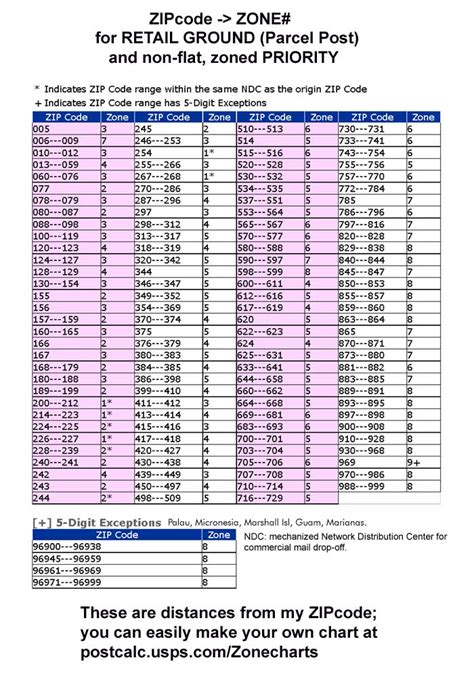

- Postal Zone: The distance the package travels can also affect the insurance rate. USPS may adjust rates based on the origin and destination zones, especially for international shipments.

To illustrate, consider a scenario where a customer wishes to ship a package via Priority Mail. If the package has a declared value of $500 and weighs 2 pounds, the insurance rate would be $4.90. However, if the same package were to be shipped via Priority Mail Express, the insurance rate would increase to $7.50, reflecting the expedited service and potential for higher risk.

| Mail Class | Declared Value | Weight | Insurance Rate |

|---|---|---|---|

| Priority Mail | $500 | 2 lbs | $4.90 |

| Priority Mail Express | $500 | 2 lbs | $7.50 |

The Process of Insuring Your Package with USPS

Insuring your package with USPS is a straightforward process. Here’s a step-by-step guide:

- Choose Your Mail Class: Decide on the mail class that best suits your shipping needs. Consider factors like speed, tracking options, and potential risks associated with your shipment.

- Declare the Value: Determine the value of your item and declare it accurately. This step is crucial as it forms the basis for insurance coverage and potential compensation in case of loss or damage.

- Select the Insurance Coverage: Based on your declared value, select the appropriate insurance coverage. USPS offers various coverage options, ranging from $0.01 to $5,000, allowing you to tailor the protection to your specific needs.

- Pay the Insurance Fee: The insurance fee is added to your shipping cost. This fee is based on the mail class, declared value, and other relevant factors. It's important to ensure you have the correct amount ready to avoid delays in shipping.

- Complete the Insurance Form: USPS requires you to complete an insurance form, either online or at the post office. This form details the contents of your package, the declared value, and other relevant information. It's crucial to provide accurate and honest information to ensure valid coverage.

- Secure Your Package: Properly package your item to minimize the risk of damage during transit. Use suitable packaging materials and ensure the package is securely sealed. This step is essential to prevent potential claims from being denied due to inadequate packaging.

- Ship Your Package: Finally, take your insured package to the post office or use the USPS shipping label to drop it off at a designated location. Remember to keep a copy of the insurance form and the shipping receipt for your records.

Tips for Maximizing Your USPS Insurance Experience

To ensure a smooth and beneficial insurance experience with USPS, consider the following tips:

- Accurate Declaration: Always declare the actual value of your item. Underestimating the value may result in insufficient coverage, while overestimating could lead to unnecessary expenses. Be honest and precise in your declaration.

- Choose the Right Coverage: Assess your needs and select the coverage that aligns with the value of your item. While it's tempting to opt for the highest coverage, it's not always necessary. Evaluate the potential risks and choose wisely.

- Package with Care: Invest in high-quality packaging materials to ensure your item is well-protected. Proper packaging reduces the chances of damage and minimizes the risk of insurance claims.

- Keep Records: Maintain a record of your insurance forms, shipping receipts, and any communications with USPS. These records can be crucial in case of a claim or dispute.

- Understand the Claim Process: Familiarize yourself with the USPS insurance claim process. This includes knowing the required documentation, the timeline for filing a claim, and the steps to follow if your claim is denied.

Conclusion

USPS insurance rates offer a balanced approach to protecting valuable shipments. By understanding the factors that influence these rates and following best practices, customers can make informed decisions to safeguard their packages effectively. Whether you’re a small business owner or an individual sender, the USPS insurance program provides an accessible and reliable solution for peace of mind during transit.

Can I insure international shipments with USPS?

+Yes, USPS offers insurance for international shipments. However, the coverage and rates may vary based on the destination country and the type of service used. It’s essential to check the specific guidelines and rates for international insurance before shipping.

What happens if my insured package is lost or damaged?

+If your insured package is lost or damaged, you can file a claim with USPS. The process involves providing proof of insurance, the declared value, and any other relevant documentation. USPS will then assess the claim and provide compensation based on the declared value and the terms of the insurance coverage.

Are there any limitations or exclusions to USPS insurance coverage?

+Yes, USPS insurance coverage has certain limitations and exclusions. These may include restrictions on certain types of items, such as live animals, perishable goods, or hazardous materials. Additionally, there may be limits on the maximum declared value for certain mail classes. It’s crucial to review the USPS insurance guidelines to understand these limitations and ensure your shipment is eligible for coverage.