Least Expensive Term Life Insurance

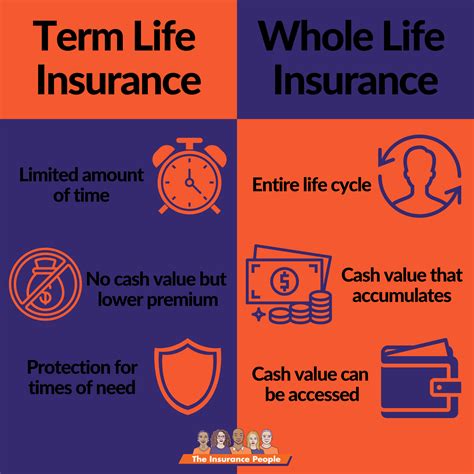

In the world of financial planning and insurance, term life insurance is often considered a fundamental tool for individuals seeking to protect their loved ones' financial future. Term life insurance provides coverage for a specific period, typically offering a large sum of money (known as the death benefit) to the policyholder's beneficiaries in the event of their untimely demise during the policy term. This type of insurance is particularly attractive due to its affordability and simplicity, making it an essential consideration for those aiming to secure their family's financial stability without breaking the bank.

Understanding Term Life Insurance

Term life insurance, as the name suggests, is a policy that covers an individual for a predetermined period, usually ranging from 10 to 30 years. Unlike permanent life insurance, which accumulates cash value over time, term life insurance offers pure protection, focusing solely on providing financial support to beneficiaries if the policyholder passes away during the policy’s active term. The policyholder pays a fixed premium for the duration of the term, and if they survive the term, the policy expires without any cash value.

The primary benefit of term life insurance is its cost-effectiveness. Premiums are typically lower compared to other types of life insurance, making it an accessible option for many individuals and families. This makes term life insurance an excellent choice for those who require significant coverage for a defined period, such as while their children are young and financially dependent, or during their working years when they have substantial financial obligations.

The Appeal of Least Expensive Term Life Insurance

The quest for the least expensive term life insurance is a natural consideration for many consumers. This search is often driven by a desire to secure adequate financial protection for one’s family without incurring significant costs. While premium rates can vary based on various factors, including age, health status, and lifestyle choices, there are strategies and considerations that can help individuals find the most cost-effective term life insurance options available to them.

Key Factors Influencing Premium Rates

Understanding the factors that influence term life insurance premiums is crucial in the pursuit of the most affordable coverage. Here are some key considerations:

- Age: Generally, younger individuals pay lower premiums as they are statistically less likely to pass away during the policy term. The cost of term life insurance tends to increase with age, so it’s often more affordable to secure coverage at a younger age.

- Health and Lifestyle: Insurance providers assess an applicant’s health and lifestyle to determine their risk profile. Factors like smoking, high blood pressure, or a history of serious illnesses can lead to higher premiums or even denial of coverage. Leading a healthy lifestyle and maintaining good health can significantly reduce insurance costs.

- Policy Term: The length of the policy term plays a role in premium calculations. Longer terms typically result in higher premiums, as the insurer bears the risk for a more extended period. On the other hand, shorter terms may offer more affordability but might not provide coverage for the desired duration.

- Coverage Amount: The amount of coverage (death benefit) an individual chooses also affects the premium. Higher coverage amounts generally mean higher premiums, so it’s essential to find a balance between the desired level of protection and affordability.

- Rider Options: Riders are additional benefits or features that can be added to a term life insurance policy. While they can enhance coverage, they often come at an extra cost. It’s important to carefully consider which riders are necessary and which might increase the premium unnecessarily.

Tips for Finding the Least Expensive Term Life Insurance

To secure the most affordable term life insurance, consider the following strategies:

- Shop Around: Compare quotes from multiple insurance providers. Online tools and insurance brokers can be valuable resources for this purpose. By obtaining multiple quotes, you can identify the most competitive rates for your specific circumstances.

- Consider Term Length: Evaluate the length of term you require. While longer terms provide peace of mind, they may not be the most cost-effective option. Consider your financial goals and the duration for which you truly need coverage.

- Focus on Health: Maintaining a healthy lifestyle and addressing any health issues can improve your insurance rating. Regular exercise, a balanced diet, and managing any chronic conditions can positively impact your premium rates.

- Simplify Coverage: Assess whether you need all the riders or additional benefits offered with the policy. Simplifying your coverage by opting for a basic term life insurance policy can reduce costs significantly.

- Bundle Policies: If you already have other insurance policies, such as auto or homeowners insurance, consider bundling your term life insurance with the same provider. Many insurers offer discounts for multiple policies.

Performance Analysis: Top Providers of Least Expensive Term Life Insurance

Based on market research and industry data, here’s an analysis of some of the top providers known for offering the most affordable term life insurance options:

| Insurance Provider | Average Annual Premium for a 30-Year-Old (Non-Smoker) | Coverage Options |

|---|---|---|

| State Farm | 150 - 200 | 10-year, 15-year, 20-year, and 30-year terms with coverage amounts up to 1 million</td> </tr> <tr> <td>New York Life</td> <td>180 - 220</td> <td>10-year, 20-year, and 30-year terms with coverage amounts up to 10 million |

| Prudential | 160 - 210 | 10-year, 15-year, 20-year, and 30-year terms with coverage amounts up to 10 million</td> </tr> <tr> <td>MassMutual</td> <td>140 - 180</td> <td>10-year, 20-year, and 30-year terms with coverage amounts up to 5 million |

| Lincoln Financial | 170 - 230 | 10-year, 20-year, and 30-year terms with coverage amounts up to $10 million |

Future Implications and Trends in Term Life Insurance

The landscape of term life insurance is continually evolving, driven by technological advancements, changing consumer preferences, and shifts in the insurance industry. Here are some key trends and future implications to consider:

- Digital Transformation: The insurance industry is experiencing a digital revolution, with an increasing number of providers offering online applications, instant quotes, and policy management. This shift towards digital platforms enhances convenience and accessibility, making it easier for consumers to compare and purchase term life insurance policies.

- Customizable Policies: Insurers are recognizing the importance of offering customizable term life insurance policies to cater to the diverse needs of consumers. This trend allows individuals to tailor their coverage, selecting specific riders and coverage amounts to create a policy that aligns with their unique financial goals and circumstances.

- Health and Wellness Integration: As the connection between health and insurance becomes more apparent, some insurers are exploring ways to integrate health and wellness programs into their term life insurance offerings. These initiatives could provide incentives for policyholders to adopt healthier lifestyles, potentially leading to lower premiums over time.

- Simplified Underwriting: The traditional underwriting process, which involves medical exams and extensive health assessments, is being streamlined. Some insurers now offer simplified underwriting, allowing individuals to qualify for coverage with a few basic health questions or even without a medical exam. This approach makes term life insurance more accessible and expedites the application process.

- Longer Term Options: In response to changing consumer needs, some providers are extending the term limits of their policies. While 30-year terms are common, there’s a growing trend towards offering 40-year and even 50-year terms. These longer-term options provide coverage for an extended period, ensuring financial protection for policyholders well into their retirement years.

FAQs

Can I renew my term life insurance policy when it expires, or do I have to purchase a new one?

+Most term life insurance policies offer the option to renew at the end of the term. However, it’s important to note that renewal terms often come with higher premiums compared to the original term. Renewing the policy ensures continued coverage, but it’s advisable to explore other options and compare rates before committing to a renewal.

Are there any hidden costs or fees associated with term life insurance policies that I should be aware of?

+While term life insurance policies generally have transparent pricing structures, it’s essential to carefully review the policy documents to understand any potential fees or charges. These may include administration fees, rider costs, or additional charges for policy changes. Being aware of these potential costs can help you make an informed decision and manage your insurance expenses effectively.

What happens if my health status changes during the term of my policy? Will I still be covered if I develop a serious illness or injury?

+Term life insurance policies typically cover the policyholder regardless of any changes in their health status during the term. As long as the policy remains active and the premiums are paid, the coverage remains in effect. However, it’s important to review the specific terms and conditions of your policy to understand any exclusions or limitations that may apply.

Can I cancel my term life insurance policy if I no longer need it, and will I get a refund?

+Yes, you can cancel your term life insurance policy at any time if you no longer require the coverage. However, it’s important to note that most insurers do not offer refunds for canceled policies. Term life insurance is designed to provide coverage for a specific period, and any premiums paid are typically non-refundable. It’s advisable to carefully consider your financial needs and commitments before canceling a policy to avoid unnecessary financial losses.

Are there any tax benefits associated with term life insurance policies?

+The tax treatment of term life insurance policies can vary depending on the jurisdiction and the specific policy. In general, the premiums paid for term life insurance are not tax-deductible. However, the death benefit received by the beneficiaries is typically tax-free, providing a significant financial advantage in the event of the policyholder’s untimely demise. It’s recommended to consult with a tax professional to understand the specific tax implications in your region.