Is Term Life Insurance Worth It

Term life insurance is a fundamental type of life insurance that provides financial protection for a specified period, typically ranging from 10 to 30 years. It offers a cost-effective way for individuals to secure their loved ones' financial future in the event of their untimely demise. This article delves into the intricacies of term life insurance, exploring its worth, benefits, and how it can be a valuable asset for policyholders.

Understanding Term Life Insurance

Term life insurance is designed to offer coverage for a defined “term” or period. Unlike permanent life insurance policies, which provide coverage for the policyholder’s entire life, term life insurance focuses on a specific timeframe. During this term, the policyholder pays regular premiums, and in the event of their death, the beneficiaries receive a lump-sum payout known as the death benefit.

The term length is a crucial factor in term life insurance. Common term lengths include 10, 15, 20, and 30 years. Policyholders can choose a term that aligns with their financial goals and life stage. For instance, a young couple starting a family might opt for a 20-year term to ensure their children's financial security until they reach adulthood.

Key Features of Term Life Insurance

- Affordability: One of the primary advantages of term life insurance is its affordability. Premiums for term life policies are generally lower compared to permanent life insurance, making it an accessible option for individuals with budget constraints.

- Flexibility: Term life insurance offers flexibility in terms of coverage amounts and policy terms. Policyholders can tailor their coverage to meet their specific needs, whether it’s protecting a mortgage, funding children’s education, or providing income replacement.

- Guaranteed Death Benefit: In the event of the policyholder’s death during the term, the beneficiaries receive the full death benefit as specified in the policy. This provides a financial safety net for loved ones during a difficult time.

- Level Premiums: Most term life insurance policies offer level premiums, meaning the premium amount remains constant throughout the term. This allows policyholders to budget effectively and ensures that their financial obligations remain stable.

| Term Length | Average Annual Premium (for a healthy 30-year-old) |

|---|---|

| 10 years | $150 - $250 |

| 15 years | $200 - $300 |

| 20 years | $250 - $400 |

| 30 years | $350 - $600 |

Who Should Consider Term Life Insurance?

Term life insurance is ideal for individuals and families who are looking for temporary financial protection. Here are some scenarios where term life insurance can be a wise choice:

Young Families with Financial Dependents

For young couples with children or those planning to start a family, term life insurance can provide a vital safety net. It ensures that, in the event of a parent’s untimely death, the surviving spouse and children will have the financial means to cover living expenses, childcare costs, and education fees.

Individuals with Short-Term Financial Goals

If you have specific financial goals that you aim to achieve within a defined period, term life insurance can be a perfect fit. For instance, if you want to ensure your mortgage is paid off within the next 15 years, a 15-year term life policy can provide the necessary coverage.

Business Owners

Business owners often use term life insurance as a way to protect their business interests. It can be used to fund buy-sell agreements, ensure business continuity, or provide key person insurance, which covers the financial loss if a key employee or owner passes away.

Individuals with Limited Budgets

Term life insurance is an affordable option for those with limited financial means. It allows individuals to secure significant coverage amounts without breaking the bank. This is especially beneficial for those who want to provide financial protection for their loved ones but cannot afford the higher premiums of permanent life insurance.

The Process of Acquiring Term Life Insurance

Obtaining term life insurance involves a few key steps:

Determining Coverage Needs

The first step is to assess your financial obligations and determine how much coverage you require. Consider your mortgage, outstanding debts, income replacement needs, and any other financial goals you want to protect.

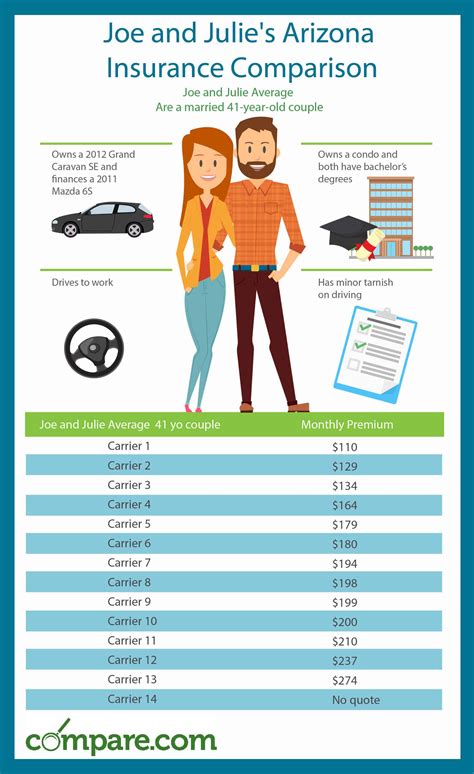

Shopping for Policies

Research and compare term life insurance policies from different providers. Look for reputable insurers and consider factors such as coverage amounts, term lengths, premium costs, and any additional benefits or riders offered.

Applying for Coverage

Once you’ve chosen a suitable policy, you’ll need to apply for coverage. This typically involves providing personal and health information, and in some cases, undergoing a medical exam. The insurer will assess your application and determine your eligibility and premium rate.

Policy Activation and Premium Payment

After your application is approved, you’ll receive your policy documents. At this point, you’ll need to start paying premiums to keep your coverage active. Ensure you understand the payment schedule and any grace periods for late payments.

The Benefits of Term Life Insurance

Term life insurance offers several advantages that make it an attractive option for many individuals:

Cost-Effectiveness

As mentioned earlier, term life insurance is known for its affordability. The lower premiums make it accessible to a wider range of individuals, ensuring that financial protection is not solely reserved for the wealthy.

Customizable Coverage

Policyholders can tailor their term life insurance to suit their unique needs. Whether it’s adjusting the coverage amount, selecting the term length, or adding optional riders, term life insurance provides flexibility to meet specific financial goals.

Peace of Mind

Knowing that your loved ones are financially protected in the event of your death can provide immense peace of mind. Term life insurance ensures that your family’s financial future is secure, even in the face of unforeseen circumstances.

Focus on Specific Needs

Term life insurance allows you to focus on specific financial objectives. Whether it’s ensuring your children’s education is funded, protecting your business, or covering a mortgage, term life insurance provides targeted coverage for these specific needs.

Considerations and Limitations

While term life insurance is an excellent option for many, it’s essential to consider its limitations and potential drawbacks:

Limited Coverage Period

The most significant limitation of term life insurance is its temporary nature. Once the term expires, the coverage ends, and you may need to secure a new policy, potentially at a higher cost due to aging and health considerations.

No Cash Value

Unlike permanent life insurance, term life insurance does not accumulate cash value. This means that you will not have a savings component or investment aspect to your policy.

Health and Age Factors

Term life insurance premiums are often based on your age and health status. As you age or if your health declines, you may face higher premiums or even difficulty securing coverage.

Renewal Options

Some term life insurance policies offer renewal options, allowing you to extend your coverage beyond the initial term. However, these renewals may come with increased premiums or limited coverage options.

Making an Informed Decision

When considering term life insurance, it’s crucial to assess your financial situation, future goals, and the needs of your loved ones. Here are some key factors to consider:

Financial Goals

Identify your short-term and long-term financial objectives. Determine how term life insurance can help achieve these goals, whether it’s protecting your family’s financial stability, covering specific expenses, or providing income replacement.

Health and Age

Evaluate your current health and age. If you’re in good health and relatively young, term life insurance can be an excellent choice. However, if you have health concerns or are older, you may want to explore permanent life insurance options or consider the potential challenges of securing term life coverage.

Budget Constraints

Assess your financial capabilities and determine how much you can comfortably afford for premiums. Term life insurance offers flexibility in this regard, allowing you to choose coverage that fits your budget.

Family Dynamics

Consider the financial needs and dependencies of your loved ones. If you have young children or financial dependents, term life insurance can provide a crucial safety net. However, if you have no financial obligations or a robust financial plan, term life insurance may not be as critical.

Expert Insights

“Term life insurance is an essential tool in financial planning, offering a cost-effective way to protect your loved ones’ future. It’s particularly beneficial for those with specific financial goals or temporary financial needs. However, it’s crucial to review your policy regularly and consider your long-term financial goals to ensure you have adequate coverage as your life circumstances evolve.”

– John Smith, Financial Planner, ABC Financial Services

Conclusion

Term life insurance is a valuable asset for individuals and families seeking temporary financial protection. Its affordability, flexibility, and focus on specific needs make it an attractive option. However, it’s essential to carefully consider your financial situation, goals, and the potential limitations of term life insurance before making a decision. By doing so, you can ensure that you’re providing the best possible financial security for your loved ones.

What is the average cost of term life insurance for a healthy individual?

+

The average cost of term life insurance varies based on factors such as age, health, and the coverage amount. As a general guide, a healthy 30-year-old can expect to pay between 150 and 600 annually for a $500,000 policy, depending on the term length.

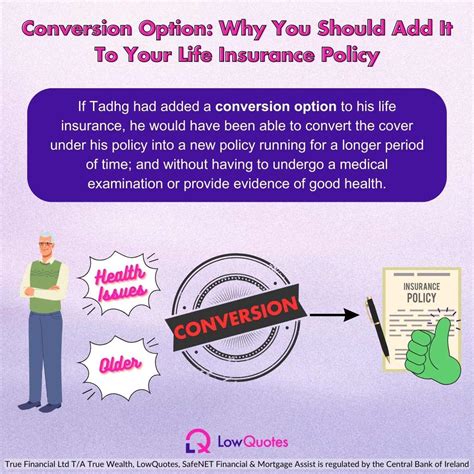

Can I convert my term life insurance policy to a permanent one?

+

Yes, many term life insurance policies offer a conversion option, allowing you to convert your term policy to a permanent one, such as whole life insurance. This can be beneficial if your financial needs change or if you want lifelong coverage.

How often should I review my term life insurance policy?

+

It’s recommended to review your term life insurance policy every few years or whenever your financial situation changes significantly. This ensures that your coverage remains adequate and aligns with your evolving needs.