Insureance

Welcome to a comprehensive exploration of the world of insurance, a vital aspect of modern life that provides financial protection and peace of mind. In this expert-crafted guide, we will delve into the intricate details of insurance, uncovering its significance, mechanisms, and impact on individuals and businesses. From its historical origins to its evolving role in a rapidly changing world, this article aims to offer an in-depth understanding of insurance, empowering readers with knowledge to navigate this essential industry.

The Evolution of Insurance: A Historical Perspective

Insurance, as a concept, has ancient roots dating back to the earliest civilizations. The fundamental idea of sharing risk and providing mutual support has been a cornerstone of human societies for millennia. Early forms of insurance can be traced to the ancient Babylonians, who developed a system of guaranteeing loans, known as the Code of Hammurabi, which outlined principles of risk sharing.

As societies progressed, so did the concept of insurance. In medieval Europe, the Lodge System emerged, where groups of individuals contributed to a common fund to provide support during times of illness, disability, or death. This marked a significant step towards modern insurance, emphasizing community support and shared responsibility.

The evolution of insurance gathered pace during the Age of Enlightenment, with the emergence of marine insurance in the 17th century. Lloyd's of London, established in 1688, became a hub for underwriters and brokers, facilitating the insurance of maritime ventures. This period saw the birth of the insurance industry as we recognize it today, with the development of actuarial science and the establishment of specialized insurance companies.

The 19th century brought about a revolution in insurance, with the introduction of life insurance and the expansion of insurance coverage to include fire, property, and casualty risks. This era witnessed the rise of iconic insurance companies like Equitable Life Assurance Society and the establishment of regulations to protect policyholders.

Understanding the Fundamentals of Insurance

At its core, insurance is a contractual arrangement whereby an individual or entity (the insured) transfers the risk of a potential loss to another entity (the insurer) in exchange for a premium. The insurer, in turn, assumes the risk and provides financial protection in the event of a covered loss.

The key elements of an insurance contract include the policy, which outlines the terms and conditions of the agreement, and the premium, which is the cost of the insurance coverage. The policyholder pays the premium to the insurer, who then assumes the risk and provides coverage for specified perils.

Insurance operates on the principle of indemnity, where the insured is compensated for their actual loss, up to the policy limit. This ensures that the insured is restored to their pre-loss financial position. Additionally, insurance contracts often include exclusions, which are specific risks or events that are not covered by the policy.

Types of Insurance

The insurance industry offers a wide range of coverage options to meet the diverse needs of individuals and businesses. Some of the most common types of insurance include:

- Life Insurance: Provides financial protection to the policyholder's beneficiaries in the event of their death.

- Health Insurance: Covers medical expenses and provides access to healthcare services.

- Property Insurance: Protects against losses related to damage or destruction of property, such as homes and businesses.

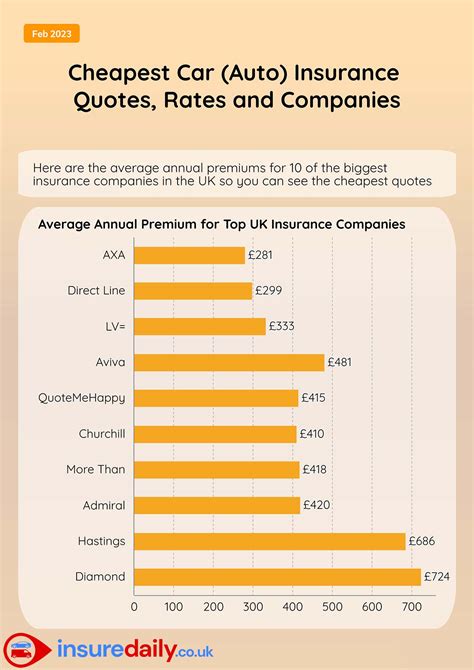

- Auto Insurance: Mandatory in many countries, it provides coverage for vehicle-related damages and liabilities.

- Business Insurance: Offers protection for businesses against various risks, including liability, property damage, and business interruption.

- Travel Insurance: Provides coverage for unforeseen events during travel, such as medical emergencies, trip cancellations, or lost luggage.

- Cyber Insurance: A relatively new type of insurance that protects against cyber risks and data breaches.

Each type of insurance serves a unique purpose and is tailored to address specific risks. The choice of insurance coverage depends on an individual's or business's unique circumstances and needs.

The Insurance Industry: A Complex Ecosystem

The insurance industry is a vast and intricate network of entities, each playing a crucial role in delivering insurance services to consumers. This ecosystem includes insurance companies, brokers, agents, reinsurers, and regulatory bodies, among others.

Insurance Companies

Insurance companies, also known as insurers or carriers, are at the heart of the industry. These entities offer various insurance products, underwrite policies, and assume the risk of providing coverage. Insurance companies employ actuaries to calculate premiums and manage risk, ensuring financial stability and the ability to pay out claims.

Brokers and Agents

Insurance brokers and agents act as intermediaries between consumers and insurance companies. They assist individuals and businesses in finding suitable insurance coverage, provide advice, and facilitate the policy procurement process. Brokers often represent multiple insurance companies, offering a wider range of options to their clients.

Reinsurers

Reinsurance is a critical component of the insurance industry, providing a layer of protection for insurers. Reinsurers assume a portion of the risk from primary insurers, allowing them to manage their exposure and maintain financial stability. This transfer of risk ensures that insurers can continue to provide coverage even in the face of catastrophic events.

Regulatory Bodies

Insurance is heavily regulated to protect consumers and ensure the stability of the industry. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK and the Insurance Regulatory and Development Authority (IRDAI) in India, oversee the insurance market, set standards, and enforce regulations. These bodies play a vital role in maintaining consumer confidence and market integrity.

The Impact of Insurance: Beyond Financial Protection

Insurance extends far beyond its primary function of providing financial protection. It plays a pivotal role in fostering economic growth, promoting social stability, and supporting innovation and entrepreneurship.

Economic Growth and Stability

Insurance contributes significantly to economic growth by providing a safety net for individuals and businesses. By offering financial protection, insurance encourages investment, risk-taking, and entrepreneurial ventures. It enables individuals to pursue their dreams without the fear of catastrophic financial losses, fostering a vibrant and innovative business environment.

Social Stability and Security

Insurance serves as a pillar of social stability by providing a sense of security and peace of mind to individuals and families. Life insurance, for instance, offers a financial safety net for loved ones in the event of a policyholder’s untimely demise. Health insurance ensures access to quality healthcare, alleviating the financial burden of medical expenses. These aspects contribute to a more stable and resilient society.

Innovation and Entrepreneurship

The insurance industry is a breeding ground for innovation, constantly adapting to meet the changing needs of its customers. Insurers are investing in technology, such as artificial intelligence and blockchain, to enhance risk assessment, streamline processes, and provide personalized coverage. This innovation not only benefits consumers but also drives economic growth and job creation.

The Future of Insurance: Embracing Technological Disruption

The insurance industry is undergoing a transformative phase, driven by technological advancements and changing consumer expectations. The rise of insurtech, a fusion of insurance and technology, is reshaping the way insurance is delivered and experienced.

Insurtech and Digital Innovation

Insurtech startups and established insurance companies are leveraging technology to enhance efficiency, improve customer experience, and expand coverage options. From digital underwriting to parametric insurance, the industry is embracing innovation to meet the evolving needs of a digitally connected world.

Digital underwriting, for instance, utilizes advanced data analytics and machine learning to streamline the insurance application process. This enables insurers to make faster and more accurate risk assessments, reducing the time and effort required to obtain coverage.

Parametric insurance, on the other hand, offers a new approach to risk transfer. This type of insurance provides coverage based on predefined parameters, such as weather events or natural disasters. It offers a faster and more predictable claims process, as payouts are triggered by objective data rather than individual assessments.

The Rise of Personalized Insurance

One of the most significant trends in insurance is the move towards personalized coverage. Insurers are leveraging data analytics and customer insights to tailor policies to individual needs. This shift from a one-size-fits-all approach to a highly customized offering is transforming the industry.

For example, usage-based insurance (UBI) in the auto insurance sector rewards safe drivers with lower premiums. By installing telematics devices in vehicles, insurers can track driving behavior and offer discounts to drivers who exhibit safe practices. This not only encourages safer driving but also provides a more equitable insurance experience.

Collaborative Insurance Models

The future of insurance also lies in collaborative models, where insurers work closely with other industries to provide comprehensive coverage. For instance, the integration of insurance with the sharing economy, such as ride-sharing or home-sharing platforms, offers a seamless experience for users. Insurers can provide coverage for both the platform and its users, addressing unique risks associated with these emerging business models.

Conclusion: Navigating the Complex World of Insurance

Insurance is a dynamic and essential industry, providing financial protection and peace of mind to individuals and businesses. From its ancient origins to its modern-day innovations, insurance has evolved to meet the changing needs of society. As we navigate an increasingly complex and uncertain world, insurance remains a crucial tool for managing risk and building a more resilient future.

By understanding the fundamentals of insurance, the role of key industry players, and the impact of insurance on our lives, we can make informed decisions and harness the power of insurance to our advantage. Whether it's protecting our homes, businesses, or loved ones, insurance serves as a vital pillar of financial security and stability.

As the insurance industry continues to evolve, embracing technological advancements and adapting to new challenges, it remains a vital force in shaping our economic, social, and entrepreneurial landscapes. With a deeper understanding of insurance, we can embrace its potential and navigate the complexities of modern life with confidence and resilience.

What are the key benefits of having insurance coverage?

+

Insurance provides several key benefits, including financial protection in the event of unforeseen circumstances, such as accidents, illnesses, or property damage. It offers peace of mind, knowing that you and your loved ones are protected from potential financial losses. Insurance also encourages responsible behavior and can provide access to essential services, such as healthcare or legal assistance.

How does insurance help promote economic growth and stability?

+

Insurance plays a crucial role in promoting economic growth by providing a safety net for individuals and businesses. It encourages investment, entrepreneurship, and risk-taking by mitigating potential financial losses. By protecting assets and providing a stable financial foundation, insurance fosters a more resilient and dynamic economy, allowing businesses to thrive and create jobs.

What is the role of reinsurance in the insurance industry?

+

Reinsurance is a critical component of the insurance industry, providing a layer of protection for insurers. Reinsurers assume a portion of the risk from primary insurers, allowing them to manage their exposure and maintain financial stability. This transfer of risk ensures that insurers can continue to provide coverage, even in the face of catastrophic events, promoting overall industry resilience.