Insurance What Is Ppo

In the complex world of health insurance, understanding the various plan types is crucial for making informed decisions about your healthcare coverage. One such plan type is the Preferred Provider Organization (PPO), a popular choice known for its flexibility and wide network of healthcare providers. This article will delve into the intricacies of PPO insurance, exploring its definition, benefits, and how it differs from other insurance plans. By the end, you'll have a comprehensive understanding of PPOs and their role in ensuring accessible and affordable healthcare.

Understanding the PPO Insurance Model

A Preferred Provider Organization (PPO) is a type of health insurance plan that offers policyholders the freedom to choose their healthcare providers, both within and outside a designated network. This flexibility is a key advantage of PPO plans, as it allows individuals to seek treatment from specialists or facilities that best meet their specific healthcare needs.

PPOs operate on a simple principle: policyholders pay a predetermined amount, known as a premium, to their insurance provider. In return, they receive coverage for a wide range of medical services, including doctor visits, hospital stays, and prescription medications. The beauty of PPO plans lies in their network of preferred providers, which are healthcare professionals and facilities that have negotiated lower rates with the insurance company. This arrangement ensures that policyholders receive quality care at more affordable rates.

One of the standout features of PPO insurance is its out-of-network coverage. Unlike some other plan types, PPOs don't limit policyholders to specific networks. While using in-network providers typically results in lower out-of-pocket costs, PPO policyholders can still access care from out-of-network providers if necessary. However, it's important to note that the cost of out-of-network care may be higher, as these providers haven't agreed to the discounted rates offered by the insurance company.

Key Benefits of PPO Insurance Plans

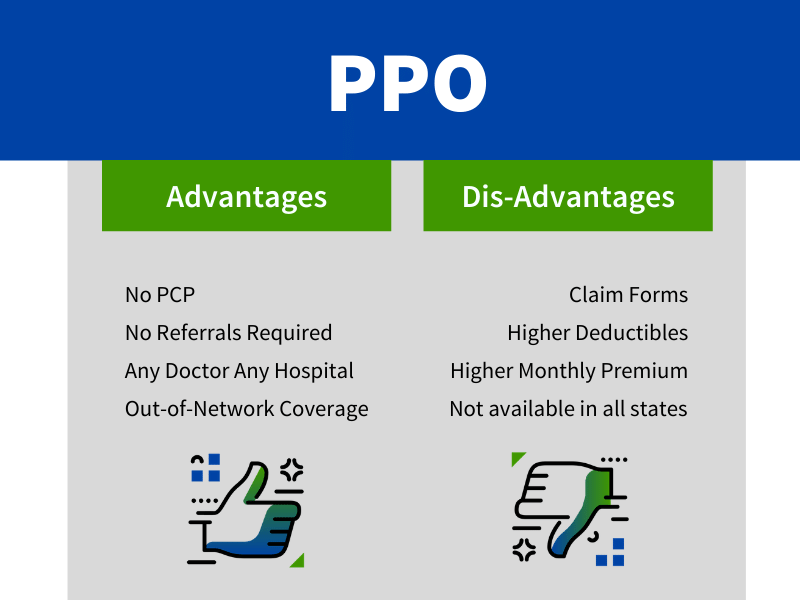

PPO insurance plans offer a host of advantages that make them an appealing choice for many individuals and families. Here’s a closer look at some of the key benefits:

Flexibility in Provider Choice

One of the primary advantages of PPO plans is the freedom to choose healthcare providers. Whether you have a preferred specialist or a trusted family doctor, PPOs allow you to maintain continuity of care by visiting the providers you trust. This flexibility is particularly beneficial for individuals with specific healthcare needs or those who prefer certain medical facilities.

Extensive Network of Providers

PPO insurance plans typically boast expansive networks of preferred providers, which include a wide range of healthcare professionals and facilities. This network often covers not just primary care physicians but also specialists, such as cardiologists, dermatologists, and pediatricians. Additionally, PPO networks frequently include major hospitals and medical centers, ensuring that policyholders have access to a comprehensive range of healthcare services.

Lower Costs for In-Network Care

By utilizing in-network providers, PPO policyholders can benefit from reduced costs for their healthcare services. Since these providers have negotiated lower rates with the insurance company, policyholders often pay less out of pocket for medical treatments, procedures, and prescriptions. This cost-saving benefit can be especially valuable for individuals who require frequent or specialized medical care.

Coverage for Out-of-Network Care

While PPO plans encourage the use of in-network providers, they also provide coverage for out-of-network care. This means that if you need to see a specialist or receive treatment at a facility outside the preferred network, your PPO insurance will still provide coverage. However, it’s important to note that out-of-network care may result in higher out-of-pocket costs, as these providers haven’t agreed to the discounted rates.

Comparing PPOs with Other Insurance Plans

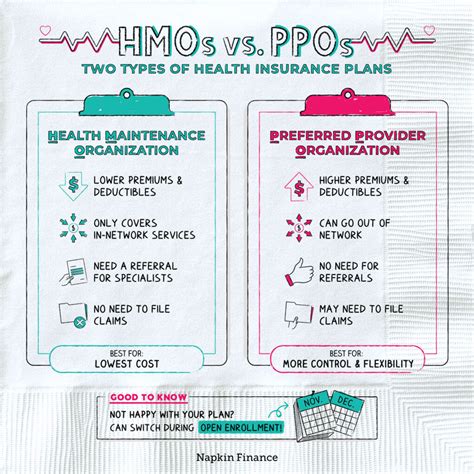

To fully understand the value of PPO insurance plans, it’s helpful to compare them with other common types of health insurance, such as Health Maintenance Organizations (HMOs) and Exclusive Provider Organizations (EPOs). Here’s a brief comparison:

| Plan Type | Provider Choice | Network Coverage | Out-of-Network Coverage |

|---|---|---|---|

| PPO | Flexible, both in and out of network | Extensive network, lower costs | Yes, with potential higher costs |

| HMO | Limited to in-network providers | Narrow network, typically lower costs | No coverage, may require prior authorization |

| EPO | Flexible, similar to PPO | No out-of-network coverage, similar to HMO | No coverage, may require prior authorization |

As the table illustrates, PPOs offer a balance between flexibility and cost-effectiveness. While HMOs provide more limited provider choices and no out-of-network coverage, PPOs offer the freedom to choose providers both within and outside the network, albeit with potentially higher costs for out-of-network care. EPOs, on the other hand, are similar to PPOs in terms of provider flexibility but lack out-of-network coverage.

Making Informed Choices with PPO Insurance

When considering PPO insurance, it’s essential to evaluate your individual healthcare needs and preferences. Factors such as the location of your preferred providers, the extent of your healthcare requirements, and your budget all play a role in determining whether a PPO plan is the right choice for you.

For individuals who prioritize flexibility and the ability to choose their healthcare providers, PPO plans offer an attractive option. However, it's important to carefully review the specifics of each PPO plan, including the network of providers, the cost of premiums and out-of-pocket expenses, and any potential limitations or exclusions. By understanding the ins and outs of PPO insurance, you can make informed decisions that align with your healthcare needs and financial situation.

What is the difference between a PPO and an HMO?

+PPOs offer more flexibility in provider choice and out-of-network coverage, while HMOs typically have a narrower network and no out-of-network coverage.

Are PPO plans suitable for families with young children?

+Yes, PPO plans can be a great option for families as they provide flexibility in choosing pediatricians and other specialists. However, it’s important to consider the cost of premiums and out-of-pocket expenses.

Do PPO plans cover pre-existing conditions?

+Most PPO plans do cover pre-existing conditions, but it’s important to check the specific plan’s coverage details and any potential waiting periods or exclusions.