Insurance Underwriting

In the complex world of insurance, one critical yet often misunderstood role stands out: the insurance underwriter. These professionals play a pivotal role in the insurance industry, shaping the very foundation of risk assessment and management. Their expertise and strategic decisions determine the success and viability of insurance policies, making them an indispensable part of the industry's ecosystem. As we delve into the intricate world of insurance underwriting, we will uncover the depth and breadth of this profession, its significance, and its evolving role in the modern insurance landscape.

The Art of Insurance Underwriting: Unveiling the Process

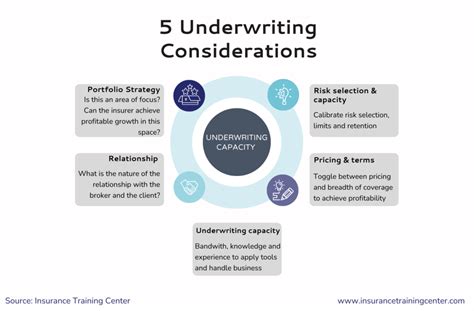

Insurance underwriting is an intricate art that demands a deep understanding of risk evaluation and management. At its core, underwriting involves assessing and accepting or rejecting insurance risks based on their potential impact and profitability. This process is not merely about numbers and statistics; it is a strategic dance between actuarial science and real-world scenarios, where underwriters must navigate the delicate balance between insuring viable risks and ensuring the financial stability of insurance companies.

Key Steps in the Underwriting Process

The underwriting journey begins with a comprehensive review of the insurance application. Underwriters scrutinize every detail, from the applicant’s personal or business information to the specific coverage requested. This initial assessment sets the tone for the entire underwriting process, as it provides the foundation for risk evaluation.

Once the application is thoroughly examined, underwriters delve into the intricate process of risk analysis. This step involves a deep dive into the applicant's background, including their financial stability, past insurance claims, and any potential risk factors. Advanced analytics and data modeling tools are employed to quantify and qualify these risks, allowing underwriters to make informed decisions about the acceptability of the risk.

After a risk has been deemed acceptable, underwriters determine the appropriate premium. This critical step ensures that the insurance company is fairly compensated for the assumed risk while also remaining competitive in the market. The premium is calculated based on a multitude of factors, including the level of risk, the coverage amount, and the insurance company's financial goals.

The final step in the underwriting process is the issuance of the insurance policy. This document, meticulously crafted by underwriters, outlines the terms and conditions of the insurance coverage, including the specific risks covered, the policy limits, and any exclusions. The policy serves as a contract between the insurance company and the insured, providing a clear framework for the relationship and ensuring that both parties understand their rights and responsibilities.

| Underwriting Stage | Description |

|---|---|

| Application Review | Thorough examination of insurance applications to assess initial risk. |

| Risk Analysis | In-depth analysis of applicant's background and potential risk factors. |

| Premium Determination | Calculation of a fair and competitive premium based on assessed risk. |

| Policy Issuance | Crafting and delivery of the insurance policy, outlining coverage terms. |

The Skills and Expertise of Insurance Underwriters

Insurance underwriters are not merely number crunchers; they are highly skilled professionals with a diverse skill set. A successful underwriter must possess a deep understanding of insurance principles, actuarial science, and risk management. Additionally, they must have strong analytical and critical thinking abilities, enabling them to evaluate complex scenarios and make informed decisions.

The Importance of Underwriter Expertise

The expertise of insurance underwriters is critical to the success of the insurance industry. Their ability to accurately assess and manage risk ensures that insurance companies remain financially solvent while providing valuable coverage to policyholders. By carefully evaluating each risk, underwriters help to mitigate potential losses and ensure the long-term viability of the insurance company.

Furthermore, underwriters play a crucial role in maintaining the balance between risk and profitability. They must consider not only the potential risks but also the insurance company's financial goals and market competitiveness. This delicate balance ensures that insurance companies remain sustainable while offering fair and affordable coverage to their customers.

In today's rapidly evolving insurance landscape, underwriters must also stay abreast of industry trends and regulatory changes. They must adapt their risk assessment and management strategies to accommodate new technologies, emerging risks, and changing consumer behaviors. This ongoing learning and adaptation are essential to the underwriter's role and the overall success of the insurance industry.

The Evolving Role of Insurance Underwriters in the Digital Age

The insurance industry, like many others, is undergoing a digital transformation. With the advent of technology and data analytics, the role of insurance underwriters is evolving rapidly. Underwriters now have access to vast amounts of data and advanced analytics tools, allowing them to make more informed and efficient decisions.

Technological Innovations in Underwriting

Technology has revolutionized the underwriting process, making it more efficient and accurate. Advanced data analytics and machine learning algorithms enable underwriters to process and analyze vast amounts of data quickly, resulting in faster decision-making and improved risk assessment. Additionally, digital tools and platforms streamline the entire underwriting workflow, from application submission to policy issuance.

The integration of technology has also enhanced the accuracy of risk assessment. Underwriters can now leverage predictive analytics and risk modeling techniques to identify and mitigate potential risks more effectively. These advanced tools provide a more comprehensive view of the applicant's risk profile, leading to better-informed underwriting decisions.

The Future of Insurance Underwriting

Looking ahead, the future of insurance underwriting is promising. As technology continues to advance, underwriters will have even more sophisticated tools at their disposal. Artificial intelligence and machine learning algorithms will play an increasingly significant role in risk assessment and decision-making. These technologies will enable underwriters to process and analyze data at unprecedented speeds, leading to even more efficient and accurate underwriting processes.

Furthermore, the rise of digital insurance platforms and online applications is expected to streamline the underwriting process even further. Applicants will be able to submit their information and receive a risk assessment and premium quote in real-time, enhancing the overall customer experience and reducing administrative burdens.

However, despite these technological advancements, the human element in underwriting will remain crucial. Underwriters will continue to play a critical role in interpreting data, making complex risk assessments, and providing valuable expertise and guidance to insurance companies and policyholders alike. The future of insurance underwriting is one of collaboration between technology and human expertise, working together to enhance the accuracy, efficiency, and overall success of the insurance industry.

What is the primary role of insurance underwriters in the insurance industry?

+Insurance underwriters are responsible for assessing and accepting or rejecting insurance risks. They play a critical role in determining the success and viability of insurance policies by evaluating risks and ensuring the financial stability of insurance companies.

How has technology impacted the role of insurance underwriters?

+Technology has revolutionized the underwriting process, making it more efficient and accurate. Advanced data analytics and machine learning algorithms enable underwriters to process vast amounts of data quickly, resulting in faster decision-making and improved risk assessment.

What skills are essential for a successful insurance underwriter?

+A successful insurance underwriter must possess a deep understanding of insurance principles, actuarial science, and risk management. Strong analytical and critical thinking abilities are also crucial for evaluating complex scenarios and making informed decisions.