Insurance Rv

The recreational vehicle (RV) insurance market has witnessed significant growth and evolution in recent years, reflecting the increasing popularity of RV lifestyles and adventures. This article delves into the intricacies of RV insurance, exploring its essential aspects, benefits, and considerations to ensure that RV enthusiasts can make informed decisions about protecting their vehicles and adventures.

Understanding RV Insurance

RV insurance is a specialized type of coverage designed to protect individuals who own and operate recreational vehicles. It provides comprehensive protection against various risks and liabilities associated with RV ownership and use. While standard auto insurance policies may offer some coverage for RVs, they often fall short when it comes to the unique needs and exposures of these versatile vehicles.

The Importance of Specialized Coverage

RV insurance policies are tailored to address the specific characteristics and potential hazards of recreational vehicles. These policies consider factors such as the size and weight of the RV, the unique storage and transportation needs, and the various activities and destinations associated with RV travel. By opting for specialized RV insurance, owners can ensure that they have adequate coverage for their vehicle and the adventures they embark upon.

For instance, standard auto insurance policies may not provide sufficient coverage for the unique risks involved in towing a trailer or for the personal belongings stored within an RV. RV insurance, on the other hand, offers tailored protection for these scenarios, ensuring peace of mind for RV enthusiasts.

Coverage Options and Considerations

RV insurance policies offer a range of coverage options to cater to the diverse needs of RV owners. Understanding these options is crucial for making informed decisions and selecting the right coverage for one’s specific situation.

Liability Coverage

Liability coverage is a fundamental aspect of RV insurance, providing protection against claims arising from accidents or incidents involving the RV. This coverage is essential to protect the RV owner from financial losses resulting from bodily injury or property damage claims made by others. It covers expenses such as medical bills, legal fees, and repair costs associated with accidents.

RV owners should carefully consider the liability limits offered by their insurance provider. Higher liability limits provide greater protection in the event of a serious accident, ensuring that the owner's financial assets are adequately safeguarded.

Comprehensive and Collision Coverage

Comprehensive and collision coverage are crucial components of RV insurance, offering protection against various risks beyond accidents. Comprehensive coverage safeguards against damages caused by non-collision incidents such as theft, vandalism, natural disasters, or collisions with animals. It provides financial assistance for repairs or replacement of the RV in such scenarios.

Collision coverage, on the other hand, specifically addresses damages resulting from collisions with other vehicles or objects. It covers the cost of repairs or replacement when the RV is involved in an accident, regardless of fault. Both comprehensive and collision coverage are essential for RV owners to ensure their vehicle is protected against a wide range of potential hazards.

Personal Effects Coverage

RV insurance policies often include coverage for personal effects, which refers to the belongings stored within the RV. This coverage is particularly important as RVs often serve as mobile homes, carrying valuable items such as clothing, electronics, and other personal belongings. Personal effects coverage ensures that these items are protected against theft, damage, or loss during RV travel.

RV owners should assess the value of their personal belongings and select an appropriate coverage limit to ensure they are adequately insured. It's worth noting that certain high-value items, such as jewelry or electronics, may require additional endorsements or separate policies to ensure comprehensive protection.

Emergency Roadside Assistance

Emergency roadside assistance is a valuable add-on to RV insurance policies, providing essential support during unexpected breakdowns or emergencies on the road. This coverage ensures that RV owners have access to immediate assistance, including towing services, flat tire repair, battery jump starts, and other essential services to get their RV back on the road.

RV owners frequently travel long distances and venture into remote areas, making emergency roadside assistance a crucial aspect of their insurance coverage. By opting for this add-on, they can ensure that they have the necessary support to handle unexpected situations and continue their adventures without significant delays.

Factors Influencing RV Insurance Premiums

RV insurance premiums, like any other insurance, are influenced by a variety of factors. Understanding these factors can help RV owners make informed decisions and potentially negotiate better rates.

RV Type and Value

The type and value of the RV play a significant role in determining insurance premiums. Larger and more luxurious RVs, such as Class A motorhomes or high-end trailers, often carry higher premiums due to their increased value and potential for more severe damages in the event of an accident.

Additionally, the age and condition of the RV can also impact insurance costs. Newer RVs or those in excellent condition may qualify for lower premiums, as they pose a lower risk of mechanical failures or breakdowns.

Driving Record and Experience

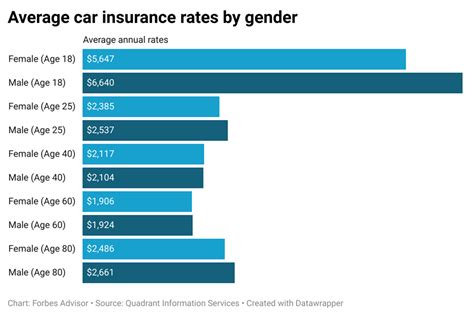

The driving record and experience of the RV owner are crucial factors in insurance premium calculations. A clean driving record, free from accidents or violations, is generally rewarded with lower premiums. Insurance providers view individuals with a history of safe driving as less risky, resulting in more favorable insurance rates.

On the other hand, RV owners with a history of accidents or traffic violations may face higher premiums. These individuals are considered higher-risk, and insurance providers adjust their rates accordingly to account for the increased likelihood of claims.

Usage and Storage

The intended usage and storage arrangements of the RV can also impact insurance premiums. RVs that are used primarily for long-distance travel or frequent camping trips may attract higher premiums due to the increased exposure to risks and potential for accidents. Conversely, RVs that are primarily used for local trips or stored in secure locations may qualify for lower premiums.

Furthermore, the storage arrangements for the RV can also influence insurance costs. RVs that are stored in secure, covered locations, such as garages or storage facilities, may be eligible for discounts, as they are less exposed to weather-related damages or theft.

Choosing the Right RV Insurance Provider

Selecting the right RV insurance provider is a crucial step in ensuring comprehensive protection for your recreational vehicle. With numerous insurance companies offering RV insurance, it’s essential to conduct thorough research and compare policies to find the best fit for your specific needs.

Research and Compare

Begin your search by researching reputable insurance companies that specialize in RV insurance. Look for providers with a strong track record of customer satisfaction, prompt claim processing, and a comprehensive understanding of the unique needs of RV owners. Online reviews and testimonials can provide valuable insights into the experiences of other RV enthusiasts with different insurance providers.

Compare the coverage options, policy limits, and premiums offered by multiple insurance companies. Assess their financial stability and rating to ensure they are capable of providing long-term coverage and prompt claim settlements. Consider factors such as the ease of communication, availability of online resources, and the overall customer service experience when evaluating potential providers.

Understanding Policy Details

When comparing RV insurance policies, pay close attention to the fine print and understand the specific details of each policy. Look for policies that offer comprehensive coverage, including liability, comprehensive, and collision protection, as well as coverage for personal effects and emergency roadside assistance.

Evaluate the policy limits and ensure they align with your needs and the value of your RV. Consider any optional endorsements or add-ons that may be beneficial for your specific situation, such as coverage for specific activities or additional protection for high-value items. Understand the deductibles and any exclusions or limitations within the policy to ensure you are fully aware of what is and isn't covered.

Customer Service and Claim Handling

The quality of customer service and claim handling processes is a critical aspect to consider when choosing an RV insurance provider. Opt for a company that offers prompt and efficient claim processing, ensuring that any necessary repairs or replacements are handled promptly and without unnecessary delays.

Inquire about the availability of 24/7 customer support, as RV owners may require assistance at any time, especially during emergencies or unexpected breakdowns. Look for providers that offer easy-to-use online platforms or mobile apps for policy management, claim reporting, and other essential services. Positive customer experiences and a reputation for fair and efficient claim handling are key indicators of a reliable insurance provider.

Maximizing RV Insurance Benefits

RV insurance offers a range of benefits beyond the basic coverage. By understanding these additional benefits and utilizing them effectively, RV owners can maximize the value of their insurance policies and enhance their overall RV experience.

Discounts and Savings

Many RV insurance providers offer a variety of discounts to policyholders. These discounts can significantly reduce insurance premiums and make RV insurance more affordable. Common discounts include safe driver discounts for individuals with clean driving records, multi-policy discounts for those who bundle their RV insurance with other policies such as auto or home insurance, and loyalty discounts for long-term customers.

Additionally, some insurance companies offer discounts for RV owners who take proactive measures to enhance safety and security. This may include installing anti-theft devices, taking RV safety courses, or implementing other safety measures. By exploring these discount opportunities, RV owners can save money on their insurance premiums while also promoting safer RV practices.

RV-Specific Resources and Support

Certain RV insurance providers offer valuable resources and support specifically tailored to the needs of RV owners. These resources can enhance the RV experience and provide additional peace of mind. Look for insurance companies that provide access to RV-related guides, maintenance tips, and safety advice, helping RV owners make informed decisions and ensure the longevity of their vehicles.

Some providers also offer RV trip planning tools, helping owners navigate their adventures with confidence. These tools may include RV park recommendations, route planning assistance, and information on local attractions and services. By leveraging these resources, RV owners can enhance their travel experiences and make the most of their adventures.

RV Rental and Sharing Programs

RV insurance policies often include coverage for rental or shared use of the RV. This allows RV owners to rent out their vehicles to others or participate in RV sharing programs, providing an additional source of income or the opportunity to offset some of the costs associated with RV ownership.

When considering RV rental or sharing, it's essential to understand the coverage provided by your insurance policy. Ensure that the policy covers rental or shared use and understand any limitations or exclusions that may apply. Additionally, consider the potential risks and responsibilities associated with renting or sharing your RV, such as proper vetting of renters and ensuring they are adequately insured.

RV Insurance and Travel Planning

RV insurance plays a crucial role in travel planning, providing the necessary protection and peace of mind for RV adventures. By understanding the connection between insurance and travel planning, RV owners can ensure a smooth and stress-free journey.

Coverage for Different Destinations

RV travel often involves visiting a variety of destinations, each with its own unique characteristics and potential risks. RV insurance policies should provide coverage for a wide range of destinations, including both local and long-distance travel. This ensures that RV owners are protected regardless of their travel plans and destinations.

Consider the specific risks associated with different destinations, such as weather conditions, road infrastructure, or potential security concerns. Choose an RV insurance policy that offers adequate coverage for these risks, ensuring that your vehicle and belongings are protected throughout your travels.

Travel Emergency Preparedness

RV insurance policies can greatly contribute to travel emergency preparedness. By including emergency roadside assistance and other add-ons, RV owners can have the necessary support in the event of breakdowns, accidents, or other unexpected situations while on the road.

Additionally, RV insurance policies often provide coverage for medical emergencies, offering financial protection for unexpected medical expenses incurred during travel. This coverage is particularly valuable for RV owners who venture into remote areas or embark on extended trips, as it ensures access to necessary medical care without incurring significant financial burdens.

Travel Insurance Integration

For RV owners who plan extended trips or international adventures, integrating travel insurance with their RV insurance policy can provide comprehensive protection. Travel insurance policies can cover a range of potential risks associated with travel, including trip cancellations, lost luggage, and medical emergencies.

By combining RV insurance with travel insurance, RV owners can ensure that they have adequate coverage for their entire journey. This integration simplifies the insurance process and provides peace of mind, knowing that they are protected against a wide range of potential travel-related risks and liabilities.

Future Trends and Innovations in RV Insurance

The RV insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Staying informed about future trends and innovations can help RV owners make more informed decisions and stay ahead of the curve.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of devices to monitor driving behavior and vehicle performance, is gaining traction in the insurance industry. Usage-based insurance, also known as pay-as-you-drive insurance, utilizes telematics data to assess the risk profile of individual drivers and offer personalized insurance rates.

In the context of RV insurance, telematics technology can provide valuable insights into driving behavior, such as speed, braking patterns, and mileage. This data can be used to reward safe driving practices with lower insurance premiums, promoting safer RV driving and potentially reducing insurance costs for responsible RV owners.

Digitalization and Convenience

The insurance industry is increasingly embracing digitalization to enhance convenience and customer experience. RV insurance providers are developing user-friendly online platforms and mobile apps, allowing policyholders to manage their policies, file claims, and access resources and support with ease.

Digitalization also facilitates the integration of various insurance policies, making it simpler for RV owners to manage their RV insurance alongside other insurance needs. Additionally, digital platforms often offer personalized recommendations and guidance, helping RV owners make informed decisions about their coverage and optimize their insurance portfolios.

Sustainable and Eco-Friendly Practices

With growing environmental consciousness, the RV industry is witnessing a shift towards sustainable and eco-friendly practices. RV insurance providers are beginning to recognize the importance of supporting these initiatives and are offering incentives and discounts for RV owners who adopt sustainable practices.

For instance, insurance companies may offer discounts for RVs equipped with solar panels or other renewable energy sources. Additionally, providers may reward RV owners who participate in eco-friendly camping practices, such as reducing waste or conserving natural resources. By encouraging sustainable practices, RV insurance companies contribute to the overall environmental sustainability of the RV lifestyle.

FAQ

How much does RV insurance typically cost?

+RV insurance costs can vary significantly based on factors such as the type and value of the RV, driving record, and coverage options chosen. On average, RV insurance premiums range from 500 to 2,000 annually. However, it’s important to obtain personalized quotes to determine the exact cost for your specific situation.

Can I add additional drivers to my RV insurance policy?

+Yes, most RV insurance policies allow for the addition of named drivers. This is particularly important if multiple individuals will be driving the RV. By adding additional drivers, you ensure that they are covered under the policy and that their driving record is considered when determining premiums.

Are there any discounts available for RV insurance?

+Absolutely! RV insurance providers offer a range of discounts to policyholders. These may include safe driver discounts, multi-policy discounts, loyalty discounts, and discounts for RV safety courses or anti-theft devices. It’s worth exploring these opportunities to potentially reduce your insurance premiums.

Can I rent out my RV and still maintain insurance coverage?

+Yes, many RV insurance policies include coverage for rental or shared use of the RV. However, it’s essential to understand the specific terms and conditions of your policy regarding rental coverage. Some policies may require additional endorsements or have limitations on the duration or frequency of rentals. Always review your policy and consult with your insurance provider to ensure proper coverage.