Employer Insurance

In the complex landscape of business management, one crucial aspect that often flies under the radar is employer insurance. This essential coverage not only safeguards businesses from potential risks but also plays a pivotal role in ensuring the well-being and security of employees. As we delve into this comprehensive guide, we will explore the intricacies of employer insurance, its types, benefits, and the critical decisions employers must make to protect their ventures and workforce.

Understanding the Core: What is Employer Insurance?

Employer insurance, a cornerstone in the business world, is a comprehensive coverage plan that shields employers from various liabilities and risks associated with their workforce. It acts as a safety net, offering financial protection and peace of mind to businesses of all sizes. This insurance encompasses a wide range of policies, each tailored to address specific concerns, from workplace accidents to employee health and beyond.

The Spectrum of Employer Insurance Policies

Workplace Liability Insurance

This policy is a cornerstone for employers, providing coverage for accidents, injuries, or illnesses that occur within the workplace. It ensures that employers are financially protected in the event of employee claims, offering a vital safety net.

Group Health Insurance

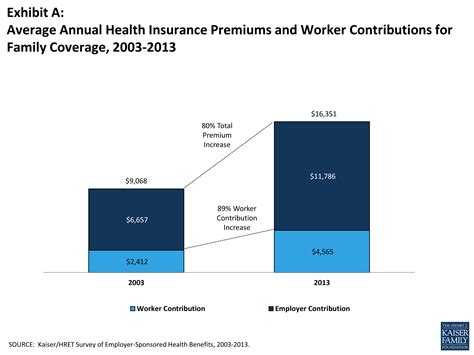

Offering group health insurance is a strategic move for employers. It not only attracts top talent but also ensures the well-being of employees, covering a range of medical expenses and promoting a healthy workforce.

Workers’ Compensation Insurance

A legal requirement in many jurisdictions, workers’ compensation insurance is designed to cover employees’ medical expenses and a portion of their wages if they are injured on the job. This policy is a critical component of employer insurance, ensuring compliance and providing essential support to injured workers.

Disability Insurance

Disability insurance steps in when employees are unable to work due to illness or injury, providing them with a portion of their regular income. This policy is crucial for employers, ensuring their workforce has financial support during challenging times.

Life Insurance

Offering life insurance as an employer benefit can be a powerful tool to attract and retain employees. This policy provides a death benefit to the beneficiaries of employees, offering a sense of security and peace of mind.

Professional Liability Insurance (E&O Insurance)

Professional liability insurance, also known as Errors and Omissions (E&O) insurance, is a critical safeguard for employers in professional services. It protects against claims of negligence, errors, or omissions in the course of providing professional services, ensuring that businesses are covered for potential legal expenses and damages.

The Impact of Employer Insurance on Business Success

Employer insurance is not merely a legal requirement but a strategic investment in the success and longevity of a business. It plays a multifaceted role, offering protection, peace of mind, and a competitive edge in the talent market.

| Policy Type | Key Benefits |

|---|---|

| Workplace Liability | Financial protection against workplace accidents, fostering a safe work environment. |

| Group Health Insurance | Attracts top talent, promotes employee health, and reduces absenteeism. |

| Workers' Compensation | Ensures compliance, provides support to injured workers, and maintains business continuity. |

| Disability Insurance | Offers financial support to employees during illness or injury, boosting morale. |

| Life Insurance | Provides peace of mind to employees and their families, enhancing loyalty. |

| Professional Liability (E&O) | Protects businesses in professional services from legal claims, ensuring reputation and financial stability. |

Navigating the Decision-Making Process

Selecting the right employer insurance policies can be a complex task, but with a strategic approach, employers can make informed choices. Here’s a step-by-step guide:

Assess Your Business Risks: Understand the unique risks associated with your industry and business operations. This assessment is crucial for identifying the most critical insurance needs.

Research and Compare Policies: Explore a range of insurance providers and policies. Compare coverage, premiums, and benefits to find the best fit for your business.

Seek Expert Advice: Consulting with insurance professionals can provide valuable insights. They can guide you through the process, ensuring you make informed decisions tailored to your business.

Review and Update Regularly: Insurance needs evolve with your business. Regularly review and update your policies to ensure they align with your current operations and risks.

Real-World Examples and Case Studies

Case Study: A Successful Implementation

Company X, a leading tech startup, recognized the importance of employer insurance early on. They implemented a comprehensive insurance strategy, including workplace liability, group health, and professional liability insurance. This proactive approach not only protected the company from potential risks but also boosted employee morale and retention, contributing to their overall success.

The Impact of Neglecting Insurance

In contrast, Company Y, a small business in the hospitality sector, overlooked the importance of employer insurance. A workplace accident led to significant legal and financial consequences, straining the business and affecting its reputation. This scenario highlights the critical role of insurance in mitigating risks and ensuring business resilience.

The Future of Employer Insurance: Trends and Innovations

The landscape of employer insurance is evolving, driven by technological advancements and changing workforce dynamics. Here’s a glimpse into the future:

Digital Transformation: The integration of digital technologies is revolutionizing insurance processes, making them more efficient and accessible. From online policy management to real-time claim processing, digital tools are enhancing the employer insurance experience.

Personalized Coverage: Insurers are increasingly offering personalized insurance packages, tailored to the unique needs of businesses. This trend allows employers to customize coverage, ensuring a perfect fit for their specific risks and operations.

Wellness-Focused Policies: With a growing emphasis on employee wellness, insurers are developing innovative policies that promote healthy lifestyles. These policies not only cover medical expenses but also incentivize employees to adopt healthier habits, reducing long-term healthcare costs.

Data-Driven Insights: Advanced analytics and data-driven approaches are shaping the future of employer insurance. Insurers are leveraging data to identify trends, predict risks, and offer more accurate and affordable coverage, benefiting both employers and employees.

Conclusion: A Secure Future with Employer Insurance

In the dynamic world of business, employer insurance stands as a cornerstone of stability and growth. By understanding the types of policies available, their benefits, and the strategic decisions involved, employers can navigate the insurance landscape with confidence. As we embrace the future, with its digital innovations and personalized approaches, employer insurance remains a vital tool for safeguarding businesses and empowering their workforce.

FAQ Section:

What is the average cost of employer insurance policies?

+

The cost of employer insurance policies can vary widely based on factors such as the size of the business, industry, and specific coverage needs. On average, small businesses can expect to pay between 500 and 1,500 per month for basic coverage, while larger enterprises may pay tens of thousands of dollars annually. However, these are rough estimates, and the actual cost will depend on the unique circumstances of each business.

Are there tax benefits associated with employer insurance?

+

Yes, employer-provided insurance often comes with tax advantages. For instance, group health insurance premiums paid by the employer are generally tax-deductible as a business expense. Additionally, certain types of insurance, like life insurance, can provide tax-free benefits to employees, making them a valuable employee benefit.

How often should I review and update my employer insurance policies?

+

It’s recommended to review your employer insurance policies annually or whenever there are significant changes in your business operations, workforce size, or industry regulations. Regular reviews ensure that your coverage remains up-to-date and aligned with your evolving needs.

What are some common challenges in managing employer insurance?

+

Managing employer insurance can present challenges such as understanding complex policy language, staying compliant with ever-changing regulations, and ensuring that your coverage meets the unique needs of your business. It’s beneficial to consult with insurance professionals who can guide you through these complexities.

How can I encourage my employees to utilize their insurance benefits effectively?

+

Effective communication is key. Provide clear and concise information about the insurance benefits you offer, including how to access and utilize them. Consider hosting educational workshops or webinars to ensure your employees understand their coverage and are empowered to make the most of their benefits.