How To Dispute Medical Bills With Insurance

Navigating the complexities of medical billing and insurance can be a daunting task, especially when unexpected charges or discrepancies arise. In this comprehensive guide, we will delve into the intricate process of disputing medical bills with insurance, providing you with the tools and knowledge to effectively advocate for yourself and ensure accurate billing practices.

Understanding Medical Billing and Insurance Claims

Before we delve into the dispute process, it’s crucial to grasp the fundamentals of medical billing and insurance claims. When you receive medical services, whether it’s a routine check-up or a complex procedure, the healthcare provider generates a bill detailing the services rendered. This bill is then submitted to your insurance company for processing.

The insurance company reviews the claim, verifying the accuracy of the services, their medical necessity, and the applicable coverage terms outlined in your insurance policy. If the claim meets the criteria, the insurance company reimburses the healthcare provider, often covering a portion of the total cost. You, as the policyholder, are responsible for the remaining amount, known as the patient responsibility or copay.

Identifying Billing Errors and Discrepancies

Despite the intricate processes involved, billing errors and discrepancies are not uncommon. It’s essential to carefully review your Explanation of Benefits (EOB) and any accompanying medical bills to identify potential issues. Common billing errors include:

- Duplicate Charges: You may notice identical charges for the same service on multiple occasions.

- Incorrect Codes: Healthcare providers use specific codes to describe services. Inaccurate or inappropriate coding can lead to incorrect billing.

- Charges for Unperformed Services: This occurs when you're billed for services you never received.

- Overcharging: Healthcare providers may charge more than the usual and customary rate for a particular service.

- Missing Insurance Coverage: Sometimes, the insurance company fails to apply the correct coverage benefits, resulting in higher patient responsibility.

Initiating the Dispute Process

If you identify any discrepancies or errors in your medical bills, it’s crucial to take immediate action. Here’s a step-by-step guide to initiating the dispute process:

Step 1: Gather Necessary Documentation

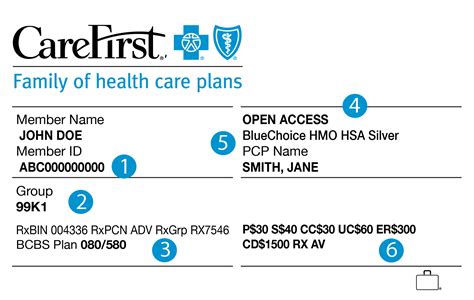

Collect all relevant documents, including your EOB, medical bills, and any correspondence from the healthcare provider or insurance company. Ensure you have a clear understanding of the services rendered, the associated charges, and the insurance coverage applied.

Step 2: Contact the Healthcare Provider

Reach out to the healthcare provider’s billing department and explain the issue. Provide specific details about the discrepancy, such as duplicate charges or incorrect codes. Request a review of the bill and ask for clarification or correction.

During this communication, remain calm and professional. Clearly articulate the problem and provide any supporting evidence or documentation you may have. Keep a record of your communication, including dates, times, and the names of the individuals you spoke with.

Step 3: Engage with Your Insurance Company

If the healthcare provider is unable to resolve the issue, it’s time to involve your insurance company. Contact their customer service department and explain the situation. Provide detailed information about the billing error and any supporting documentation.

The insurance company may request additional information or documentation to verify the claim. Cooperate fully and provide any necessary details to facilitate a thorough review. Remember, the insurance company is responsible for ensuring accurate billing and adherence to your policy's coverage terms.

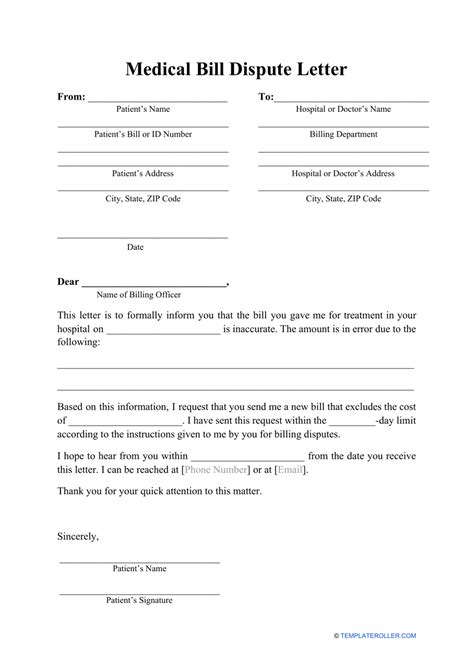

Step 4: Submit a Formal Dispute

If the initial communication with the healthcare provider and insurance company doesn’t yield a satisfactory resolution, it’s time to submit a formal dispute. Most insurance companies have established processes for handling billing disputes.

Follow the insurance company's guidelines for dispute submission, which typically involve completing a dispute form and providing supporting documentation. Clearly outline the reasons for the dispute and any evidence that supports your claim. Ensure your communication is concise, factual, and free of any personal biases.

Working with Healthcare Providers and Insurance Companies

Throughout the dispute process, it’s crucial to maintain open lines of communication with both the healthcare provider and the insurance company. Collaborate with them to resolve the issue efficiently and effectively. Here are some tips to enhance your interaction:

- Stay Organized: Keep a detailed record of all communication, including dates, times, and the names of individuals you interact with.

- Be Proactive: Don't wait for issues to escalate. Address billing discrepancies promptly to prevent further complications.

- Use Clear and Concise Language: When communicating, avoid jargon and technical terms that may be confusing. Use simple, straightforward language to ensure your message is understood.

- Provide Supporting Evidence: Whenever possible, back up your claims with concrete evidence, such as EOBs, medical records, or correspondence.

- Remain Professional: Maintain a respectful and professional tone throughout the process. Avoid accusatory language or personal attacks, as this may hinder a productive resolution.

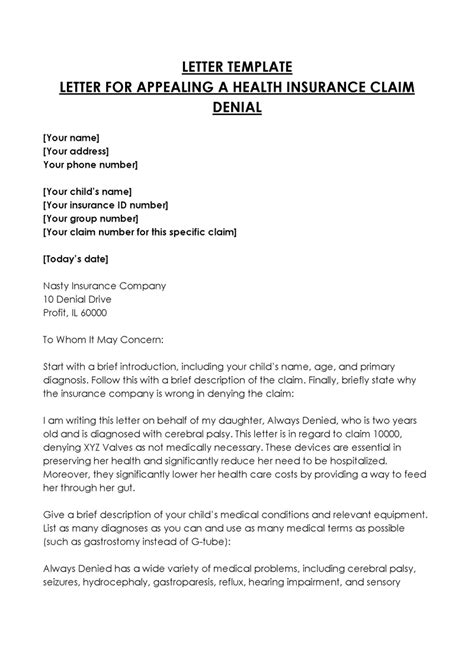

Appealing Insurance Denials

In some cases, the insurance company may deny your claim or only partially approve it. If you believe the denial was unjustified, you have the right to appeal the decision. The appeals process typically involves the following steps:

Step 1: Review the Denial Notice

Carefully examine the denial notice you receive from the insurance company. This notice should outline the reasons for the denial and provide specific details about the disputed claim.

Step 2: Gather Supporting Evidence

Collect any additional evidence or documentation that supports your appeal. This may include medical records, physician statements, or any other relevant information that demonstrates the necessity of the disputed service.

Step 3: Submit an Appeal

Follow the insurance company’s guidelines for submitting an appeal. Provide a detailed explanation of why you believe the denial was incorrect, along with any supporting evidence. Ensure your appeal is well-organized and clearly presents your case.

Step 4: Await the Appeal Decision

Once you’ve submitted your appeal, the insurance company will review the additional information and make a determination. They will typically provide a response within a specified timeframe, outlining their decision and the reasons for it.

Protecting Your Financial Well-being

Disputing medical bills with insurance is not only about resolving billing errors but also about safeguarding your financial health. Medical bills can be a significant financial burden, and inaccurate billing practices can exacerbate this burden. Here are some tips to protect your financial well-being during the dispute process:

- Understand Your Insurance Coverage: Familiarize yourself with your insurance policy's terms and conditions. Know the types of services covered, any applicable deductibles or copays, and the specific benefits you're entitled to.

- Monitor Your Bills: Regularly review your medical bills and EOBs. Identify any discrepancies early on to prevent potential financial surprises.

- Negotiate Payment Plans: If you're unable to pay the full amount owed, consider negotiating a payment plan with the healthcare provider. Many providers are willing to work with patients to establish manageable payment arrangements.

- Seek Financial Assistance: Some healthcare providers and organizations offer financial assistance programs for patients facing financial hardships. Explore these options to ease the financial burden.

Future Implications and Preventative Measures

Successfully disputing medical bills not only ensures accurate billing but also serves as a learning experience for future interactions with healthcare providers and insurance companies. Here are some key takeaways and preventative measures to consider:

- Maintain Detailed Records: Keep a comprehensive record of all medical services received, including dates, procedures, and associated costs. This will help you identify any discrepancies more easily.

- Review Your Policy Regularly: Familiarize yourself with your insurance policy's coverage terms and conditions. Understand any changes or updates that may impact your benefits.

- Communicate with Healthcare Providers: Establish open lines of communication with your healthcare providers. Discuss any concerns or questions about billing or services before receiving treatment.

- Advocate for Yourself: Don't hesitate to voice your concerns or seek clarification when dealing with billing issues. Remember, you have the right to accurate and fair billing practices.

By adopting these preventative measures and remaining vigilant, you can minimize the likelihood of billing errors and ensure a smoother experience when dealing with medical bills and insurance claims.

How long does the dispute process typically take?

+The duration of the dispute process can vary depending on the complexity of the issue and the responsiveness of the involved parties. In some cases, it may take several weeks or even months to reach a resolution. It’s essential to remain patient and proactive throughout the process.

What if the healthcare provider refuses to correct the billing error?

+If the healthcare provider is unwilling to rectify the billing error, you may need to escalate the issue to higher levels within the organization. Contact the provider’s patient advocate or ombudsman, who can assist in resolving complex billing disputes. Additionally, you can reach out to your state’s insurance department or consumer protection agency for guidance and support.

Can I seek legal assistance during the dispute process?

+While legal assistance is an option, it’s essential to explore other avenues first. Most billing disputes can be resolved through direct communication and collaboration with the healthcare provider and insurance company. However, if you believe your rights have been violated or the dispute is particularly complex, consulting with an attorney specializing in healthcare law may be beneficial.

Are there any time limits for submitting billing disputes?

+Yes, insurance companies and healthcare providers often have specific timeframes within which billing disputes must be submitted. These time limits vary depending on the organization and the nature of the dispute. It’s crucial to review the applicable policies and guidelines to ensure you meet the required deadlines.