Insurance Rates Motorcycle

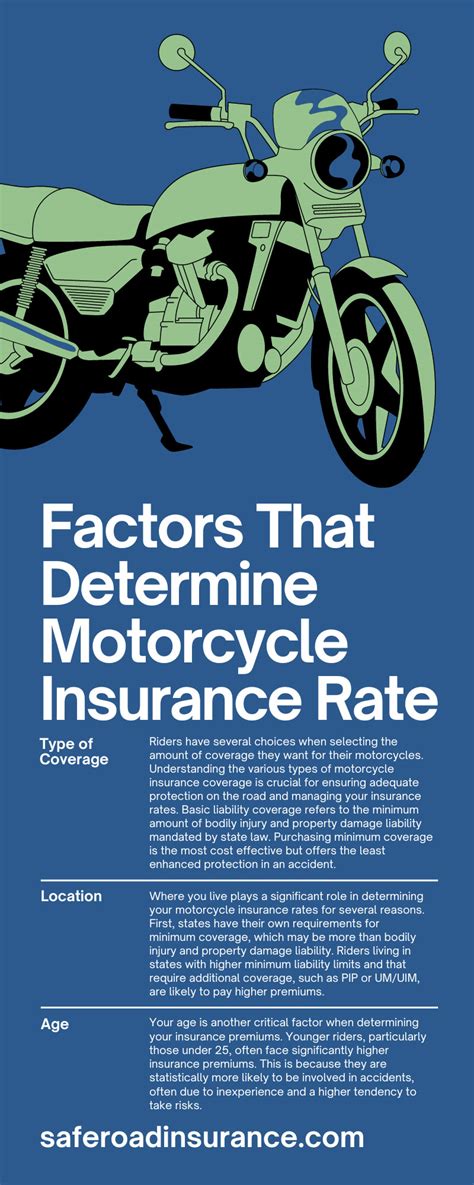

When it comes to insuring a motorcycle, many factors come into play that can impact the cost of your insurance premiums. Understanding these factors and how they affect your rates is crucial for any motorcycle enthusiast. In this comprehensive guide, we will delve into the world of motorcycle insurance, exploring the various aspects that influence insurance rates and providing you with valuable insights to navigate this complex topic.

The Complexity of Motorcycle Insurance Rates

Motorcycle insurance rates are influenced by a multitude of variables, making them more intricate than those for standard car insurance. From the type of bike you ride to your personal driving history, numerous factors contribute to the calculation of your insurance premiums. In this section, we will unravel the complexities of motorcycle insurance rates and shed light on the key elements that insurers consider.

Understanding Risk Assessment in Motorcycle Insurance

Insurance companies assess the risk associated with insuring a motorcycle by evaluating a range of criteria. This risk assessment process helps insurers determine the likelihood of accidents, claims, and potential losses. By understanding how these factors impact your insurance rates, you can make informed decisions to potentially lower your premiums.

One of the primary considerations in risk assessment is the type of motorcycle you ride. Different bike models and categories carry varying levels of risk. For instance, sports bikes with high-performance engines tend to attract higher insurance rates due to their association with speed and potentially aggressive riding styles. On the other hand, standard or cruiser-style motorcycles, known for their relaxed riding experience, often enjoy more favorable insurance rates.

| Motorcycle Type | Risk Level | Average Insurance Rate |

|---|---|---|

| Sports Bike | High | $1,200 - $1,800 annually |

| Standard/Cruiser | Moderate | $800 - $1,200 annually |

| Adventure/Dual-Sport | Moderate | $900 - $1,300 annually |

Another critical factor in risk assessment is your personal driving history. Insurance companies thoroughly examine your record to evaluate your safety as a rider. A clean driving history, free from accidents and traffic violations, is highly favorable and can lead to significant savings on your insurance premiums. Conversely, a history marked by accidents or traffic citations may result in higher insurance rates.

Impact of Personal Factors on Insurance Rates

Beyond the type of motorcycle and your driving history, personal factors also play a significant role in determining your insurance rates. These factors can vary widely and include your age, gender, and even your marital status.

Age is often a key consideration for insurance companies. Younger riders, typically between the ages of 16 and 25, are generally viewed as higher-risk due to their lack of experience on the road. As a result, insurance rates for younger riders tend to be substantially higher. However, as riders gain experience and reach more mature ages, their insurance rates often decrease, reflecting the reduced risk they pose to insurers.

| Age Group | Average Insurance Rate |

|---|---|

| 16-25 years | $1,500 - $2,500 annually |

| 26-40 years | $1,000 - $1,800 annually |

| 41+ years | $800 - $1,500 annually |

Gender is another factor that can influence insurance rates, albeit to a lesser extent. Statistical data suggests that male riders tend to be involved in more accidents and receive more traffic citations than female riders. As a result, insurance rates for male riders may be slightly higher compared to their female counterparts.

The Role of Coverage Options and Deductibles

When it comes to motorcycle insurance, the coverage options you choose and the deductibles you select can significantly impact your insurance rates. Understanding the relationship between these choices and your premiums is essential for making informed decisions about your motorcycle insurance coverage.

Choosing the Right Coverage for Your Needs

Motorcycle insurance coverage options vary, offering different levels of protection tailored to your specific needs. The coverage you choose will directly affect your insurance rates, so it’s crucial to select the right balance of coverage and cost. Here are some common coverage options and their potential impact on your rates:

- Liability Coverage: This is the most basic form of insurance, covering damages you cause to others' property or injuries you cause to others. While liability coverage is often the minimum required by law, it provides limited protection and may result in higher insurance rates if you opt for higher liability limits.

- Collision Coverage: Collision coverage protects your motorcycle in the event of an accident, regardless of fault. It covers repairs or replacements for your bike after a collision. This coverage can be more expensive but provides essential protection for your vehicle. The choice to include collision coverage in your policy will influence your insurance rates.

- Comprehensive Coverage: Comprehensive coverage goes beyond collision, protecting your bike from various non-accident-related incidents like theft, vandalism, or natural disasters. While it offers the most comprehensive protection, it also tends to be the most expensive coverage option.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have sufficient insurance coverage. It can be a valuable addition to your policy, especially in areas with high uninsured driver rates, but it may also increase your insurance premiums.

The Impact of Deductibles on Insurance Rates

Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance rates, as you’re taking on more financial responsibility in the event of a claim. However, it’s important to strike a balance, as a deductible that’s too high might leave you vulnerable if you need to make a claim.

| Deductible Amount | Average Insurance Rate |

|---|---|

| $250 | $1,100 - $1,300 annually |

| $500 | $1,000 - $1,200 annually |

| $1,000 | $900 - $1,100 annually |

Discounts and Strategies to Lower Insurance Rates

Navigating the world of motorcycle insurance rates can be challenging, but there are strategies and discounts available that can help you lower your insurance premiums. By understanding these options and taking advantage of them, you can potentially save a significant amount on your insurance costs.

Common Discounts Offered by Insurance Providers

Insurance companies often provide a range of discounts to incentivize safe riding practices and reward loyal customers. Here are some common discounts you may qualify for:

- Multi-Policy Discount: Many insurance providers offer discounts when you bundle your motorcycle insurance with other policies, such as car insurance or home insurance. This strategy can lead to substantial savings, so it's worth exploring if you have multiple insurance needs.

- Loyalty Discount: Staying with the same insurance provider for an extended period can earn you loyalty discounts. Insurance companies value long-term customers, so if you've maintained your policy with the same insurer for several years, you may be eligible for reduced rates.

- Safe Riding Discounts: Insurers often reward riders who demonstrate a commitment to safe riding practices. This can include discounts for completing a certified riding course, having a clean driving record, or even installing anti-theft devices on your motorcycle.

- Membership Discounts: Belonging to certain organizations or clubs, such as motorcycle associations or alumni groups, can unlock exclusive insurance discounts. These partnerships between insurance companies and specific organizations can result in lower rates for members.

Strategies to Lower Your Insurance Rates

In addition to taking advantage of available discounts, there are proactive strategies you can employ to potentially lower your insurance rates. Here are some effective approaches to consider:

- Shop Around and Compare Rates: Don't settle for the first insurance quote you receive. Take the time to shop around and compare rates from multiple insurance providers. Different companies may offer varying rates for the same level of coverage, so finding the best deal can save you money.

- Increase Your Deductible: As mentioned earlier, choosing a higher deductible can lower your insurance rates. However, it's essential to ensure that the increased deductible aligns with your financial capabilities and won't strain your budget if you need to make a claim.

- Improve Your Riding Skills: Investing in your riding skills through certified courses can not only make you a safer rider but also qualify you for insurance discounts. Many insurers offer incentives for riders who complete advanced riding training programs, recognizing the reduced risk these riders pose.

- Consider Coverage Adjustments: Review your coverage options regularly and make adjustments as needed. If your motorcycle's value has depreciated significantly, you may be overinsured and paying unnecessary premiums. Reevaluating your coverage and making informed decisions can help you save on insurance costs.

Conclusion

Understanding the factors that influence motorcycle insurance rates is essential for any rider. From the type of motorcycle you ride to your personal driving history and coverage choices, numerous variables come into play. By being aware of these factors and taking advantage of available discounts and strategies, you can navigate the complex world of motorcycle insurance with confidence and potentially lower your insurance premiums.

As you embark on your journey as a motorcycle enthusiast, remember that informed decisions about insurance coverage and costs are key to a smooth riding experience. Stay safe, stay informed, and enjoy the open road!

How much does motorcycle insurance typically cost?

+The cost of motorcycle insurance can vary widely based on various factors. On average, motorcycle insurance rates range from 800 to 1,500 annually. However, rates can be significantly higher or lower depending on factors such as the type of bike, the rider’s age and driving history, coverage options chosen, and the insurance provider.

Are there any ways to get cheap motorcycle insurance?

+Yes, there are several strategies to obtain affordable motorcycle insurance. These include shopping around for quotes from different insurers, increasing your deductible, taking advantage of available discounts (such as multi-policy or safe rider discounts), and maintaining a clean driving record. Additionally, considering coverage adjustments and regularly reviewing your policy can help you find the best value for your insurance needs.

What factors influence the cost of motorcycle insurance the most?

+The cost of motorcycle insurance is influenced by a combination of factors. The type of motorcycle you ride, your age, gender, and driving history are among the most significant factors. Other considerations include the coverage options you choose, the deductibles you select, and the insurance provider you choose to work with. Each of these factors can impact your insurance rates differently, so it’s important to carefully consider all aspects when obtaining a motorcycle insurance policy.