Insurance Quote Nationwide

Obtaining an insurance quote is a crucial step for individuals and businesses alike when it comes to securing the right coverage for their needs. In this comprehensive guide, we will delve into the process of acquiring an insurance quote from Nationwide, a leading insurance provider in the United States. With a focus on providing valuable insights and an expert perspective, we aim to empower readers with the knowledge to make informed decisions regarding their insurance coverage.

Understanding the Insurance Quote Process with Nationwide

Nationwide, a trusted name in the insurance industry, offers a wide range of insurance products, including auto, home, life, and business insurance. The process of obtaining a quote from Nationwide is designed to be efficient and tailored to the specific needs of each individual or business. Let’s explore the key steps and considerations involved in acquiring an insurance quote from this renowned provider.

1. Identifying Your Insurance Needs

Before requesting a quote, it’s essential to have a clear understanding of your insurance requirements. Consider the following factors:

- Type of Insurance: Determine whether you need auto, home, life, or business insurance. Each type of insurance serves a unique purpose and covers specific risks.

- Coverage Amounts: Assess the level of coverage you require. For example, in auto insurance, consider the value of your vehicle and the extent of coverage you desire for liabilities, collision, and comprehensive protection.

- Additional Coverages: Explore optional coverages that may be beneficial for your situation. Nationwide offers various endorsements and riders to customize your policy.

2. Gathering Relevant Information

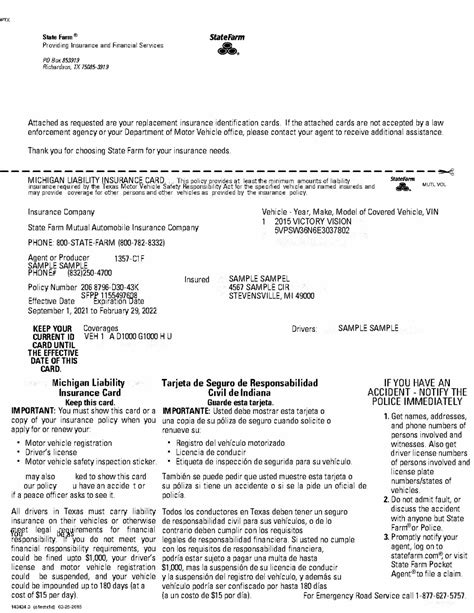

To obtain an accurate quote, Nationwide will require specific information about you, your assets, and your insurance history. Here’s a checklist of the key details you should have ready:

- Personal Information: Your full name, date of birth, and contact details.

- Vehicle Details: If seeking auto insurance, provide make, model, year, and VIN (Vehicle Identification Number) of your vehicle(s). Also, share information about any modifications or special equipment.

- Home Information: For home insurance quotes, have the address, square footage, and details about the structure and contents of your home.

- Insurance History: Provide details about your existing or previous insurance policies, including coverage amounts and any claims made.

- Additional Factors: Depending on the type of insurance, you may need to provide information about your driving record, credit score, or business operations.

3. Exploring Quote Options

Nationwide offers multiple channels through which you can request a quote. Here are the primary methods:

- Online Quote: Visit Nationwide’s official website and navigate to the “Get a Quote” section. Follow the prompts to input your information and receive an instant quote. This method is convenient and provides a quick estimate.

- Phone Quote: Call Nationwide’s customer service hotline and speak with a representative. They will guide you through the quoting process and provide personalized assistance.

- Agent Quote: Connect with a Nationwide insurance agent in your area. An agent can provide expert advice and help you tailor a policy to your specific needs. They can also assist with any complex coverage requirements.

4. Customizing Your Quote

Once you receive your initial quote, it’s essential to review it carefully and consider whether it aligns with your needs. Here are some steps to customize your quote:

- Compare Coverage Options: Review the different coverage limits and deductibles offered in your quote. Discuss with a Nationwide representative or agent to understand the implications of each option.

- Explore Discounts: Nationwide offers various discounts, such as multi-policy discounts, safe driver discounts, and loyalty rewards. Ensure you’re taking advantage of all applicable discounts to reduce your premium.

- Consider Endorsements: If your quote doesn’t cover specific risks or needs, explore Nationwide’s range of endorsements and riders. These add-ons can provide tailored coverage for unique situations.

5. Reviewing and Finalizing Your Quote

Before finalizing your insurance policy with Nationwide, take the time to review the quote and policy documents thoroughly. Here’s what to consider:

- Coverage Details: Ensure that the coverage limits, deductibles, and policy terms match your expectations and needs.

- Premium Amount: Understand the breakdown of your premium, including any applicable discounts. Confirm that the premium is within your budget and aligns with the coverage provided.

- Policy Exclusions: Carefully read through the policy exclusions to ensure you’re aware of any situations or risks not covered by the policy.

6. Managing Your Policy with Nationwide

Once you’ve finalized your insurance policy with Nationwide, you’ll have access to their suite of policy management tools and resources. Here’s a glimpse of what you can expect:

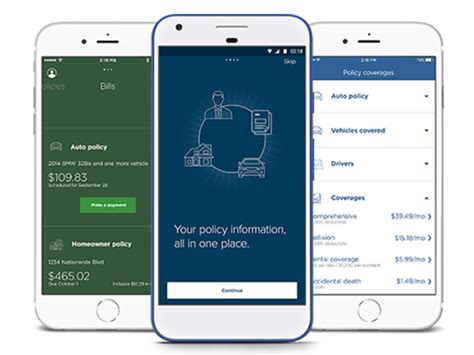

- Online Account Management: Create an online account with Nationwide to manage your policy, make payments, and access important documents.

- Mobile App: Download the Nationwide mobile app for convenient access to your policy information and to file claims quickly.

- Claims Support: In the event of a claim, Nationwide provides dedicated claims support to guide you through the process. You can report claims online, via phone, or through the mobile app.

- Policy Reviews: Regularly review your policy with your Nationwide representative or agent to ensure it continues to meet your changing needs. This is especially important if you experience significant life events or changes in your assets.

Frequently Asked Questions

How long does it take to receive a quote from Nationwide?

+The time it takes to receive a quote from Nationwide varies depending on the method you choose. Online quotes are typically available instantly, while quotes obtained through a phone call or an agent may take a few hours to a day to process.

Can I customize my insurance policy after receiving the quote?

+Absolutely! Nationwide offers a high degree of flexibility in customizing your insurance policy. Whether you want to adjust coverage limits, add endorsements, or explore different deductibles, you can work with a representative or agent to tailor the policy to your needs.

What factors influence the cost of my insurance premium with Nationwide?

+The cost of your insurance premium with Nationwide is influenced by a variety of factors, including the type of insurance, your coverage limits, deductibles, discounts applied, and your personal circumstances (e.g., driving record, credit score, or business operations). Nationwide offers competitive rates and various discounts to help keep premiums affordable.

Can I bundle multiple insurance policies with Nationwide to save money?

+Yes, bundling multiple insurance policies with Nationwide is an excellent way to save money. By combining policies like auto and home insurance, or business and life insurance, you can often qualify for significant multi-policy discounts. Nationwide encourages policyholders to explore bundling options to maximize their savings.

How can I make a claim with Nationwide if I have an accident or loss?

+If you experience an accident or loss covered by your Nationwide insurance policy, you can file a claim through their online portal, by calling their dedicated claims hotline, or by contacting your local Nationwide agent. They provide comprehensive support throughout the claims process to ensure a smooth and timely resolution.

Acquiring an insurance quote from Nationwide is a straightforward process that empowers you to take control of your insurance needs. By understanding your requirements, gathering relevant information, and exploring the various quote options, you can obtain a quote that aligns with your specific circumstances. Remember to review and customize your quote, taking advantage of Nationwide’s range of coverage options and discounts. With their expert guidance and support, you can make informed decisions and secure the right insurance coverage for your peace of mind.