Insurance Prudential

Welcome to a comprehensive exploration of Insurance Prudential, a renowned name in the insurance industry. This article delves into the depths of Prudential's journey, its key offerings, and the impact it has had on the financial landscape. As we navigate through the sections, you'll discover the intricate details that make Prudential a trusted partner for millions worldwide.

Unveiling Insurance Prudential: A Legacy of Financial Protection

Insurance Prudential, often simply referred to as Prudential, is a global leader in the insurance and financial services sector. With a rich history spanning over a century, Prudential has solidified its position as a beacon of reliability and innovation.

Headquartered in London, United Kingdom, Prudential operates across the globe, offering a diverse range of insurance and investment products. The company's journey began in 1848, founded with a vision to provide financial security and peace of mind to individuals and families.

Over the years, Prudential has expanded its reach, acquiring notable companies and establishing a strong presence in key markets. Today, it boasts a comprehensive portfolio of products, catering to various financial needs and aspirations.

Key Offerings and Services

Prudential’s suite of insurance products is extensive and tailored to meet diverse requirements. Here’s a glimpse into some of their flagship offerings:

- Life Insurance: Prudential's life insurance plans provide financial protection in the event of death or terminal illness. These policies offer peace of mind to policyholders and their families, ensuring financial stability during difficult times.

- Health Insurance: With a focus on holistic well-being, Prudential's health insurance plans cover a wide range of medical expenses, including hospitalization, surgeries, and long-term care. The company aims to promote access to quality healthcare services.

- Investment Products: Prudential's investment portfolio includes a range of options, such as mutual funds, unit trusts, and retirement plans. These products enable individuals to grow their wealth and plan for the future.

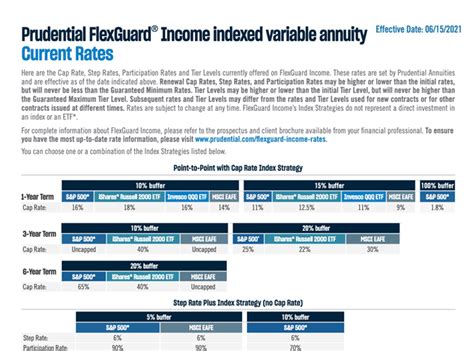

- Annuities and Retirement Solutions: Recognizing the importance of retirement planning, Prudential offers annuities and pension products. These solutions provide a steady income stream during retirement, ensuring financial independence.

- Travel and Personal Insurance: Prudential's travel insurance policies offer coverage for unexpected events during journeys, while their personal insurance products protect against various risks, including property damage and liability.

Innovation and Digital Transformation

Prudential has embraced digital transformation, leveraging technology to enhance its services and customer experience. The company has invested in developing user-friendly digital platforms, enabling customers to access their policies, make claims, and manage their finances with ease.

Prudential's online presence has revolutionized the insurance landscape, making it more accessible and convenient for individuals to obtain the coverage they need. The company's mobile apps and online portals provide real-time policy information and allow for quick and efficient claim settlements.

| Key Metrics | Values |

|---|---|

| Total Assets Under Management | $750 billion (as of 2022) |

| Number of Customers | 25 million (globally) |

| Employees Worldwide | 30,000 (as of 2023) |

| Countries of Operation | Over 40 countries |

Social Impact and Corporate Responsibility

Beyond its financial offerings, Prudential has demonstrated a strong commitment to social impact and corporate responsibility. The company actively engages in initiatives aimed at fostering financial literacy, promoting sustainable practices, and supporting communities in need.

Prudential's corporate social responsibility programs focus on education, environmental conservation, and community development. Through partnerships with various organizations, the company strives to make a positive difference in the lives of individuals and communities it serves.

Performance and Recognition

Prudential’s success and impact on the insurance industry have been widely recognized. The company has consistently ranked among the top insurers globally, receiving accolades for its financial strength, customer satisfaction, and innovative approaches.

Several reputable rating agencies, including Standard & Poor's and Moody's, have bestowed high ratings upon Prudential, affirming its financial stability and sound business practices. These ratings reflect Prudential's ability to deliver on its promises and provide long-term value to its stakeholders.

The Future of Insurance Prudential: Navigating Challenges and Opportunities

As the insurance industry evolves, Prudential finds itself at the forefront, navigating a landscape shaped by technological advancements, changing consumer preferences, and global economic shifts.

Embracing Technological Advancements

Prudential recognizes the potential of emerging technologies such as artificial intelligence, blockchain, and data analytics. The company is investing in these areas to enhance its operational efficiency, improve risk assessment, and personalize its product offerings.

By leveraging technology, Prudential aims to stay ahead of the curve, offering innovative solutions that meet the evolving needs of its customers. This includes developing smart insurance products, optimizing claims processes, and providing data-driven insights to policyholders.

Expanding Global Presence

Prudential’s global expansion strategy continues to be a key focus. The company aims to strengthen its presence in emerging markets, particularly in Asia, where the insurance industry is experiencing rapid growth.

By entering new markets and partnering with local entities, Prudential seeks to tap into untapped potential, offer its comprehensive suite of products, and provide financial protection to a broader range of individuals.

Addressing Industry Challenges

Like any industry, the insurance sector faces its share of challenges. Prudential is proactive in addressing these challenges, including regulatory compliance, cybersecurity risks, and changing customer expectations.

The company's robust compliance framework ensures adherence to evolving regulatory standards, while its cybersecurity measures protect customer data and prevent fraud. Additionally, Prudential actively listens to customer feedback and adapts its products and services to meet evolving needs and preferences.

Conclusion: Insurance Prudential’s Enduring Legacy

Insurance Prudential’s journey from a humble beginning to a global leader in insurance and financial services is a testament to its unwavering commitment to financial protection and innovation. With a rich history, a diverse range of products, and a focus on digital transformation, Prudential continues to shape the insurance landscape.

As Prudential navigates the future, its ability to adapt, embrace technology, and maintain its core values of reliability and customer centricity will be key to its continued success. The company's impact on the financial well-being of individuals and communities worldwide is undeniable, and its legacy is one that will endure for generations to come.

How does Prudential ensure the security of customer data?

+Prudential employs advanced cybersecurity measures, including encryption protocols, secure data storage, and regular security audits. The company also educates its employees on data protection best practices to safeguard customer information.

What are some of Prudential’s sustainability initiatives?

+Prudential has committed to reducing its environmental impact through initiatives like carbon footprint reduction, sustainable investment practices, and promoting eco-friendly office spaces. The company aims to be a leader in sustainable business practices.

How does Prudential support financial literacy among its customers?

+Prudential offers educational resources, workshops, and online tools to empower customers with financial knowledge. These initiatives aim to help individuals make informed decisions about their insurance and investment choices.