How Much Is Car Insurance Monthly

Unveiling the Costs: Exploring Monthly Car Insurance Rates

Car insurance is an essential financial consideration for every vehicle owner. Understanding the monthly costs associated with this coverage is crucial for budgeting and financial planning. In this comprehensive article, we delve into the factors influencing car insurance premiums, explore average monthly rates, and provide insights into optimizing your insurance costs.

The Complex Web of Car Insurance Premiums

Car insurance premiums are calculated based on a intricate combination of factors, each playing a unique role in determining the overall cost. Here’s a breakdown of the key elements:

Vehicle Type and Age: The make, model, and age of your vehicle significantly impact insurance rates. Newer, luxury vehicles often come with higher premiums due to their expensive repair costs.

Coverage Level: The extent of coverage you opt for directly affects your monthly premiums. Comprehensive and collision coverage, while offering broader protection, typically come at a higher cost.

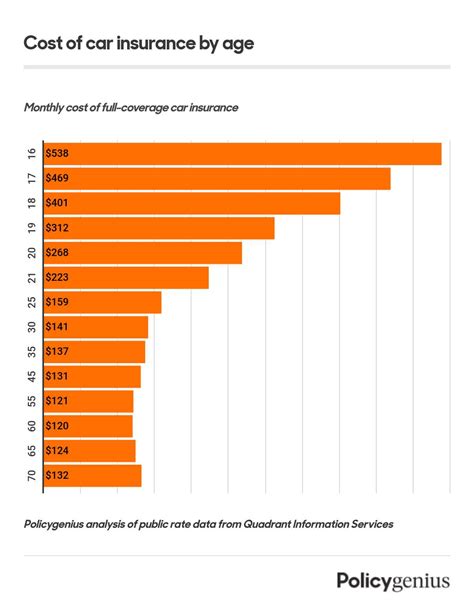

Driver Profile: Your age, gender, driving record, and years of experience all contribute to your insurance premium. Younger drivers and those with a history of accidents or traffic violations often face higher rates.

Location and Usage: The area where you reside and the purpose for which you use your vehicle also influence premiums. Urban areas with higher traffic density and accident rates generally result in higher insurance costs.

Insurance Company and Policy Terms: Different insurance providers offer varying rates and policy options. The specific terms and conditions of your policy, such as deductibles and coverage limits, can greatly impact your monthly payments.

Unraveling Average Monthly Car Insurance Costs

According to recent industry data, the average monthly cost of car insurance in the United States varies significantly across states and can range from 50 to 200. However, it’s essential to note that these averages provide a general guideline and individual circumstances can greatly affect your personal insurance rates.

To illustrate, let’s examine some real-world examples:

| State | Average Monthly Premium |

|---|---|

| California | $120 |

| New York | $180 |

| Texas | $85 |

| Florida | $150 |

| Washington | $95 |

These figures highlight the variability in insurance costs across different states. Factors such as traffic density, accident rates, and state-specific regulations contribute to these differences.

Optimizing Your Car Insurance Costs

While insurance premiums are influenced by various factors beyond your control, there are strategic steps you can take to potentially reduce your monthly costs:

Shop Around: Compare quotes from multiple insurance providers. Each company has its own rating system, and you may find significant variations in premiums for similar coverage.

Bundling Policies: Insuring multiple vehicles or combining car insurance with other policies, such as home or renters insurance, can often lead to discounted rates.

Safe Driving Practices: Maintaining a clean driving record by avoiding accidents and traffic violations can result in lower insurance premiums over time.

Consider Deductibles: Opting for higher deductibles can reduce your monthly premiums, but it’s important to ensure you can afford the deductible in the event of a claim.

Review Coverage: Regularly assess your insurance coverage to ensure it aligns with your current needs. Over time, your circumstances may change, and you might be able to reduce coverage for certain aspects, leading to cost savings.

The Future of Car Insurance Premiums

The landscape of car insurance is continually evolving, influenced by technological advancements and changing consumer behaviors. Here’s a glimpse into the potential future implications:

Telematics and Usage-Based Insurance: With the rise of telematics and usage-based insurance, drivers can provide real-time data on their driving habits, allowing for more accurate premium calculations. This could lead to fairer rates based on individual driving patterns.

Autonomous Vehicles: As self-driving technology advances, it may reduce accident rates, leading to lower insurance costs over time. However, the initial introduction of autonomous vehicles could present unique challenges and potential increased premiums.

Data Analytics: Insurance companies are increasingly leveraging advanced data analytics to assess risk more accurately. This could result in more precise premium calculations, potentially benefiting low-risk drivers.

Conclusion: A Comprehensive Understanding of Car Insurance Costs

Understanding the factors that influence car insurance premiums and exploring average monthly rates provides a solid foundation for making informed decisions about your coverage. By staying informed, comparing quotes, and implementing strategic cost-saving measures, you can navigate the complex world of car insurance with confidence.

Remember, your specific circumstances and the unique characteristics of your vehicle and driving profile will ultimately determine your personal insurance costs. Stay proactive, and you’ll be well-equipped to find the right coverage at a price that suits your budget.

FAQ Section

How often should I review my car insurance policy?

+

It’s advisable to review your car insurance policy annually or whenever you experience significant life changes, such as getting married, buying a new car, or moving to a new location. Regular reviews ensure your coverage remains adequate and aligned with your current needs.

Can I negotiate car insurance premiums with my provider?

+

While insurance premiums are largely determined by standardized formulas, it’s worth discussing your options with your provider. They may offer discounts for loyalty, safe driving records, or other qualifying factors. Don’t hesitate to inquire about potential savings opportunities.

What factors can lead to an increase in my car insurance premiums?

+

Several factors can lead to premium increases, including getting into accidents, receiving traffic violations, or filing insurance claims. Additionally, changes in your personal circumstances, such as adding a young driver to your policy or relocating to a high-risk area, can impact your rates.

Are there any government programs or initiatives to reduce car insurance costs for specific demographics?

+

Some states offer government-backed programs or initiatives aimed at reducing car insurance costs for specific demographics, such as low-income individuals or those with a history of accidents. It’s worth exploring these options to see if you qualify for any financial assistance or discounted rates.

How can I ensure I’m getting the best value for my car insurance premium?

+

To ensure you’re getting the best value, compare quotes from multiple providers, review your coverage annually, and consider bundling policies to take advantage of potential discounts. Additionally, maintain a clean driving record and explore safe driver discounts or other incentives offered by insurance companies.