Calculate Insurance

Insurance is an essential aspect of modern life, providing financial protection and security to individuals, families, and businesses. The process of calculating insurance, also known as insurance underwriting, is a complex and intricate task that involves assessing risks, evaluating factors, and determining premiums. In this comprehensive guide, we will delve into the world of insurance calculations, exploring the various components, methodologies, and considerations involved in determining insurance costs.

Understanding Insurance Calculations

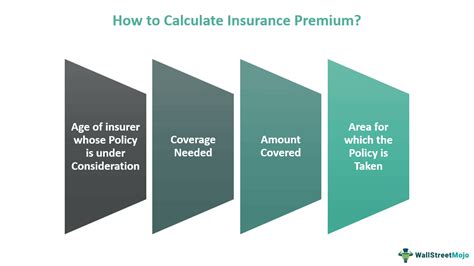

Insurance calculations serve as the foundation for establishing insurance premiums. These calculations take into account a multitude of factors to assess the level of risk associated with insuring an individual or entity. The goal is to strike a balance between providing adequate coverage and ensuring the insurer can maintain profitability. Let’s explore the key elements involved in insurance calculations.

Risk Assessment and Factors

Risk assessment is a critical component of insurance calculations. Insurers evaluate a range of factors to determine the likelihood of a claim occurring and the potential cost associated with it. These factors can vary depending on the type of insurance and the specific risks involved. Here are some common factors considered in risk assessment:

- Age and Health: In health and life insurance, the age and health status of the insured person play a significant role. Older individuals or those with pre-existing medical conditions may face higher premiums due to the increased likelihood of claims.

- Location and Environment: Property and casualty insurance often consider the location of the insured property. Factors like natural disasters, crime rates, and proximity to fire stations can influence the risk assessment.

- Occupation and Hobbies: Certain occupations or hobbies carry higher risks. For example, individuals working in high-risk jobs or engaging in extreme sports may face higher insurance premiums.

- Driving Record: Auto insurance companies assess the driving record of policyholders. A history of accidents or traffic violations can result in higher premiums.

- Claims History: Previous claims made by the insured person can impact future premiums. Frequent claims may indicate a higher risk profile.

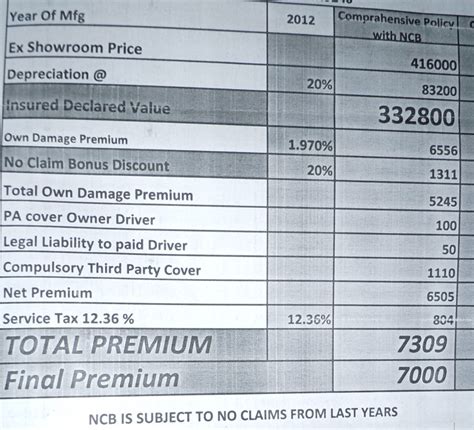

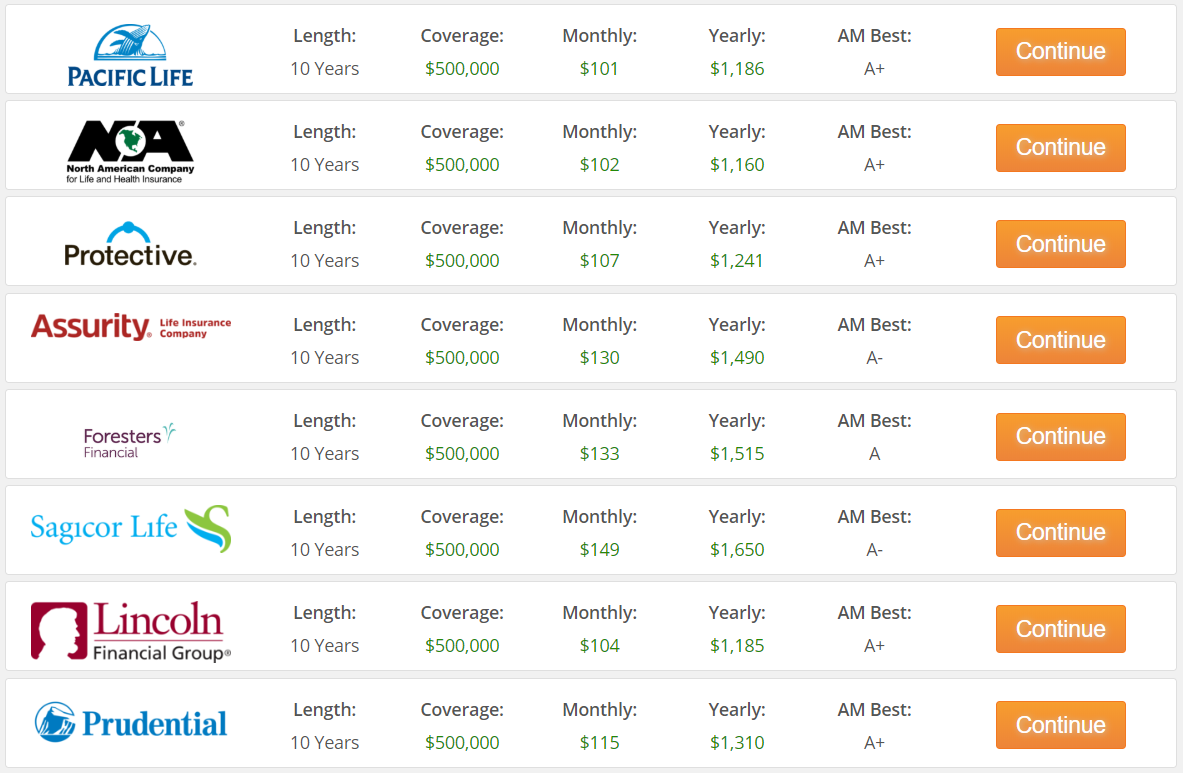

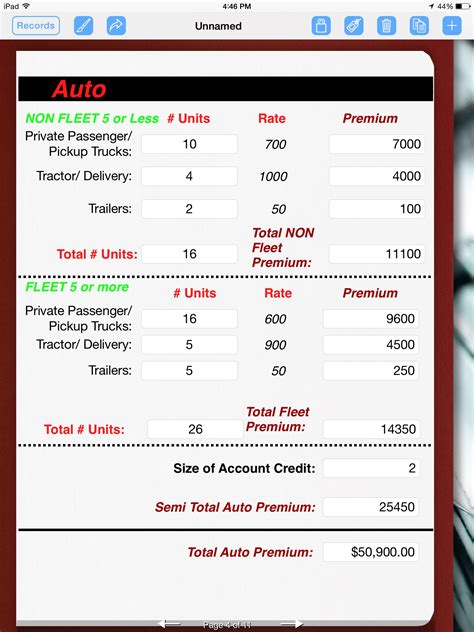

Premium Calculation Methods

Once the risk assessment is complete, insurers employ various methods to calculate premiums. The chosen method depends on the type of insurance and the insurer’s policies. Here are some common approaches:

- Actuarial Models: Actuaries play a crucial role in insurance calculations. They use mathematical models and statistical techniques to predict the likelihood and cost of future claims. These models consider historical data and industry trends.

- Rate Classes: Insurers often categorize policyholders into rate classes based on their risk profiles. These classes are determined by factors such as age, location, occupation, and driving record. Each rate class is associated with a specific premium.

- Experience Rating: In commercial insurance, insurers may use experience rating to calculate premiums. This method takes into account the insured entity's past claims experience and industry-specific factors.

- Loss Ratio Analysis: Insurers analyze their loss ratios, which represent the ratio of claims paid out to premiums earned. A high loss ratio may indicate higher premiums to maintain profitability.

Adjustments and Discounts

Insurance calculations are not solely based on risk assessment and premium determination. Insurers may offer adjustments and discounts to policyholders to encourage certain behaviors or promote safety. Here are some common adjustments and discounts:

- Multi-Policy Discounts: Insurers often provide discounts when policyholders bundle multiple insurance policies, such as auto and home insurance, with the same company.

- Safe Driver Discounts: Auto insurance companies may offer discounts to drivers with clean driving records or those who complete defensive driving courses.

- Security System Discounts: Homeowners with security systems or fire alarms may be eligible for discounts on their property insurance.

- Good Student Discounts: Young drivers with good academic records may receive discounts on their auto insurance policies.

The Role of Technology in Insurance Calculations

Advancements in technology have revolutionized the insurance industry, particularly in the realm of calculations. Insurers now leverage data analytics, artificial intelligence (AI), and machine learning algorithms to enhance the accuracy and efficiency of insurance calculations.

Data Analytics and Predictive Modeling

Data analytics plays a vital role in insurance calculations. Insurers collect and analyze vast amounts of data to identify patterns, trends, and correlations. By applying predictive modeling techniques, they can forecast future claims and assess risks more accurately. This enables insurers to make data-driven decisions and improve their underwriting processes.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms have transformed the way insurers calculate premiums. These technologies can process and analyze large datasets, identify complex patterns, and make real-time adjustments to premiums based on changing risk factors. AI-powered chatbots and virtual assistants also enhance the customer experience by providing instant quotes and personalized recommendations.

Telematics and Usage-Based Insurance

In the auto insurance industry, telematics technology has gained popularity. Telematics devices installed in vehicles collect real-time driving data, such as speed, acceleration, and braking patterns. This data is then used to calculate premiums based on individual driving behavior. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive, offers policyholders the opportunity to pay premiums based on their actual driving habits, encouraging safer driving practices.

The Future of Insurance Calculations

As technology continues to advance, the future of insurance calculations holds exciting possibilities. Insurers are exploring innovative approaches to enhance risk assessment and premium calculation methods.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize insurance calculations. Smart contracts, self-executing contracts with predefined rules, can automate various aspects of insurance processes, including risk assessment and premium calculations. Blockchain’s decentralized nature ensures transparency and security, reducing the risk of fraud and enhancing trust between insurers and policyholders.

Personalized Insurance

The concept of personalized insurance is gaining traction, where insurance policies are tailored to the unique needs and circumstances of each individual. By leveraging advanced analytics and AI, insurers can offer customized coverage options, allowing policyholders to select the specific risks they want to insure against. This level of personalization provides greater flexibility and control for consumers.

Risk Mitigation and Prevention

Insurance calculations are not solely focused on assessing risks but also on mitigating and preventing them. Insurers are investing in risk management strategies and innovative technologies to reduce the likelihood of claims. For example, insurers may collaborate with healthcare providers to promote preventive care, offering incentives for policyholders to adopt healthier lifestyles.

| Insurance Type | Key Factors in Calculations |

|---|---|

| Health Insurance | Age, pre-existing conditions, family history, lifestyle factors |

| Life Insurance | Age, health status, occupation, family history, tobacco use |

| Auto Insurance | Driving record, vehicle type, location, claims history, credit score |

| Homeowners Insurance | Location, construction type, age of property, claims history, security features |

| Commercial Insurance | Industry, size of business, claims history, risk management practices |

Frequently Asked Questions

How often are insurance premiums recalculated?

+Insurance premiums are typically recalculated annually or when policyholders make significant changes to their coverage or personal circumstances. Factors like age, health status, and driving record can trigger premium adjustments.

Can insurance companies deny coverage based on risk assessment?

+Insurance companies have the right to assess risks and determine whether to offer coverage. In some cases, high-risk individuals or entities may face higher premiums or even be denied coverage if the insurer deems the risk too significant.

Are there any factors that can lower my insurance premiums?

+Yes, certain factors can lead to lower insurance premiums. These include having a clean driving record, installing security systems, maintaining a healthy lifestyle (for health insurance), and implementing risk management practices in business (for commercial insurance). Additionally, taking advantage of discounts and bundle deals can reduce premiums.

How accurate are insurance calculations, especially with the use of technology?

+Insurance calculations have become increasingly accurate with the integration of technology. Advanced analytics, AI, and machine learning algorithms enable insurers to process vast amounts of data and make more precise predictions. However, it’s important to note that calculations are based on historical data and assumptions, and future events may still impact the accuracy of predictions.