Insurance Login

In today's digital age, insurance companies have embraced online platforms to enhance customer experience and streamline their operations. One crucial aspect of this digital transformation is the implementation of secure and user-friendly login systems. Insurance Login is a critical component, ensuring that policyholders, agents, and other authorized users can access their accounts and essential information securely and efficiently.

This article delves into the world of Insurance Login, exploring its significance, the challenges it addresses, and the innovative solutions employed by insurance providers. We will uncover the latest trends, best practices, and industry insights, providing a comprehensive guide to understanding and optimizing Insurance Login experiences.

The Evolution of Insurance Login

Insurance Login has come a long way from its traditional paper-based systems. With the advent of technology, insurance companies recognized the need to modernize their operations and offer convenient digital services to their customers. The evolution of Insurance Login can be traced through several key phases, each bringing significant improvements to the user experience.

Phase 1: Basic Online Portals

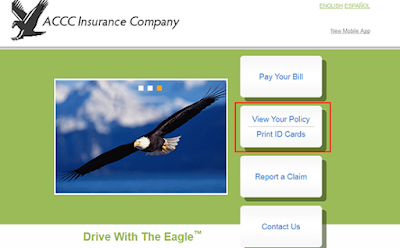

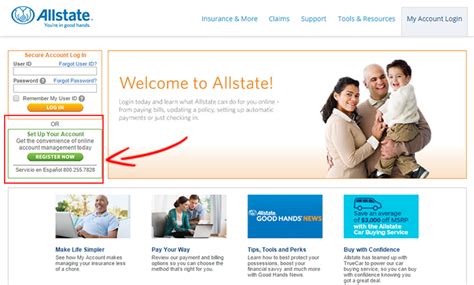

The initial foray into Insurance Login involved the creation of basic online portals. These early platforms allowed policyholders to access their policy details, make payments, and perform simple tasks like updating personal information. While a step forward, these portals lacked the sophistication and security features expected in today’s digital landscape.

Challenges during this phase included limited functionality, cumbersome navigation, and basic security measures that often failed to meet modern standards. Additionally, the lack of personalized experiences and self-service options left much to be desired for tech-savvy customers.

Phase 2: Enhanced Security and Personalization

As the insurance industry recognized the importance of data security and customer satisfaction, efforts were made to enhance the Insurance Login experience. This phase witnessed the implementation of robust security protocols, including two-factor authentication, encryption technologies, and biometric authentication methods.

Personalization became a key focus, with insurance companies striving to create tailored experiences for each user. This involved the development of intuitive dashboards, customized recommendations, and easy-to-use interfaces that adapted to individual preferences. The goal was to make Insurance Login not just secure but also user-friendly and engaging.

Phase 3: Integration and Innovation

The current phase of Insurance Login evolution is characterized by integration and innovation. Insurance providers are now leveraging advanced technologies such as artificial intelligence, machine learning, and blockchain to revolutionize the login process.

AI-powered chatbots and virtual assistants are being deployed to offer instant support and guidance, enhancing the overall user experience. Machine learning algorithms analyze user behavior and preferences, enabling insurance companies to provide highly personalized services and recommendations. Additionally, blockchain technology is being explored to ensure secure and transparent data sharing, further bolstering the security aspects of Insurance Login.

Addressing Challenges: Security, Convenience, and Accessibility

Insurance Login faces a unique set of challenges that insurance providers must address to ensure a seamless and secure user experience.

Security Concerns

With the increasing frequency and sophistication of cyber attacks, ensuring the security of user data and login credentials is paramount. Insurance companies invest heavily in cybersecurity measures, employing advanced encryption techniques, secure tokenization, and continuous monitoring to protect against potential threats.

Furthermore, insurance providers are adopting decentralized identity management systems, leveraging blockchain technology to create a secure and tamper-proof environment for user authentication and data storage.

Convenience and User Experience

While security is crucial, insurance companies must also prioritize convenience and user experience. Insurance Login platforms should be designed with ease of use in mind, offering intuitive navigation, clear call-to-actions, and a seamless journey from login to desired services.

Mobile optimization is a key consideration, as an increasing number of users access insurance services through their smartphones and tablets. Responsive design and mobile-friendly features ensure a consistent and positive user experience across various devices.

Accessibility for All

Insurance providers have a responsibility to ensure that their Insurance Login platforms are accessible to all users, including those with disabilities. This involves implementing accessibility standards, such as WCAG (Web Content Accessibility Guidelines), to make the login process inclusive and user-friendly for everyone.

Features like keyboard navigation, screen reader compatibility, and alternative text for images enhance the accessibility of Insurance Login platforms, ensuring that individuals with visual, auditory, or motor impairments can access their insurance accounts without barriers.

Industry Best Practices and Innovations

The insurance industry is constantly innovating to stay ahead of the curve and offer the best possible Insurance Login experiences. Here are some notable best practices and innovative solutions employed by leading insurance providers.

Passwordless Authentication

Passwordless authentication is gaining traction as a secure and convenient alternative to traditional password-based systems. Insurance companies are adopting passwordless methods such as one-time passwords (OTP) sent via SMS or email, as well as biometric authentication using facial recognition or fingerprint scanning.

By eliminating the need for complex passwords, insurance providers reduce the risk of password-related security breaches and enhance the overall login experience for users.

Single Sign-On (SSO)

Single Sign-On (SSO) is a widely adopted practice in the insurance industry, offering users a seamless experience by allowing them to access multiple insurance-related services with a single login. SSO eliminates the need for users to remember multiple passwords and navigate through different login screens, improving efficiency and reducing friction.

Risk-Based Authentication

Risk-based authentication is an intelligent approach to login security, where the authentication requirements are dynamically adjusted based on the perceived risk associated with a particular login attempt. This adaptive approach ensures that high-risk situations trigger additional security measures, such as multi-factor authentication, while low-risk scenarios provide a more streamlined login experience.

AI-Powered Personalization

Artificial intelligence plays a significant role in personalizing the Insurance Login experience. AI algorithms analyze user behavior, preferences, and historical data to offer tailored recommendations and services. This level of personalization enhances user engagement and satisfaction, fostering long-term customer loyalty.

Performance Analysis and Future Implications

Insurance Login performance is a critical aspect that insurance providers must continually analyze and optimize. Here’s a breakdown of key performance metrics and their implications for the future.

Login Success Rate

The login success rate measures the percentage of successful login attempts by users. A high success rate indicates a seamless and user-friendly login process, while a low success rate suggests areas for improvement, such as simplifying the login process or enhancing security measures.

Average Login Time

Measuring the average time it takes for users to complete the login process provides insights into the efficiency of the Insurance Login platform. A quick average login time is indicative of a well-optimized system, while prolonged login times may point to bottlenecks or areas where the user experience can be enhanced.

User Satisfaction Surveys

Conducting user satisfaction surveys provides valuable feedback on the overall Insurance Login experience. By gathering feedback from users, insurance providers can identify pain points, uncover areas for improvement, and make data-driven decisions to enhance the login journey.

Security Breach Analysis

Regular security breach analysis is essential to identify vulnerabilities and potential threats to the Insurance Login platform. By analyzing breach patterns and trends, insurance providers can strengthen their security measures, stay ahead of emerging threats, and ensure the long-term integrity of their login systems.

Future Trends and Innovations

The future of Insurance Login holds exciting possibilities, driven by emerging technologies and changing user expectations. Here are some trends and innovations to watch out for:

- Biometric Authentication: The widespread adoption of biometric authentication, including facial and voice recognition, will continue to enhance security and convenience for users.

- Blockchain Integration: Blockchain technology will play a more significant role in secure data sharing and decentralized identity management, revolutionizing the way insurance providers handle user authentication and data protection.

- Voice-Enabled Insurance: Voice-enabled assistants and chatbots will become increasingly sophisticated, offering personalized insurance advice and assistance to users.

- AI-Powered Risk Assessment: AI algorithms will be leveraged to assess and mitigate risks associated with Insurance Login, ensuring a more secure and tailored experience for users.

Conclusion

Insurance Login is a critical aspect of the digital transformation journey for insurance providers. By embracing innovative technologies, prioritizing security, and delivering seamless user experiences, insurance companies can enhance customer satisfaction, loyalty, and overall operational efficiency.

As the insurance industry continues to evolve, staying abreast of the latest trends and best practices in Insurance Login will be essential for providers to remain competitive and deliver exceptional services to their customers.

How can insurance companies ensure the security of Insurance Login platforms?

+Insurance companies employ a multi-layered approach to ensure the security of Insurance Login platforms. This includes robust encryption techniques, two-factor authentication, regular security audits, and the use of advanced technologies like blockchain and AI-powered threat detection systems.

What measures can be taken to improve the convenience and user experience of Insurance Login?

+To enhance convenience and user experience, insurance providers can focus on mobile optimization, simplify the login process, offer personalized experiences, and provide intuitive navigation. Additionally, integrating AI-powered chatbots and virtual assistants can offer instant support and guidance to users.

How can insurance companies ensure accessibility for users with disabilities in their Insurance Login platforms?

+Insurance companies can ensure accessibility by implementing accessibility standards like WCAG, providing keyboard navigation, offering screen reader compatibility, and including alternative text for images. These measures ensure that users with disabilities can access and navigate the Insurance Login platform seamlessly.