Insurance Life Online Quote

In today's digital age, obtaining an insurance life online quote has become increasingly accessible and convenient for individuals seeking comprehensive life insurance coverage. With a few clicks, you can explore various options, compare policies, and gain a better understanding of the insurance landscape tailored to your specific needs. This guide aims to delve into the world of online life insurance quotes, providing you with valuable insights and expertise to navigate this essential financial decision with confidence.

Understanding Life Insurance and Its Benefits

Life insurance is a crucial financial tool designed to provide financial protection and security for your loved ones in the event of your untimely passing. It serves as a safety net, ensuring that your beneficiaries receive a predetermined sum, known as the death benefit, which can be utilized to cover a range of expenses, including funeral costs, outstanding debts, and everyday living expenses.

The primary purpose of life insurance is to offer peace of mind, knowing that your family's financial well-being is protected even in the face of unforeseen circumstances. Additionally, life insurance can serve as a valuable asset for long-term financial planning, offering potential benefits such as tax advantages and the opportunity to build wealth over time through cash value accumulation.

The Rise of Online Insurance Quotes

The traditional method of obtaining life insurance involved meeting with an insurance agent, filling out extensive paperwork, and waiting for an assessment of your eligibility and quote. However, the digital revolution has brought about a significant shift in this process, making it more efficient, convenient, and accessible.

Online insurance quotes have emerged as a popular and preferred option for many individuals. This approach allows you to research and compare various insurance providers and their policies from the comfort of your own home. It empowers you to make informed decisions about your life insurance coverage without the pressure of sales tactics or the need to commit immediately.

Key Considerations When Seeking an Online Quote

When embarking on your journey to find the perfect life insurance policy, there are several crucial factors to keep in mind to ensure you make the right choice:

1. Type of Life Insurance

Life insurance comes in various forms, each with its unique features and benefits. The two main types are term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years, and is ideal for individuals seeking affordable protection for a defined timeframe. On the other hand, permanent life insurance, including whole life and universal life policies, provides lifelong coverage and often includes a cash value component that can be accessed for various financial needs.

Understanding the differences between these types and assessing your long-term financial goals is essential to choosing the right policy.

2. Coverage Amount and Term

Determining the appropriate coverage amount is a critical step in the process. Consider your financial obligations, such as mortgage payments, outstanding debts, and the financial needs of your dependents. Aim to choose a coverage amount that will adequately support your loved ones’ financial stability in your absence.

Similarly, selecting the right term or duration of coverage is crucial. Whether you opt for a shorter term to align with specific financial goals or a longer term for lifelong protection, ensuring that the policy's term aligns with your needs is essential.

3. Policy Features and Riders

Life insurance policies often come with additional features and riders that can enhance your coverage. These add-ons may include accelerated death benefits, waiver of premium riders, or long-term care riders. Understanding the available options and their potential benefits can help you customize your policy to align with your specific circumstances and needs.

4. Premium Payments and Flexibility

Life insurance premiums can vary significantly depending on the provider, policy type, and coverage amount. When obtaining online quotes, compare not only the premiums but also the payment flexibility offered. Some policies allow for annual, semi-annual, or monthly payments, providing you with the option to choose a payment schedule that aligns with your financial situation.

5. Company Reputation and Financial Strength

When selecting a life insurance provider, it is crucial to assess their reputation and financial stability. Research the company’s history, customer reviews, and financial ratings to ensure they are a reliable and trustworthy partner for your long-term financial protection. A strong financial foundation is essential to ensure the company’s ability to fulfill its obligations and pay out claims promptly.

The Online Quote Process

Obtaining an online life insurance quote is a straightforward and user-friendly process. Here’s a step-by-step guide to help you navigate through it seamlessly:

Step 1: Choose a Reputable Insurance Provider

Begin by researching and selecting a reputable insurance company that offers online quotes. Look for providers with a solid track record, positive customer feedback, and competitive pricing. You can use online comparison tools or consult financial advisors for recommendations.

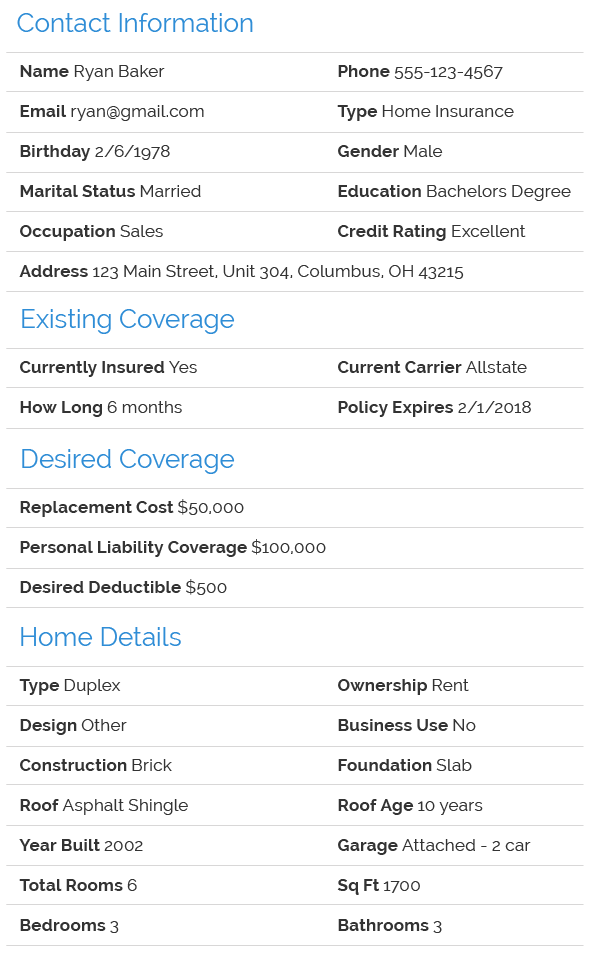

Step 2: Gather Necessary Information

Before starting the quote process, gather the required information, including your personal details, health status, and lifestyle habits. This data will be used to assess your eligibility and calculate an accurate quote. Having this information ready will streamline the process and provide more precise results.

Step 3: Navigate the Online Quote Tool

Most insurance providers offer user-friendly online quote tools. These tools guide you through a series of questions to gather the necessary details for an accurate quote. Follow the prompts, ensuring you provide accurate and honest responses to obtain the most relevant results.

Step 4: Compare Quotes and Policies

Once you have obtained quotes from multiple providers, take the time to compare the policies side by side. Evaluate the coverage amounts, premium costs, policy terms, and any additional features or riders included. Consider your specific needs and financial goals to determine which policy offers the best value and aligns with your long-term objectives.

Step 5: Seek Professional Advice (if Needed)

If you require further guidance or have complex financial circumstances, consulting a financial advisor or insurance specialist can be beneficial. They can provide personalized advice, help you navigate the complexities of life insurance, and ensure you make an informed decision tailored to your unique situation.

The Advantages of Online Insurance Quotes

Opting for online life insurance quotes offers several distinct advantages that make the process more accessible and efficient:

1. Convenience and Accessibility

Online quotes provide unparalleled convenience, allowing you to obtain multiple quotes from the comfort of your home or on the go. You can compare policies, assess your options, and make informed decisions without the need for in-person meetings or lengthy paperwork.

2. Transparency and Comparison

The online quote process promotes transparency, enabling you to compare policies and premiums side by side. This level of visibility empowers you to make confident choices, ensuring you select the policy that best suits your needs and budget.

3. Time Efficiency

Traditional insurance quote processes can be time-consuming, requiring multiple meetings and paperwork. Online quotes streamline this process, saving you valuable time and allowing you to make decisions more efficiently.

4. Privacy and Control

With online quotes, you maintain control over your personal information and have the flexibility to explore various options without any sales pressure. This privacy-focused approach ensures you can make decisions at your own pace, free from external influences.

The Future of Life Insurance and Digital Innovation

The life insurance industry is continuously evolving, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of life insurance and the digital innovations shaping the landscape:

1. Digital Underwriting and Instant Quotes

Advancements in technology have led to the development of digital underwriting processes, enabling insurance providers to assess eligibility and provide instant quotes with greater accuracy. This innovation streamlines the quote process, providing real-time feedback and making it more efficient for both consumers and insurers.

2. Personalized Insurance Policies

The future of life insurance lies in personalized policies tailored to individual needs. With the help of advanced algorithms and data analytics, insurance providers can offer customized coverage options, taking into account factors such as health, lifestyle, and financial goals. This level of personalization ensures that policyholders receive the most suitable and comprehensive protection.

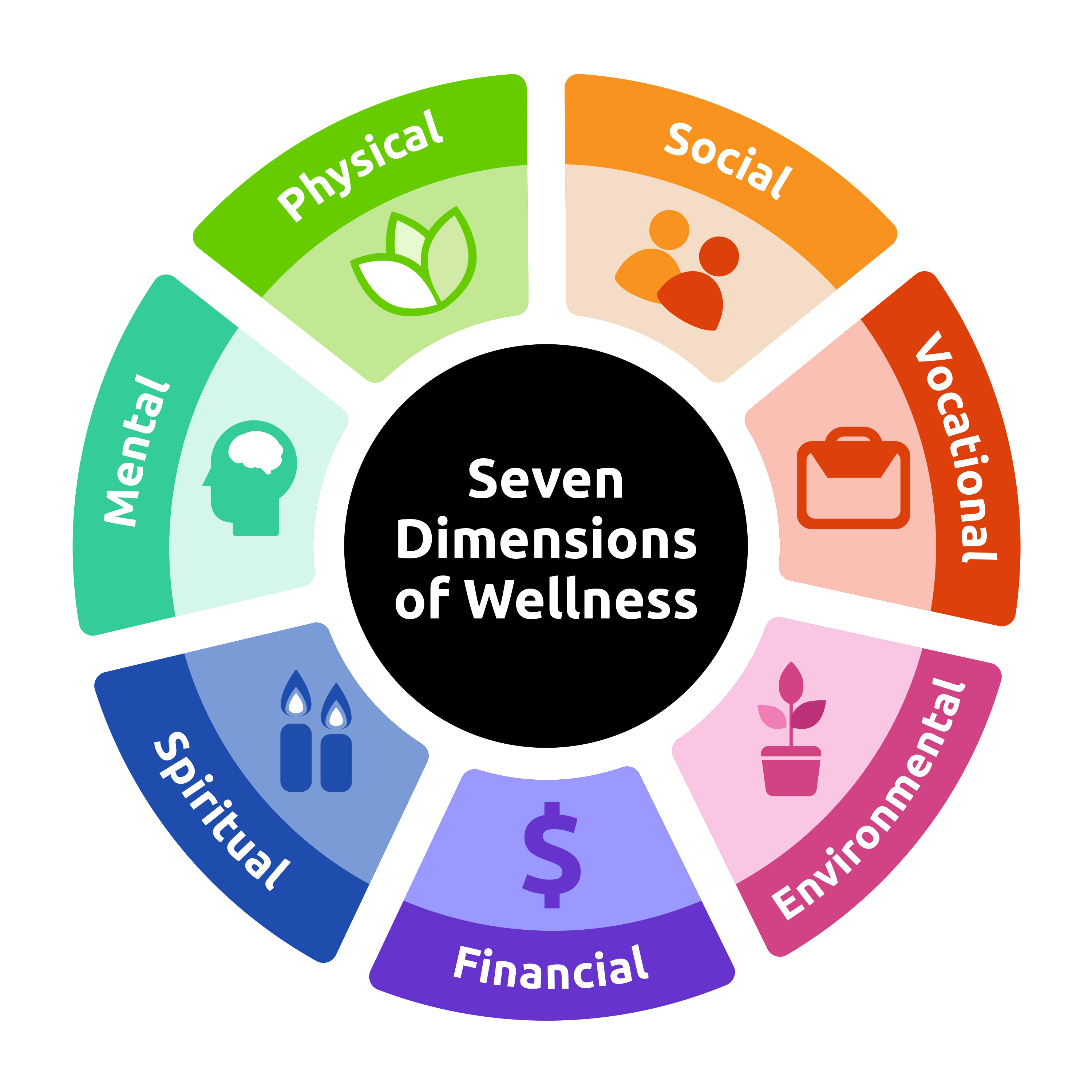

3. Integration of Health and Wellness Data

Insurers are increasingly integrating health and wellness data into their underwriting processes. By leveraging wearable technology and health tracking devices, insurance companies can offer incentives and discounts to policyholders who maintain healthy lifestyles. This integration not only encourages healthier habits but also allows for more accurate risk assessments, resulting in potentially lower premiums.

4. Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize the insurance industry by introducing smart contracts. These self-executing contracts can automate various aspects of the insurance process, such as claim settlements and policy updates. Blockchain’s decentralized nature enhances security and transparency, providing greater trust and efficiency in insurance transactions.

5. AI-Driven Customer Service

Artificial Intelligence (AI) is transforming customer service in the insurance industry. Chatbots and virtual assistants powered by AI can provide instant support, answer queries, and guide customers through the insurance journey. This enhances the overall customer experience, making it more accessible and convenient.

FAQ

Can I get an online life insurance quote without providing personal health information?

+While some providers offer preliminary quotes without detailed health information, obtaining an accurate quote typically requires providing health-related details. However, rest assured that your privacy is protected, and your information is used solely for assessment purposes.

How do I know if I’m eligible for life insurance coverage?

+Eligibility for life insurance depends on various factors, including age, health status, and lifestyle habits. Online quote tools guide you through a comprehensive assessment process to determine your eligibility and provide accurate quotes. However, if you have pre-existing conditions or complex health concerns, consulting with a professional advisor is recommended.

Are online life insurance quotes reliable?

+Yes, online life insurance quotes are reliable when obtained from reputable insurance providers. These quotes are generated based on the information you provide and serve as a valuable starting point for your insurance journey. However, it’s important to compare quotes from multiple providers to ensure you’re getting the best value and coverage.

Can I switch insurance providers after obtaining an online quote?

+Absolutely! The beauty of online quotes is that they empower you to explore various options without commitment. If you find a better-suited policy with another provider, you can switch seamlessly, ensuring you have the coverage that aligns perfectly with your needs.

In conclusion, obtaining an insurance life online quote is a powerful tool to take control of your financial future and protect your loved ones. With the insights and guidance provided in this article, you can navigate the world of life insurance with confidence, making informed decisions that align with your unique circumstances and goals. Embrace the convenience and transparency of online quotes, and embark on your journey to secure a brighter and more secure financial future.