Best Car/Home Insurance

In today's fast-paced world, having reliable insurance coverage for your vehicle and home is essential to protect your assets and provide peace of mind. With numerous insurance providers and policies available, choosing the best car and home insurance can be a daunting task. This comprehensive guide will delve into the key factors to consider when selecting insurance, exploring real-world examples and expert insights to help you make an informed decision.

Understanding Your Insurance Needs

Before diving into the sea of insurance options, it’s crucial to assess your specific needs and requirements. Every individual’s situation is unique, and understanding these nuances is the first step toward securing the right coverage.

Assessing Your Vehicle’s Insurance Needs

When it comes to car insurance, there are several factors to consider. Firstly, evaluate the value of your vehicle and the level of coverage it requires. High-value cars may necessitate comprehensive coverage, including collision and comprehensive insurance, to protect against accidents and damage from natural disasters. On the other hand, older vehicles with lower market values may be better suited for liability-only coverage, which is more cost-effective.

Additionally, consider your driving habits and the risks associated with them. If you frequently drive in congested urban areas or have a history of accidents, you may require insurance with higher liability limits to protect yourself financially. Conversely, if you primarily drive on rural roads with minimal traffic, you might opt for insurance with lower liability limits and save on premiums.

Home Insurance Considerations

Home insurance is equally important, as it safeguards your dwelling and personal belongings. Begin by assessing the replacement cost of your home and its contents. This will help you determine the appropriate coverage limits for your policy. Consider factors such as the age of your home, its construction materials, and any unique features that may impact repair or rebuilding costs.

Moreover, evaluate the potential risks in your area. If you live in a region prone to natural disasters like hurricanes, earthquakes, or wildfires, it’s crucial to ensure your policy includes coverage for these specific perils. Additionally, consider the security measures in your home and whether they might qualify you for insurance discounts, such as having a monitored security system or smoke detectors.

Researching Insurance Providers

With a clear understanding of your insurance needs, the next step is to research reputable insurance providers. A thorough investigation will ensure you select a provider that offers the coverage you require at a competitive price.

Reputation and Financial Stability

Start by evaluating the reputation and financial stability of potential insurance companies. Look for providers with a solid track record of customer satisfaction and financial strength. This ensures that the company will be able to pay out claims promptly and efficiently, even in the event of a large-scale disaster.

You can research insurance companies through independent rating agencies like A.M. Best, Standard & Poor’s, and Moody’s. These agencies provide financial strength ratings, which offer insight into an insurer’s ability to meet its ongoing obligations to policyholders.

Policy Coverage and Customization

Examine the range of policies offered by each provider. Look for insurance companies that offer customizable policies to suit your specific needs. For instance, some providers may specialize in offering unique coverage options for classic cars or high-value homes, catering to niche markets.

Additionally, consider the add-on coverage options available. Certain providers offer endorsements or riders that can be added to your policy to provide additional protection. These might include coverage for identity theft, water backup, or personal belongings outside your home.

Customer Service and Claims Handling

Excellent customer service and efficient claims handling are crucial aspects of any insurance provider. Research the provider’s reputation for customer satisfaction and claims handling. Check online reviews and ratings to get an idea of the provider’s responsiveness and the quality of their customer service.

Consider the provider’s claims process, including how claims are filed, processed, and paid out. Look for providers that offer a straightforward and transparent claims process, with quick turnaround times and fair settlements.

Comparing Insurance Policies

Once you’ve narrowed down your list of potential insurance providers, it’s time to compare their policies side by side. This step is crucial to ensure you’re getting the best value for your money and the coverage you need.

Coverage Limits and Deductibles

Examine the coverage limits and deductibles offered by each policy. Coverage limits refer to the maximum amount the insurance company will pay for a covered loss. Ensure that the limits align with your assessed needs and provide adequate protection.

Deductibles, on the other hand, are the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles can result in lower premiums, so consider your financial situation and risk tolerance when choosing a deductible.

Discounts and Bundle Options

Look for insurance providers that offer discounts and bundle options. Many providers offer discounts for policyholders who bundle their car and home insurance policies together. Additionally, consider other discounts such as those for safe driving, loyalty, or certain home safety features.

Bundling your insurance policies can not only save you money but also provide added convenience. With one provider handling both your car and home insurance, you’ll have a single point of contact for all your insurance needs, simplifying the management of your policies.

Additional Benefits and Perks

Explore the additional benefits and perks offered by each insurance provider. Some providers offer roadside assistance, rental car coverage, or accident forgiveness as standard features in their policies. These added benefits can provide extra peace of mind and make your insurance policy more comprehensive.

Furthermore, consider the digital tools and resources provided by each insurer. Many modern insurance providers offer mobile apps and online portals that allow policyholders to manage their policies, file claims, and access important documents quickly and conveniently.

Securing Your Insurance Policy

With your research complete and your preferred insurance provider and policy identified, it’s time to secure your coverage.

Obtaining Quotes and Finalizing Your Policy

Contact your chosen insurance provider and request quotes for your car and home insurance policies. Compare the quotes against your assessed needs and budget to ensure they align with your expectations.

Once you’ve found a policy that meets your needs, review the policy documentation thoroughly. Ensure that all the coverage limits, deductibles, and add-ons are as you expected. If you have any questions or concerns, don’t hesitate to reach out to the insurance provider’s customer service team for clarification.

Maintaining Your Insurance Coverage

Insurance policies are not set-it-and-forget-it contracts. Regularly review your coverage to ensure it continues to meet your changing needs. Life circumstances can change, and so can your insurance requirements. For instance, if you make significant home improvements or acquire new valuable belongings, you may need to adjust your home insurance coverage accordingly.

Stay up to date with any changes in your insurance provider’s offerings. Many providers introduce new coverage options or adjust their existing policies over time. By staying informed, you can take advantage of these changes to enhance your coverage or potentially save money.

Conclusion

Choosing the best car and home insurance involves a careful assessment of your needs, thorough research of insurance providers, and a comprehensive comparison of policies. By following the steps outlined in this guide, you can navigate the insurance landscape with confidence and select coverage that provides the protection you deserve.

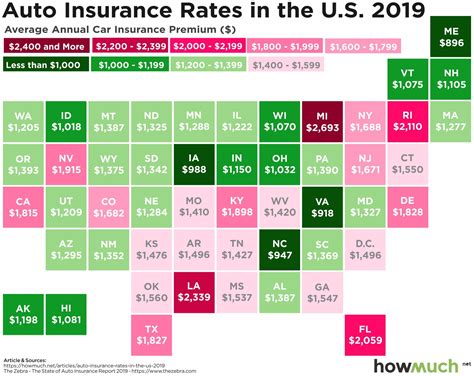

What is the average cost of car insurance?

+The average cost of car insurance can vary significantly based on factors such as your location, driving record, and the type of vehicle you own. According to recent data, the national average cost for car insurance is around 1,674 annually, or approximately 140 per month. However, your specific premium may be higher or lower depending on your individual circumstances.

How much does home insurance typically cost?

+Home insurance costs can also vary widely depending on factors like the location and value of your home, the level of coverage you choose, and any additional endorsements you add to your policy. On average, homeowners in the United States pay around 1,312 per year for home insurance, or approximately 110 per month. However, as with car insurance, your specific premium may differ based on your individual situation.

What factors can influence the cost of insurance premiums?

+Several factors can impact the cost of insurance premiums. For car insurance, these factors include your age, gender, driving record, and the type of vehicle you drive. Home insurance premiums can be influenced by factors such as the location and age of your home, the replacement cost of your home and its contents, and the coverage limits you choose.