Insurance Information

In the intricate world of personal and commercial protection, insurance stands as a cornerstone, offering a vital safety net against life's unforeseen challenges. This comprehensive guide aims to demystify the often-complex landscape of insurance, shedding light on the critical information you need to navigate this essential domain confidently.

Whether you're a homeowner seeking peace of mind, a business owner protecting your enterprise, or an individual safeguarding your health and finances, understanding insurance is paramount. With a myriad of policies, providers, and fine print to decipher, making informed choices can be daunting. However, with the right knowledge, you can ensure your assets, your health, and your future are adequately protected.

The Fundamentals of Insurance

At its core, insurance is a contractual arrangement between an individual or entity (the policyholder) and an insurance company (the insurer). In this agreement, the insurer promises to compensate the policyholder for specific losses, damages, or liabilities in exchange for a premium, which is a regular payment. This premise is underpinned by the concept of risk pooling, where the insurer spreads the financial risk across a large number of policyholders, ensuring that those who suffer a loss are compensated.

The primary purpose of insurance is to provide financial protection against unforeseen events that could lead to significant financial losses. These events could range from a house fire or a car accident to a critical illness or a business disruption. By purchasing insurance, individuals and businesses transfer the financial risk associated with these events to the insurer, thereby safeguarding their financial stability and peace of mind.

Key Components of an Insurance Policy

- Premium: The amount the policyholder pays to the insurer for the coverage provided. Premiums can vary based on several factors, including the type of coverage, the amount of coverage required, the policyholder's location, and their risk profile.

- Deductible: This is the amount the policyholder agrees to pay out of pocket before the insurance coverage kicks in. Higher deductibles typically result in lower premiums, and vice versa.

- Coverage Limit: This is the maximum amount the insurer will pay for a covered loss. Exceeding this limit means the policyholder will have to bear the additional costs.

- Policy Term: This is the duration for which the insurance coverage is valid. It could be for a specific period, such as a year, or it could be a continuous policy with no set end date.

- Exclusions: These are specific events or circumstances that are not covered by the policy. It's crucial to understand these exclusions to avoid any surprises when making a claim.

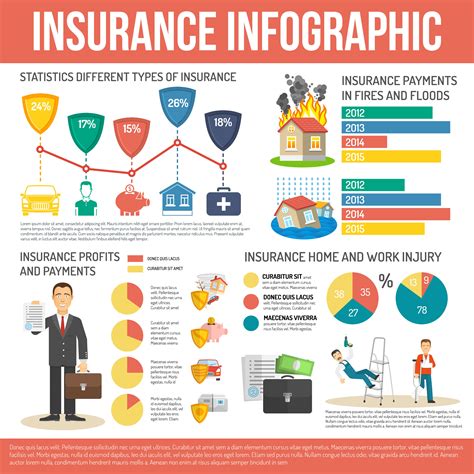

Types of Insurance

The insurance industry offers a wide array of policies to cater to various needs and risks. Here's an overview of some of the most common types of insurance:

Life Insurance

Life insurance provides financial protection to the policyholder's beneficiaries in the event of their death. There are two primary types: term life insurance, which offers coverage for a specified period, and permanent life insurance, which provides lifelong coverage and also accumulates cash value.

| Term Life Insurance | Permanent Life Insurance |

|---|---|

| Affordable | More Expensive |

| No Cash Value | Accumulates Cash Value |

| Coverage for a Specific Period | Lifetime Coverage |

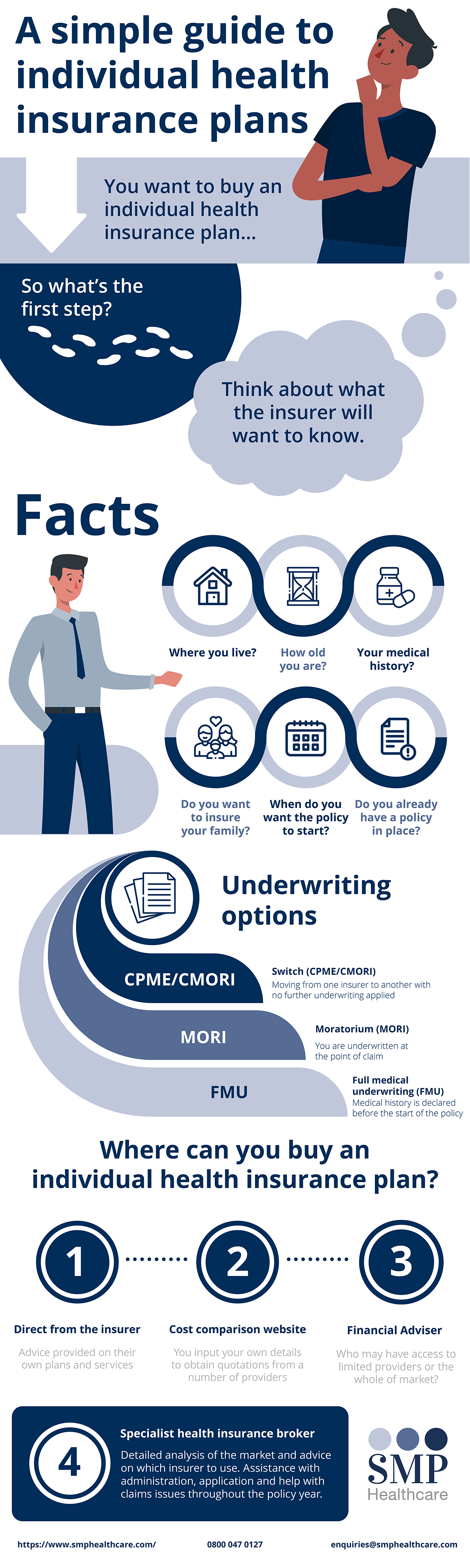

Health Insurance

Health insurance covers the cost of medical and surgical expenses. It's a vital safeguard against the potentially crippling financial burden of healthcare costs. Common types of health insurance include:

- Individual Health Insurance: This type of insurance is purchased by an individual or family to cover their medical expenses.

- Group Health Insurance: Often provided by employers, this type of insurance covers a group of people, typically employees and their dependents.

Auto Insurance

Auto insurance provides financial protection against physical damage or bodily injury resulting from traffic accidents and also covers against liability that could arise from an accident. It's typically mandatory by law for all vehicle owners.

| Liability Coverage | Collision Coverage | Comprehensive Coverage |

|---|---|---|

| Covers Damage/Injury to Others | Covers Damage to Your Vehicle | Covers Non-Collision Incidents |

Homeowners Insurance

Homeowners insurance protects against financial losses due to damages to a house or its contents, as well as liability for any injuries that occur on the property. It's a crucial safeguard for homeowners, providing peace of mind and financial protection.

Business Insurance

Business insurance protects businesses from various risks, including property damage, liability, and business interruption. Different types of business insurance cater to different needs, such as professional liability insurance, product liability insurance, and workers' compensation insurance.

Understanding Your Insurance Needs

Determining your insurance needs is a critical step in the process. It involves assessing your personal or business circumstances, identifying potential risks, and understanding the level of protection required. Here are some key considerations:

Risk Assessment

Conduct a thorough risk assessment to identify potential threats to your assets, health, or business. This could include natural disasters, accidents, theft, lawsuits, or any other event that could lead to significant financial loss.

Coverage Requirements

Once you've identified the risks, determine the level of coverage you require. This will depend on the value of your assets, the potential costs of medical treatment, or the potential liabilities you face. Ensure you're not underinsured, as this could leave you vulnerable to financial strain in the event of a claim.

Cost Considerations

While it's essential to have adequate coverage, you also need to consider the financial feasibility of your insurance choices. Premiums can vary significantly based on the type of coverage, the amount of coverage required, and your personal or business circumstances. It's a delicate balance between ensuring adequate protection and managing your budget.

The Claims Process

Understanding the claims process is a vital aspect of insurance. When an insured event occurs, you'll need to follow specific steps to ensure a smooth and timely resolution. Here's a general overview of the claims process:

- Report the Claim: Notify your insurance company as soon as possible after an insured event occurs. Most insurance companies have dedicated claims hotlines or online portals to report claims.

- Provide Documentation: You'll need to provide detailed documentation of the loss or damage. This could include photographs, receipts, police reports, or any other relevant evidence.

- Assessment and Evaluation: The insurance company will assess the claim, evaluate the extent of the damage or loss, and determine the amount payable based on the policy terms and conditions.

- Settlement: Once the claim is approved, the insurance company will settle the claim, either by paying the agreed amount or by providing the necessary repairs or replacements.

Tips for a Successful Claim

- Document everything: Keep a record of all communications with the insurance company, including dates, times, and the names of the people you speak with.

- Read the fine print: Understand the terms and conditions of your policy, especially the exclusions and limitations. This will help you manage your expectations and ensure you're not surprised by any potential denial of coverage.

- Be prompt: Report the claim as soon as possible after the event. Delaying could result in your claim being denied.

- Provide accurate information: Be honest and provide accurate details when reporting the claim. Misleading or false information could lead to claim denial or even legal consequences.

Insurance and the Law

Insurance is heavily regulated by law, and understanding the legal framework surrounding insurance is essential. Here are some key legal aspects to consider:

Insurance Contracts

Insurance contracts are legally binding agreements. It's crucial to read and understand the terms and conditions before signing. Ensure you're comfortable with the coverage provided and that it meets your needs.

Regulation and Oversight

Insurance companies are regulated by various governmental bodies to ensure they operate ethically and fairly. In the United States, this oversight is primarily carried out by state insurance departments. These departments set rules and regulations, enforce compliance, and protect consumers from fraudulent or unfair practices.

Legal Remedies

If you feel your insurance company has acted unfairly or in violation of the law, you have legal remedies. You can file a complaint with the relevant state insurance department, seek mediation or arbitration, or, in more severe cases, file a lawsuit.

Future Trends in Insurance

The insurance industry is constantly evolving, driven by technological advancements, changing consumer preferences, and emerging risks. Here are some trends to watch:

Digital Transformation

The insurance industry is increasingly embracing digital technologies, from online policy management and claims reporting to the use of artificial intelligence for risk assessment and fraud detection. This digital transformation is enhancing efficiency, convenience, and customer experience.

Personalized Insurance

With the advent of big data and advanced analytics, insurance companies are now able to offer more personalized insurance products. By analyzing an individual's or business's unique circumstances and risk profile, insurers can tailor policies to provide more precise coverage and pricing.

Emerging Risks

As our world becomes more complex, new risks emerge. This includes risks associated with technological advancements, such as cyber threats, as well as environmental risks like climate change. Insurance companies are developing new products and services to address these emerging risks.

Conclusion

Insurance is a complex but essential aspect of modern life. It provides a crucial safety net, offering financial protection against a wide range of risks. By understanding the fundamentals of insurance, your specific needs, and the claims process, you can make informed decisions to protect your assets, your health, and your future.

Stay informed, ask questions, and don't hesitate to seek professional advice. With the right knowledge and preparation, you can navigate the world of insurance with confidence and peace of mind.

How do I choose the right insurance policy for my needs?

+Choosing the right insurance policy involves assessing your unique needs and risks. Consider factors like your financial situation, the value of your assets, potential liabilities, and any specific risks you face. It’s often beneficial to consult with an insurance professional who can guide you through the process and recommend suitable policies.

What happens if I need to make a claim but my policy has exclusions for that specific event?

+If your policy has exclusions for a specific event or circumstance, it means that the insurance company will not provide coverage for that particular loss. It’s crucial to carefully review your policy’s terms and conditions, including the exclusions, to understand what’s covered and what’s not. If you have concerns or questions about exclusions, it’s best to clarify them with your insurance provider before purchasing the policy.

Are there any legal requirements for insurance coverage in specific situations?

+Yes, there are certain situations where insurance coverage is legally mandated. For example, most states in the U.S. require vehicle owners to have auto insurance that includes liability coverage. Similarly, if you have a mortgage on your home, the lender may require you to have homeowners insurance. It’s essential to understand the legal requirements in your jurisdiction to ensure you’re complying with the law.