Auto Insured

The concept of auto insurance, also known as car insurance, is an essential aspect of vehicle ownership and operation. It provides financial protection and coverage for various risks and liabilities associated with owning and driving a motor vehicle. Auto insurance is a legal requirement in many countries and plays a crucial role in ensuring the safety and security of vehicle owners, passengers, and others on the road. In this comprehensive guide, we will delve into the world of auto insurance, exploring its significance, types of coverage, factors influencing premiums, and the claims process.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance is a contract between an individual (the policyholder) and an insurance company. This contract outlines the terms and conditions of coverage, including the types of risks insured, the limits of coverage, and the obligations of both parties. The primary purpose of auto insurance is to provide financial assistance in the event of an accident, theft, or other incidents that result in property damage, personal injury, or liability claims.

Key Components of Auto Insurance Policies

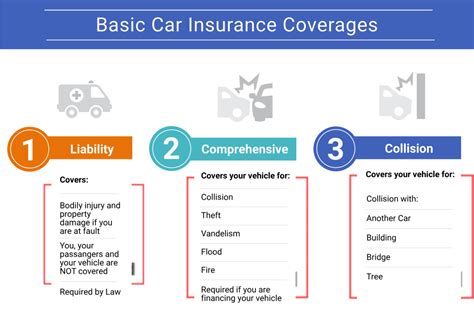

Auto insurance policies typically consist of several key components, each addressing specific risks and providing different levels of coverage:

- Liability Coverage: This is the foundation of any auto insurance policy. It covers the policyholder’s legal responsibility for bodily injury or property damage caused to others in an accident. Liability coverage includes both bodily injury liability and property damage liability.

- Collision Coverage: This optional coverage protects the policyholder’s vehicle in the event of a collision with another vehicle or object. It pays for the repair or replacement of the insured vehicle, regardless of fault.

- Comprehensive Coverage: This coverage extends beyond collisions and provides protection against theft, vandalism, natural disasters, and other non-collision incidents. It covers damages caused by events like fire, flooding, or falling objects.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for the medical expenses of the policyholder and their passengers in the event of an accident, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when the at-fault driver in an accident does not have sufficient insurance to cover the damages. It provides protection against uninsured or underinsured drivers.

- Rental Car Reimbursement: This optional coverage reimburses the policyholder for the cost of renting a vehicle while their insured car is being repaired due to a covered incident.

Factors Influencing Auto Insurance Premiums

The cost of auto insurance, known as the premium, varies significantly based on several factors. Understanding these factors can help policyholders make informed decisions and potentially reduce their insurance costs:

- Driver’s Age and Gender: Younger drivers, particularly males, often face higher premiums due to their perceived higher risk of accidents. As drivers age and gain experience, premiums tend to decrease.

- Driving Record: A clean driving record with no accidents or violations is rewarded with lower premiums. Conversely, a history of accidents or traffic violations can significantly increase insurance costs.

- Vehicle Type and Usage: The make, model, and year of the vehicle, as well as its primary usage (e.g., commuting, pleasure driving), influence insurance rates. Sports cars and luxury vehicles generally have higher premiums due to their higher repair costs.

- Coverage Limits and Deductibles: Higher coverage limits and lower deductibles typically result in higher premiums. Policyholders can balance their coverage needs and budget by adjusting these factors.

- Location: The area where the vehicle is primarily driven and parked affects insurance rates. Urban areas with higher population density and traffic congestion often have higher premiums.

- Credit Score: In many states, insurance companies consider an individual’s credit score when determining premiums. A higher credit score can lead to lower insurance costs.

The Auto Insurance Claims Process: A Step-by-Step Guide

When an accident or incident occurs, the auto insurance claims process ensures that policyholders receive the financial support they need. Here’s a detailed breakdown of the typical claims process:

- Reporting the Claim: After an accident or incident, the policyholder should promptly report the claim to their insurance company. Most insurers offer multiple reporting methods, including phone calls, online portals, and mobile apps.

- Claim Investigation: The insurance company assigns a claims adjuster to investigate the details of the incident. They gather information, assess the extent of damages, and determine liability.

- Determining Fault and Liability: Based on the investigation, the claims adjuster determines who is at fault and assigns liability. This step is crucial as it determines which insurance company will cover the damages.

- Estimating Damages: The claims adjuster works with repair shops or assesses the vehicle’s condition to estimate the cost of repairs or the vehicle’s total loss value. They may also consider rental car costs or additional expenses incurred due to the accident.

- Payment Processing: Once the damages and liability are established, the insurance company processes the payment to the policyholder or the repair shop, depending on the coverage and policy terms.

- Resolving Disputes: In cases where there are disagreements over liability, damages, or other aspects of the claim, policyholders can seek assistance from their insurance company’s customer service team or, if necessary, file a complaint with their state’s insurance regulator.

Tips for a Smooth Claims Process

To ensure a smooth and efficient claims process, policyholders can take the following steps:

- Document the accident scene by taking photographs and noting the location, weather conditions, and any relevant details.

- Exchange information with the other party involved, including their insurance details and contact information.

- Provide accurate and detailed information to the insurance company during the claim reporting process.

- Keep records of all communications with the insurance company, including dates, times, and the names of the representatives involved.

- Seek medical attention promptly if there are any injuries, even if they seem minor.

The Future of Auto Insurance: Technological Innovations and Industry Trends

The auto insurance industry is continuously evolving, driven by technological advancements and changing consumer preferences. Here are some key trends shaping the future of auto insurance:

- Telematics and Usage-Based Insurance: Telematics devices and smartphone apps allow insurance companies to track driving behavior and offer usage-based insurance policies. These policies provide personalized premiums based on actual driving habits, encouraging safer driving practices.

- Connected Cars and Data Analytics: With the rise of connected cars, insurers can access real-time data on vehicle performance and driving patterns. This data enables more accurate risk assessment and personalized coverage options.

- Digital Claims Processing: Insurers are investing in digital technologies to streamline the claims process. Mobile apps, online portals, and artificial intelligence (AI) are being used to expedite claim reporting, assessment, and payment.

- Peer-to-Peer Insurance: Peer-to-peer insurance platforms allow individuals to pool their resources and share risks, offering an alternative to traditional insurance models. These platforms leverage blockchain technology for secure transactions and record-keeping.

- Personalized Insurance Packages: Insurers are increasingly offering customizable insurance packages tailored to individual needs and preferences. Policyholders can choose specific coverages and limits, creating a personalized insurance plan.

Conclusion

Auto insurance is an indispensable component of responsible vehicle ownership. It provides financial protection and peace of mind, ensuring that individuals can navigate the complexities of accidents, theft, and other incidents with confidence. By understanding the various types of coverage, factors influencing premiums, and the claims process, policyholders can make informed decisions and navigate the auto insurance landscape effectively.

What is the difference between comprehensive and collision coverage?

+Comprehensive coverage provides protection against non-collision incidents like theft, vandalism, and natural disasters. Collision coverage, on the other hand, specifically covers damages caused by collisions with other vehicles or objects. While comprehensive coverage is optional, collision coverage is often required if you have a loan or lease on your vehicle.

How can I reduce my auto insurance premiums?

+There are several ways to potentially reduce your auto insurance premiums. Maintaining a clean driving record, shopping around for quotes from different insurers, and bundling your auto insurance with other policies (such as home insurance) can all lead to lower rates. Additionally, considering higher deductibles and taking advantage of discounts for safe driving or good grades can further reduce costs.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, prioritize safety and well-being first. Exchange information with the other party, including their insurance details and contact information. Promptly report the accident to your insurance company, providing them with accurate and detailed information. Take photographs of the accident scene and any visible damages. Seek medical attention if necessary, and follow the guidance provided by your insurance company throughout the claims process.