Auto Insurance Low Cost

Finding low-cost auto insurance is a top priority for many vehicle owners. With rising costs and economic uncertainty, it's crucial to explore ways to save on insurance premiums without compromising on coverage. This comprehensive guide aims to provide an in-depth analysis of the factors that influence auto insurance costs and offer expert tips on securing the best deals.

Understanding Auto Insurance Premiums

Auto insurance premiums are influenced by a myriad of factors, and understanding these can help drivers make informed decisions to reduce their costs. The primary factors include:

1. Vehicle Type and Usage

The type of vehicle you drive and how you use it play a significant role in determining your insurance premiums. High-performance cars, SUVs, and luxury vehicles often attract higher premiums due to their higher repair and replacement costs. Additionally, vehicles with advanced safety features may be eligible for discounts.

The distance you travel daily and your annual mileage are also considered. Long-distance commuters may face higher premiums due to increased risk exposure. Conversely, low-mileage drivers may benefit from discounted rates.

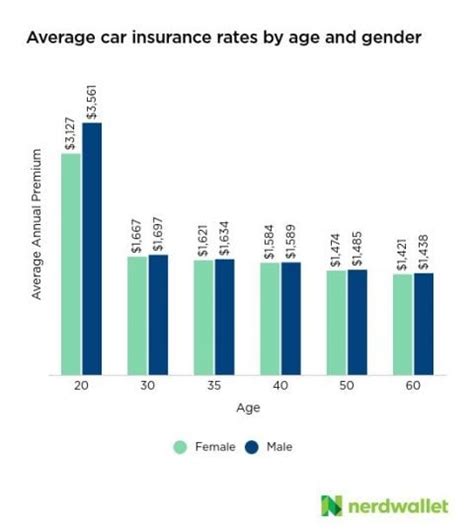

2. Driver Profile

Your driving record and personal details are crucial in determining your insurance costs. Young drivers, particularly males under 25, often face higher premiums due to their perceived higher risk of accidents. Conversely, mature drivers with a clean record may enjoy significant discounts.

Your credit score can also impact your premiums. Insurers often use credit-based insurance scores to assess your financial responsibility, with higher scores leading to lower premiums.

3. Location and Usage Patterns

Your geographic location and usage patterns can significantly affect your insurance costs. Areas with high accident rates or frequent claims may have higher premiums. Similarly, urban areas often have higher rates due to increased traffic density and theft risks.

Usage patterns, such as frequent short trips or nighttime driving, can also influence premiums. Insurers may offer discounts for specific usage patterns, such as driving during off-peak hours or using a vehicle primarily for pleasure rather than commuting.

Strategies for Lowering Auto Insurance Costs

There are numerous strategies drivers can employ to lower their auto insurance costs. Here are some effective approaches:

1. Shop Around and Compare

One of the simplest yet most effective ways to save on auto insurance is to compare quotes from multiple insurers. Insurance rates can vary significantly between companies, and shopping around can lead to substantial savings. Online comparison tools and insurance broker services can simplify this process.

When comparing quotes, ensure you’re comparing similar coverage levels. Some insurers may offer lower premiums but with reduced coverage, so it’s essential to understand the fine print.

2. Bundle Policies

If you have multiple insurance needs, such as auto, home, or life insurance, consider bundling your policies with a single insurer. Many insurers offer multi-policy discounts, which can lead to significant savings.

For instance, bundling your auto and home insurance policies may result in a 10-15% discount on your auto insurance premiums. The savings can be even more substantial if you have multiple vehicles or policies with the same insurer.

3. Optimize Your Coverage

Review your insurance coverage regularly to ensure you’re not over- or underinsured. Assess your needs and adjust your coverage accordingly. If you have an older vehicle, you may consider reducing or eliminating collision and comprehensive coverage, which can significantly reduce your premiums.

On the other hand, if you’ve made significant upgrades to your vehicle, such as adding custom parts or improving its performance, ensure your insurance coverage reflects these changes. Failing to do so may leave you underinsured in the event of an accident.

4. Utilize Discounts

Insurers offer a range of discounts to attract and retain customers. Some common discounts include:

- Safe Driver Discounts: Insurers often reward drivers with clean records who have not had accidents or traffic violations for a certain period.

- Multi-Vehicle Discounts: If you insure multiple vehicles with the same insurer, you may be eligible for a discount.

- Good Student Discounts: Many insurers offer discounts to young drivers who maintain good grades in school.

- Loyalty Discounts: Staying with the same insurer for an extended period may result in loyalty discounts.

- Defensive Driving Course Discounts: Completing a defensive driving course can lead to premium reductions.

It's worth noting that discount eligibility and values can vary between insurers, so it's essential to inquire about available discounts when comparing quotes.

5. Maintain a Clean Driving Record

Your driving record is a critical factor in determining your insurance premiums. A clean record with no accidents or traffic violations can lead to significant savings. Conversely, even a single accident or violation can cause your premiums to skyrocket.

If you’ve had an accident or violation, consider taking steps to improve your driving record. Many insurers offer accident forgiveness programs or discounts for completing a defensive driving course. Additionally, maintaining a clean record for an extended period can lead to substantial premium reductions.

The Future of Auto Insurance

The auto insurance industry is evolving rapidly, and technological advancements are shaping its future. Here are some key trends and developments to watch:

1. Usage-Based Insurance (UBI)

Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, is gaining popularity. This type of insurance uses telematics devices or smartphone apps to monitor driving behavior and usage. Insurers then use this data to offer personalized premiums based on actual driving habits.

UBI can benefit safe drivers who may see their premiums decrease significantly. However, it’s essential to understand the data collection process and privacy implications before opting into such programs.

2. Connected Car Technology

The increasing adoption of connected car technology, such as advanced driver-assistance systems (ADAS) and vehicle-to-everything (V2X) communication, is influencing auto insurance. These technologies can improve safety and reduce the risk of accidents, leading to potential premium reductions.

Insurers are exploring ways to integrate connected car data into their risk assessment models. This may lead to more accurate pricing and potentially lower premiums for drivers who adopt these technologies.

3. Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are revolutionizing the auto insurance industry. Insurers are using these technologies to improve risk assessment, fraud detection, and claims handling.

AI-powered algorithms can analyze vast amounts of data, including driving behavior, weather patterns, and accident trends, to identify risk factors and price insurance more accurately. This can lead to more tailored coverage and potentially lower premiums for drivers.

4. Peer-to-Peer Insurance

Peer-to-peer (P2P) insurance is an emerging model that allows individuals to pool their resources and share risks. In this model, drivers contribute to a communal fund, and in return, they receive coverage. P2P insurance can offer lower premiums and more flexible coverage options.

While still in its early stages, P2P insurance has the potential to disrupt the traditional insurance model and offer new opportunities for cost-conscious drivers.

5. Electric and Autonomous Vehicles

The rise of electric and autonomous vehicles is expected to have a significant impact on auto insurance. Electric vehicles (EVs) generally have lower repair and maintenance costs, which could lead to reduced insurance premiums. Autonomous vehicles, with their advanced safety features, may also reduce accident rates and influence insurance pricing.

Insurers are closely monitoring these technological advancements and their potential impact on the industry. As the adoption of EVs and autonomous vehicles increases, we can expect to see insurance products and pricing models adapt accordingly.

Conclusion

Securing low-cost auto insurance requires a combination of understanding the factors that influence premiums and employing effective strategies. By shopping around, optimizing coverage, utilizing discounts, and maintaining a clean driving record, drivers can significantly reduce their insurance costs.

Additionally, keeping an eye on emerging trends and technologies can provide insights into the future of auto insurance. As the industry evolves, drivers who stay informed and adapt to these changes may be able to access even more cost-effective insurance options.

What is the average cost of auto insurance in the US?

+

The average cost of auto insurance in the US varies widely depending on factors such as location, driving record, and vehicle type. As of 2022, the national average for annual premiums was around 1,674, but rates can range from under 1,000 to over $3,000.

How often should I review my auto insurance policy and rates?

+

It’s a good idea to review your auto insurance policy and rates at least once a year, or whenever your circumstances change significantly. This ensures you’re getting the best coverage and rates for your needs.

Can I get auto insurance without a driver’s license?

+

In most cases, you need a valid driver’s license to purchase auto insurance. However, some insurers may offer non-owner or named non-driver policies for individuals who don’t have a license but own a vehicle.

What are some common mistakes to avoid when buying auto insurance?

+

Common mistakes include underestimating the value of your vehicle, not understanding the coverage limits, and assuming all insurers are the same. It’s important to carefully review your policy, understand the exclusions and limitations, and compare quotes from multiple insurers.

How do I know if I’m getting a good deal on auto insurance?

+

A good deal on auto insurance is one that provides adequate coverage for your needs at a competitive price. Compare quotes from multiple insurers, understand the coverage offered, and ensure you’re not paying for unnecessary coverage. It’s also worth checking online reviews and customer satisfaction ratings.