Insurance For Home And Auto

Securing your home and automobile with comprehensive insurance coverage is an essential aspect of responsible financial planning. In a world where unexpected events can occur at any moment, having the right insurance policies in place provides peace of mind and financial protection. This comprehensive guide aims to delve into the intricacies of home and auto insurance, offering expert insights and practical advice to help you navigate the complex world of insurance.

Understanding the Importance of Home Insurance

Your home is likely one of your most significant investments, and safeguarding it against potential risks is crucial. Home insurance acts as a safety net, providing financial coverage for various unforeseen circumstances. From natural disasters like hurricanes and wildfires to accidental damages and even theft, a robust home insurance policy ensures you're protected.

Coverage Options for Homeowners

Home insurance policies offer a range of coverage options tailored to your specific needs. Here's a breakdown of some key aspects:

- Dwelling Coverage: This covers the structure of your home, including repairs or rebuilding costs in the event of damage.

- Personal Property: Insures your belongings against theft, damage, or loss. It's crucial to regularly update your inventory to ensure adequate coverage.

- Liability Protection: Safeguards you against legal claims and lawsuits, providing financial assistance if someone is injured on your property.

- Additional Living Expenses: Covers temporary living costs if your home becomes uninhabitable due to a covered event.

It's essential to review your policy regularly and adjust coverage as your circumstances change. For instance, if you've made significant home improvements, ensure your policy reflects the increased value.

Understanding Home Insurance Costs

The cost of home insurance varies based on several factors, including your location, the age and condition of your home, and the level of coverage you choose. Here's a glimpse at some average costs:

| Coverage Type | Average Annual Cost |

|---|---|

| Standard Homeowners Insurance | $1,000 - $2,500 |

| High-Value Home Insurance | $3,000 - $5,000 |

| Renters Insurance | $150 - $300 |

Note: These are approximate figures, and actual costs may vary significantly based on individual circumstances.

Auto Insurance: Protecting Your Vehicle and Yourself

Owning a vehicle comes with inherent risks, and auto insurance is designed to mitigate these risks and provide financial security. Whether it's a fender bender or a more significant accident, having the right coverage can make a world of difference.

Key Components of Auto Insurance

Auto insurance policies typically include the following essential components:

- Liability Coverage: Pays for damages or injuries you cause to others in an accident. It's a legal requirement in most states.

- Collision Coverage: Covers repair or replacement costs for your vehicle if you're involved in an accident, regardless of fault.

- Comprehensive Coverage: Provides protection against non-collision events like theft, vandalism, and natural disasters.

- Personal Injury Protection (PIP): Covers medical expenses and lost wages for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who has little or no insurance.

When selecting auto insurance, it's crucial to strike a balance between comprehensive coverage and affordability. Consider your vehicle's value, your driving record, and your personal financial situation when choosing coverage limits.

Factors Influencing Auto Insurance Costs

The cost of auto insurance is influenced by a multitude of factors, including:

- Vehicle Type: Sports cars and luxury vehicles often have higher insurance costs due to their value and potential for higher-risk driving.

- Driver's Age and Experience: Younger drivers and those with less driving experience typically pay more for insurance.

- Location: Insurance rates vary based on the state and even the specific area you live in, as crime rates and accident statistics can impact premiums.

- Driving Record: A clean driving record can lead to lower insurance rates, while accidents and traffic violations may increase costs.

It's beneficial to explore discount opportunities, such as safe driver discounts, multi-policy discounts (if you bundle home and auto insurance), and loyalty discounts for long-term customers.

Bundling Home and Auto Insurance: A Smart Strategy

One effective way to streamline your insurance needs and potentially save money is by bundling your home and auto insurance policies with the same provider. Here's why bundling is a wise choice:

Convenience and Simplified Management

Having a single provider for both home and auto insurance simplifies the management process. You can make payments, review policies, and file claims all in one place, making insurance administration more efficient.

Potential Cost Savings

Insurance providers often offer discounts when you bundle multiple policies with them. These discounts can lead to significant savings over time, especially when compared to purchasing policies separately.

Seamless Claims Process

In the event of a claim, having a single provider can streamline the process. Your insurer can easily coordinate between your home and auto policies, ensuring a smoother and more efficient claims experience.

Choosing the Right Insurance Provider

Selecting the right insurance provider is a critical decision. Here are some factors to consider when choosing a provider:

- Financial Stability: Ensure the provider has a strong financial rating, indicating their ability to pay claims.

- Reputation and Customer Service: Research online reviews and ratings to gauge the provider's reputation and customer satisfaction levels.

- Policy Options and Customization: Look for a provider that offers flexible policies and the ability to customize coverage to fit your unique needs.

- Claims Process: Inquire about their claims process, including how quickly they respond to claims and their average settlement times.

Don't be afraid to shop around and compare multiple providers. Request quotes from several insurers to find the best coverage and pricing for your specific circumstances.

Future Trends in Home and Auto Insurance

The insurance industry is evolving, and several trends are shaping the future of home and auto insurance:

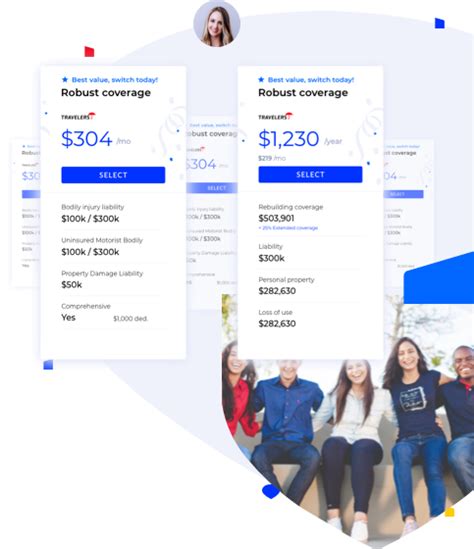

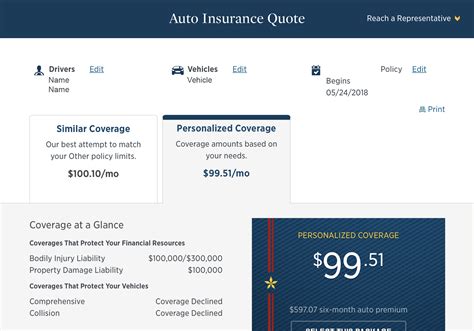

Digitalization and Online Platforms

Insurance providers are increasingly embracing digital technologies, offering online platforms for policy management, claims filing, and real-time updates. This trend enhances convenience and efficiency for policyholders.

Usage-Based Insurance (UBI)

UBI is gaining traction, especially in auto insurance. It involves using telematics devices or smartphone apps to track driving behavior, rewarding safe drivers with lower premiums. This pay-as-you-drive model is expected to become more prevalent.

Data Analytics and Risk Assessment

Advanced data analytics allow insurers to assess risks more accurately, leading to more precise pricing and coverage. This benefits policyholders by ensuring they receive the right coverage at a fair price.

Sustainability and Green Initiatives

Insurance providers are increasingly incorporating sustainability and environmental considerations into their offerings. This includes incentives for eco-friendly home improvements and discounts for electric or hybrid vehicles.

Frequently Asked Questions

What are the basic types of home insurance policies available?

+

Home insurance policies typically fall into four main categories: HO-1, HO-2, HO-3, and HO-5. HO-1 provides the most basic coverage, while HO-5 offers the broadest protection. HO-2 and HO-3 fall in between, offering varying levels of coverage for specific perils.

How often should I review my home insurance policy?

+

It’s recommended to review your home insurance policy annually, especially after significant life events like home renovations, marriages, or the birth of a child. These changes may impact your coverage needs and policy costs.

What factors influence auto insurance rates the most?

+

The primary factors influencing auto insurance rates include your driving record, the type of vehicle you drive, your location, and your age. Additionally, insurance companies may consider your credit score and claims history.

Are there any ways to lower my auto insurance premiums?

+

Yes, there are several strategies to reduce auto insurance premiums. These include maintaining a clean driving record, bundling policies, choosing a higher deductible, and taking advantage of available discounts, such as safe driver or good student discounts.

What is the average cost of homeowners insurance in the US?

+

The average cost of homeowners insurance in the US is around $1,200 per year. However, this can vary significantly based on factors like location, home value, and coverage limits. States like Florida and Louisiana often have higher premiums due to the risk of natural disasters.