Best Car Cheap Insurance

In today's world, finding affordable car insurance is a top priority for many drivers, especially those seeking the best value for their hard-earned money. With the vast array of insurance providers and policies available, navigating the market to identify the most suitable and cost-effective coverage can be a daunting task. This comprehensive guide aims to provide an in-depth analysis of the factors influencing cheap car insurance, offering practical tips and insights to help you secure the best rates while maintaining adequate coverage.

Understanding Cheap Car Insurance

The term “cheap” is relative when it comes to car insurance. What constitutes a good deal for one driver might not be the same for another. Several key factors influence the cost of car insurance, and understanding these factors is essential to identifying the best and most affordable coverage for your specific needs.

Factors Influencing Car Insurance Rates

Car insurance rates are influenced by a multitude of factors, including but not limited to the following:

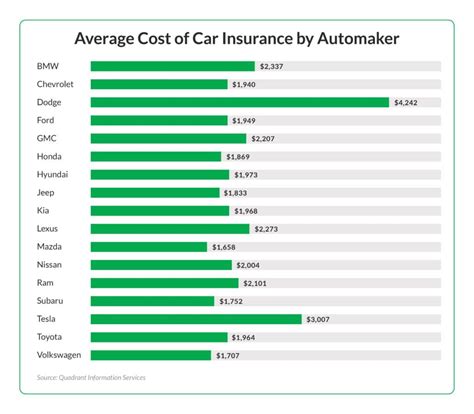

- Vehicle Type and Usage: Different types of vehicles attract varying insurance premiums. Luxury and high-performance cars, for instance, generally cost more to insure due to their higher repair and replacement costs. Similarly, the purpose for which you use your vehicle can impact your insurance rates. If you primarily use your car for commuting to work, your rates may be different from someone who uses their vehicle for business purposes.

- Driver’s Profile: Your personal profile as a driver plays a significant role in determining your insurance rates. Factors such as your age, gender, driving record, and years of driving experience all contribute to the assessment of your risk level by insurance companies. Young drivers, for example, are often considered high-risk due to their lack of experience, leading to higher insurance premiums.

- Location: The area where you reside and drive your vehicle significantly impacts your insurance rates. Urban areas, for instance, typically have higher insurance rates due to the increased risk of accidents, theft, and vandalism. Additionally, states with stricter laws and regulations regarding car insurance may also influence the cost of coverage.

- Coverage and Deductibles: The level of coverage you choose and the deductibles you select can greatly affect your insurance premiums. Comprehensive coverage options, such as collision and comprehensive insurance, provide broader protection but come at a higher cost. On the other hand, increasing your deductibles can lower your premiums, but it also means you’ll have to pay more out of pocket in the event of a claim.

- Insurance Company and Policy Features: Different insurance companies offer varying policies with different features and price points. Some providers may specialize in certain types of coverage or cater to specific driver profiles, offering more competitive rates for certain groups. Additionally, policy features such as accident forgiveness, roadside assistance, and rental car coverage can impact the overall cost of your insurance.

Tips for Securing the Best Car Insurance Rates

Now that we’ve established the key factors influencing car insurance rates, let’s delve into some practical strategies to help you secure the best and most affordable coverage:

Shop Around and Compare Quotes

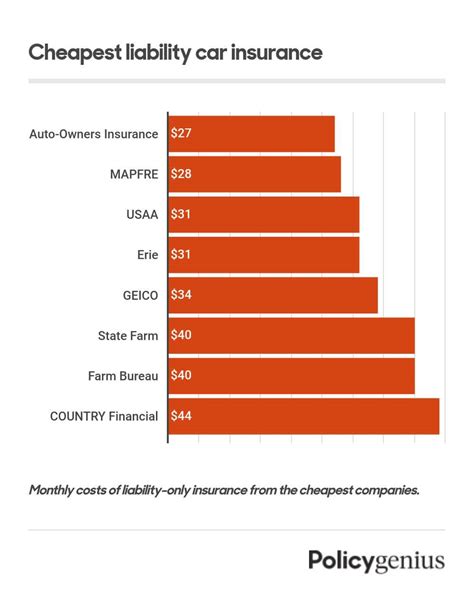

One of the most effective ways to find cheap car insurance is to compare quotes from multiple providers. Each insurance company uses its own formula to calculate premiums, so rates can vary significantly between different providers. By obtaining quotes from at least three to five reputable insurance companies, you can identify the most competitive rates for your specific circumstances.

Bundle Your Policies

If you have multiple insurance needs, such as car, home, or life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts for customers who purchase multiple policies, as it simplifies their operations and reduces administrative costs. By bundling your policies, you can often secure a significant discount on your overall insurance costs.

Review Your Coverage Regularly

Insurance needs can change over time, so it’s important to regularly review your coverage to ensure it aligns with your current requirements. As your life circumstances evolve, you may find that you no longer need certain coverage options, or you may identify areas where you could benefit from additional protection. Regularly reviewing your policy can help you identify opportunities to save money or make necessary adjustments to your coverage.

Consider Higher Deductibles

Increasing your deductible is a straightforward way to lower your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you’re essentially assuming more financial responsibility in the event of a claim, which can lead to reduced premiums. However, it’s important to choose a deductible amount that you’re comfortable paying if the need arises.

Maintain a Clean Driving Record

Your driving record is a significant factor in determining your insurance rates. Insurance companies view drivers with a history of accidents, traffic violations, and claims as higher-risk individuals, which can result in increased premiums. By maintaining a clean driving record, you can demonstrate your responsible driving behavior and potentially qualify for lower insurance rates.

Explore Discounts and Special Offers

Insurance companies often offer a variety of discounts and special offers to attract new customers and reward existing ones. Some common discounts include good student discounts, safe driver discounts, loyalty discounts, and discounts for belonging to certain organizations or professional groups. It’s worth exploring these options and taking advantage of any discounts for which you’re eligible.

Utilize Technology and Telematics

Advancements in technology have led to the development of telematics devices and usage-based insurance programs. These programs use data from your driving behavior, such as speed, acceleration, and mileage, to calculate your insurance premiums. If you’re a safe and cautious driver, you may benefit from lower rates through these programs. Additionally, some insurance companies offer apps or devices that provide real-time feedback on your driving habits, helping you improve your driving skills and potentially qualify for additional discounts.

Choosing the Right Insurance Company

With so many insurance companies to choose from, selecting the right provider can be a challenging task. Here are some key considerations to help you make an informed decision:

Financial Stability and Reputation

It’s essential to choose an insurance company with a solid financial standing and a good reputation. Look for providers that have been in business for a considerable amount of time and have a history of paying claims promptly and fairly. You can research financial ratings from reputable agencies such as A.M. Best or Standard & Poor’s to assess the financial stability of different insurance companies.

Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your overall experience with an insurance company. Look for providers with a strong track record of excellent customer service, prompt claim processing, and fair claim settlements. Read reviews and testimonials from existing and former customers to gauge the level of satisfaction and the company’s responsiveness to customer needs.

Policy Options and Customization

Different drivers have unique insurance needs, so it’s important to choose an insurance company that offers a range of policy options and allows for customization. Look for providers that offer flexible coverage options, optional add-ons, and the ability to tailor your policy to your specific requirements. This ensures that you can obtain the coverage you need without paying for unnecessary features.

Digital Capabilities and Convenience

In today’s digital age, many insurance companies offer online and mobile services to enhance convenience and efficiency. Look for providers that offer user-friendly websites and mobile apps for easy policy management, claim reporting, and payment processing. Digital capabilities can streamline your insurance experience and provide added convenience, especially in today’s fast-paced world.

The Future of Cheap Car Insurance

The insurance industry is continuously evolving, and the future of cheap car insurance looks promising with the advent of new technologies and innovative business models. Here are some key trends and developments to watch for:

Advanced Telematics and Usage-Based Insurance

Usage-based insurance programs, which rely on telematics data to assess driving behavior and calculate premiums, are expected to gain further traction in the future. As these programs become more widespread and sophisticated, they may offer even greater opportunities for safe drivers to save on insurance costs. Additionally, advancements in telematics technology may lead to more accurate and detailed assessments of driving behavior, further refining insurance pricing.

Data Analytics and Personalized Pricing

The insurance industry is increasingly leveraging data analytics to gain deeper insights into risk factors and pricing models. With the availability of vast amounts of data, insurance companies can develop more personalized pricing structures that take into account individual driving behaviors, patterns, and preferences. This shift towards personalized pricing may lead to more accurate and fair insurance rates, benefiting drivers who demonstrate responsible driving habits.

Digital Transformation and Online Insurance

The rise of digital technology and the increasing preference for online services have led to the emergence of online-only insurance providers. These companies offer a purely digital experience, from policy procurement to claim management, often at a lower cost compared to traditional insurance companies. As digital transformation continues to shape the insurance landscape, online insurance providers are expected to become more prevalent, offering convenient and cost-effective alternatives to traditional insurance models.

Collaborative Insurance Models

The concept of collaborative insurance, where consumers collectively share risks and premiums, is gaining traction in the insurance industry. This model, often facilitated by technology platforms, allows individuals to pool their resources and share the costs of insurance coverage. Collaborative insurance models have the potential to offer more affordable rates and greater flexibility, particularly for individuals with unique or specialized insurance needs.

Conclusion

Securing cheap car insurance is a multifaceted process that requires a thorough understanding of the various factors influencing insurance rates. By comparing quotes, bundling policies, reviewing coverage regularly, and exploring discounts, you can take control of your insurance costs and find the best value for your money. Additionally, staying abreast of the latest trends and developments in the insurance industry can help you make informed decisions and take advantage of emerging opportunities to save on your car insurance.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually, or whenever your life circumstances change significantly. Regular reviews ensure that your coverage remains adequate and aligned with your current needs.

Can I switch insurance companies to save money?

+Absolutely! Shopping around and comparing quotes from different insurance companies is an effective way to find the best rates. Don’t hesitate to switch providers if you find a more competitive offer.

Are there any drawbacks to choosing a higher deductible?

+While choosing a higher deductible can lead to lower premiums, it’s important to consider your financial capabilities. If you opt for a higher deductible, ensure that you can afford to pay it in the event of a claim without causing financial strain.

How can I improve my chances of qualifying for insurance discounts?

+To increase your chances of qualifying for discounts, maintain a clean driving record, explore loyalty discounts by staying with the same provider, and consider enrolling in safe driving programs or courses that may offer additional savings.