Insurance Compare Quote

Welcome to this comprehensive guide on the world of insurance, where we delve into the intricacies of comparing insurance quotes to make informed decisions. In today's dynamic market, understanding the process of obtaining accurate and competitive insurance quotes is essential. This article aims to provide an expert-level analysis, offering valuable insights and strategies to navigate the insurance landscape with confidence. As we explore the various aspects of insurance quote comparison, you'll discover the key factors that influence policy costs and learn effective techniques to secure the best coverage at the right price.

Unraveling the Complexity of Insurance Quotes

In the vast insurance market, obtaining accurate quotes is the first step towards securing the right coverage. However, the process can be intricate, with numerous variables influencing the final quote. From the type of insurance to individual risk factors, a multitude of considerations come into play.

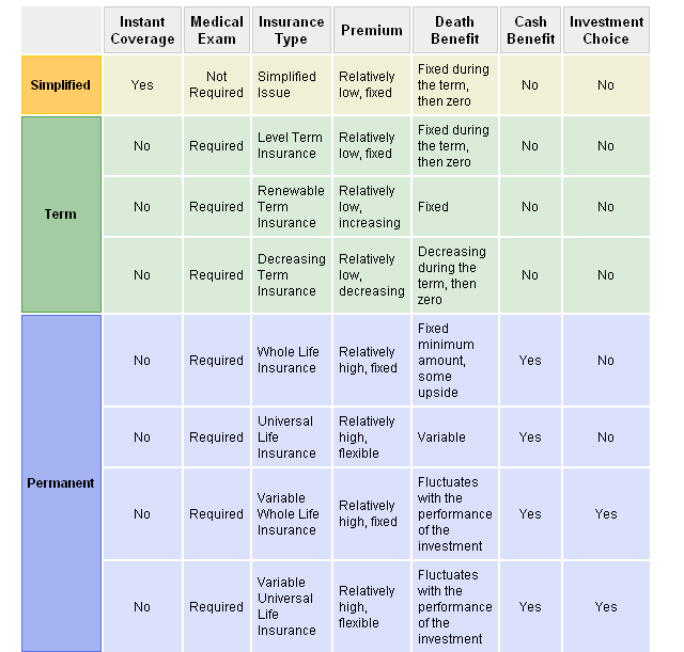

Understanding Insurance Types and Coverage

The insurance industry offers a wide array of policies, each designed to address specific needs. Whether it’s life insurance, health insurance, auto insurance, or property insurance, the coverage and premiums can vary significantly. For instance, life insurance policies may focus on term life or whole life coverage, impacting the overall cost and benefits.

| Insurance Type | Key Coverage |

|---|---|

| Life Insurance | Financial protection for beneficiaries upon the insured's death. |

| Health Insurance | Covering medical expenses, from routine check-ups to major surgeries. |

| Auto Insurance | Protecting vehicles and drivers against accidents and liabilities. |

| Property Insurance | Safeguarding homes, businesses, and their contents from damage or loss. |

Each insurance type comes with its own set of coverage options and premiums. For instance, health insurance policies may offer different deductibles, co-pays, and networks, impacting the overall cost and flexibility.

The Role of Individual Risk Factors

When it comes to insurance quotes, individual risk factors play a pivotal role. These factors, unique to each person, influence the perceived risk by insurance providers and subsequently, the premium rates. For instance, in auto insurance, factors like driving history, age, and location can significantly impact the quote.

| Risk Factor | Impact on Quote |

|---|---|

| Driving History | Clean records may lead to lower premiums, while accidents or violations can increase costs. |

| Age | Younger drivers are often considered higher risk, resulting in higher premiums. |

| Location | Urban areas with higher traffic and crime rates may attract higher premiums. |

Similarly, in life insurance, factors like health history, lifestyle choices, and occupation can affect the quote. For example, individuals with a history of serious health conditions may face higher premiums or may be declined coverage altogether.

The Art of Comparing Insurance Quotes

Comparing insurance quotes is an art that requires a keen eye for detail and a strategic approach. It involves evaluating multiple quotes from different providers to identify the best coverage at the most competitive price. Here’s a detailed guide on how to effectively compare insurance quotes.

Identifying Your Insurance Needs

The first step in comparing insurance quotes is to clearly define your insurance needs. Consider the type of insurance you require and the level of coverage you desire. For instance, if you’re seeking auto insurance, determine whether you need comprehensive coverage, collision coverage, or liability-only insurance. Similarly, for health insurance, decide if you prefer a high-deductible plan or a more comprehensive option with lower out-of-pocket costs.

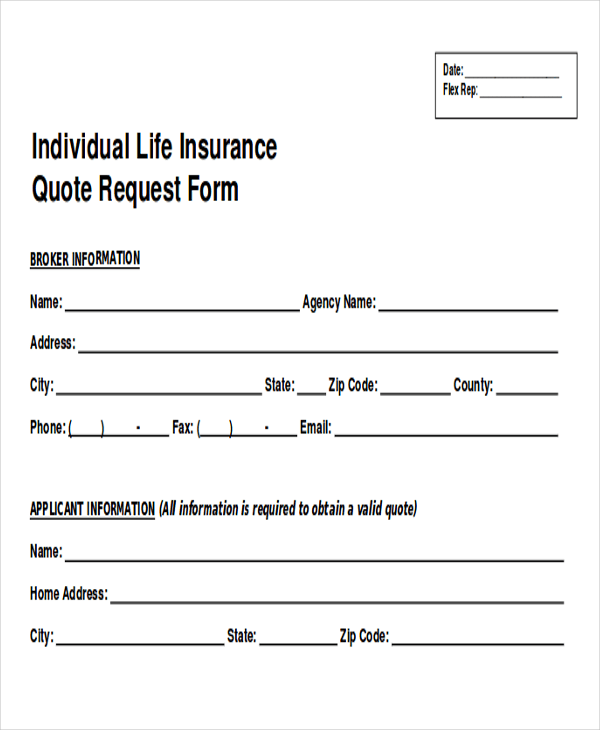

Gathering Quotes from Multiple Providers

The next step is to collect quotes from various insurance providers. Utilize online comparison tools, insurance brokerages, or directly contact insurance companies to obtain quotes. Ensure that you’re comparing apples to apples by requesting quotes for the same level of coverage from each provider. This step is crucial as it provides a diverse range of options to choose from and helps identify the most competitive rates.

Evaluating the Quotes

Once you have a collection of quotes, it’s time to evaluate them thoroughly. Beyond just comparing the premium amounts, delve into the details of each quote. Consider the following factors:

- Coverage Limits: Ensure that the policy limits align with your needs. For instance, in auto insurance, check if the liability limits are sufficient to cover potential damages in an accident.

- Deductibles and Out-of-Pocket Costs: Lower premiums often come with higher deductibles. Evaluate if the increased out-of-pocket costs are manageable for your budget.

- Policy Exclusions: Carefully read the fine print to identify any exclusions or limitations. Certain policies may exclude coverage for specific events or situations, which could leave you unprotected.

- Additional Benefits and Riders: Some policies offer additional benefits or the option to add riders to customize your coverage. These can include rental car coverage, roadside assistance, or accident forgiveness.

- Customer Service and Claims Process: Consider the reputation and customer satisfaction ratings of the insurance provider. A seamless claims process and responsive customer service can make a significant difference in times of need.

Remember, the cheapest quote may not always be the best option. A thorough evaluation of the coverage, terms, and conditions is essential to ensure you're getting the right protection for your needs.

Negotiating for the Best Deal

In certain cases, you may have the opportunity to negotiate your insurance quote. This is particularly true if you’re a loyal customer with a good payment history or if you’re bundling multiple policies with the same provider. Insurance companies often offer discounts for long-term customers or for those who choose to bundle their insurance needs. Don’t be afraid to inquire about potential discounts or to ask for a better rate, especially if you’ve received a more competitive quote from another provider.

Advanced Strategies for Insurance Quote Comparison

Comparing insurance quotes is a complex process, and there are advanced strategies that can help you secure the best coverage at the most competitive price. These strategies involve a deeper understanding of the insurance market and a more nuanced approach to policy evaluation.

Understanding Insurance Provider Reputation

When comparing insurance quotes, it’s essential to consider the reputation of the insurance provider. A company’s reputation can provide valuable insights into the quality of their services, the reliability of their coverage, and the overall customer experience. Positive reviews and high ratings can indicate a provider’s commitment to customer satisfaction, while negative feedback may highlight potential issues with claims handling, customer service, or policy terms.

Researching insurance provider reputations can be done through online reviews, industry ratings, and consumer advocacy groups. Websites like Yelp, Google Reviews, and the Better Business Bureau (BBB) offer a wealth of information on customer experiences with various insurance providers. Additionally, industry publications and consumer advocacy organizations often provide rankings and reports on insurance companies, offering valuable insights into their financial stability, customer satisfaction, and overall performance.

Analyzing Policy Exclusions and Limitations

A critical aspect of comparing insurance quotes is understanding the policy exclusions and limitations. These are specific situations or events that are not covered by the insurance policy, despite the general coverage it provides. For instance, a home insurance policy may exclude coverage for floods, earthquakes, or acts of war, requiring separate policies or endorsements to cover these events.

Policy exclusions and limitations can vary significantly between insurance providers and even between different policies offered by the same provider. It's crucial to carefully review these exclusions and limitations to ensure that your insurance coverage aligns with your specific needs and potential risks. For example, if you live in an area prone to natural disasters, you'll want to ensure that your policy covers these events or that you have adequate alternative coverage in place.

Evaluating Customer Service and Claims Handling

The quality of customer service and claims handling is a critical aspect of any insurance provider. In times of need, efficient and responsive customer service can make a significant difference in your experience. Consider the following factors when evaluating these aspects:

- Response Time: How quickly does the insurance provider respond to inquiries or claims? A prompt response can indicate a commitment to customer service.

- Accessibility: Are customer service representatives easily accessible via phone, email, or live chat? Multiple contact methods can provide convenience and flexibility.

- Claims Process: Research the provider's claims process, including the steps involved, the documentation required, and the average time for claim resolution. A seamless and efficient claims process is ideal.

- Customer Reviews: Read customer reviews and testimonials to gain insights into the provider's customer service and claims handling. Positive feedback can indicate a positive experience, while negative reviews may highlight areas of concern.

Remember, while premiums are important, the overall experience with an insurance provider can significantly impact your satisfaction and peace of mind. A provider with excellent customer service and claims handling can make the entire insurance process smoother and more stress-free.

Future Implications and Trends in Insurance Quote Comparison

As the insurance landscape continues to evolve, several trends and developments are shaping the future of insurance quote comparison. These advancements are driven by technological innovations, changing consumer expectations, and shifts in the regulatory environment.

The Rise of Insurtech and Digital Platforms

Insurtech, a combination of insurance and technology, is revolutionizing the way insurance quotes are compared and obtained. Digital platforms and apps are now offering seamless and efficient ways to compare quotes, apply for insurance, and manage policies. These platforms often leverage advanced algorithms and data analytics to provide personalized recommendations and instant quotes.

For instance, Insurtech startups are developing innovative solutions like parametric insurance, which uses predefined parameters and triggers to determine coverage and payouts. This technology can provide faster and more efficient claims processing, especially in cases of natural disasters or major events. Additionally, the use of artificial intelligence (AI) and machine learning is enhancing the accuracy and speed of insurance quote comparisons, making the process more efficient and user-friendly.

Increased Focus on Personalized Insurance

The traditional one-size-fits-all approach to insurance is evolving, with a growing emphasis on personalized insurance solutions. Insurance providers are now leveraging data analytics and customer insights to offer customized policies that cater to individual needs and preferences. This shift towards personalized insurance is driven by the desire to provide more tailored coverage and better value for consumers.

For example, in the health insurance sector, providers are developing dynamic pricing models that take into account an individual's health status, lifestyle choices, and medical history to offer more accurate and affordable coverage. Similarly, in auto insurance, usage-based insurance programs are gaining traction, where premiums are based on an individual's actual driving behavior and mileage, rather than generalized risk factors.

Regulatory Changes and Consumer Protection

Regulatory bodies and consumer protection agencies are playing a crucial role in shaping the insurance industry, particularly in the context of quote comparison. Increased oversight and stricter regulations are being implemented to ensure transparency, fairness, and consumer protection in the insurance market.

For instance, many countries are introducing regulations that require insurance providers to clearly disclose all policy terms, conditions, and exclusions. This ensures that consumers are fully informed about the coverage they're purchasing and helps prevent misleading or deceptive practices. Additionally, regulatory bodies are encouraging insurance providers to adopt digital solutions and streamlined processes to enhance consumer convenience and protection.

FAQ

How often should I compare insurance quotes to ensure I’m getting the best rates?

+It’s generally recommended to review and compare insurance quotes annually, or whenever you experience significant life changes such as a move, marriage, or the purchase of a new vehicle. This ensures that you’re always getting the most competitive rates and adequate coverage for your needs.

What are some common mistakes to avoid when comparing insurance quotes?

+Some common mistakes include focusing solely on the premium without considering coverage, overlooking policy exclusions and limitations, and neglecting to research the reputation and financial stability of the insurance provider. It’s crucial to thoroughly evaluate all aspects of the policy to ensure you’re getting the best value.

How can I improve my chances of getting lower insurance quotes?

+To improve your chances of getting lower insurance quotes, consider bundling multiple policies with the same provider, maintaining a good credit score, and exploring loyalty discounts. Additionally, reducing risk factors, such as improving your driving record or making home improvements to prevent theft or damage, can also lead to lower premiums.

Are there any online tools or resources that can help me compare insurance quotes more efficiently?

+Yes, there are several online platforms and comparison tools that can streamline the process of comparing insurance quotes. These tools often provide instant quotes from multiple providers, allowing you to quickly evaluate and compare policies. Some popular options include InsuranceQuoteCompare.com, PolicyGenius, and InsureMyTrip, among others.